Building your own payment infrastructure from scratch can be costly, time-consuming, and complex. Try a white-label payment gateway that can provide numerous benefits, including cost-effectiveness, security, customization, and scalability. Let’s explore the benefits in more detail

White-Label vs. Creating your own payment platform

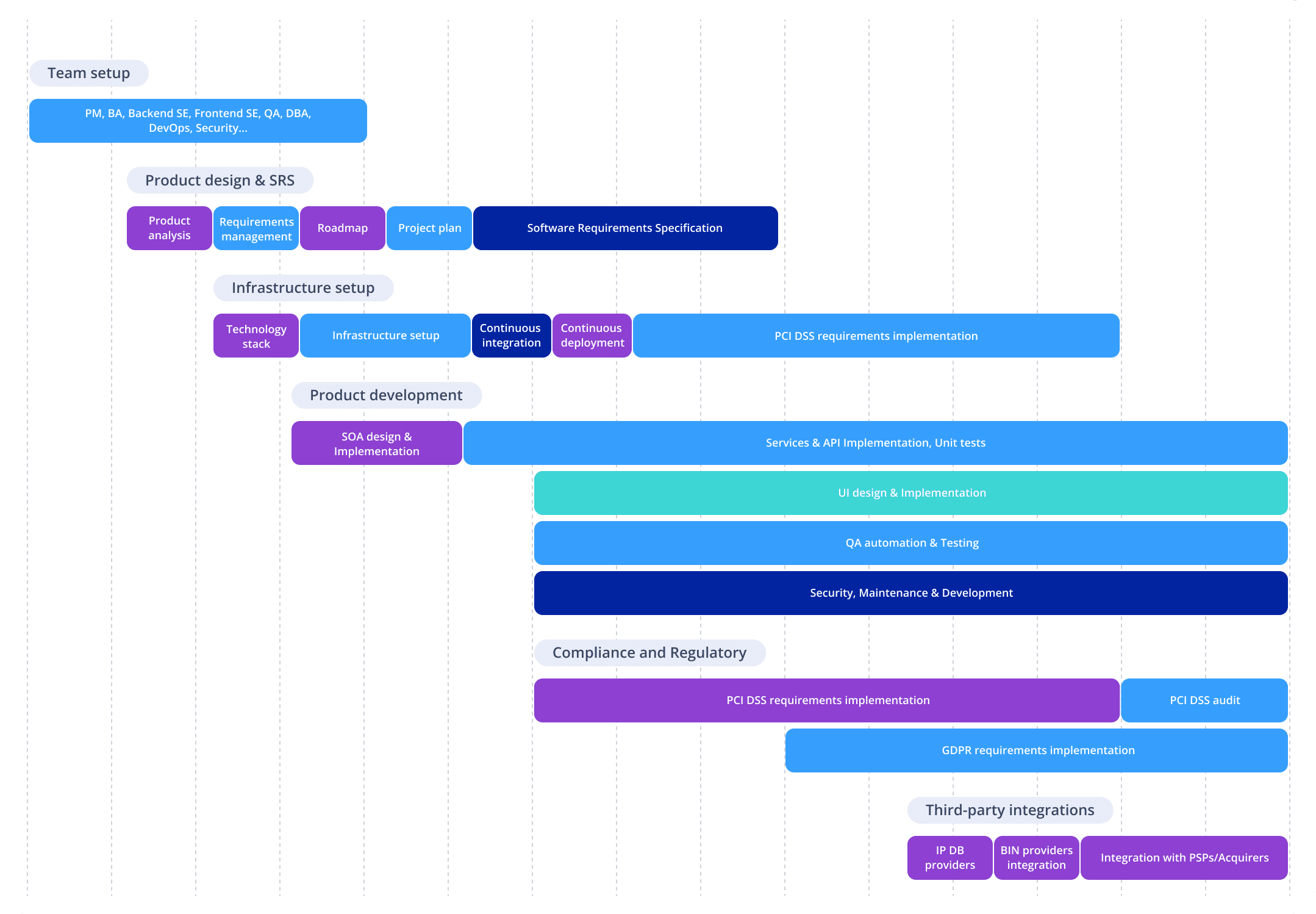

High development costs and long timelines

Problem

Creating your own gateway requires significant time, money, and resource investments. It involves building a custom solution from scratch, which can take months or even years. Additionally, the development costs can quickly spiral out of control, requiring you to allocate more resources than initially anticipated

Solution

Choose a white-label, fully functional payment platform that is ready to use. This will help you to avoid the loss of time on technical development and maintenance, which leads to the loss of potential income and opportunities. Instead, you can focus on attracting and serving customers, staying ahead of your competitors

Lack of experience risks

Problem

Creating a digital transaction gateway requires specific knowledge and experience in payment processing, security protocols, compliance standards, and software development. Lack of experience can lead to fatal mistakes in development that could have negative financial and reputational impacts for a business

Solution

It is much more profitable to cooperate with professionals who can offer a wide range of services, including secure payment processing, fraud prevention, compliance management, and customer support. Minimize the risks associated with payment processing and ensure the security of customer financial information

Security and compliance risks factors

Problem

Developing a payment platform from scratch requires extensive knowledge of payment processing and security protocols. This means that any errors or oversights during the development process can lead to serious security and compliance risks. Meeting strict compliance standards, such as PCI DSS and GDPR, can be challenging and expensive, especially for small or medium-sized businesses

Solution

A white-label online transaction gateway comes with built-in security features and compliance standards that have already been tested and proven. This ensures that your digital payment solution is secure and compliant with industry standards, reducing your risk of fraud, data breaches, and non-compliance

Let your payments be effective and safe with the Transferty payment solution

Want to stay ahead of the game and boost your profits? Reduce risks and diversify your payment options with our ready-to-use, reliable, and secure payment solution

Unlock the benefits of white-label solution

White-label payment processing solutions provide an effective and productive way for PSPs, acquirers, and banks to offer a secure and reliable payment solution to their clients while maintaining control over their brand and client relationships

Frequently Asked Questions

Here you will find the answers to commonly asked questions. If you can't find the answer on your question or need any further information, please, feel free to contact our sales team

-

Why using a white-label payment gateway is better than developing my own solution?

Developing your own payment processing solution can be a time-consuming and costly process, requiring significant technical expertise and resources. In contrast, a white-label payment gateway offers a ready-made solution that can be customized and integrated into an existing platform more quickly and easily, allowing companies to focus on their core business. Additionally, a white-label payment gateway provider typically offers ongoing support and maintenance, as well as compliance with industry regulations and standards, reducing the risk and complexity of managing payment processing in-house

-

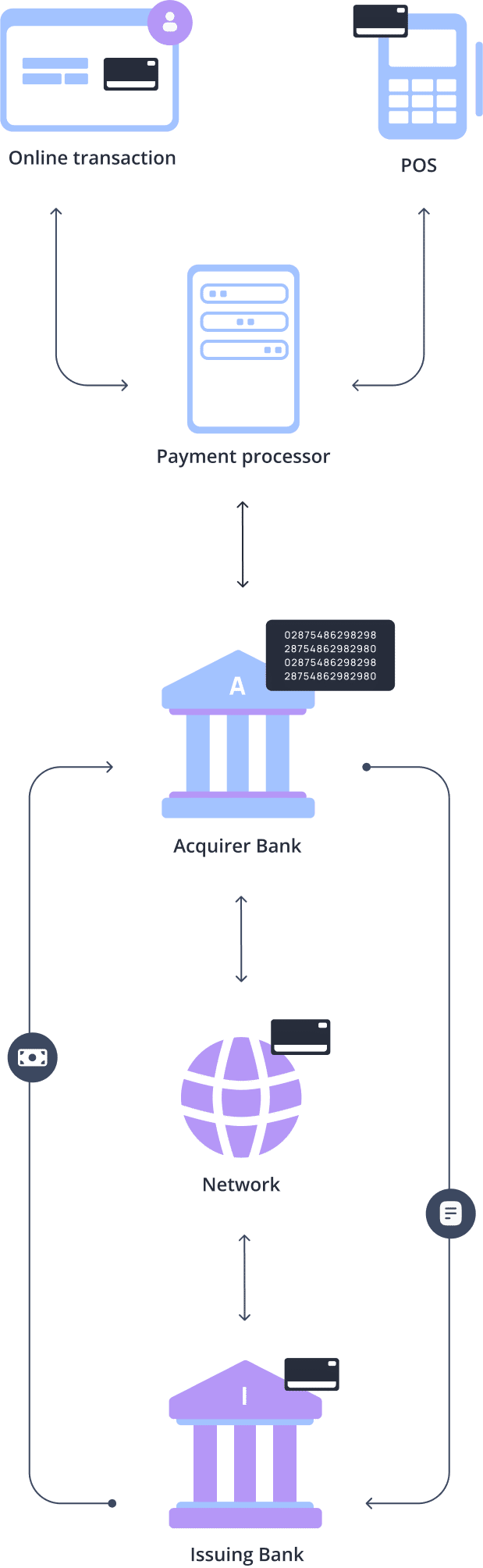

What is a payment acquirer?

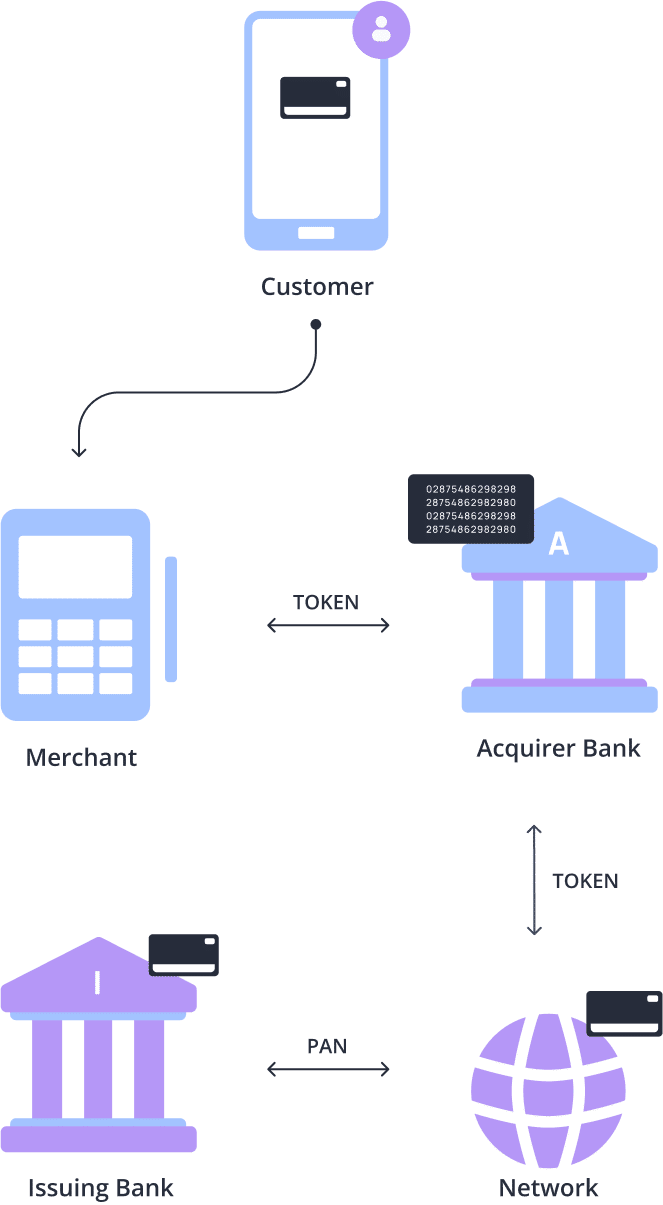

A payment acquirer, also known as an acquiring bank or acquiring processor, is a financial institution that processes payment transactions on behalf of merchants. They are responsible for authorizing and settling payment transactions with card networks such as Visa, Mastercard, or American Express, and ensuring that funds are transferred from the customer’s bank account to the merchant’s bank account

-

How many acquirers is needed to ensure payment continuity?

It is recommended that merchants have at least two payment acquirers to ensure payment continuity. This is because if one acquirer experiences technical issues or service disruptions, the merchant can switch to the other acquirer to continue processing payments. Additionally, having multiple acquirers can provide redundancy and improve the reliability and speed of payment processing