A powerful suite of management tools is a must-have for any business owner or manager who wants to stay ahead of the curve, optimize business processes, and be on guard against potential issues

Keep an eye on your business processes and be on guard

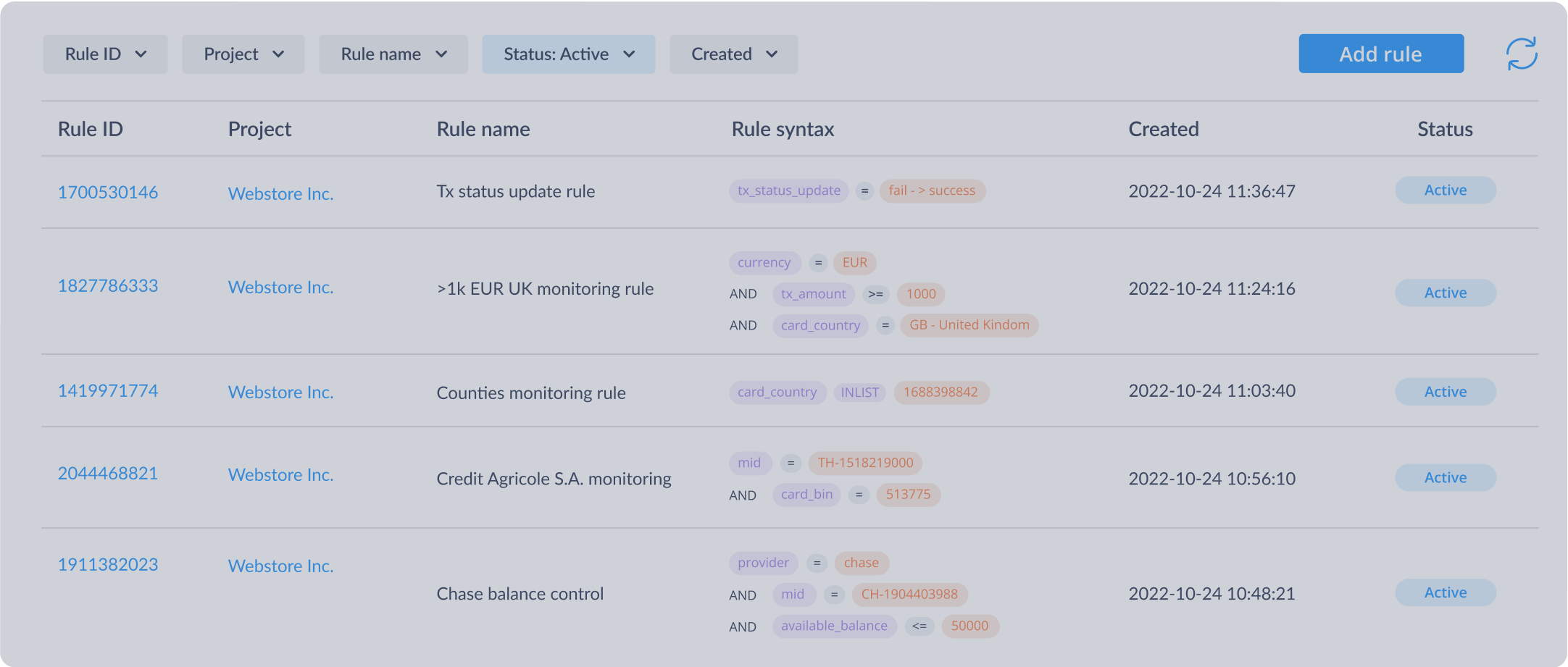

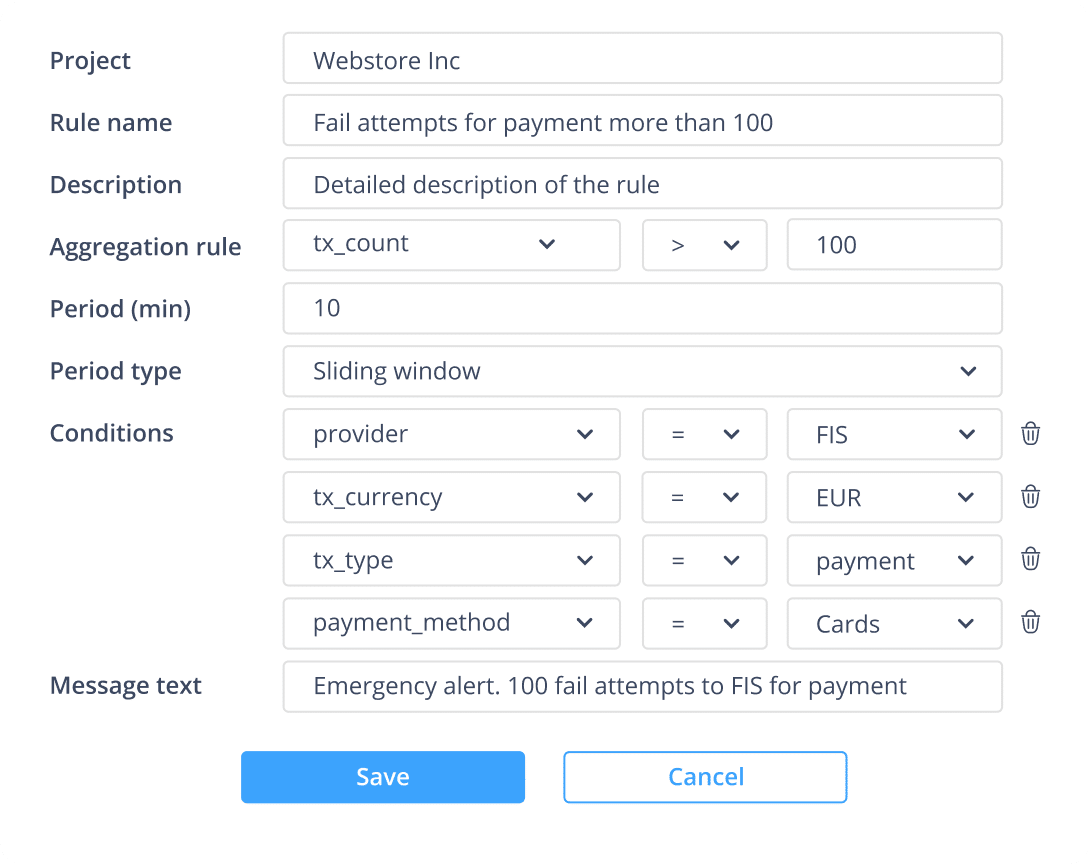

Rules builder

Establish transaction rules, prevent fraudulent transactions, review them, direct them to a specific provider, balance them between MIDs, and generate notifications

- Easily route transactions to different MIDs based on a variety of criteria, such as GEO attributes, card brands, 3DS verification, and more

- Block transactions that are subject to sanctions according to parameters such as PAN, BIN, or card issuer country

- Balance the distribution of transaction traffic between different MIDs by defining specific percentage ratios or volumes to improve performance

- Adjust emergency alerts to notify not only for transaction and MID-related events but also for security rules

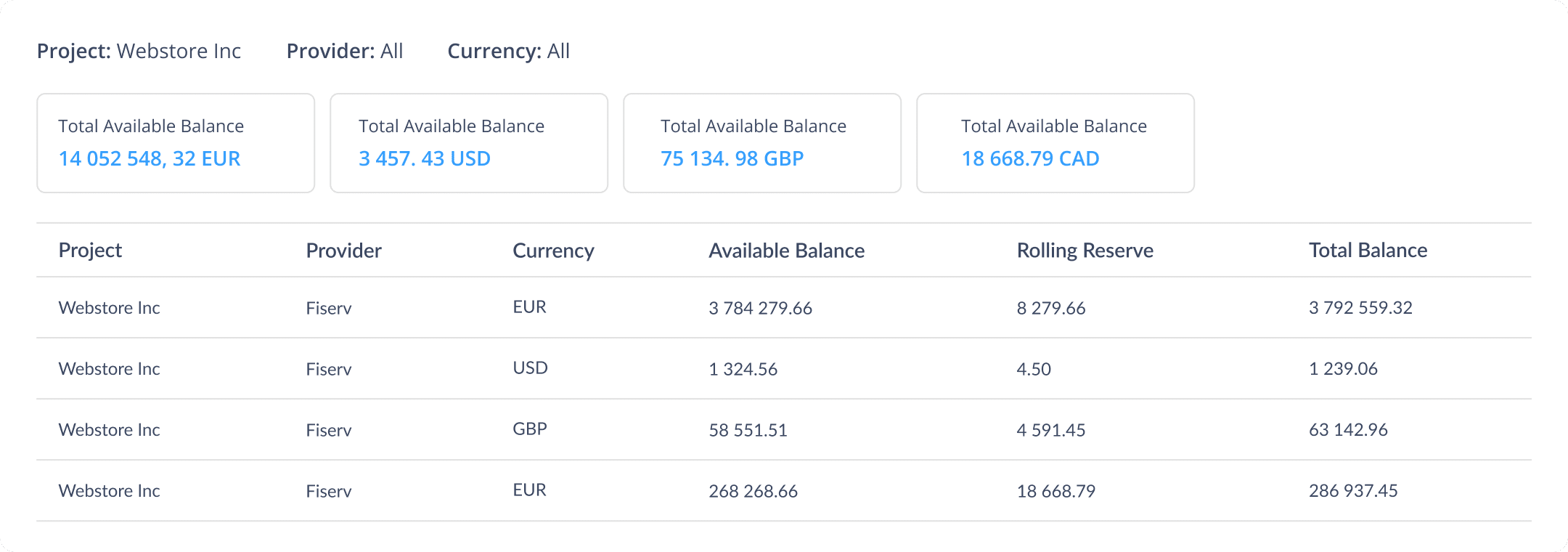

Balance manager

Stay up-to-date with your balances in real-time. Monitor, analyze, optimize, and manage your balances in one place with Transferty Balance Manager

- Keep updated on your balances’ status with a comfortable solution that collects everything in one place

- Analyze detailed insights and analytics on your spending patterns and income sources to make informed decisions

- Focus on the specific balances by sorting them with filters for a better understanding of your processes

- Manage multiple merchant accounts by merchant identification numbers (MIDs), currency, and provider

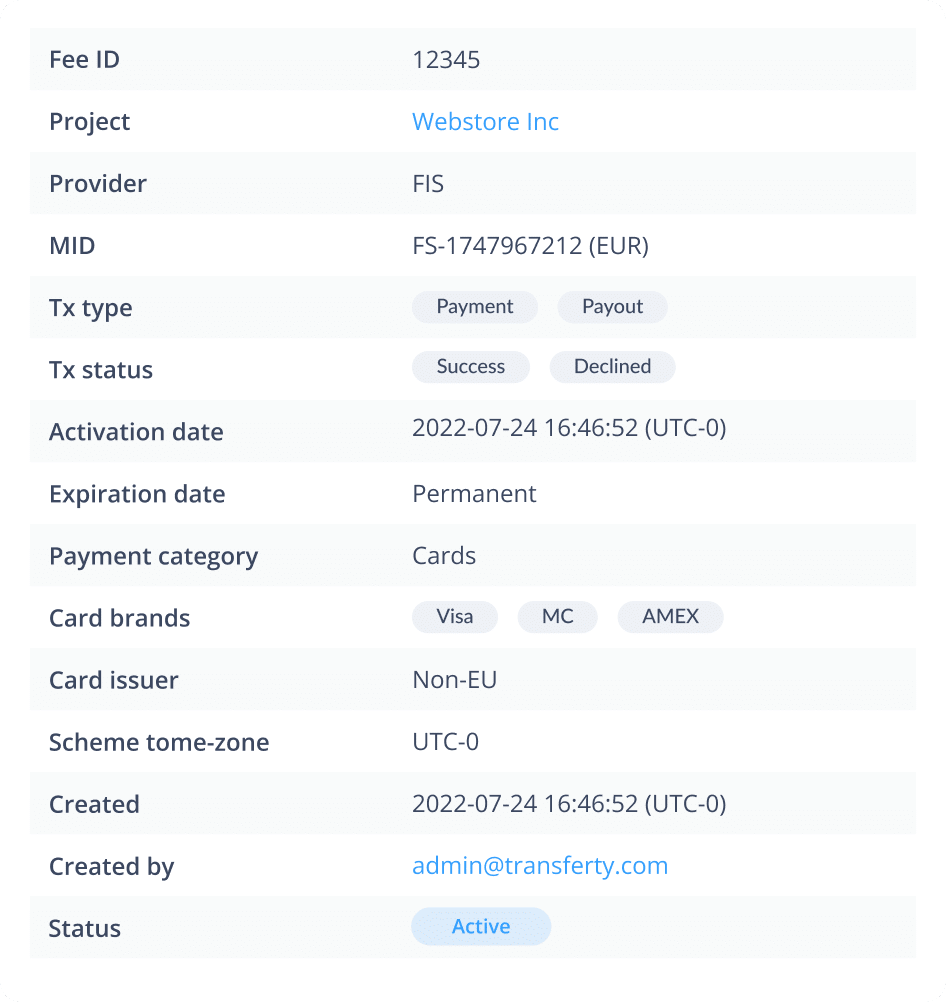

Fees manager

Fees Manager helps optimize financial processes via easy fees monitoring and informed decision-making. White-label gateway users get an added feature of configuring and categorizing fees for their merchants

- Configure various fee rates for different projects according to your business needs using the white-label payment gateway

- Analyze and monitor the charges you pay to reduce extra expenditures

- Prioritize sending transactions to MIDs with lower commissions to optimize your fees and, therefore, revenue using routing rules

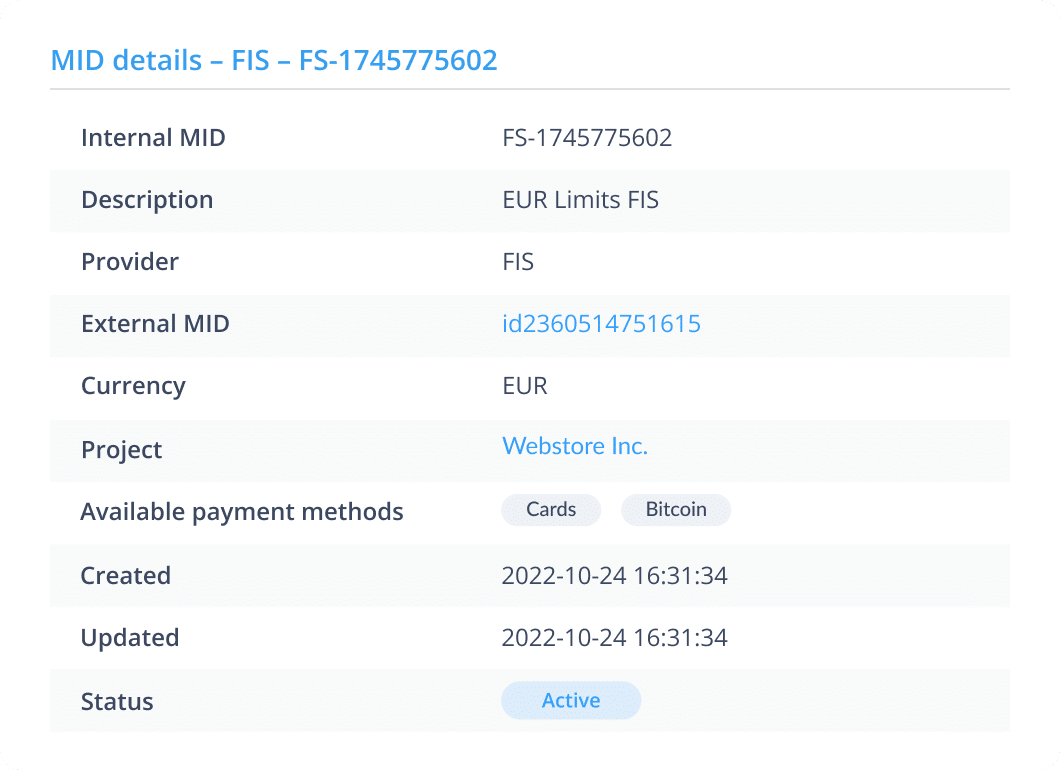

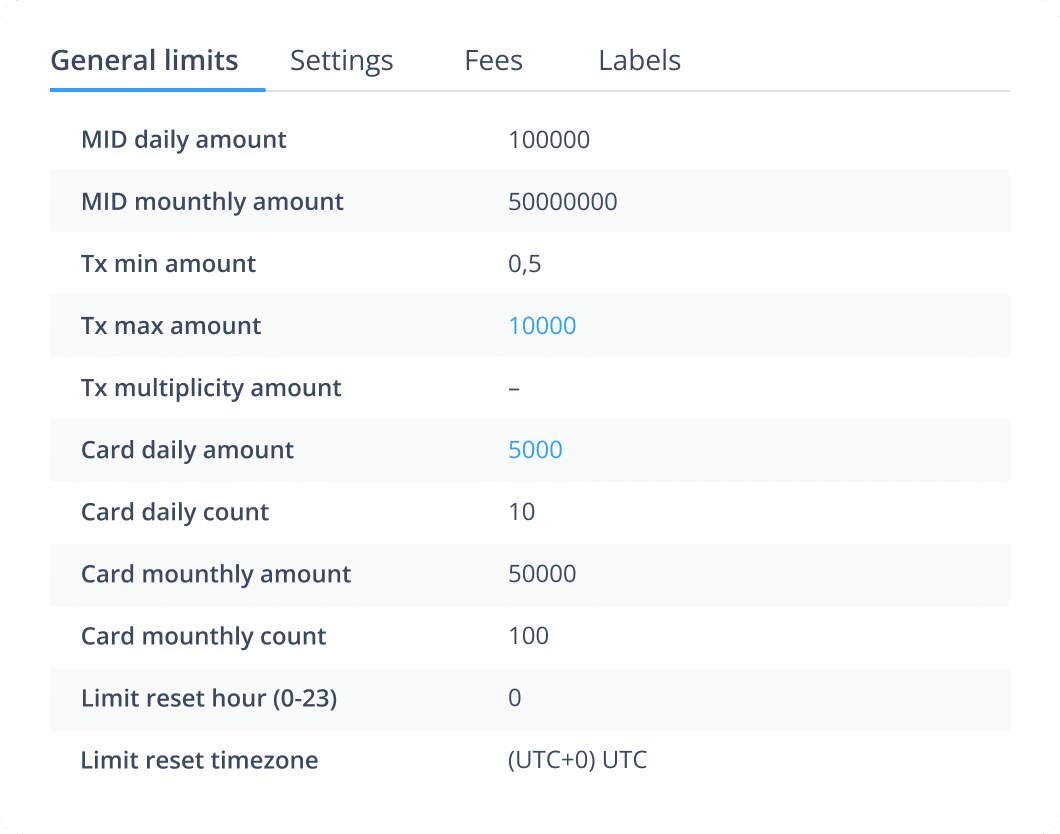

Limits manager

The Limits Manager is an effective tool for merchants that enables them to adjust payment limits to optimize payment performance, and comply with agreements with acquiring banks

- Customize limits to fit your specific business needs and requirements thanks to different types: general limits, transaction limits, and card limits

- Automate your limit management processes, saving you time and reducing the risk of errors or oversights

- Increase conversion and improve customer experience by avoiding unsuccessful transactions due to limit errors

- Monitor your limits in real-time, gaining greater visibility and control over your payment processes

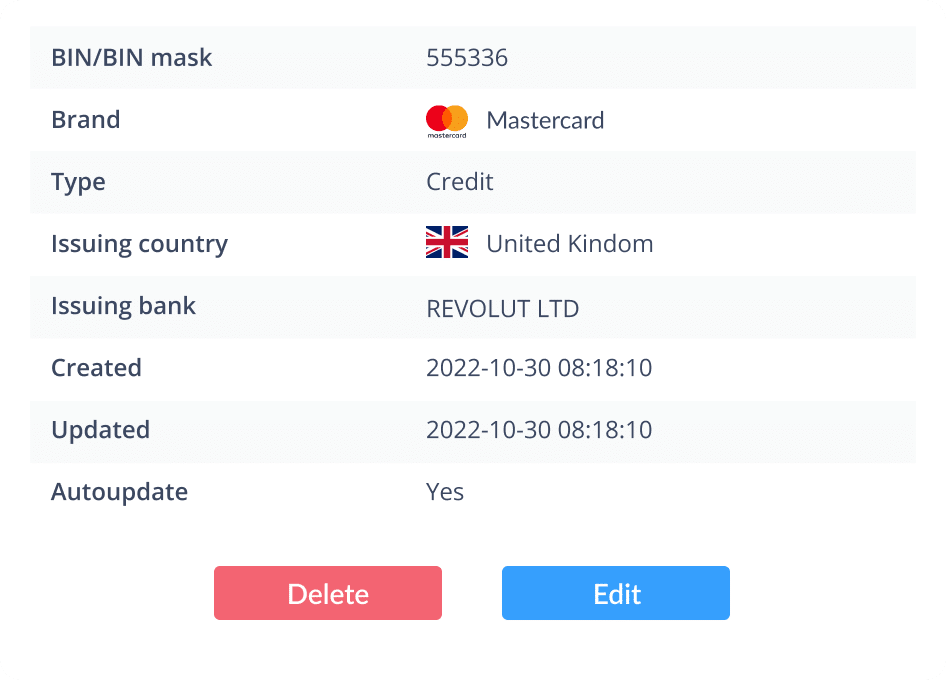

BIN manager

Improve customer experience, increase sales, and optimize risk strategy by managing payment method acceptance and analyzing issuer and country information to fit local security requirements

- Optimize payment flows by excluding expensive or foreign-issued cards, using our up-to-date databases that support 6-7-8 digit BINs

- Ensure security and prevent data leakage by managing access to our up-to-date BIN data, editable manually if needed

- Keep your BIN info up-to-date with auto-updates and manual editing

Cards & APMs manager

Use an all-in-one payment solution to manage complex processes with simple, smart tools and features. Increase the variety of acceptance options and optimize your payments

- Expand your customer reach by accepting a wide variety of payment methods, including popular alternative payment methods

- Track your payment activity, identify trends, and make data-driven decisions to improve your business processes

- Manage all Cards & APMs data in one place and set the triggers and payment rules to eliminate payment issues

- Avoid sending payments with blocked payment cards to certain providers by assigning tags (labels) to the cards

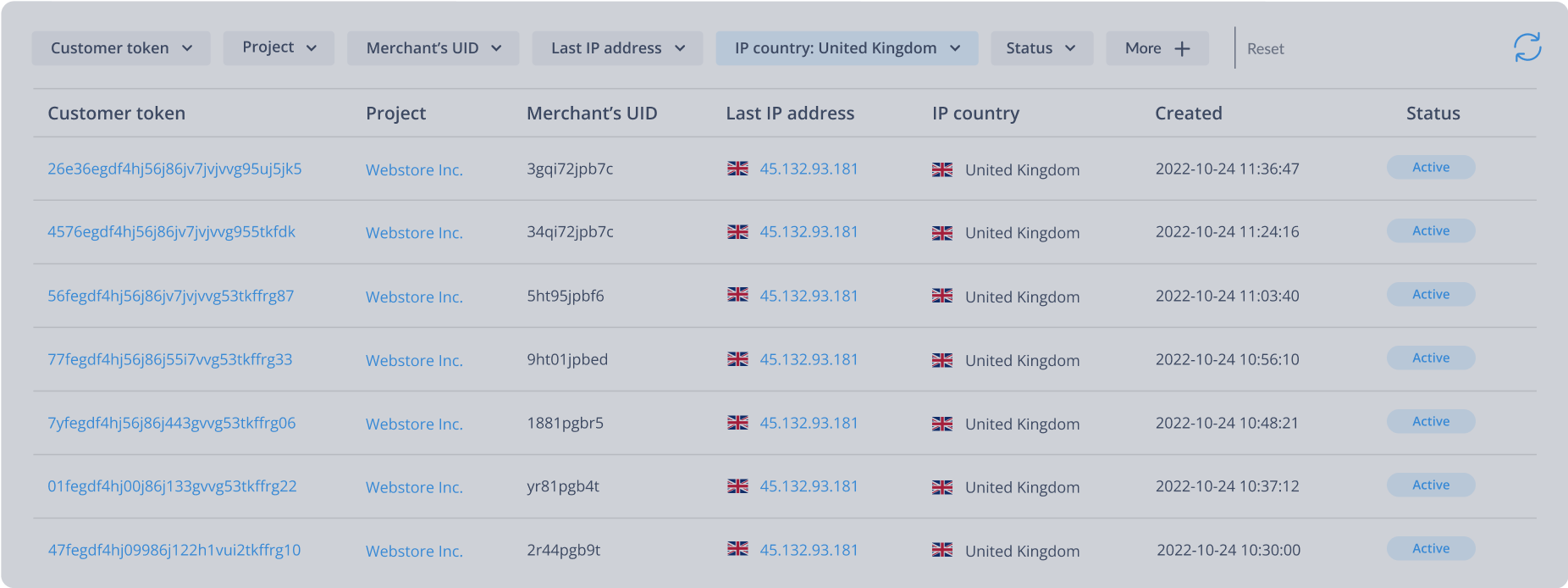

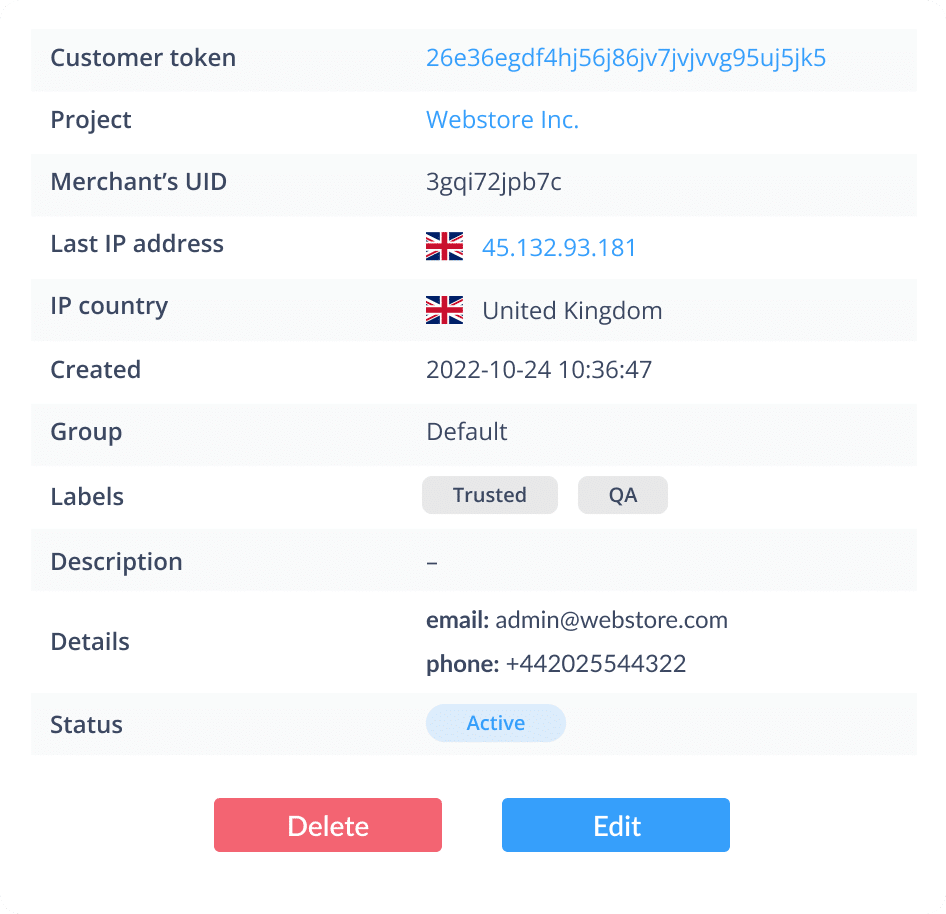

Customers manager

Manage your customer data, monitor activity, improve security measures, and identify potential fraud or suspicious behavior with our easy-to-use Customers Manager

- Create and manage customer profiles, including tokens and labels, for better organization and tracking of customer behavior

- Improve security by tracking customer activity, identifying potential fraud or suspicious behavior, and taking appropriate measures

- Improve customer service and support by accessing a customer’s profile information and transaction history

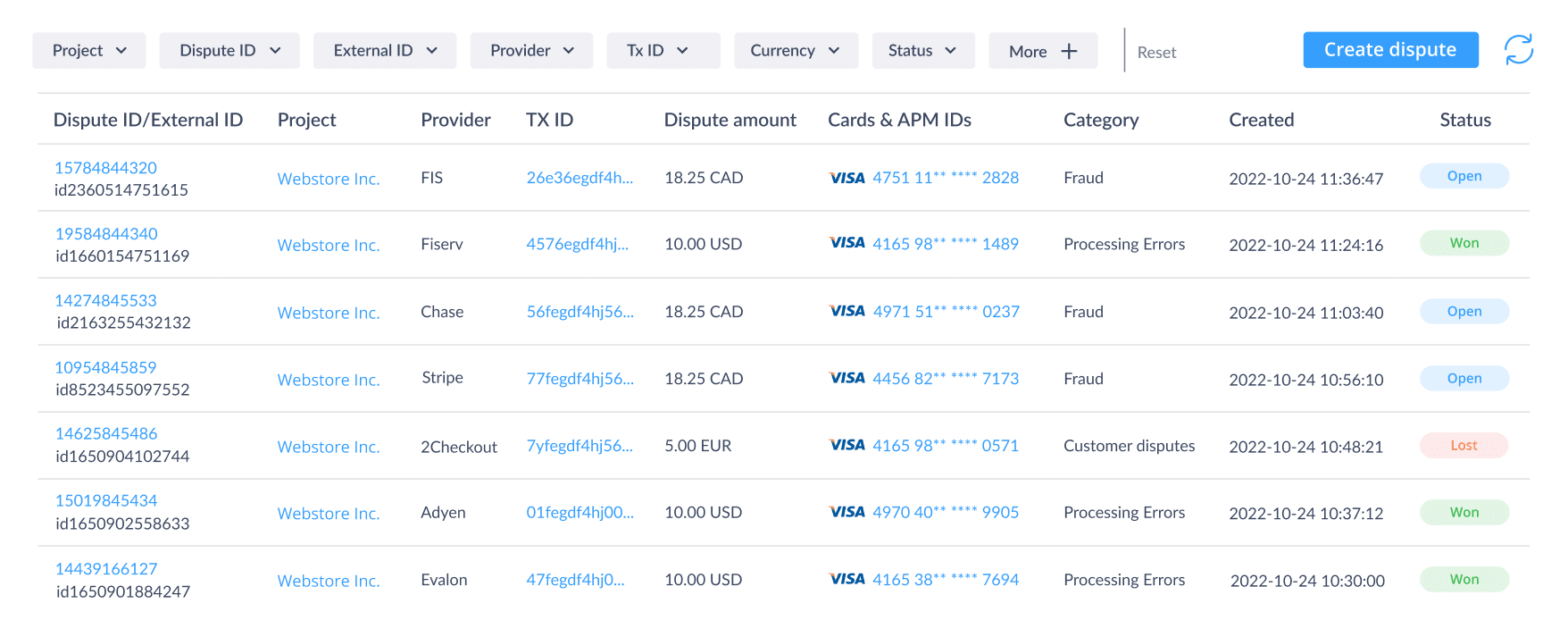

Disputes manager

Manage communication with acquirers and merchants in dispute cases and safely exchange sensitive information in compliance with the requirements

- Monitor an indicator that shows the level of chargebacks for the period and determine the category of risk: low, moderate, high

- Use the drag-and-drop tool for file exchange, like screens of communication with a cardholder, the history of the transactions, and refund policies

- Save your time by managing all chargebacks from merchant accounts with different providers or acquirers in one place

- Maintain control over dispute details, including terms, statuses, and transaction information being disputed

Start managing your payments effectively

All you need to do is just click on the ‘Try Now’ button to start using all the benefits right now, or ‘Contact Sales’ to find out more benefits specifically for your business

Frequently Asked Questions

Here you will find the answers to commonly asked questions. If you can't find the answer on your question or need any further information, please, feel free to contact our sales team

-

Why is it important to analyze the payment process?

Analyzing the payment process in a payment gateway is important as it allows businesses to identify and address any inefficiencies, bottlenecks, or issues that may arise during payment transactions. It helps optimize the user experience by ensuring smooth and seamless payment flows, reducing friction, and minimizing errors. By conducting a thorough analysis, businesses can improve transaction success rates, enhance security measures, identify trends or patterns in payment behavior, and ultimately provide a more reliable and satisfying payment experience for customers

-

What is BIN?

BIN stands for Bank Identification Number. It is the first 6–8 digits of a credit or debit card number and is used to identify the issuing bank and other information about the card, such as the card brand and card type (e.g., Visa, Mastercard, debit, credit). BIN information is often used by merchants and payment processors to verify card details and prevent fraud

-

What is a dispute?

A dispute refers to a disagreement or conflict between a customer (cardholder) and a merchant regarding a particular transaction. It typically arises when the customer questions or disputes the validity, accuracy, or quality of a purchase made using their payment card. Disputes can occur for various reasons, such as unauthorized transactions, billing errors, non-receipt of goods or services, dissatisfaction with the product or service, or issues related to refunds and returns. Resolving disputes involves investigating the claims, gathering evidence from both parties, and reaching a resolution that is fair and satisfactory for all parties involved. Dispute management processes and tools are used by payment service providers and merchants to handle and resolve these conflicts effectively.

-

How disputes manager can support my business?

The Transferty Dispute Management tool provides a solution to help your business manage disputes effectively. With our tool, you will be notified as soon as a dispute arrives, ensuring that you have enough time to take action and resolve the issue before it escalates. Our platform gathers all disputes in one place, regardless of how or which MIDs they arrive from, making it easy for you to track and manage them. You can also use filters to sort the disputes by ID, provider, category, status and more to resolve them appropriately. With our Dispute Management tool, you’ll be able to streamline your dispute resolution process, reduce your workload, and maintain customer satisfaction

-

How to use the Dispute Management tool?

Our Dispute Management tool centralizes disputes from multiple providers and acquiring banks, offering convenience. It provides details about disputed transactions, necessary documents, and enables merchants to submit proofs. We manage the process and keep you updated on outcomes, including wins, losses, or any additional steps required

-

Why is it important to track the changes my employees make in the payment system?

Tracking changes made by employees in the payment system can help businesses maintain control and ensure that the system is being used appropriately. By monitoring changes, businesses can identify potential errors or fraud, and take action to correct them. Additionally, tracking changes can help businesses identify areas where employees may need additional training or support, and improve overall system performance. By maintaining a clear audit trail of changes, businesses can also demonstrate compliance with regulatory requirements and protect against legal or financial liability

-

Who can see the changes in my merchant account?

Tracking changes made by employees in the payment system is crucial for maintaining control, detecting errors, preventing fraud, improving performance, ensuring compliance, and protecting against legal and financial liability. By closely monitoring and documenting these changes, businesses can identify and rectify errors, detect and investigate suspicious activities, provide necessary training and support, demonstrate compliance with regulations, and establish a clear audit trail for accountability and protection in case of disputes or legal inquiries

-

What is a balance manager?

A balance manager is a functionality to help merchants manage their account balances. Firstly, it offers convenience by keeping them updated on the status of their balances in one centralized location, eliminating the need to check multiple platforms. Secondly, the ability to focus on specific balances through sorting and filtering options enhances their understanding of various processes and helps them prioritize tasks efficiently. Lastly, the balance manager allows merchants to easily manage multiple merchant accounts by organizing them based on merchant identification numbers (MIDs), currency, and provider, streamlining their operations and facilitating seamless account management

-

How can I get a limits’ manager?

Each Transferty payment gateway user can easily utilize the limits’ manager to optimize the payments and improve the payment flow