- Payment gateway

- Blog

- CBDCs Integration: Streamlining Cross-border Payments with the New Technologies

CBDCs Integration: Streamlining Cross-border Payments with the New Technologies

Central Bank Digital Currencies are expected to improve cross-border payments, offering the features making transactions faster, more secure, and less costly. As we step into 2024, the impact of CBDCs on international payments is becoming increasingly apparent, driven by the widespread exploration of digital currencies by countries representing 98% of the global GDP. The value of payments via CBDCs, expecting it to reach $213 billion annually by 2030, up from just $100 million in 2023. Today we will discover the influence CBDCs have on cross-border payments, expectations on their interaction in 2024 and tools, helping to easily integrate CBDCs and make cross-border payments more effective

What are CBDCs?

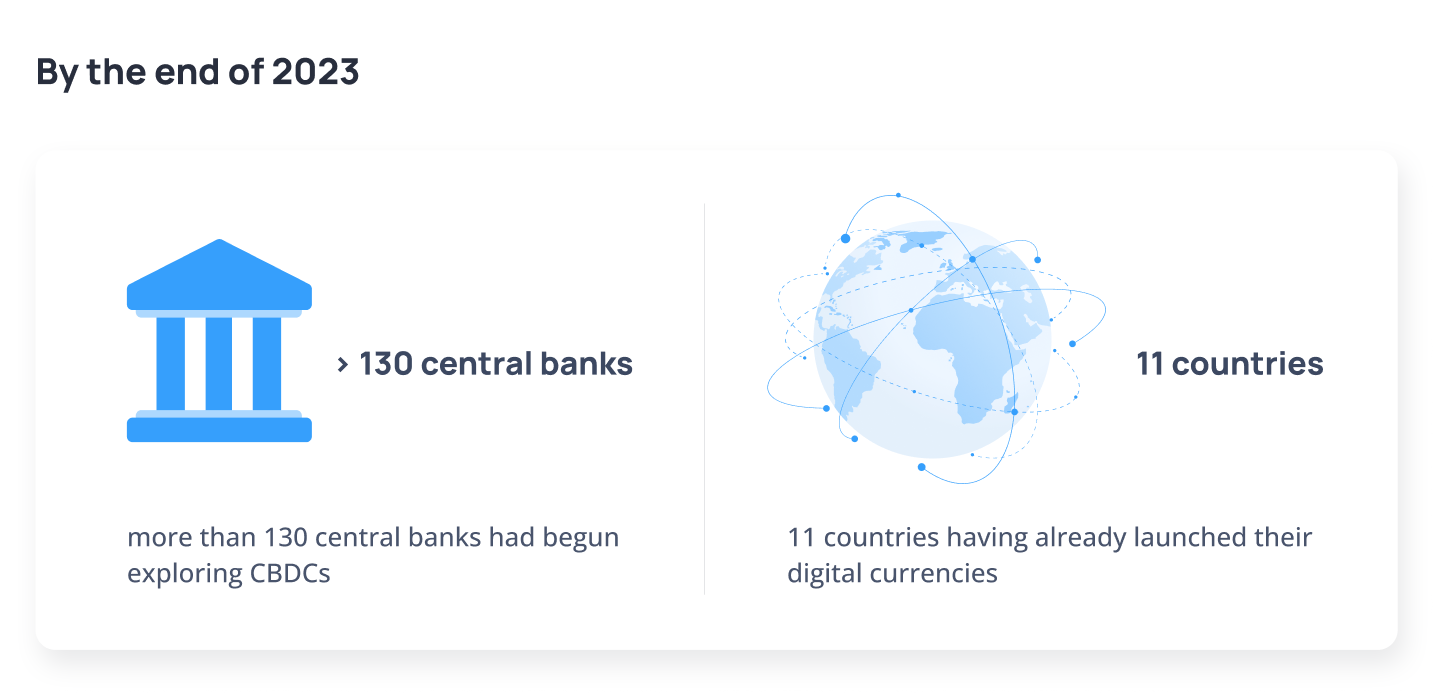

Central Bank Digital Currencies are aiming to combine the efficiency of blockchain technology with the regulatory assurance of fiat currencies managed by central banks. This digital innovation aims to streamline cross-border payments, enhance financial inclusion, and redefine the efficiency of monetary transactions on a global scale. By the end of 2023, more than 130 central banks, accounting for 98% of the global GDP, had begun exploring CBDCs, with 11 countries having already launched their digital currencies. This exploration is part of a broader effort to facilitate more efficient and direct cross-border transactions, potentially leveraging technologies like atomic swaps for instant foreign exchange transactions

Unlike cryptocurrencies, CBDCs maintain central control, ensuring legal tender status and potentially improving the speed and security of transactions. However, challenges such as privacy, government oversight, and integration with existing financial systems persist. By digitising national currencies under the auspices of central banks, CBDCs aim to streamline the process of cross-border transactions, offering a slew of opportunities for businesses worldwide. Deutsche Bank highlights the transformative potential of CBDCs in improving the efficiency of cross-border payments by eliminating intermediaries and streamlining reconciliation processes. This is particularly evident in wholesale CBDCs, where blockchain technology enables instant payment-versus-payment systems, potentially saving global corporations $100 billion a year in transaction costs in a sector currently fraught with inefficiencies. Let’s take a closer look at the benefits of CBDCs for businesses:

CBDCs streamline cross-border payments, reducing costs, and speeding up settlements

Backed by central banks, employing blockchain for less fraud risk, enhancing transaction safety

CBDCs ease entry into global markets, making international trade more attainable

They simplify adherence to global standards, ensuring transparent transaction tracking

Opens new markets by reaching unbanked populations, expanding business opportunities

Encourages novel financial solutions and services, from smart contracts to new payment models

Despite these opportunities, the adoption and impact of CBDCs on cross-border payments will depend on various factors, including technological infrastructure, regulatory frameworks, and international cooperation among central banks. Let’s discover some thoughts on the CBDCs role in cross-border payments in 2024

The Promise of CBDCs

CBDCs hold the potential to streamline cross-border payments by enabling direct, real-time transactions between countries. This digital transformation can significantly reduce the need for intermediaries, lowering transaction costs and settlement times

Despite the optimism surrounding CBDCs, there are notable challenges to their widespread adoption for cross-border payments. Concerns regarding settlement times, interoperability among different countries’ banking systems, and ensuring regulatory compliance are prominent. The adoption of CBDCs is expected to enhance security and trust in cross-border transactions. However, the technology’s success hinges on achieving interoperability among different banking systems and aligning with international regulatory standards

The impact of CBDCs on cross-border payments is expected to vary across different economies. While developing countries may embrace CBDCs more readily, leading to enhanced financial inclusion and more efficient payment systems, G7 economies face scepticism and regulatory hurdles that may slow their adoption. The response to CBDCs will likely reflect each country’s unique economic, regulatory, and technological landscape

Streamlining the Payments

Some say that the CBDC does not need any intermediaries to carry out transactions, because everything goes through central banks. But, it all depends on the specific CBDC system. Also, when the question is about the commercial use of CBDC, systems that will process it are still needed. Partnering with a reliable payment gateway is a strategic move for businesses looking to leverage Central Bank Digital Currencies for optimising cross-border payments and opening International Bank Account Numbers. A payment gateway that understands the intricacies of CBDCs can offer several advantages:

Seamless Integration

Payment gateways enable businesses to incorporate CBDCs into their systems smoothly, maintaining operational flow

Cross-Border Payment Efficiency

CBDCs enhance international transactions, making them faster, cheaper, and more secure through supportive payment gateways

IBAN Process Simplification

Expertise in CBDCs helps streamline the IBAN opening process, ensuring regulatory compliance for international transactions

Compliance and Security Assurance

Payment gateways safeguard against fraud and ensure transactions meet global standards

Strategic Consultation

Provides guidance on using CBDCs effectively for cross-border payments, including best practices and risk management

Conclusion

In summary, CBDCs are at the forefront of transforming cross-border payments by 2024, offering opportunities for greater efficiency and security. However, their full impact will depend on overcoming existing challenges and how different economies navigate the transition towards digital currencies. Partnering with a payment gateway that is proficient in handling CBDC transactions and understands the global financial landscape can provide businesses with the tools they need to optimise their cross-border payments and facilitate the opening of IBANs. This partnership can unlock new opportunities for efficiency, growth, and competitive advantage in the digital payment landscape

Sources

- Deutsche Bank’s analysis on CBDCs and their impact on cross-border payments

- McKinsey & Company, “2023 Global Payments Report”

- Official Monetary and Financial Institutions Forum