Transferty white-label payment gateway is the partner that gives you a SaaS-based, state-of-the-art payment solution tailored to your needs. With us, you eliminate all the risks and worries related to the development of your payment gateway. Launch your payment gateway quickly with innovative technology, reliable security, and personal customization

Your business's caring white-label payment gateway partner

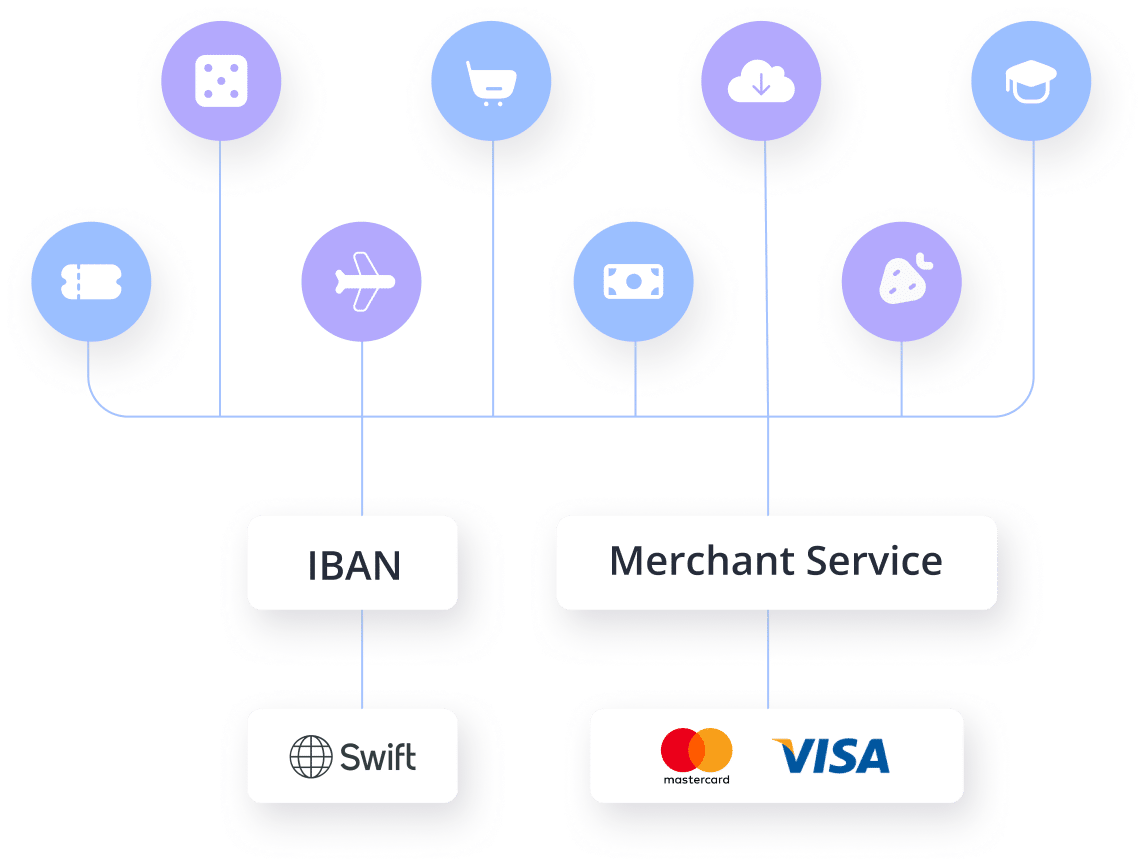

PSPs

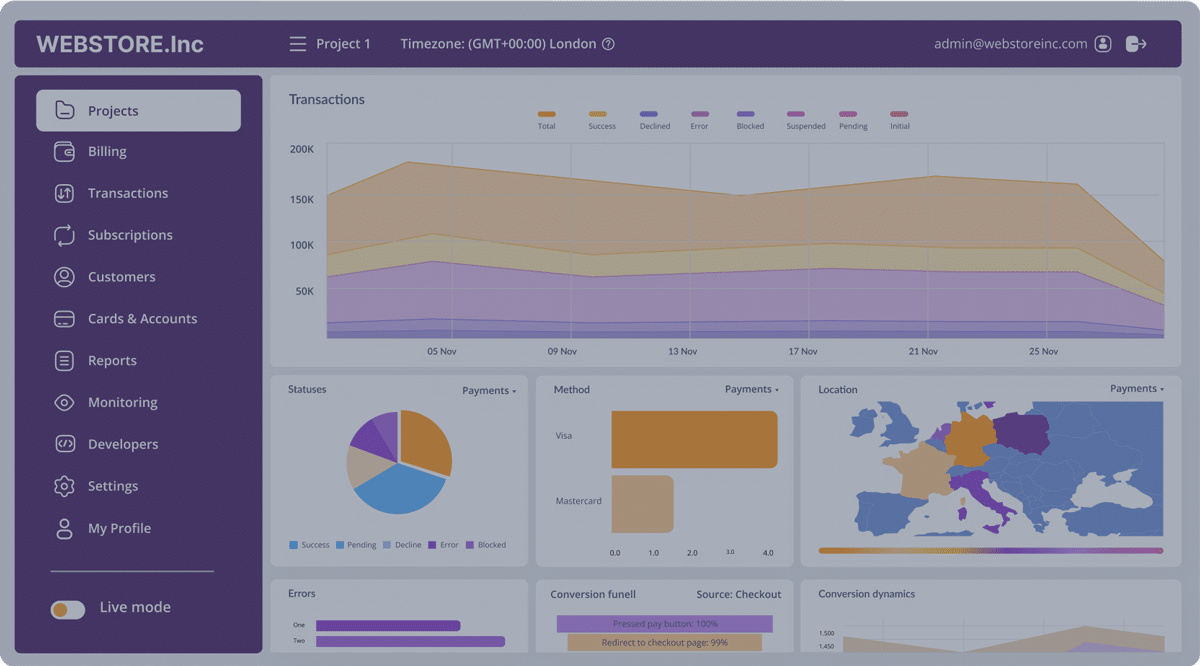

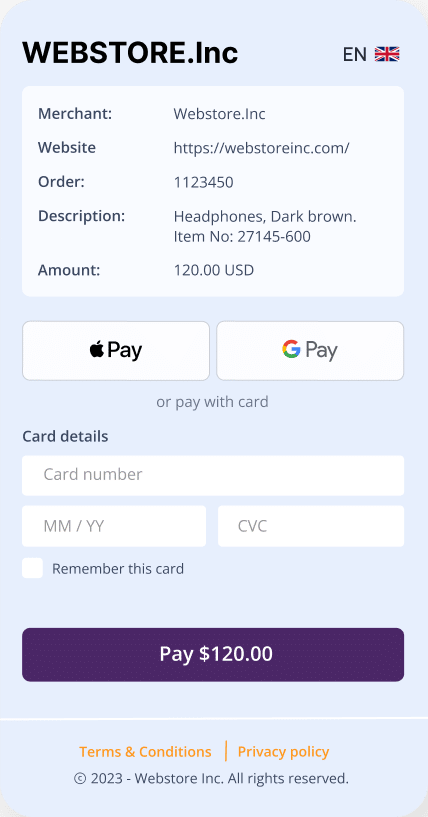

Launch your own PSP with a white-label payment platform. Use our reliable and effective infrastructure under your brand without major investments in development, administration, compliance, and support

- Save time on quick integration of our ready-to-use white-label payment solution and start growing your business faster

- Take advantage of individual control: create multiple merchant accounts, set up payment methods, use smart routing and cascading to increase conversion rates, and easily track transactions

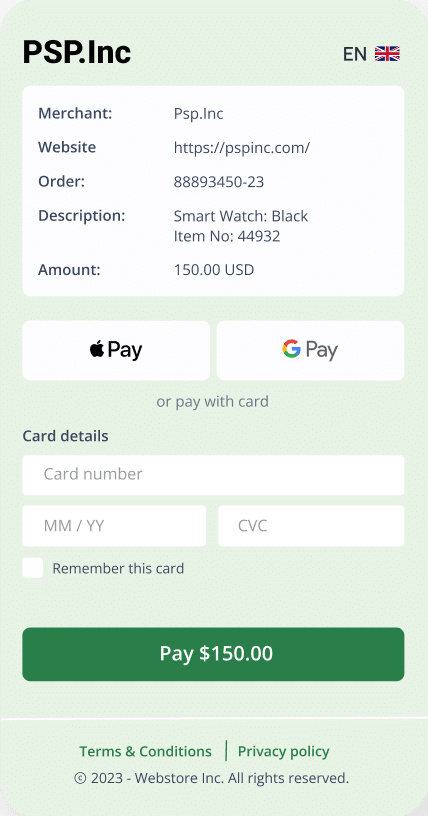

- Customize the user-friendly front and back-office interfaces to match your brand identity and level up your customers’ checkout experience

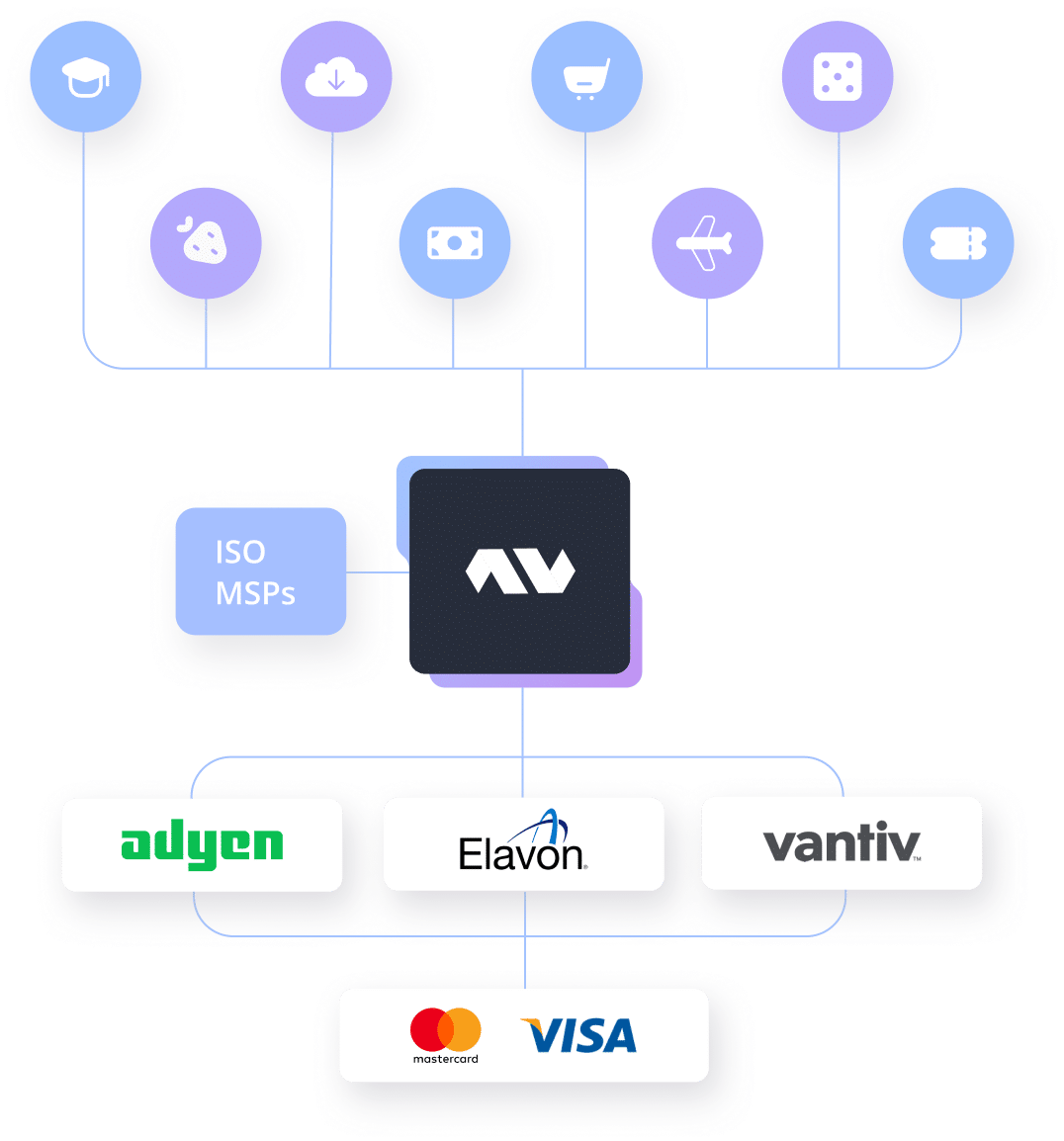

ISOs and MSPs

Become more competitive with a secure and functional payment gateway to boost your service and accelerate your income. A white-label payment gateway solution will add value to your products and services, help you earn more money, and reduce operating costs

- Keep control over your multilevel merchant accounts and increase transaction approval ratios using smart routing, cascading, audit trails, and data insights

- Increase your brand awareness and customer loyalty when entering new markets by offering payment services under your own brand

- Start turning merchant results into your own profits faster thanks to the rapid integration and adaptation of the SaaS white-label gateway

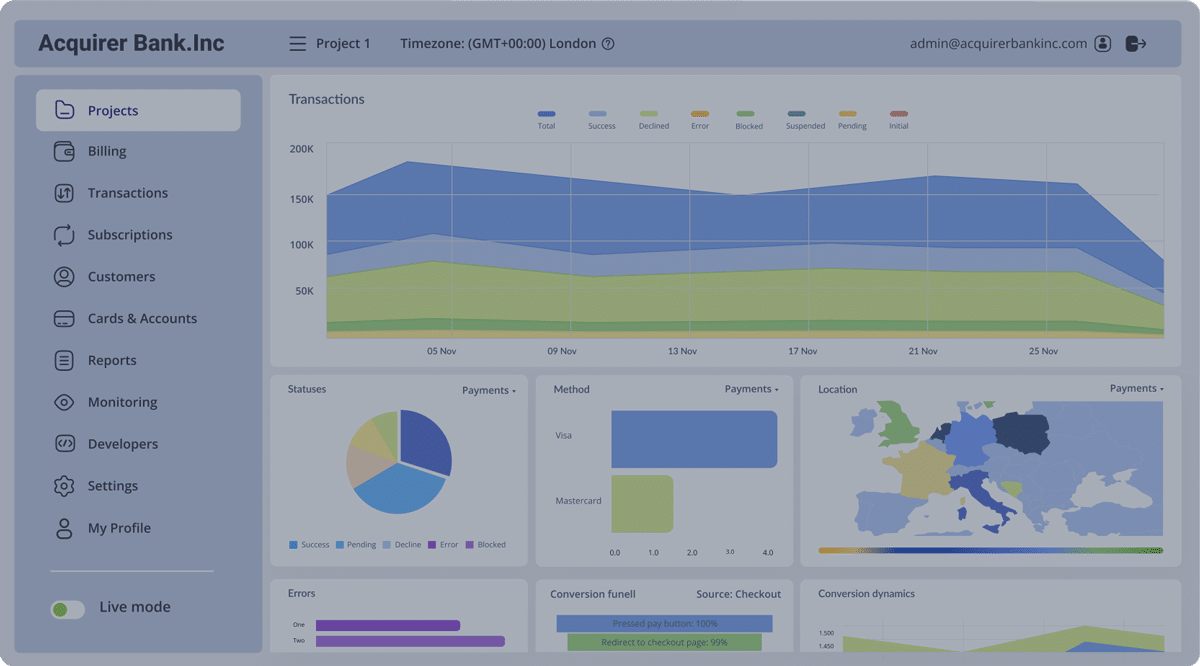

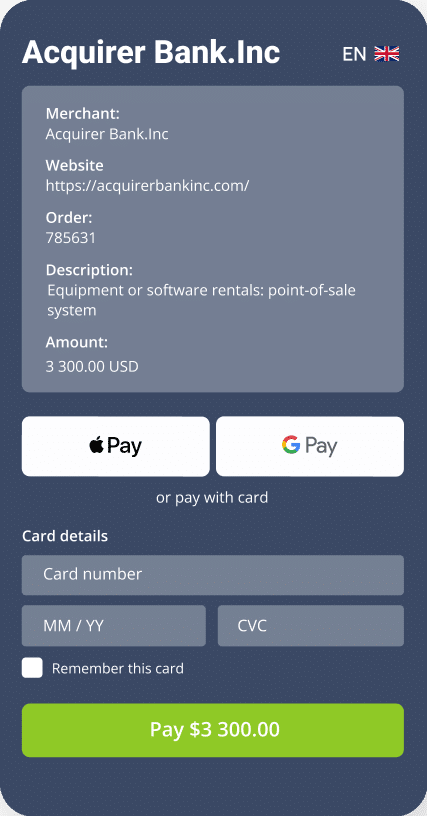

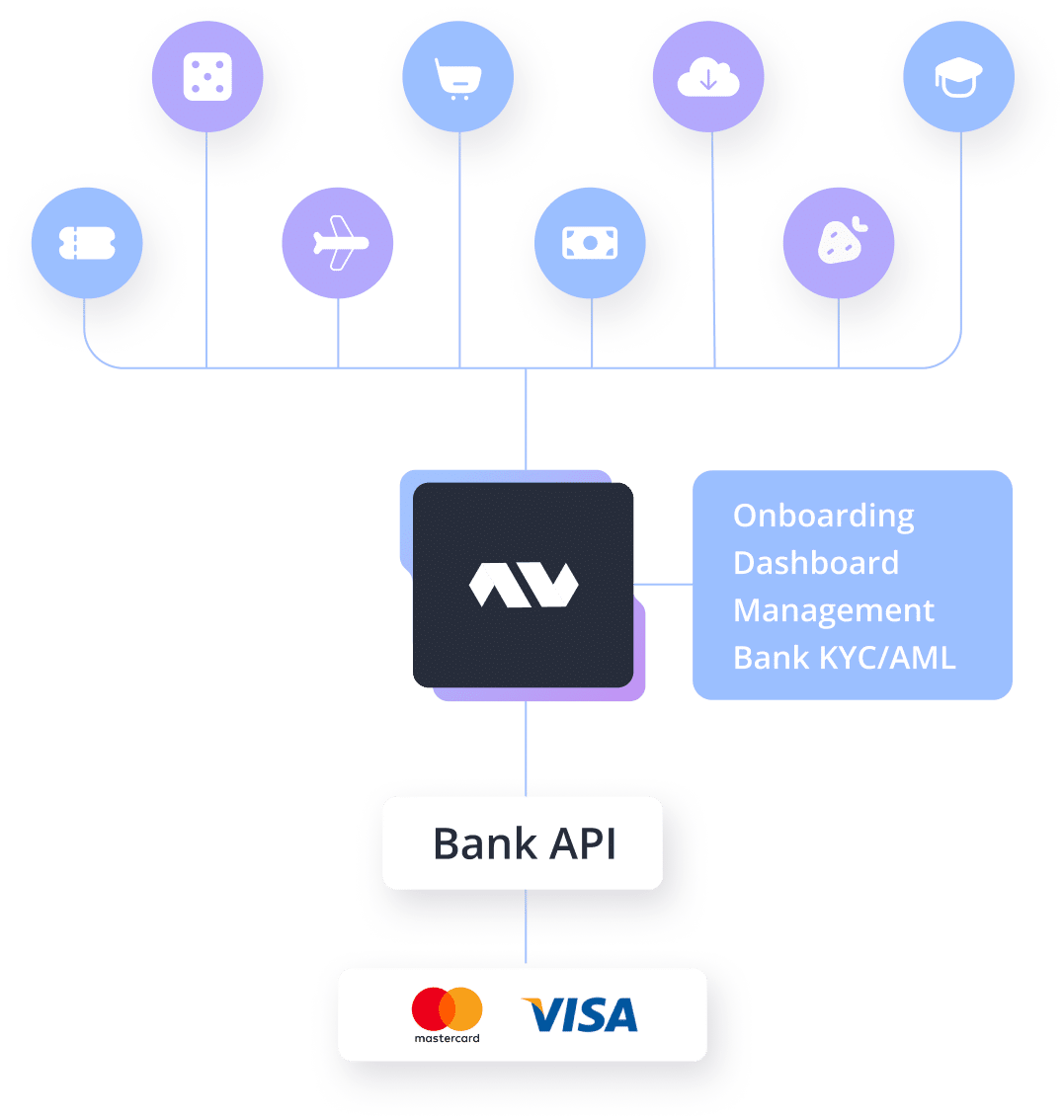

Banks and Acquirers

Purchase the scalable, fully customizable white-label solution that ensures all required functions under your brand and guarantees confidence and high uptime to stay competitive and popular among your customers

- Lead the innovations: we provide leading-edge technology, a high traffic load, PCI DSS Level 1 compliance, and professional technical support to ensure payment continuity

- Take advantage of a personal approach to onboarding, step-by-step technical consulting, and specific features made due to your requirements and risk prevention to ensure smooth and seamless migration for your customers

- Expand new markets fast and effectively thanks to an easily integrated cloud-based infrastructure and flexible PCI-certified architecture

Merchants

Outclass your competitors and accelerate business growth using a reliable, customizable white-label payment processing solution that allows you to control payments and increase profit. We provide a personal approach to ensure the needs of each industry are met. Our solution has a successful track record in handling high traffic and optimizing transaction acceptance

- Enjoy flexible customization options and individual feature development

- Set transaction rules, optimize financial operations, increase the conversion ratio, and reduce fees

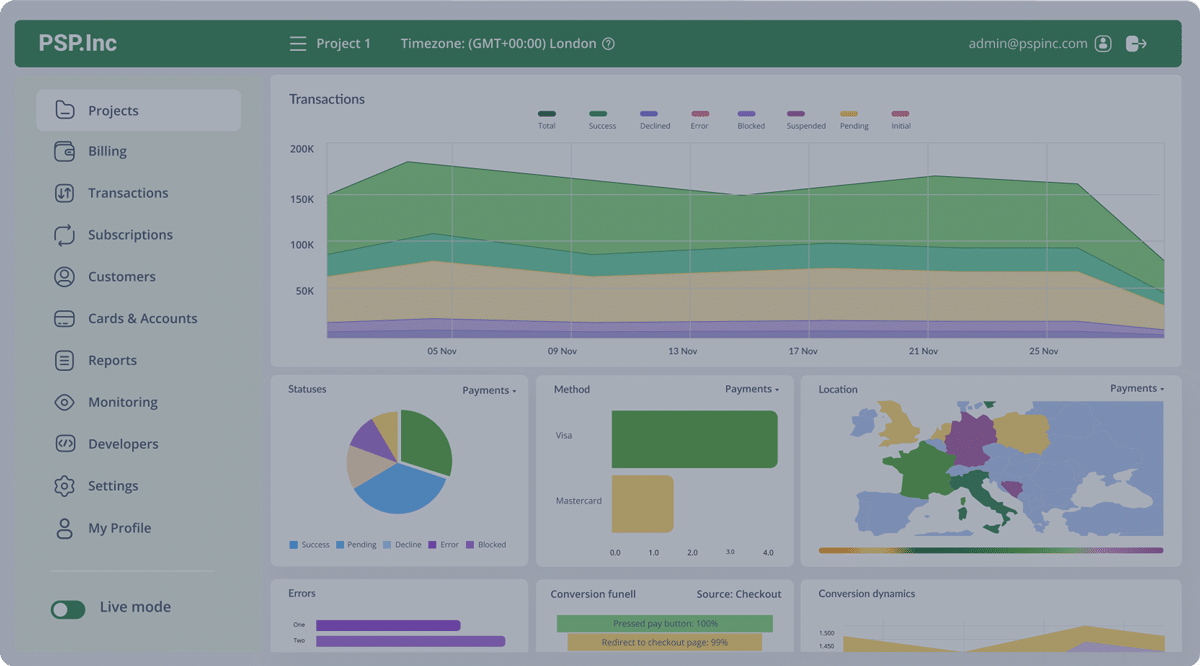

- Keep control over all financial data in the all-in-one dashboard and analyze data insights with analytics and reports

Try out our white-label payment solution and take your business to the next level today

Focus on driving strategic business growth, and let us take care of the technical details. Operate payments under your own brand with zero development cost

Everything you need to manage payments smarter

A full suite of tools designed to simplify payments, increase efficiency, and support your business growth at every stage

Built for Developers. Powered by Flexibility.

Our API is designed to be fast, secure, and easy to integrate — whether you’re launching a simple checkout or building a full-scale payment infrastructure

One API for total control

With full white-label support, Transferty gives you maximum control and customization at every step

Sample code, test cards, sandbox access, logs, and expert support — all in one place

Frequently Asked Questions

Here you will find the answers to commonly asked questions. If you can't find the answer on your question or need any further information, please, feel free to contact our sales team

-

What is a white-label payment gateway?

A white-label payment gateway is a payment processing platform that can be rebranded and customized to match the branding of a specific company or organization. Essentially, it allows businesses to provide their own branded payment gateway to their customers without having to build the technology from scratch. This can help businesses improve their brand recognition and customer loyalty, as well as provide a seamless and cohesive payment experience for their customers. The white-label payment gateway can support a variety of payment methods, currencies, and languages and may also offer additional features such as fraud prevention, reporting, and analytics

-

What’s the difference between a white-label payment gateway and a simple one?

A simple payment gateway typically provides a standard payment processing solution. In contrast, a white-label payment gateway offers a customizable solution that can be tailored to the specific needs and branding of a business. This includes custom branding, user interfaces, reporting, and integration options. With a white-label payment gateway, you can offer payment services to your customers under your own brand name

-

What kind of business will benefit from a white-label payment gateway?

Any business that wants to offer a seamless and fully branded payment experience for its customers can benefit from a white-label payment gateway. This includes online marketplaces, e-commerce platforms, software providers, and businesses that want to empower their brands, such as PSPs, banks, acquirers, ISOs, and big enterprises, among others

-

Why using a white-label payment gateway is better than developing my own solution?

Developing your own payment processing solution can be a time-consuming and costly process, requiring significant technical expertise and resources. In contrast, a white-label payment gateway offers a ready-made solution that can be customized and integrated into an existing platform more quickly and easily, allowing companies to focus on their core business. Additionally, a white-label payment gateway provider typically offers ongoing support and maintenance, as well as compliance with industry regulations and standards, reducing the risk and complexity of managing payment processing in-house