- Payment gateway

- Blog

- Digital Payments: Comprehensive Guideline on Payment Gateway UK

Digital Payments: Comprehensive Guideline on Payment Gateway UK

In the British digital marketplace of today, where numerous transactions are being processed every second, the security and efficiency of these financial operations hold paramount importance. The corestone of online commerce is the payment gateway, a technological solution that ensures the smooth transition of funds and also secures the operations against potential data breaches and fraud. For British businesses venturing into the e-commerce industry or seeking to optimise their online payment systems, understanding the role and mechanisms of payment gateways is vital. Today we will discover what is a payment gateway and how does it work, as well as the key elements businesses should consider while looking for the reliable payment gateway providers

What is a Payment Gateway?

An online payment gateway acts as the digital equivalent of a physical payment processor. However, its responsibilities extend far beyond just facilitating transactions. It encrypts sensitive data, such as credit card numbers and security codes, right at the point of entry, ensuring that the information remains secure reaching the merchant’s bank. By implementing advanced security measures like tokenization and SSL encryption, payment gateways create a fortress around the transaction process, repelling unauthorised access and minimising online risks. For businesses that demand a robust online payment infrastructure, choosing the right ecommerce payment gateway is vital to effectively implement digital commerce strategy

How the Internet Payment Gateway Work?

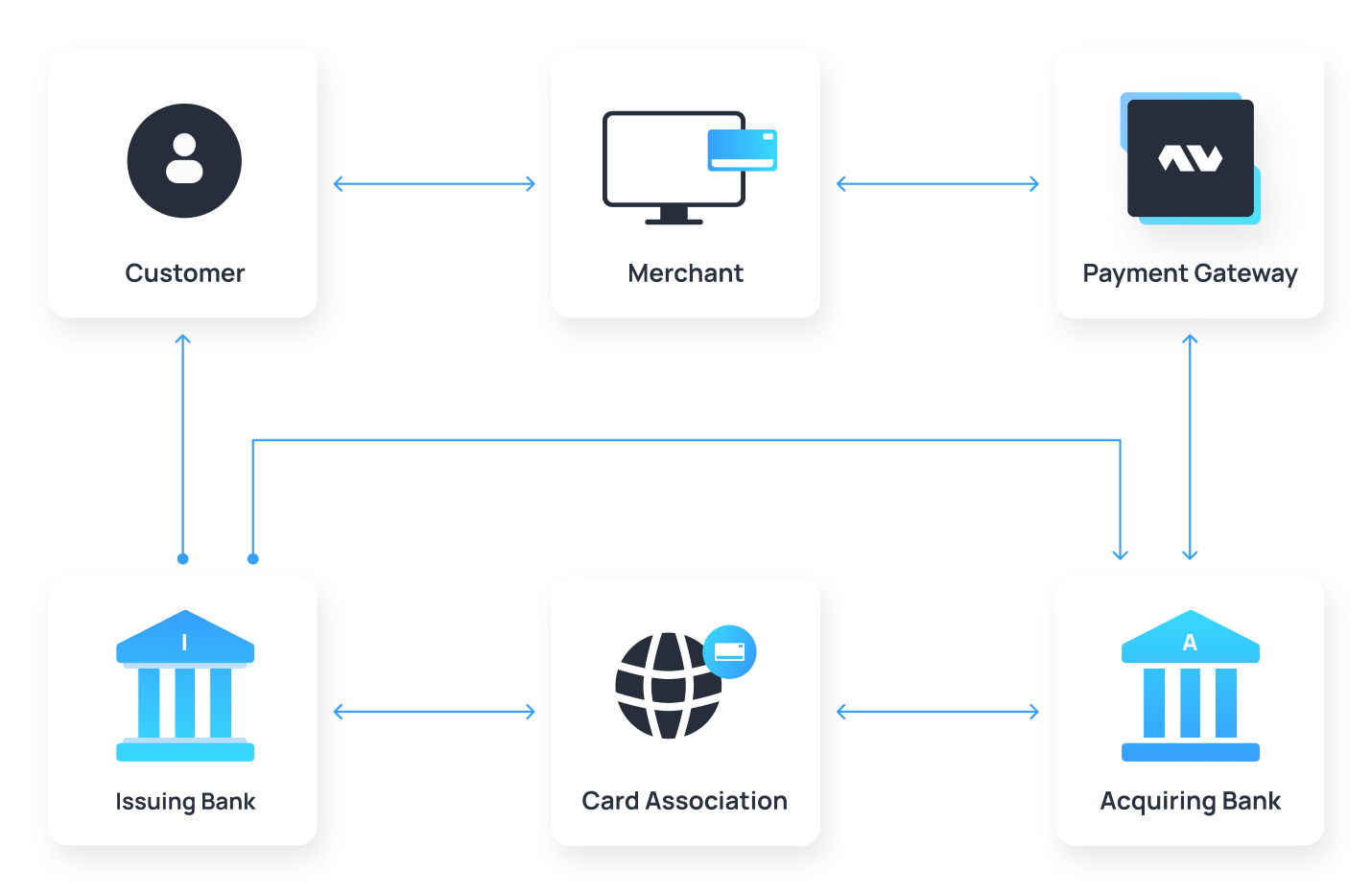

The transaction process through the payment gateway services unfolds in a meticulously orchestrated sequence of steps:

- A customer, entranced by your product, decides to make a purchase and enters their credit card information at checkout

- The payment gateway provider springs into action, encrypting this data and securely transmitting an authorization request to the merchant’s acquiring bank

- In parallel, it reaches out to the card network to validate the card and confirm fund availability

- The card network communicates with the issuing bank, verifying the transaction details before sending approval back through the network, to the gateway, and then to the merchant’s bank

- With the transaction approved, the customer’s bank account is debited, and the sale proceeds are transferred to the merchant’s account, heralding a successful transaction

The Revenue Models of Online Payment Gateway UK

Sustaining the reliable infrastructure of a secure payment gateway entails various fees. These fees range from transaction percentages to fixed charges for maintaining the system’s integrity. Additionally, payment gateway for website may levy fees for extra services such as fraud prevention and chargeback management, ensuring merchants have all the tools needed for a smooth digital transaction process

These gateway payment fees can be broadly categorised into:

Interchange Fees

Interchange fees are determined by card networks like Visa and Mastercard. These fees are dynamic, influenced by factors such as transaction type and merchant category, and are periodically revised to reflect the evolving payment ecosystem

Assessment Fees

Paid by payment processors to card networks, these fees are calculated as a percentage of transaction volumes. They’re nominal yet significant over time, especially for businesses processing a high volume of transactions

Processing Fees

Directly charged to merchants, processing fees are for the use of payment gateway services. This cost varies, often structured as a fixed fee, a percentage of the transaction, or a hybrid of both, reflecting the complexity and value of the services provided

Understanding what is payment gateway cost model is crucial for businesses in budgeting their operations and selecting a cheapest payment gateway UK that aligns with their financial strategies

Fortifying Transactions

The paramount importance of security in digital transactions cannot be overstated. Website payment gateway employs several advanced measures to ensure data integrity and protect against fraud:

Data Encryption

By transforming sensitive information into a secure code, encryption ensures that data intercepted during transmission remains unusable to unauthorised entities

TLS Protocols

These protocols secure the data transmission channel, preventing data breaches and ensuring that transaction data reaches its intended destination safely

Tokenization

Replacing sensitive data with a unique identifier or token, tokenization minimises the risk of data exposure without impeding the transaction process

3D Secure Authentication

This added layer of security requires cardholders to authenticate themselves, reducing the risk of unauthorised transactions and increasing consumer confidence

Choosing the Best Payment Gateway in UK

Selecting a payments gateway that aligns with your business needs involves considering factors such as supported payment methods, compliance with security standards, and the cost structure. Moreover, the credit card payment gateway integration method — be it through APIs, plugins, or SDKs — plays a critical role in determining the feasibility and efficiency of the payment gateway within your existing digital infrastructure

Integration of the UK payment gateway through APIs offers customization and control, allowing businesses to tailor the payment process to their operational workflow. Plugins, used by UK payment gateways, on the other hand, provide a more straightforward, less technical path to gateway integration, suitable for businesses leveraging popular e-commerce platforms. SDKs offer a middle ground, with pre-built libraries simplifying the development process for payment gateway providers UK while still allowing for a degree of customization

High-risk or White-Label?

Discovering the complexities of online payment gateways, businesses encounter various solutions tailored to specific needs. Among these, high-risk payment gateways and white-label payment processing platforms stand out, each offering distinct benefits. Understanding the specificities of payment gateway meaning and payment gateway comparison can guide businesses toward the most suitable choice:

High-Risk Payment Gateways

Specialised Risk Management

Best suited for industries considered high-risk due to higher instances of chargebacks and fraud. Such gateway payments offer advanced security and fraud prevention tools tailored to navigate the challenges unique to these sectors

Enhanced Approval Rates

High-risk payment gateways UK are designed to approve a broader range of transactions, including those typically declined by standard payment processors, ensuring businesses in high-risk categories don’t miss out on valid sales

Flexible Banking Relationships

High-risk gateways maintain relationships with a variety of banks, including those comfortable working with high-risk merchants, facilitating smoother transaction processes.

High-Risk best payment gateway UK will be ideal for businesses in industries such as gaming, adult entertainment, and certain types of e-commerce, which face stringent banking regulations and higher scrutiny

White-Label Payment Gateway

Brand Consistency

White-label gateway for payment allows businesses to offer payment processing under their own brand, maintaining a consistent user experience by avoiding the confusion of redirecting customers to third-party merchant gateway

Customer Trust and Retention

By keeping the payment process within the familiar ecosystem of the merchant’s branding, white-label online gateways help reduce cart abandonment rates, fostering greater customer trust and loyalty

Outsourced Maintenance and Upgrades

Merchants benefit from robust, up-to-date payment technology without the overhead of developing and maintaining the software, as the white-label online gateways handle ongoing updates and security measures

White-label merchant payment gateway is ideal for businesses seeking to establish a seamless, branded online payment experience and payment processors looking to consolidate payment data across multiple channels on a single platform

Both high-risk online payment gateway service providers and white-label payment processing gateway offer pathways to enhancing online transaction processes, each catering to distinct business needs. The first-one provides a robust framework for high-risk industries to manage secure payment gateway process, while the second-one offers businesses across various sectors the opportunity to streamline the customer payment experience under their own brand

Considering the Partner for Credit Card Gateway Processing

In the digital commerce industry, the gateway of payment stands as an essential facilitator of growth and security. For British businesses, understanding the nuances of card payment gateway is vital for success in the online marketplace. By choosing the right cheapest payment gateway, businesses can ensure not only the security and efficiency of their transactions but also foster trust and loyalty among their customer base. Here are some insights on what you should keep an eye:

Enhancing Customer Experience

The choice of the online payment gateway providers significantly influences the customer experience. Seamless integration, minimal transaction delays, and a wide array of payment options can markedly enhance customer satisfaction and retention. Businesses should prioritise payment gateway in the UK that offer a frictionless checkout process, supporting popular payment methods in the UK, including e-wallets and direct bank transfers, alongside traditional credit and debit card transactions

Global Expansion Considerations

For businesses eyeing international markets, the capability of the ecommerce payment providers to handle multiple currencies and comply with varied international payment standards and regulations becomes crucial. Selecting a payment gateway website with a global footprint can simplify the complexities of cross-border transactions, providing a unified solution that supports expansion while managing compliance and currency conversion seamlessly

Adapting to Payment Trends

The digital payment sector is characterised by rapid technological advancements and changing consumer preferences. Emerging payment technologies, such as blockchain and cryptocurrency transactions, are gaining traction. Businesses should consider the adaptability of their payment gateway online to future trends and technologies, ensuring longevity and relevance in a dynamic market

Data Analytics and Insights

Advanced online payments gateway offers more than just transaction processing. Integrated payment gateway provides valuable data analytics and insights into customer behaviour and transaction patterns. These analytics can inform strategic decisions, optimise the payment process, and identify opportunities for growth. Businesses should leverage these capabilities to gain the revenue

Partnerships and Ecosystem Integration

Finally, the integration of payment gateways into the wider ecosystem of business operations, including inventory management, customer relationship management, and accounting software, can streamline processes and enhance operational efficiency. Businesses should compare payment gateways that offer easy integration with their existing technology stack or provide APIs for custom integrations

Conclusion

As we discovered the multifaceted role of payment gateways in empowering British businesses within the digital marketplace, it’s clear that these platforms are not just transaction facilitators but strategic assets that can drive growth, enhance customer experience, and support global expansion. By cleverly selecting and integrating a payment gateway that aligns with their operational needs, future-proofing strategies, and ethical considerations, businesses can easily overcome the complexities of digital commerce with confidence, securing their place on the market