- Payment gateway

- Blog

- Most Preferred Payment Methods and the Role of Payment Gateway in Germany

Most Preferred Payment Methods and the Role of Payment Gateway in Germany

In 2024, Germany’s payment industry continues to be a crucial element for businesses aiming to expand or enter this market. Offering the right mix of payment methods is a necessity for boosting conversion rates and meeting customer expectations. This article explores the importance of selecting appropriate payment methods, highlights the most popular options in 2024, and explains the role of a payment gateway in Germany for successful operating at this market

The Importance of Localisation in Payment Methods

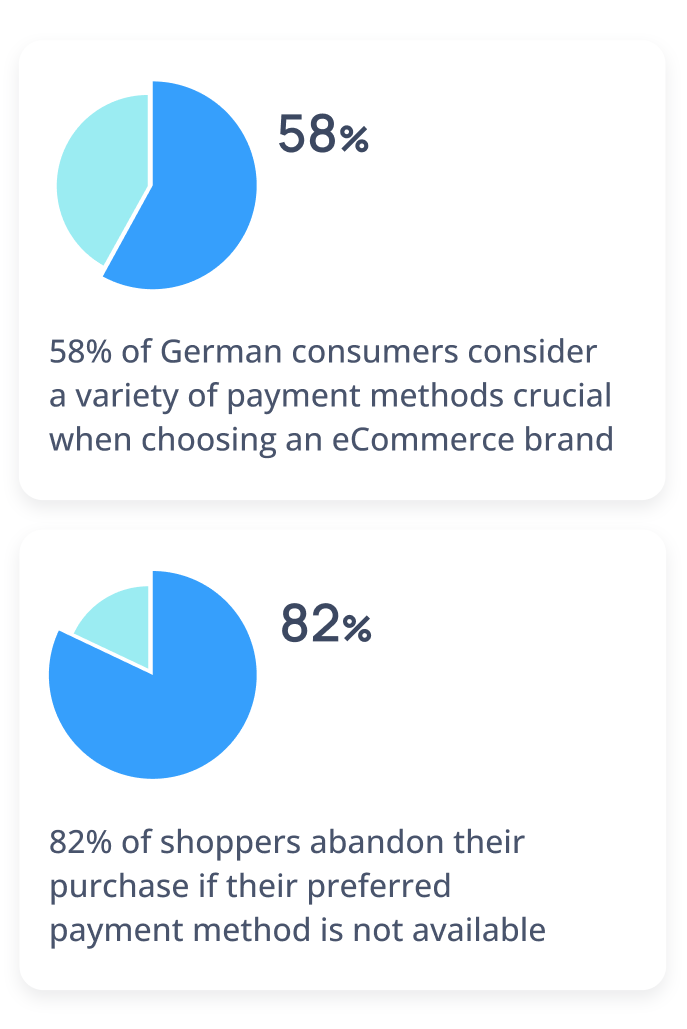

When expanding into a foreign market like Germany, localisation is not just about translating your website or adapting your marketing messages. It extends to the payment methods you offer, which can significantly impact your success in the German market. In fact, research shows that 58% of German consumers consider a variety of payment options essential when choosing an eCommerce brand. This means that if you do not offer the right payment methods, you risk losing potential customers at the crucial point of checkout. Let’s discover some local specificities you should consider:

Cultural Preferences and Trust

Germans tend to be more conservative and cautious when it comes to online payments compared to other markets. They often prefer established, trusted methods that are closely tied to their bank accounts. For instance, invoice payments, where customers pay after receiving goods, remain highly popular, particularly in the B2B sector. This conservative approach stems from a long-standing cultural preference for secure, tangible transactions, where payment is made only after the product is delivered and inspected

Adapting to Local Payment Habits

Localisation also involves adapting to the specific payment habits that dominate in Germany. Although digital wallets and credit cards are growing in popularity, they still lag behind more traditional payment methods. For example, PayPal is overwhelmingly popular in Germany, with 91% of online shoppers preferring this option due to its security, convenience, and familiarity. A payment gateway Germany solution must prioritise PayPal and other localised methods like Sofort, which provides instant bank transfers directly from German banks

Businesses that enter the German market without understanding these localised payment preferences may find it challenging to convert customers. German shoppers expect to see payment options they recognize and trust. Offering only credit card payments or less familiar options can lead to high cart abandonment rates, as up to 82% of German shoppers are likely to abandon a purchase if their preferred payment method isn’t available

Tailoring the Mobile Payment Experience

Germany, like many other markets, is seeing a rise in mobile commerce. In fact, over 61% of German shoppers now use smartphones to make online purchases. However, mobile shoppers are particularly sensitive to friction during the checkout process. A payment gateway in Germany should offer mobile-friendly payment methods, as well as easy-to-use features like one-click payments. This level of localisation not only makes the transaction seamless but also enhances the overall shopping experience, leading to higher conversion rates

Popular Payment Methods in Germany in 2024

Here are the most popular payment methods that should be offered through a payment gateway in Germany:

PayPal

With 91% of Germans using PayPal, it is by far the most popular payment method in the country. PayPal’s ease of use, strong brand reputation, and buyer protection policies make it an essential option for businesses entering the German market. For international companies, PayPal’s global presence makes it an easy integration into a payment gateway Germany solution

Invoice Payment

Invoice payments are still a highly favoured option in Germany, especially in B2B sectors. Around 44% of consumers prefer to pay by invoice, receiving goods before making a payment. While this method poses risks for merchants, it remains an expected payment option that is easily facilitated through a payment gateway in Germany

Credit and Debit Cards

Although credit card usage is less widespread compared to other countries, about 28% of Germans use local debit and credit cards. Visa and Mastercard are also widely accepted. Including these options in your payment gateway Germany setup is vital to accommodate customers who prefer card payments

Bank Transfer

Bank transfer methods remain popular, with 25% of shoppers using services like Sofort. Although giropay is set to wind down by the end of 2024, direct bank transfer options should still be integrated into any payment gateway in Germany

Direct Debit

Direct debit, used by 23% of consumers, allows businesses to withdraw payments directly from customer bank accounts. This convenient option is well-suited for recurring payments, making it the best option for subscription services and easily supported by a payment gateway Germany system

Digital Wallets

While adoption has been slower compared to other countries, digital wallets like Apple Pay and Google Pay are growing in popularity, especially among younger and mobile-savvy consumers. Incorporating these wallets into a payment gateway in Germany provides a modern, mobile-friendly payment option

The Role of a Payment Gateway in Germany

A payment gateway in Germany is a crucial component of successfully entering the market. It enables seamless, secure transactions and ensures that your customers can use their preferred payment methods. Here are the primary benefits of utilising a payment gateway Germany solution:

A payment gateway in Germany allows businesses to integrate several payment methods without the need for complex technical setups. Such a variety is essential for meeting the diverse needs of German businesses and consumers

A payment gateway Germany ensures compliance with GDPR and offers advanced fraud prevention tools like encryption and two-factor authentication, ensuring reliability and safeguarding both your business and your customers

Gateway solution offers features like one-click payments, pre-filled payment forms, and mobile-friendly interfaces. This is especially important, as more than 61% of German consumers now shop online via mobile devices

For businesses offering subscription services, a payment gateway in Germany simplifies the management of recurring payments. This not only improves customer satisfaction but also ensures consistent cash flow for your business

Сonclusion

In 2024, entering the German market requires businesses to carefully consider local payment preferences. Offering a range of popular payment methods is essential for meeting consumer expectations. A robust payment gateway in Germany ensures these options are easily available, secure, and optimised for a smooth customer experience. By leveraging the right payment gateway Germany solution, businesses can effectively enter the market, reduce cart abandonment, and increase conversion rates, setting themselves up for long-term success in German market