Streamline payment processes to save time, reduce transaction errors and fraud, and improve efficiency. Negotiate transaction fees, choose the right digital transaction gateway provider, and optimize payments to cut expenses and boost profits. Start exploring options now!

Main ways for cost reduction

Save on development

Developing a new payment solution from scratch is costly and time-consuming. That includes the expenses associated with hiring developers, project management, testing, and infrastructure setup. A ready-made Transferty gateway saves money and time and provides a fast start for your business

Stop overpaying

Stop paying needless fees for services that should be included in your payment provider’s baseline. Transferty charges a processing fee per transaction, with no monthly or other hidden fees. We are flexible in our personal approach; if you process a high volume of payments, you may negotiate custom pricing options

Improve the efficiency

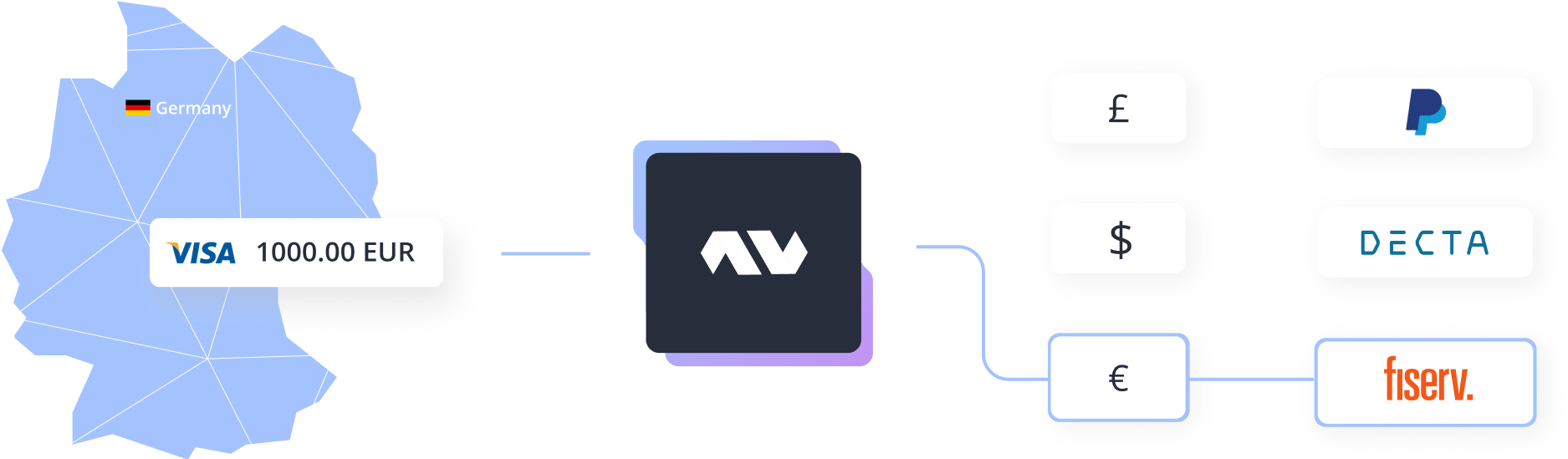

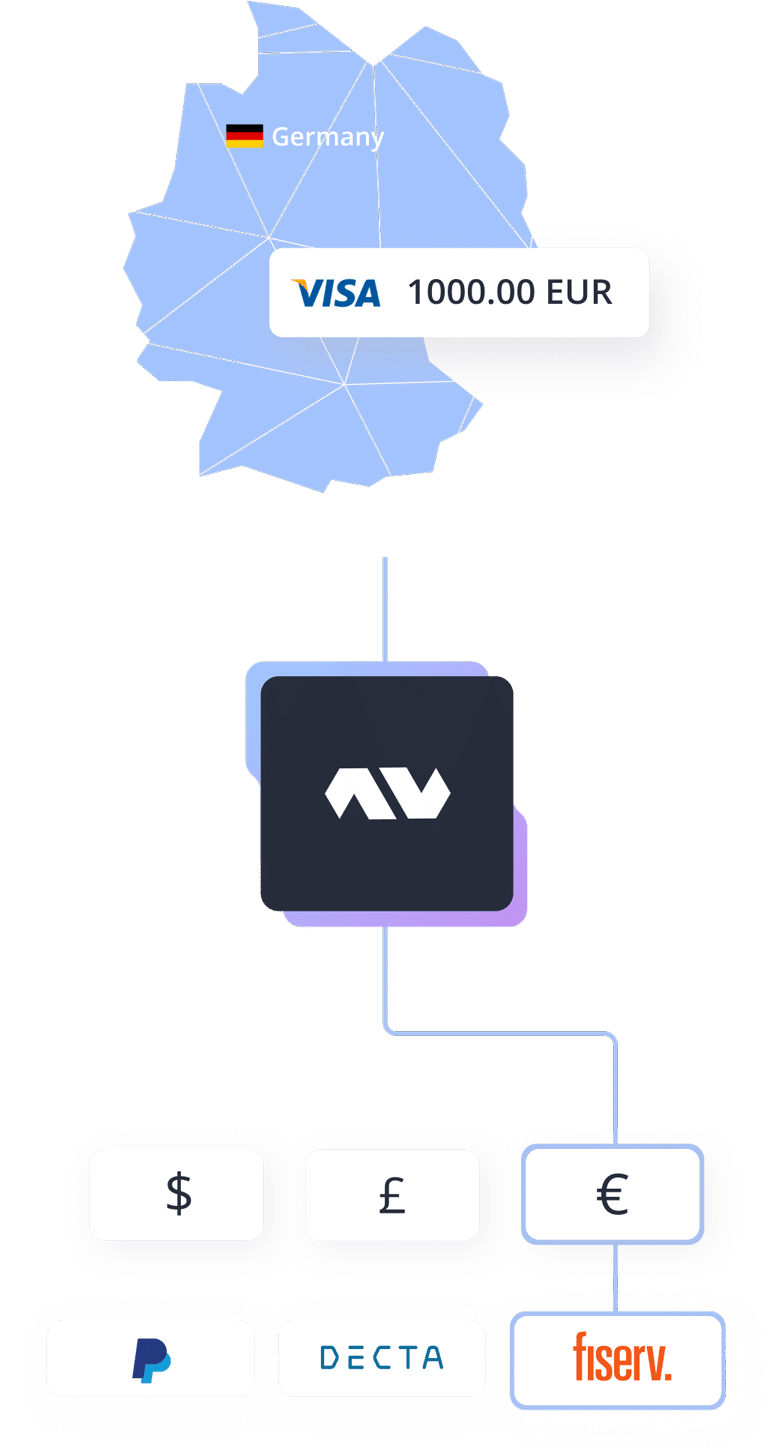

To ensure the success of payments, you should have integrations with multiple acquirers. To do so by yourself, you should prove not only the technical efficiency of your own solution but also your reputation. Transferty has a wide range of acquiring partners as well as smart routing and cascading technologies to guarantee the success of each transaction

Use routing and cascading

Transferty routing and cascading will help you increase the success rate of transactions, reduce transaction processing times, transaction fees, and transaction declines, and ensure the reliability of payment processing by providing a backup option in case one acquiring bank or processor is unavailable or experiencing technical difficulties

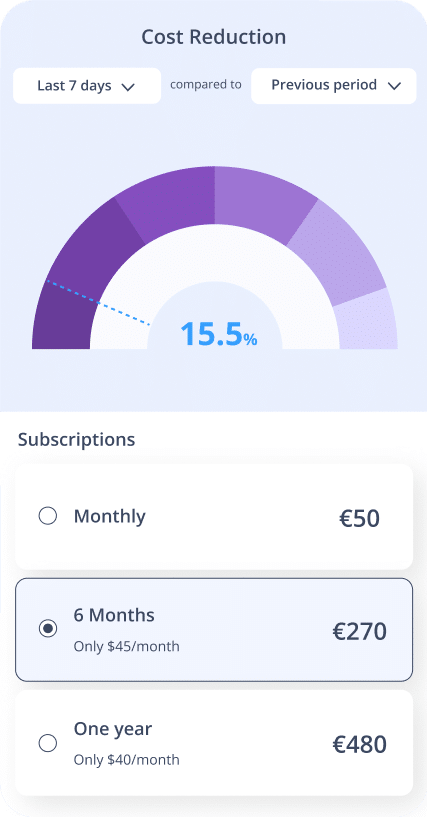

Save with recurring payments

Getting a new customer is about seven times more expensive than retaining an existing one. With subscriptions and recurring payments, you’ll save money on re-attraction (customers are less likely to cancel their subscription if they are receiving ongoing value), get predictable revenue, improve cash flow, and enhance customer loyalty. We use tokenization for data security, so it’s absolutely safe

Minimize chargebacks

We provide a complex approach for identifying and mitigating chargebacks. This includes providing refunds to customers to avoid disputes if they contact you first. We offer notifications if customers contact their bank to initiate a dispute. We provide documentation support and accompaniment to ensure that disputes don’t become chargebacks

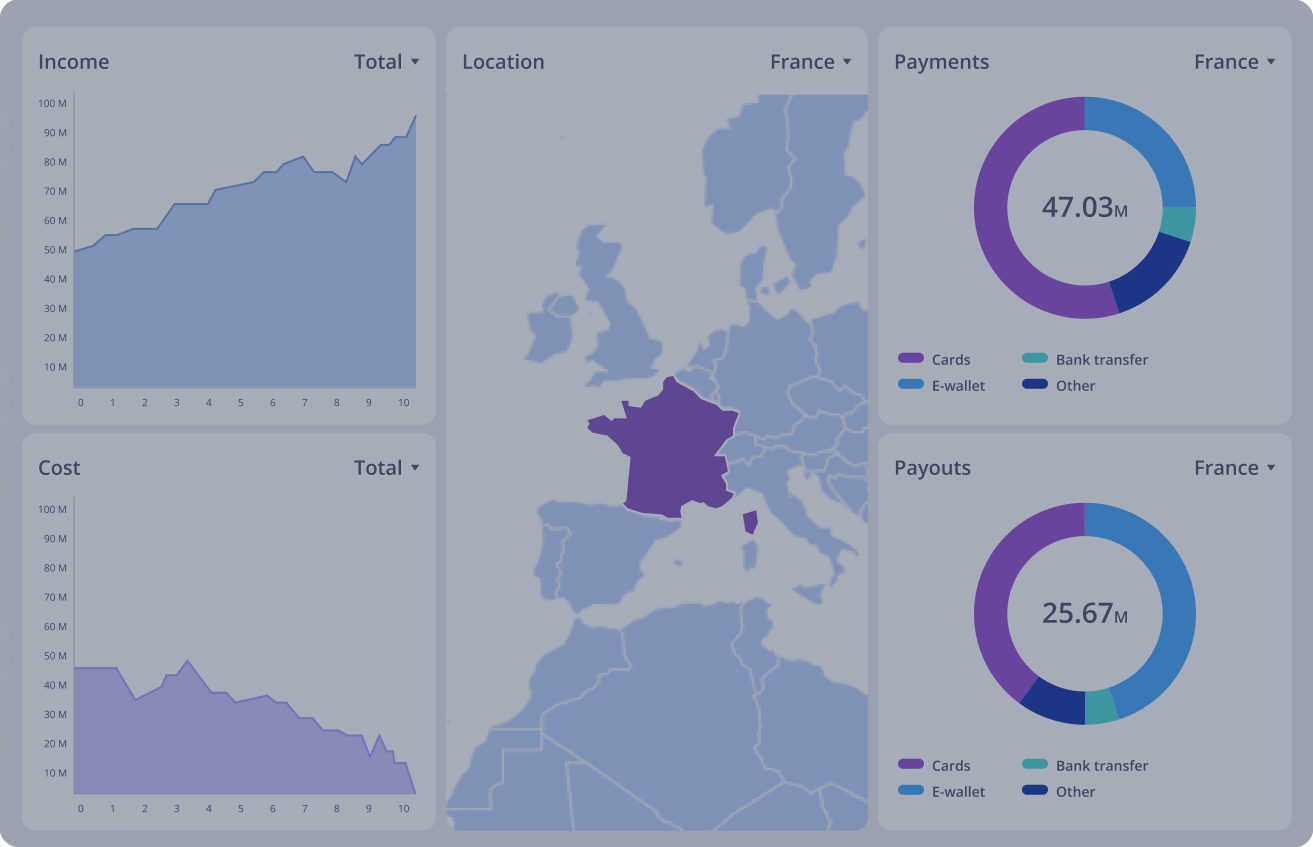

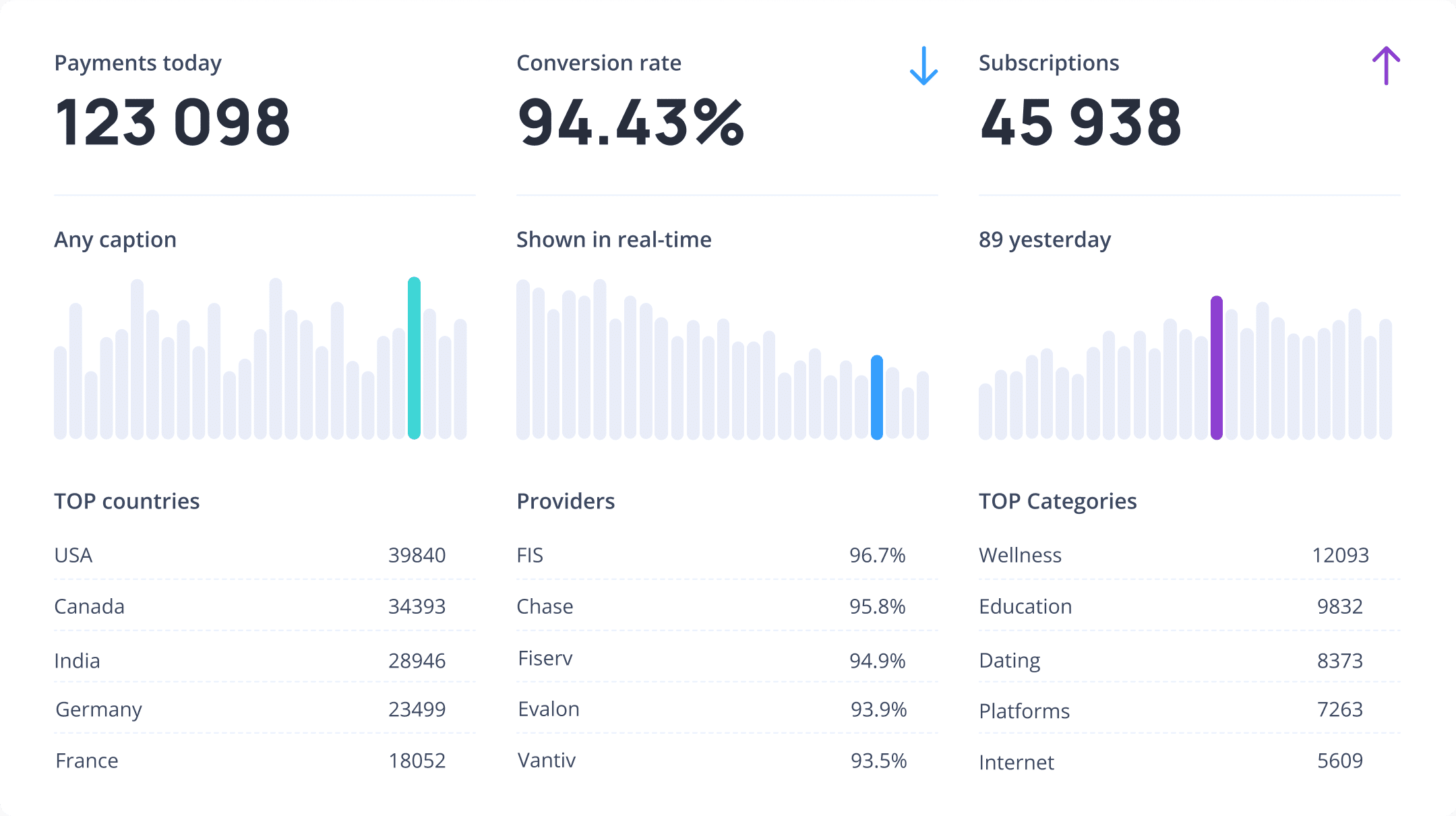

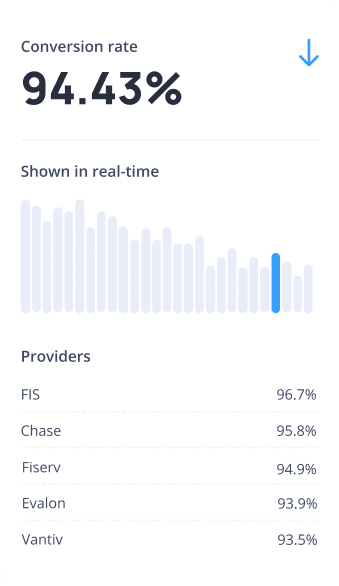

Try now to estimate your potential savings

See your potential cost savings by using multiple acquirers, smart routing, and cascading. Simply input your current expenses and compare the results to our efficient and cost-effective solutions

Start your cost-saving journey

Don’t let inefficient payment processing eat into your profits. Take advantage of the main ways to reduce costs and start seeing the benefits right away

Reach the best payment experience

By implementing a modern payment solution and leveraging data insights, you can provide secure and convenient payment options, driving customer satisfaction and revenue growth

Frequently Asked Questions

Here you will find the answers to commonly asked questions. If you can't find the answer on your question or need any further information, please, feel free to contact our sales team

-

Why using a white-label payment gateway is better than developing my own solution?

Developing your own payment processing solution can be a time-consuming and costly process, requiring significant technical expertise and resources. In contrast, a white-label payment gateway offers a ready-made solution that can be customized and integrated into an existing platform more quickly and easily, allowing companies to focus on their core business. Additionally, a white-label payment gateway provider typically offers ongoing support and maintenance, as well as compliance with industry regulations and standards, reducing the risk and complexity of managing payment processing in-house

-

How much can the development of my own payment gateway cost?

The cost of developing your own payment gateway can vary widely, depending on the complexity of the solution and the level of customization required. It can range from tens of thousands of dollars to millions of dollars. In addition to development costs, there are ongoing maintenance and compliance costs associated with payment gateway solutions, including PCI DSS certification

-

Why is PCI DSS certification so important?

PCI DSS (Payment Card Industry Data Security Standard) certification is important because it ensures that your payment processing system is secure and compliant with industry standards. PCI DSS certification requires adherence to a set of security standards and practices designed to protect customer payment data from unauthorized access, use, or theft. Failure to comply with PCI DSS standards can result in significant fines and penalties and damage your business’s reputation

-

What are routing and cascading in payments?

Routing and cascading are two methods used in payment processing to ensure that transactions are processed efficiently and cost-effectively. Routing refers to the process of directing payment transactions to the most cost-effective payment processor based on factors such as transaction volume, currency, and location. Cascading, on the other hand, involves routing transactions to multiple payment processors in a predetermined order until a transaction is processed successfully. This can improve transaction success rates and reduce the risk of payment processing disruptions