A payment platform means a lot if you want to expand your business. Here are some factors that will help you evaluate the readiness of your online transaction gateway to conquer new markets with you

Key factors for triumph

Start your growth now

Whether you’re launching a new business or expanding an existing one, there are several key steps you can take to help ensure success

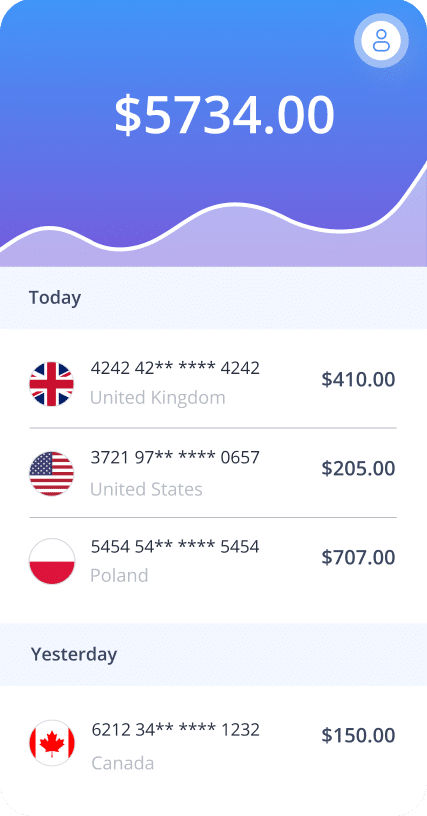

Transferty payment solution is your reliable partner to expand into the new market

We propose the best solution to satisfy the needs for your business and ensure the best experience of your customers

Frequently Asked Questions

Here you will find the answers to commonly asked questions. If you can't find the answer on your question or need any further information, please, feel free to contact our sales team

-

Can I use the same payment gateway to expand my business into different markets?

You may be able to use the same payment gateway to expand your business into different markets. However, it’s important to ensure that the payment gateway supports the currencies and payment methods used in the markets you’re expanding into. Additionally, you may need to comply with local regulations and requirements, such as data privacy laws or anti-money laundering regulations, which could impact your choice of payment gateway. By choosing a payment gateway provider with local expertise, merchants receive easier and more organic expansion, which allows them to take advantage of their competitors

-

How can I integrate local payment methods?

We offer the flexibility to integrate any local or alternative payment method of your choice. Simply contact us, and we will work with you to ensure seamless integration into our payment gateway

-

Can I set up an automatic currency conversion from the local currency?

Yes, a reliable payment gateway provider usually offers automatic currency conversion services that allow you to accept payments in multiple currencies and convert them to your local currency. This can be a convenient way to expand your business into different markets without having to manage multiple currency accounts

-

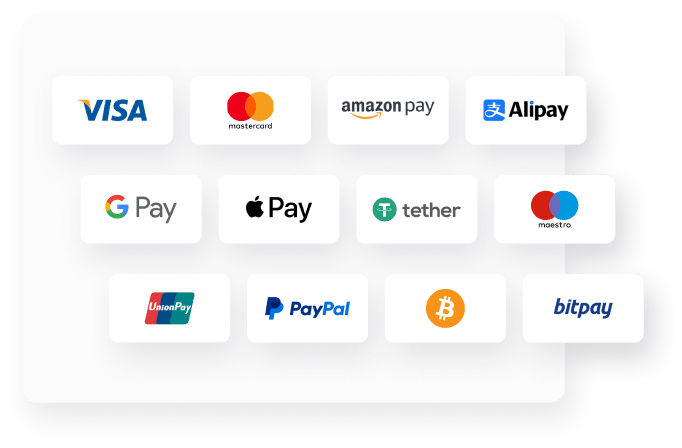

What is an APMs?

APMs stands for Alternative Payment Methods. These are payment options that differ from traditional payment methods such as credit cards, debit cards, or bank transfers. This term includes many payment methods, like e-money, cryptocurrency, and regional payment methods. APMs have gained popularity in recent years, driven by changing consumer behaviors, advancements in technology, and the desire for more convenient and flexible payment options

-

Can I use both traditional and alternative payment methods in my payments?

Yes, it is common and beneficial to use both traditional and alternative payment methods in your payment options. By offering a combination of payment methods, you cater to a wider range of customer preferences and increase the likelihood of converting potential customers into paying customers. Transferty allows you to connect the payment methods you need to ensure your business’s growth

-

Why should I include alternative payment methods for the external markets?

Including alternative payment methods can help you reach a wider range of customers in different markets, especially in regions where credit card penetration may be lower. By offering local payment methods, you can provide a more seamless and convenient checkout experience for your customers, which can help increase conversions and customer satisfaction. Additionally, offering alternative payment methods can help you stand out from your competitors and build trust with your customers by demonstrating your commitment to serving their needs

-

How many payment methods should I connect to increase revenue?

It depends on your business strategy, regions, customers, and sales channels. You may use as many payment methods as you need, and use other benefits of Transferty to boost your business