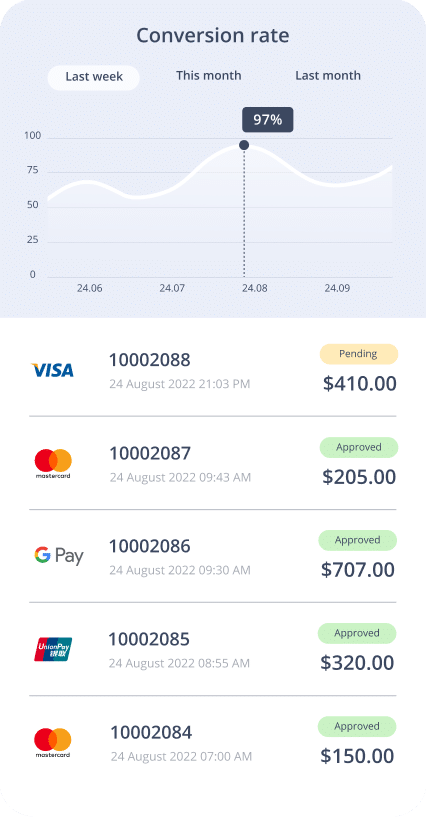

Optimizing your payment gateway is crucial to boosting conversion rates. Offer convenient payment options, ensure a seamless checkout, and implement features like one-click payments to streamline the checkout process and improve conversion rates

Improvement points to increase conversion

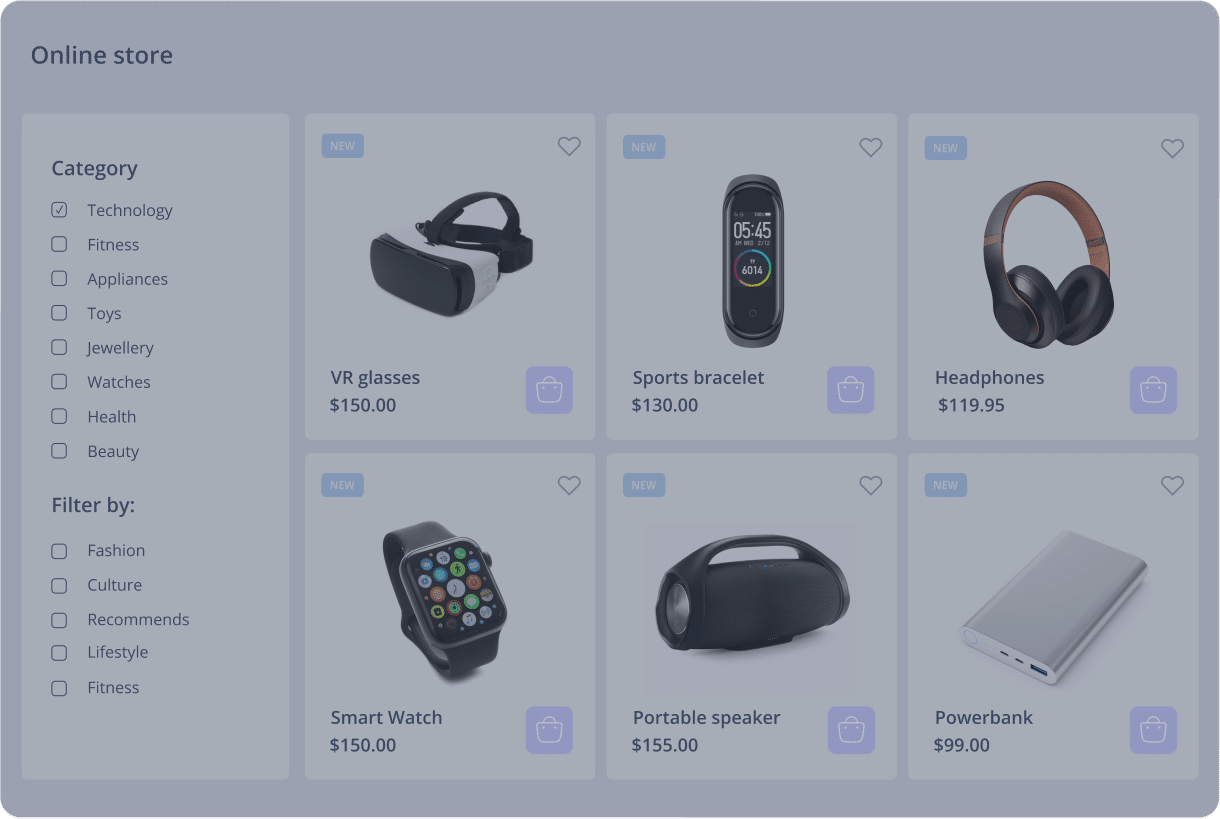

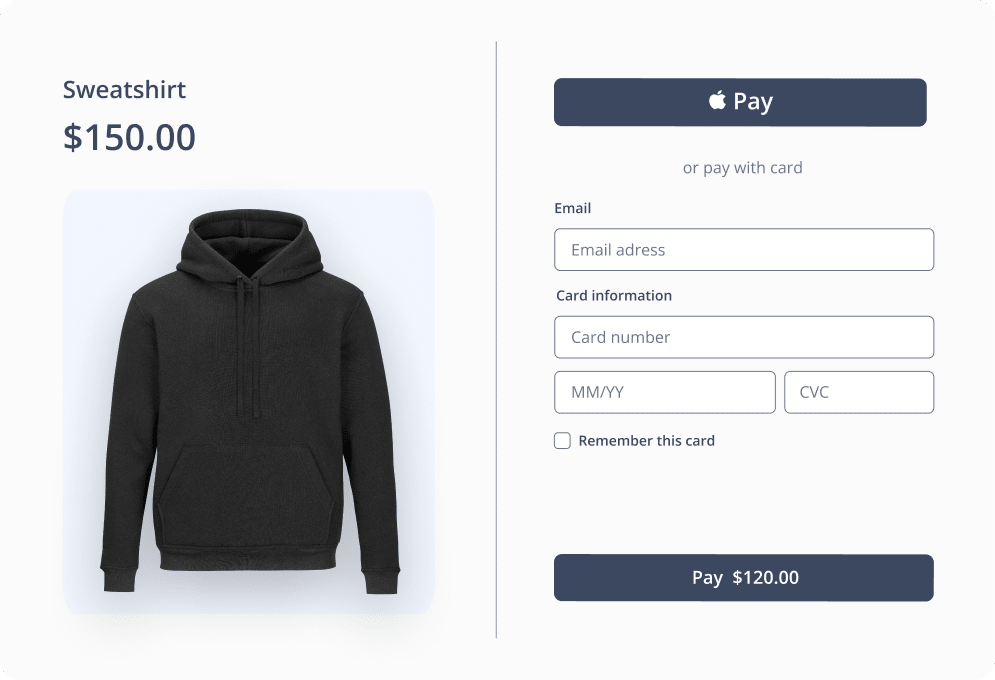

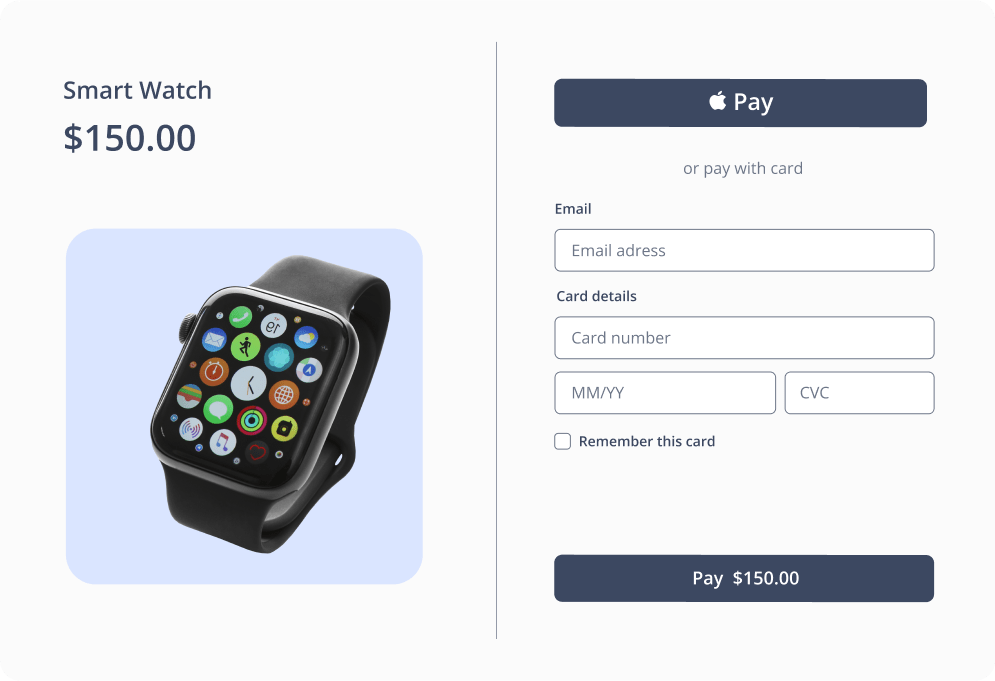

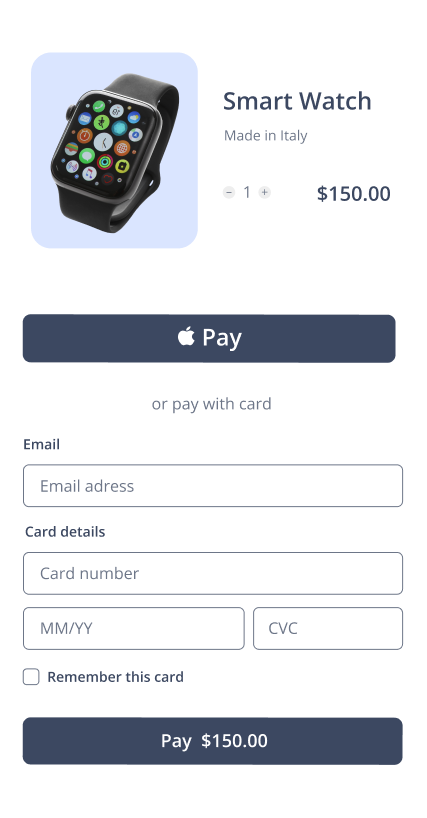

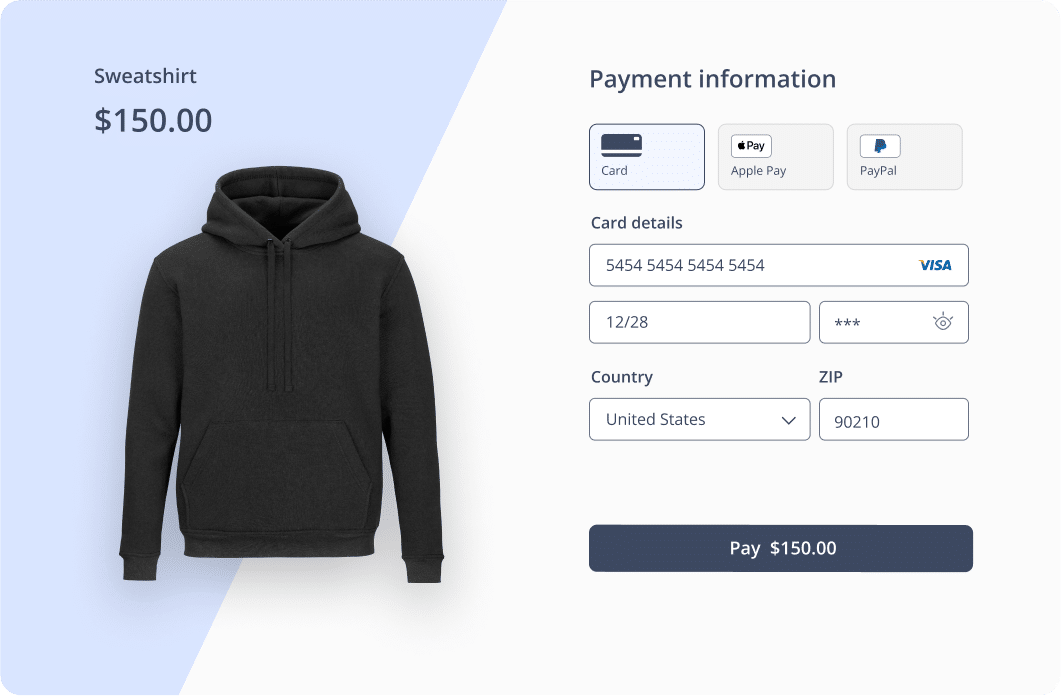

Use the power of design to optimize the checkout page

Reduce the number of customer actions so that they can complete a purchase in one minute

With the Transferty Custom Form feature, streamline the checkout experience and reduce the number of steps required for your customers to complete a purchase

You can also increase your brand awareness by customizing your logo, color scheme, checkout theme, language, and payment methods

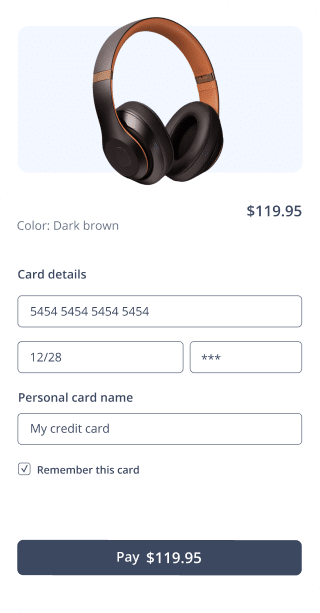

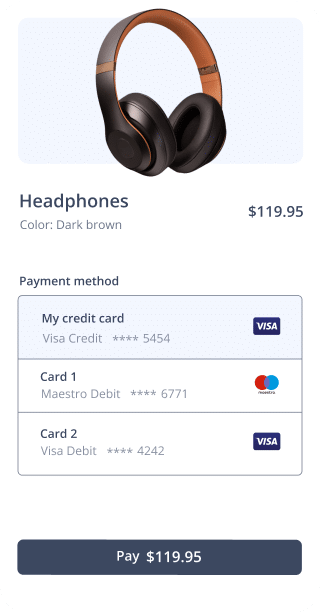

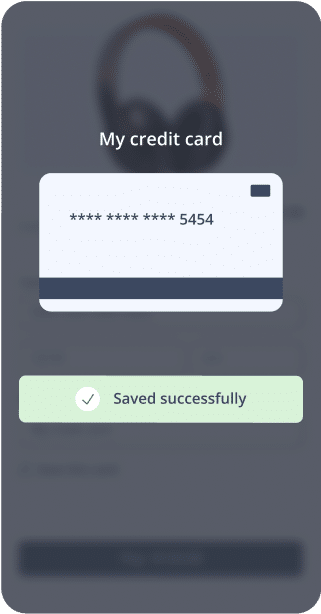

Make use of 'Save card' and one-click payments

Simplify the purchasing process for customers, resulting in higher conversion rates and greater satisfaction, while also mitigating the risk of fraudulent transactions

Save card: Securely store the customer’s payment information for future purchases, bypassing the need to manually input it every time

One-click payment: Store customer card details as a token, allowing for quick and secure payments without requiring CVC code or 3D secure authentication

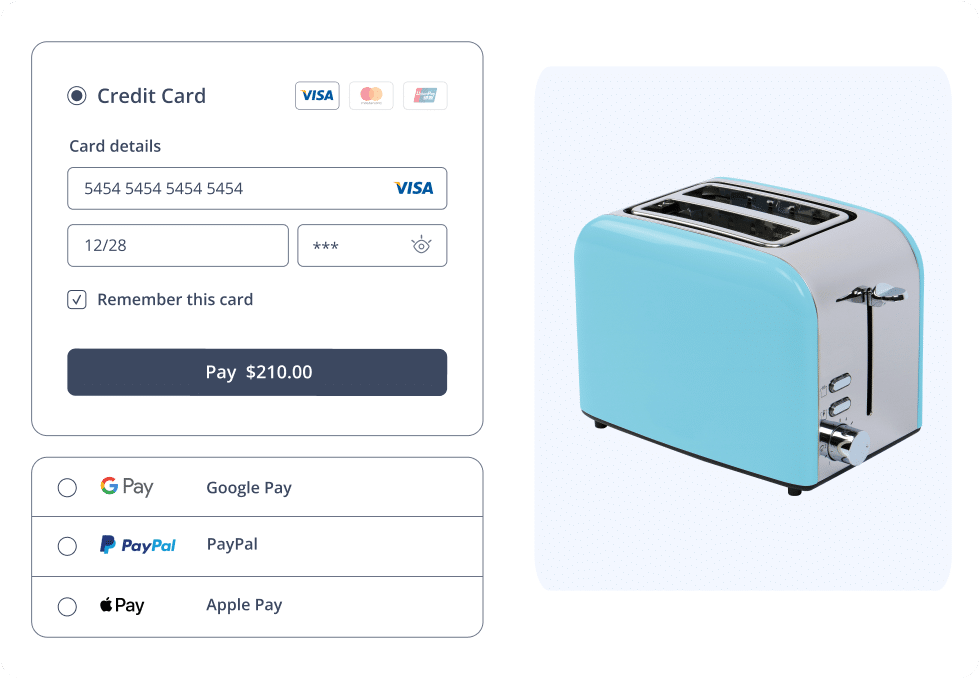

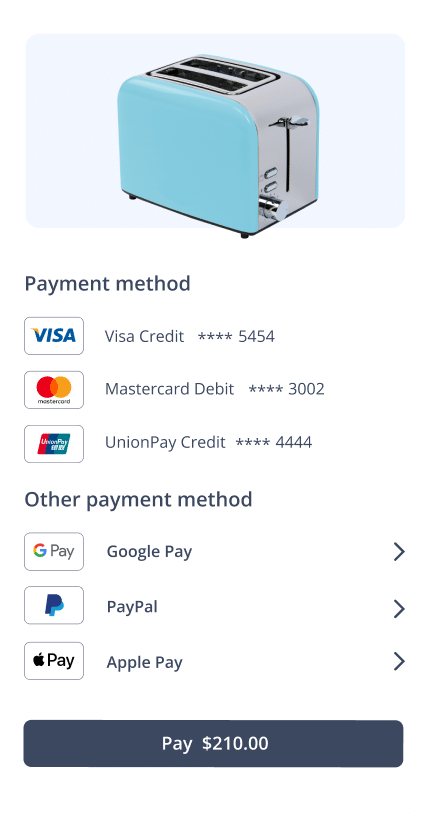

Let your customers pay in ways they prefer

Consider the customer experience based on location, payment options, and sales channels. Lack of a suitable payment option may lead to cart abandonment

Don't force the user to go to another page

Using an iframe to display a payment page on a website allows you to improve the user experience, improve data analysis, and increase trust with customers

Also, you can customize the payment page to match the website branding; it will appear to be a seamless part rather than a separate entity

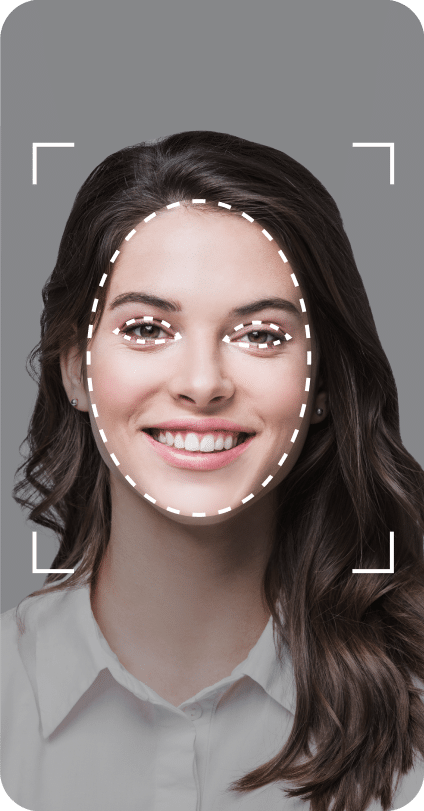

Improve conversion rates with smart security

Increased conversion rates and client loyalty may result from protecting your platform and fostering trust with your customers

Transferty helps merchants eliminate financial and reputational risks by providing PCI DSS-compliant payment flows, high uptime, and data protection

Much more steps to improve your income

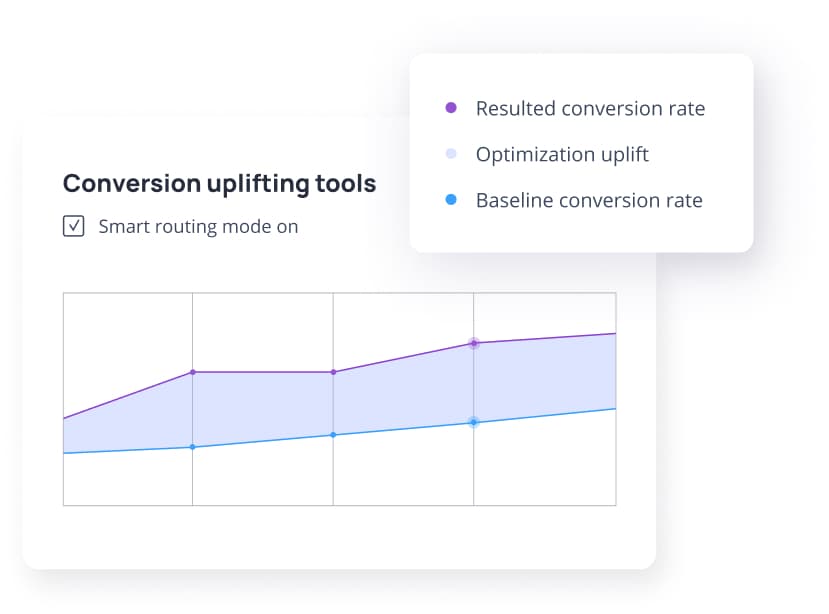

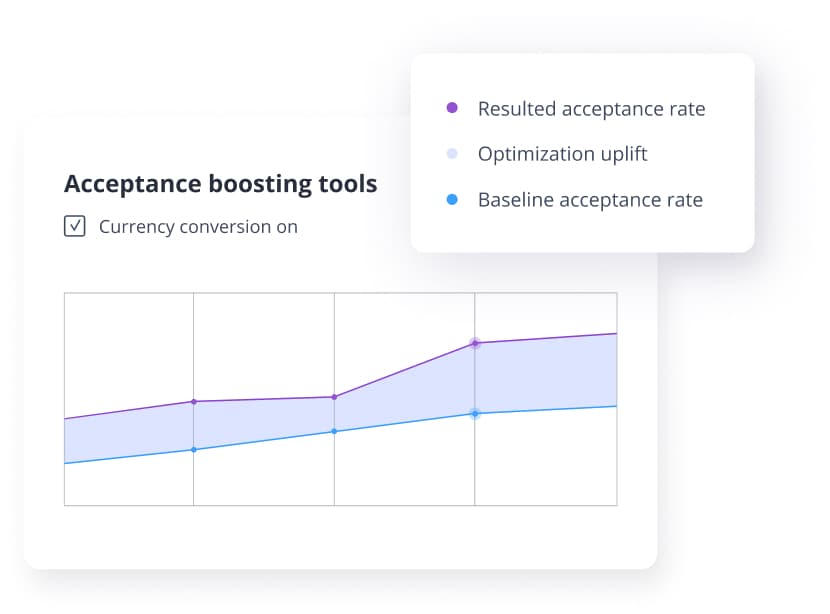

Maximize your income with smart payment flows and savings strategies. Use routing, cascading, dynamic currency conversion, and subscription payments to streamline finances and save money

Your profit is our responsibility

Try the Transferty Payment Gateway now to make your clients happier, increase conversion rates, and feel the new future of payments

Frequently Asked Questions

Here you will find the answers to commonly asked questions. If you can't find the answer on your question or need any further information, please, feel free to contact our sales team

-

What is payment conversion?

Payment conversion refers to the percentage of successful transactions out of the total attempted transactions. In this context, it specifically pertains to the rate at which sales or transactions are completed.

For instance, let’s consider this example: There were 100 visitors, 20 of whom intended to make a purchase and proceeded to the checkout page. Out of those 20, 15 successfully completed their transactions, while the remaining 5 either abandoned the process, failed to pass the 3DS verification, or encountered some other error.

Thus, the payment conversion rate can be calculated as 15/20 = 0.75 = 75%. This indicates that 75% of the attempted transactions resulted in successful sales.

Simultaneously, the conversion rate of visitors to customers is 15%, as it represents the proportion of visitors who became paying customers

-

Why is payment conversion more critical than than revenue amount?

Payment conversion within a payment gateway refers to the percentage of successful transactions processed through the gateway. It is an essential metric for businesses that operate online and rely on electronic payments. While revenue is crucial for measuring overall financial success, payment conversion in a payment gateway holds its own significance for the following reasons:

1. Revenue realization: A high payment conversion rate in your payment gateway ensures that a larger percentage of your customers successfully complete their transactions. This directly translates into the realization of revenue for your business. Even if you generate substantial revenue, it is of little value if a significant number of transactions fail or are abandoned at the payment stage. Maximizing payment conversion ensures that you capture the full potential of your revenue2. Customer experience: The payment gateway is a critical touchpoint in the customer journey, as it’s where customers provide their payment information and complete their transactions. If the payment conversion rate is low, it may indicate issues or obstacles during the payment process that frustrate or discourage customers from completing their purchases. By prioritizing payment conversion, you focus on optimizing the customer experience and ensuring a smooth and seamless payment process, which can lead to higher customer satisfaction and repeat business

3. Operational efficiency: A high payment conversion rate within your payment gateway signifies that your payment infrastructure is functioning optimally. It suggests that the gateway is reliable, secure, and capable of processing transactions efficiently. Conversely, a low payment conversion rate may indicate technical issues, payment failures, or potential vulnerabilities in the payment process. By emphasizing payment conversion, you can identify and address any underlying issues promptly, ensuring the smooth operation of your payment gateway and minimizing revenue loss due to transaction failures

4. Fraud detection and prevention: Payment gateways are essential for optimizing fraud detection and prevention in transactions. By implementing advanced measures like customizable anti-fraud rules and 3D Secure authentication, payment gateways effectively mitigate the risks associated with fraud and chargebacks. The gateway allows flexibility in setting risk levels, minimizing false-positives and targeting only the riskiest transactions

While revenue is the ultimate goal, focusing on payment conversion within your payment gateway is critical for optimizing revenue realization, enhancing customer experience, maintaining operational efficiency, and mitigating fraud risks

-

Which factors can make my payment conversion decrease?

Several factors can impact your payment conversion, including a complicated checkout process, a lack of payment options, technical issues with the payment gateway, slow page load times, security concerns, and transaction errors such as errors from providers or exceeding MIDs limits. It’s important to regularly monitor and analyze your payment conversion rates to identify any issues and take appropriate actions to improve the user experience and optimize conversion rates

-

How can a payment gateway boost my payment conversion?

A payment gateway can significantly enhance your payment conversion in multiple ways:

- provides a wide range of payment methods, including alternative and local options, tailored to meet the diverse needs of your customers. This reduces cart abandonment and increases the likelihood of transaction completion

- offers advanced fraud prevention measures, such as customizable anti-fraud rules and 3D Secure authentication. The gateway allows flexibility in setting risk levels, minimizing false-positives and targeting only the riskiest transactions

- offers a user-friendly checkout experience with localized language options and adaptable design for various devices. Alternatively, merchants have the option to seamlessly integrate the payment gateway into their own checkout page. Both options contribute to improved conversion rates

- includes routing and cascading features that optimize transaction success rates. By automatically selecting the best acquiring bank or payment processor for each transaction, it reduces errors such as declines due to limits or provider issues, while also optimizing processing time

- provides real-time data and analytics on transaction performance, empowering you to quickly identify and address any issues. This enables you to optimize your payment flow, resolve bottlenecks, and continuously improve your payment conversion over time