- Payment gateway

- Blog

- How Fintech grew in 2023 and what should we expect in 2024

How Fintech grew in 2023 and what should we expect in 2024

The passing year of 2023 marked a significant milestone for the Fintech industry. The Digital Payments market was anticipated to hit a staggering US$9.45 trillion, as predicted by Statista. Experts and industry insiders shared their insights, envisioning trends that would continue to shape the landscape in the forthcoming year. In this article we will reflect on the past year delving into the main accomplishments and discern the trends that are expected to boost the industry forward in 2024

We will start with revision of what was expected for 2023. Which predictions were relevant, which failed and which trends continue to grow. Let’s figure out

Global Revenue Surge

An unparalleled growth surge unfolded within the payments industry, marking a monumental leap from $1.9 trillion in 2019 to an impressive $2.7 trillion in 2023. This rapid expansion underscores the evolving nature of consumer transactions and the pivotal role of digital payments in today’s global economy. Projections indicate an annual growth rate of 11.83%, expected to result in a monumental total transaction value of US$14.78 trillion by 2027. This exponential rise underlines evolving consumer behaviours, emphasising the continued dominance of digital transactions in the foreseeable future

Regional analysis

Europe anticipates a significant annual compound growth of 10.7% between 2022 and 2027, driven by the expanding realm of instant payments and bolstered by regulatory enhancements. Meanwhile, North America foresees a steady yet substantial 6.5% CAGR during the same period. However, the Asia-Pacific region emerges as a powerhouse, poised to represent more than half of the global non-cash payment volume, with a staggering 19.8% CAGR from 2022 to 2027. In the Middle East and Africa, the expected growth stands at an impressive 14.1% CAGR over the same period. Simultaneously, Latin America demonstrates robust potential, projecting non-cash volume growth at a compelling 15.7% CAGR from 2022 to 2027. These forecasts underscore the diverse yet promising trajectories shaping the evolution of global payment landscapes

E-commerce Evolution

The rapid rise of e-commerce has been relentless. This digital marketplace, poised to claim 12% of worldwide consumer spending by 2025, experienced a 81% surge in online transactions globally. E-commerce’s remarkable rise reinforces its status as a fundamental part of modern consumer behaviour. This trend means the exponential growth of the fintech solutions and features, focused on the e-commerce clients coverage. As a result, the landscape of online payment products is expected to become more competitive

Cross-border payments

With two in five senders and nearly half of the receivers planning to increase usage and transaction values of the cross-border payments. Despite the demand for cross-border payments, especially in high-developed countries, consumers still find these payments slower and more complex than domestic methods, pointing to a need for improvement. This market, crucial for various demographics like foreign workers and remittances, demands streamlined processes. Despite stable or increased earnings for 85% of cross-border users, economic uncertainties impact 53%, while 42% express concerns about fraud. Addressing these concerns is vital for enhancing the efficiency and gaining usage of cross-border transactions

Recovery Strategies

As sustainability and high uptime are vital in payments, innovative strategies surrounding failed payments emerged as game-changers in 2023. Businesses that effectively tracked and recovered failed payments experienced a remarkable 60% success rate, highlighting the paramount importance of vigilance and remediation in this realm. Routing and cascading technologies stand as essential players, shaping the landscape of payment recovery methodologies

Mobile Payments and BNPL Dynamics

The narrative of mobile payments took centre stage, poised to constitute an astonishing 59% of e-commerce spending by 2025. Additionally, the Buy Now, Pay Later mechanisms were expected to secure a 5.3% share of global transactions by the same year, reshaping the financial landscape. However, the efficiency of BNPL models showed varied results across companies in the latter part of the year. The impending prevalence of mobile payments, despite recent efficiency challenges, signify evolving consumer preferences and their substantial influence on financial norms

Focus on SMEs

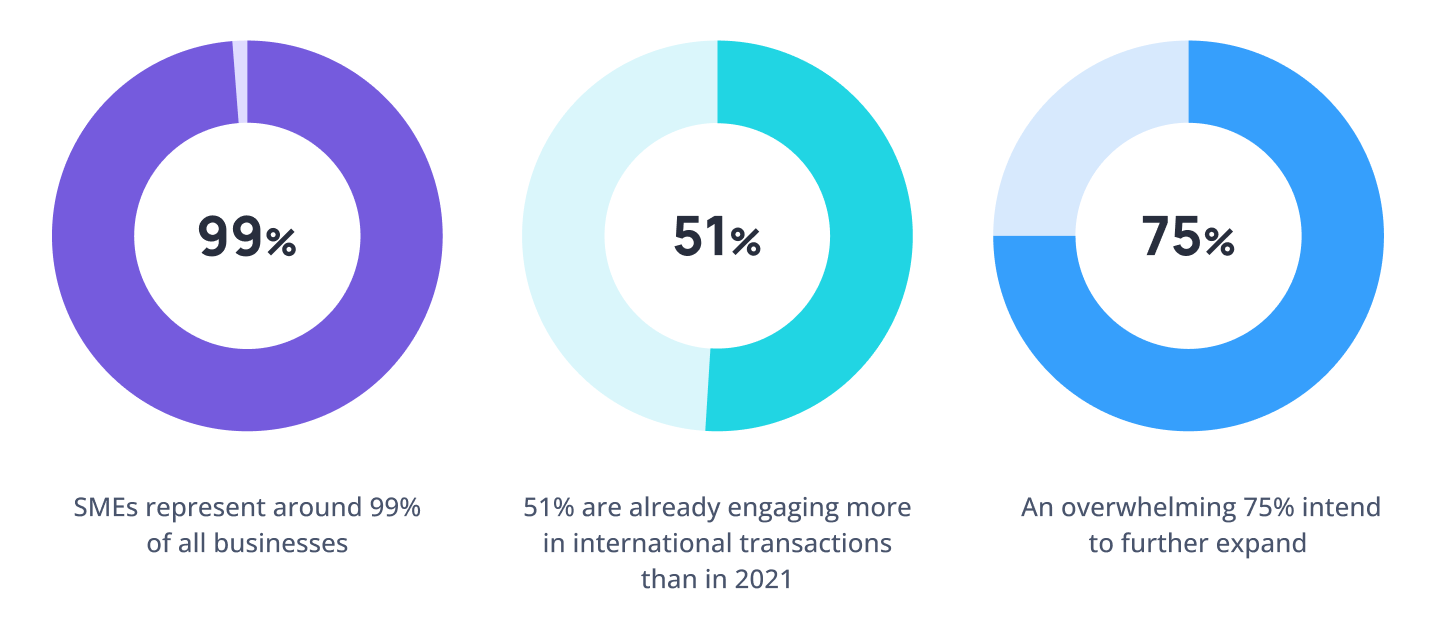

Small and medium-sized enterprises are pivotal in the global economy, contributing significantly to annual payments worldwide. In developed countries, SMEs represent around 99% of all businesses and contribute to 70% of total employment. Surveyed SMEs express optimism about their economic outlook, with two-thirds reporting increased revenue in 2023 compared to the previous year. Notably, 51% are already engaging more in international transactions than in 2021, and an overwhelming 75% intend to further expand their international business in the future. This growth trajectory, emphasises the important role of SMEs as the attractive clients of Fintech industry

Market Transformation

The Fintech market in 2023 witnessed an extraordinary growth trajectory. Estimated at USD 194.57 billion, this market is set to soar to approximately USD 501.9 billion by 2032. Cutting-edge technologies such as AI and cloud computing continued to shape this transformative evolution. The projected exceptional growth of the fintech market, sets the stage for a transformative decade. However, implementation of these technologies are associated with risk, as all of them have their own specificities, could be used by fraudsters

Security and Convenience

Cryptocurrency’s influence on payments soared by 45% in the first quarter of 2023. The inherent security and decentralised nature of digital currencies make them ideal for online platforms. Cryptocurrency’s rising influence underscores its potential within online platforms. Integrating cryptocurrencies into online payments not only streamlines transactions but also enhances privacy, meeting the evolving demands of customers, as for some regions such payment method looks more convenient and accessible, than the traditional ones

What's on the Horizon for 2024?

As we look forward to the trends in payments for the next year, it’s essential to focus on the pivotal areas that are poised to influence the industry landscape

These apps streamline direct fund transfers between individuals, providing an unmatched level of ease and accessibility. Their rise is reshaping how people manage their money, from splitting bills to supporting small businesses

Beyond being an alternative to traditional banking, cryptocurrencies like Bitcoin and Ethereum represent a paradigm shift in finance. They offer a decentralised and secure means of transactions, challenging conventional monetary systems

Through APIs, open banking fosters an interconnected financial ecosystem. According to Juniper Research, global open banking payment transactions are forecasted to surge from $57 billion presently to a striking $330 billion by 2027

The emergence of CBDCs represents a digital evolution in national currencies. These regulated digital currencies, backed by central banks, aim to modernise financial systems, potentially offering faster, cheaper, and more transparent transactions

Social media platforms are transforming into virtual marketplaces, redefining how businesses interact with consumers. By integrating payment functionalities within these platforms, businesses can directly engage with customers

With the rapidly evolving fintech landscape, governments are expected to implement stricter regulations. These will focus on safeguarding consumer interests, ensuring data privacy, and fortifying cybersecurity measures

AI and Machine Learning power sophisticated algorithms that enhance risk assessment, fraud detection, and personalised financial services. The implementation of AI in Fintech products and services will be the core point of the following year

Welltech combines wellness practices with financial management. It focuses on enhancing people's overall financial health. These offerings range from apps that track and improve spending habits to platforms offering tailored financial advice

By delivering tailored offers, recommendations, and payment choices, businesses meet the customers expectations. McKinsey suggests that personalised marketing could slash customer acquisition costs by up to 50%

Biometric payment methods are surging in popularity. Valued at $7.4 billion last year, this market is forecasted to surpass $19 billion by 2029, indicating a rapid adoption rate, as per Maximise Market Research projections

As we look to the future, the trends poised for prominence in 2024 include P2P Payment Apps, Cryptocurrency Payments, Open Banking, Central Bank Digital Currencies, AI, Welltech, and Social Commerce Payments. These trends are set to reshape the fintech landscape, catering to evolving consumer preferences and industry innovation

Conclusion

In 2023, Fintech ventured into more customer-centric technologies and features. With its highs and lows, it offered us a glimpse into the direction the industry might take. 2023 not only set the stage for unparalleled growth but also demonstrated Fintech’s adaptability to dynamic consumer trends. The confluence of evolving technologies, market dynamics, and consumer behaviour promises an exciting trajectory for Fintech’s future, where innovation intertwines seamlessly with consumer-centric financial solutions. As we stride into 2024, the industry expects transformative advancements, poised to shape a dynamic and customer-focused financial landscape

Sources:

- Statista. 2023. Digital Payments — Worldwide.

- McKinsey & Company. 2022. Consumer trends in digital payments.

- Insider Intelligence. 2022. Worldwide Ecommerce Forecast Update 2022.

- PYMNTS Subscription Businesses That Measure Lifetime Customer Value Outperform Competitors 2023.

- EUROPEAN E-COMMERCE REPORT 2023.

- World Payments Report 2023: Embracing Digital Payments by Capgemini

- BORDERLESS PAYMENTS REPORT by Mastercard 2023

- Open Banking: Opportunities, Competitor Leaderboard & Market Forecasts 2023-2027 by Juniper Research 2023