Reach out to the payment features we propose and start growing your business with Transferty’s smart technologies

Start improving your payments to increase your sales

Accept payments

Maximize your sales with all popular online payment methods acceptance, optimize your costs due to smart routing, and start to grow your revenue

- Use a variety of popular payment methods globally, including alternative and local ones, to match your audience

- Pick the currencies you want to accept payments in according to your customers preferences

- Maximize transaction success by analyzing acquirers and providers and building the most optimal transaction routes

- Increase your customer loyalty with dynamic currency conversion that helps reduce extra fees for customers

- Pick only relevant payment methods to reduce unnecessary fees

- Build different secure payment flows fully compliant with PCI DSS

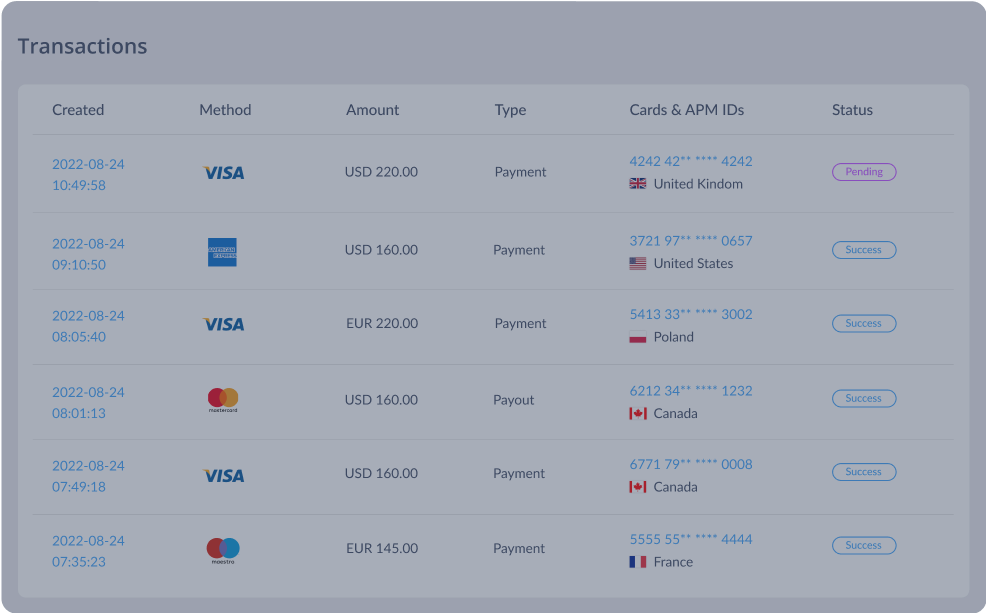

Make payouts

Send money for any distribution, including winnings and rebates to your clients, payments to service providers, and reimbursement of costs to your regional partners and affiliates

- Make single direct or mass payouts, track statuses, payment updates, and transaction details in real-time

- Utilize various alternative and locally recognized payment methods to simplify and expedite the payment process

- Increase transaction acceptance for every payout due to smart routing and cascading technologies

- Use simplifying features such as «Customer Labels» to bring order and structure and to conduct payout analysis

- Manage your payouts in a variety of currencies, wherever you are

- Track payout analytics on the dashboard

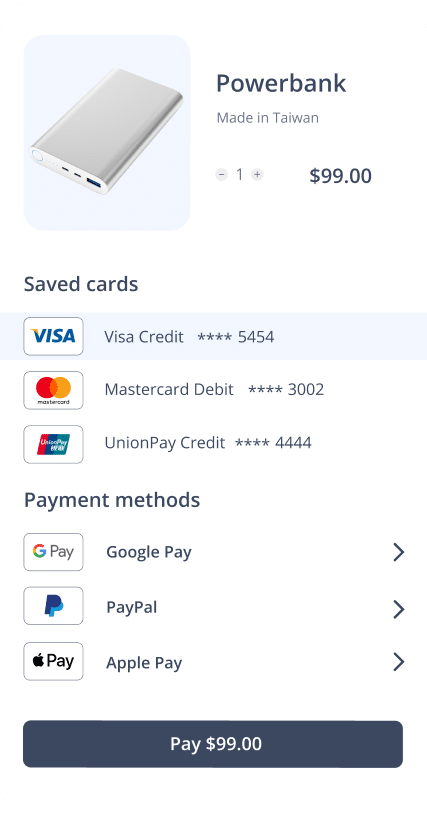

Checkout

Customize your checkout page to match your brand’s look, let your customers pay easily on any device or channel, and watch them return again and again

- Harness the power of design elements to align with your brand’s unique style: logo, button, header, fonts, color scheme, and dark or light theme

- Customize payment methods and checkout layout based on your business model, and the channels through which you sell

- Empower your customers by providing them with the option to select their preferred checkout language from a list of 22 available options

- Use simplifying features like a «Save card» option to remember the card, one-click purchases to speed purchases, etc

- Show the necessary custom hints to complete the flow successfully

- Show the payment page directly on your website using an iframe

Server-to-Server API

Transferty payment gateway proposes the server-to-server (host-to-host, S2S or H2H API) API to boost your online business. Feel the advantages of payment features and improve customer payment facilities

- Automate the processes with the rules and tune the H2H API payments to increase your conversion

- Ensure that your company meets the PCI DSS requirements when working with this API, as it involves the transfer of sensitive card data

- Keep the payment data well protected by using encryption in Transferty H2H API payments

- Tailor the H2H API payments according to your business model to optimize your transactions

- Transfer the payment information simply and quickly

- Enjoy 24/7 support while accepting H2H API payments

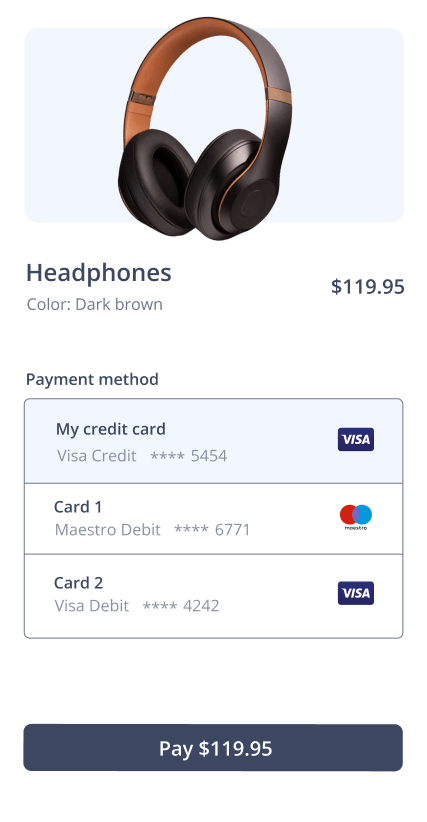

Oneclick

Boost your payments by enabling one-click technology

Transferty ensures a comfortable shopping experience and the availability to pay your customers with a single click

- Minimize the fraud by replacing sensitive customers’ payment data with a token

- Use the customer data to charge a card without additional actions

- Reduce sales time by making the purchase process a few clicks

- Ensure the perfect consumer experience without spending extra time

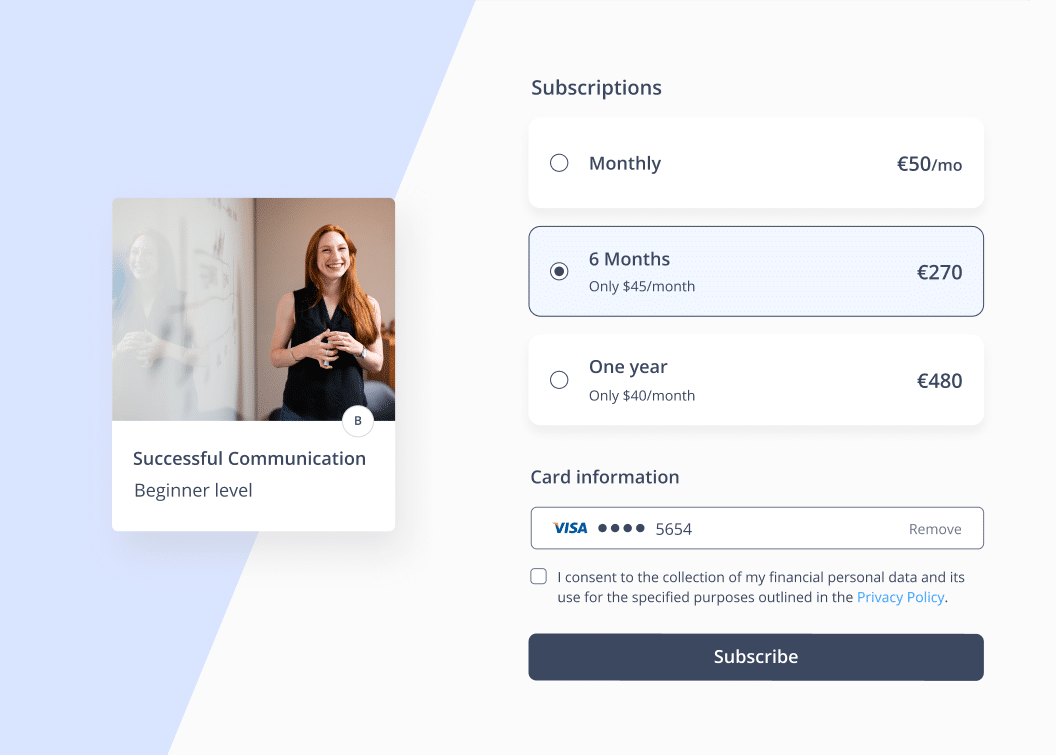

Recurring payments

Increase your revenue by accepting recurring payments globally, building strong relationships with your customers and boosting new products or business models

- Increase conversion with a range of payment methods, including cards, APMs, e-money, mobile payments, cryptocurrency, etc

- Automatically retry the failed transactions to keep customers involved and ensure cost efficiency

- Tailor the subscription and recurring payments to match the preferences of your audience

- Ensure the ability to purchase goods without any interruptions due to your business model

- Adjust the conversion of free trials into various membership options

- Pay as you go: allows users to easily unlock paid features you propose

Start gaining revenue right now

Experience the flexibility of our payment methods and increase your conversion rate, or reach out to our sales team for a customized offer tailored to your business needs

Frequently Asked Questions

Here you will find the answers to commonly asked questions. If you can't find the answer on your question or need any further information, please, feel free to contact our sales team

-

How can I improve my online payments?

Provide multiple payment options: Offering a variety of payment options, such as credit/debit cards, digital wallets, and APMs, can help customers choose the method that is most convenient for them

Simplify the checkout process: Make the checkout process as simple and easy as possible, with minimal form fields and clear instructions

Ensure security: Choose a reputable payment gateway that has encryption and tokenization to protect sensitive customer information and increase trust

Enable one-click payments: Make the shopping process clear and fast for your customers to ensure more successful payments on your website

Enable recurring payments and a “save card” option: Build long-term relationships with your customers to increase their loyalty

-

Why checkout customization could increase the number of sales?

Checkout customization can increase sales by improving the user experience, building trust, and enhancing branding. A streamlined and intuitive checkout process eliminates friction and makes it easier for customers to complete their purchase. Customized branding and design elements create a cohesive and professional impression, increasing trust and credibility. Security assurances and multiple payment options instill confidence. Ultimately, checkout customization helps create a positive and seamless buying experience, increasing the likelihood of conversions and driving more sales

-

What is H2H API?

H2H API refers to an integration method where two parties, a merchant and a payment gateway provider, exchange data directly through an API without the involvement of the end customer. In this case, the H2H API integration does not involve processing the card data directly by the payment gateway provider, nor does it require any interaction with the customer. Instead, the customer provides their card data to the merchant separately, outside of the payment gateway provider’s system. The merchant then sends the necessary card data to the payment gateway provider through the API, allowing for the secure and efficient processing of transactions. Note that in this case, the merchant must meet the PCI DSS requirements when working with this API, as it involves the transfer of sensitive card data

-

What is API In online payments?

An API (Application Programming Interface) in the context of online payments refers to a communication interface that allows different systems to exchange information and interact with each other. When a merchant integrates with a payment gateway provider, such as our system, they typically connect to the provider’s API to enable the processing of transactions. An API enables merchants to securely and conveniently transmit payment data between their systems and the payment gateway provider. Our payment service offers a secure API to facilitate seamless integration and processing of online payments

-

How do one-click payments improve sales?

One-click payments allow customers to complete their purchase with a single click without having to enter their payment and shipping information again. This can improve the customer experience by making the checkout process faster and more convenient, which can lead to increased sales. By reducing the number of steps required to make a purchase, one-click payments can also help reduce cart abandonment

-

Why are recurring payments so important for conversion increases?

Recurring payments, such as subscriptions or memberships, can provide a predictable revenue stream for businesses and encourage customer loyalty. By offering a recurring payment option, businesses can reduce the friction of having to repeatedly make payments for ongoing services or products, which can increase customer retention. Additionally, recurring payments can be a convenient way for customers to manage their budgets and ensure that they continue to receive the products or services they need without interruption

-

What type of businesses will win, using recurring payments?

Subscription businesses

Businesses that sell subscriptions are the biggest beneficiaries of recurring payments due to their business model. It may be any streaming service, app, or software company

Membership businesses

Businesses that aim to sell customer membership usually charge a fixed price for their services or goods. For example, learning courses or fitness gyms

Businesses related to the financial sector

Financial services related to loans, insurance, investments, etc. They usually deal with fixed amounts, and they charge on a regular basis

-

What is payment gateway fraud?

Payment gateway fraud refers to fraudulent activities or unauthorized transactions that occur within a payment gateway system. It involves the misuse of payment information or unauthorized access to payment accounts, resulting in financial loss for the merchant, payment processor, or the cardholder. Payment gateway fraud can take various forms, including stolen payment card details, identity theft, account takeover, fraudulent chargebacks, or manipulation of payment processes. Fraudsters may exploit vulnerabilities in the payment gateway system to gain unauthorized access, make fraudulent transactions, or deceive the system to bypass security measures. Choosing a reliable and secure payment gateway provider like Transferty is essential to protect against payment gateway fraud

-

How does payment gateway fraud happen?

The most common types of payment gateway fraud include:

BIN attacks and Card testing: In BIN attacks, cybercriminals use specialized software to generate long lists of potential card numbers by combining the first six digits of a card (the BIN) and testing them to find an active card that can be used for fraudulent purchases. In card testing, fraudsters create long lists of card numbers and make spam purchases in the hope that some of them will be successful

Theft of identity: By using identity theft tools, a hacker receives the personal payment data of a victim and makes a purchase using the victim’s card. To reduce the risk of data leakage, payment providers use tokenization technology, which replaces the customer’s sensitive data with a token, that could not be used by fraudsters to steal the information

To help prevent these types of fraud, payment providers often use various security measures, such as 3DS (3-Domain Secure), which adds an extra layer of authentication to the payment process by requiring the customer to enter a unique OTP (one-time password) or verification via a banking app before the transaction is approved. This security measure can help reduce the risks of payment gateway fraud and ensure that transactions are secure and protected