- Payment gateway

- Blog

- What is a Payment Gateway and How Does it Work?

What is a Payment Gateway and How Does it Work?

Nowadays, a payment gateway enables businesses to ensure that they receive customers’ payments in a swift and secure way, supporting transactions globally. From websites to subscription services or high-risk merchant industries, understanding what a payment gateway is and the processes it undergoes is essential for success. Whether it’s handling large transaction volumes or addressing complex compliance requirements, the role of a payments gateway cannot be overstated

For businesses operating in high-risk sectors, the stakes are even higher. Transferty’s high-risk payment gateway is tailored to address these challenges, offering robust security, flexibility, and scalability. It stands out as an essential payment processing solution for industries facing unique obstacles. In this article, we will explore the payment gateways, how does it work and provide tips on how to choose the best one for your needs

What is Payment Gateway?

A payment gateway is, in essence, a technology solution that authorises and processes electronic payments. It acts as the bridge between the merchant’s website and the financial institutions involved in a transaction. Comparable to a point-of-sale terminal in physical retail, a payment gateway for websites ensures seamless and secure transactions between customers and merchants

How Does It Work?

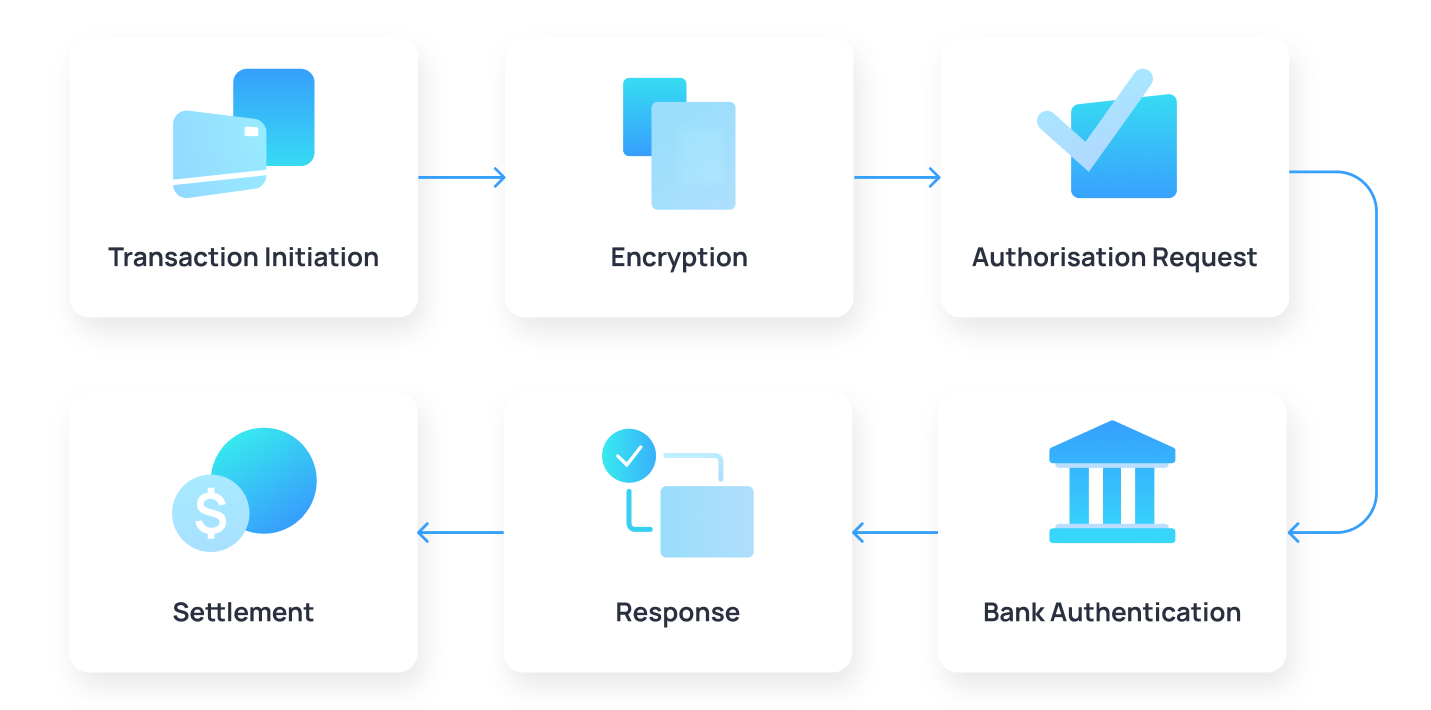

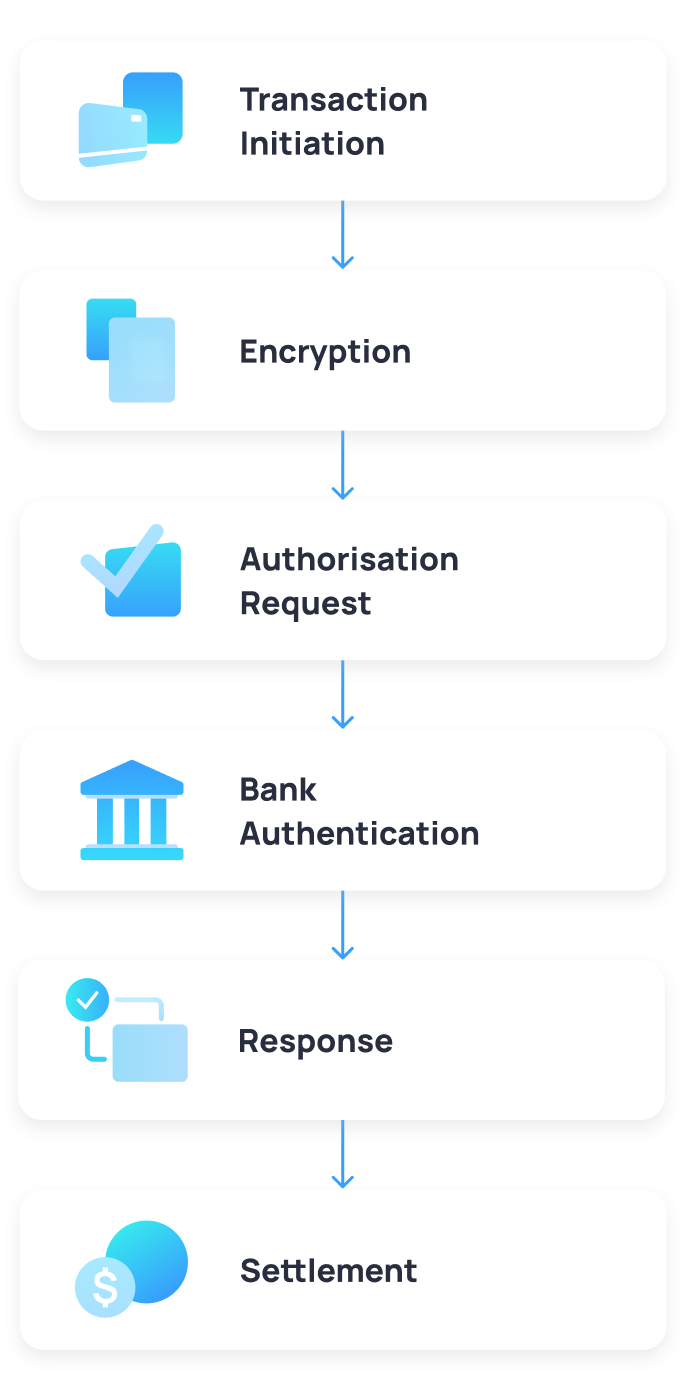

The gateway for payment acts as an intermediary between the customer, merchant, and financial institutions. Here’s an overview of the process:

1. Transaction Initiation: The customer initiates a transaction by entering payment details, such as credit/debit card information, e-wallet credentials, or bank account details, on the merchant’s website or app

2. Encryption: The online payment gateways encrypt this sensitive information to ensure security during transmission, safeguarding against cyber threats

3. Authorisation Request: The encrypted information is sent to the acquiring bank, which relays it to the relevant payment network, Visa, Mastercard, or another processor, for verification

4. Bank Authentication: The issuing bank validates the customer’s payment details, checking for sufficient funds or credit limits

5. Response: The bank either approves or declines the transaction, sending a response back through the chain

6. Settlement: For approved transactions, funds are transferred from the customer’s account to the merchant’s account, completing the process

This complex process takes place in mere seconds, thanks to advancements in gateway processing technology, allowing businesses to provide customers with a seamless experience

Why Do Businesses Need a Payment Gateway?

Whether operating in low-risk or high-risk industries, every business that accepts online payments needs a gateway of payment. The reasons are as follows:

Security

A payment gateway is designed to handle sensitive customer data securely, including credit card numbers and personal details. Features like encryption, fraud detection tools, and compliance with global standards like PCI DSS ensure protection against cyber threats, reducing the risk of data breaches

Operational Efficiency

Automating the payment process through a payment gateway system reduces manual intervention, eliminating errors and speeding up transaction cycles. Additionally, payment gateway provider offers detailed reporting tools to help businesses analyse and reconcile transactions effectively

Customer Experience

A streamlined and secure checkout process builds customer trust, reduces cart abandonment, and improves loyalty. Integrated payment gateways that support multiple payment methods and currencies help businesses cater to a broader audience, driving higher conversion rates

Global Reach

For businesses looking to expand internationally, a global payment gateway is crucial. It facilitates transactions in multiple currencies and integrates with local payment methods, ensuring accessibility for customers worldwide

Fraud Prevention

Advanced fraud detection tools, such as Address Verification Services and Card Verification Value checks, are embedded into most online payment gateway services, minimising the risk of fraudulent transactions

High-Risk Industries and Website Payment Gateways Challenges

What Constitutes a High-Risk Industry?

Certain industries are labeled as high-risk due to factors such as:

- High chargeback ratios

- Regulatory scrutiny

- Frequent fraud attempts

- Large transaction volumes

Examples include online gaming, cryptocurrency, travel, and subscription-based services. Businesses in these industries often face greater challenges in finding suitable payment gateway providers due to the perceived risks

Challenges Faced by High-Risk Businesses:

Difficulty in Securing Payment Processing

Traditional payment providers are reluctant to work with high-risk industries, leaving businesses with fewer options

Higher Fees

Payment processing fees for high-risk businesses are often elevated due to the associated risks

Exposure to Fraud

High-risk businesses are prime targets for fraudulent activities, necessitating advanced security measures

Compliance Requirements

Addressing complex compliance regulations across regions adds another layer of difficulty

Building Your Own Payment Gateway vs. Partnering with a Third-Party Provider

When it comes to payment processing, businesses often face the decision of whether to build their own payment gateway or partner with a third-party provider. Each approach has its advantages and challenges, depending on the business’s resources, goals, and specific needs

Building Your Own Payment Gateway

Advantages:

Complete Control

Businesses have full control over the design, security, and customisation of the payment gateway, tailoring it to their unique requirements

Branding Opportunities

A self-built gateway can be fully white-labeled, offering a consistent brand experience for customers

Flexibility

Companies can integrate bespoke features or specific workflows that might not be supported by third-party providers

Challenges:

High Initial Investment

Building a payment gateway online platform requires significant upfront costs for development, infrastructure, and compliance

Regulatory Complexity

Maintaining compliance with global standards, such as PCI DSS, and managing fraud prevention protocols can be resource-intensive

Ongoing Maintenance

Businesses need dedicated teams to handle updates, security patches, and support, which can increase operational costs

Partnering with a Third-Party Provider

Advantages:

Quick Setup

Third-party gateway payments providers offer ready-to-use solutions, enabling businesses to start processing payments faster

Cost-Effective

Partnering with payment provider service like Transferty eliminates the need for heavy initial investments and reduces the ongoing burden of maintaining compliance and security

Advanced Features

Many service payment providers come with built-in fraud detection, multi-currency support, and detailed reporting tools

Expert Support

Providers offer technical assistance and guidance, which is particularly valuable for high-risk industries or businesses with limited in-house expertise

Challenges:

Limited Customisation

While many third-party providers offer customisation options, they may not meet the unique needs of highly specialised businesses

Dependency on the Provider

Businesses rely on the provider’s infrastructure and support, which may limit control over some aspects of the payment process

For most businesses, partnering with a trusted provider offers a faster, more efficient, and cost-effective way to handle payments. However, companies with unique needs, ample resources, and the ability to address complex regulations may benefit from building their own online payments gateway system

How to Choose the Best Payment Gateway for Your Business

Selecting the right online gateway payment provider is a critical decision that can significantly impact your business’s operations, customer experience, and overall growth. Here are key factors to consider when choosing a payment gateway provider, tailored to different business types:

Security and Compliance

Ensure the gateway adheres to global security standards, such as PCI DSS compliance, and offers robust fraud prevention tools. This is especially critical for high-risk businesses dealing with sensitive customer information

Industry-Specific Needs

Businesses in high-risk industries, such as online gaming or cryptocurrency, should prioritise gateways with experience in handling high chargeback ratios and complex compliance requirements. Transferty’s high-risk payment gateway is an excellent choice for these sectors

Global Reach

If your business operates internationally, choose a global payment gateway that supports multiple currencies and local payment methods. This is essential for websites targeting a global audience

Integration Flexibility

For businesses looking to streamline operations, consider a gateway that offers seamless integration with your existing systems, whether through API integration, self-hosted solutions, or local bank integrations

Customer Experience

A gateway that provides a smooth, fast, and secure checkout process can enhance customer satisfaction and reduce cart abandonment rates. Ensure the gateway supports multiple payment methods, such as credit cards, e-wallets, and bank transfers

Cost-Effectiveness

Compare the gateway online payment fees across providers. Look for a solution that balances cost with features, ensuring that you get maximum value without compromising on quality or security

Scalability

Choose a payment gateway solution that can grow with your business, offering the flexibility to adapt to increasing transaction volumes or new market demands

Support and Service

Reliable technical and customer support are essential. A provider like Transferty offers dedicated assistance to help navigate challenges, such as fraud management and regulatory compliance

By carefully evaluating these factors, businesses. Whether they are startups, platforms, or high-risk merchants, they can select a gateway for online payments that aligns with their goals and enhances their operational efficiency

Features of Transferty’s Payment Gateway

Transferty’s payment gateway solution is tailored to meet the demands of high-risk businesses. Key features include:

Advanced Security Protocols

- Encryption: Protects sensitive data during transmission

- Fraud Detection Tools: Monitors transactions in real-time to identify suspicious activities

- PCI DSS Compliance: Meets global standards for processing and securing cardholder information

Wide MCC Acceptance

Transferty supports a wide range of Merchant Category Codes, making it perfect for businesses across diverse high-risk industries

Multi-Currency and Multiple Payment Methods

Transferty enables businesses to accept payments in multiple currencies and supports various methods, including credit cards, e-wallets, and bank transfers. This flexibility is essential for businesses targeting global markets

Rapid Settlement Processing

Fast processing times enhance the customer experience, ensuring that merchants receive funds promptly

Customisable Solutions

Transferty offers custom payment gateway solutions, including tailored integrations and advanced reporting tools to meet specific business needs

Dedicated Support

High-risk businesses benefit from comprehensive support, including compliance consultations and chargeback management assistance

By partnering with Transferty, businesses gain access to:

- Expertise in High-Risk Markets: Specialised knowledge ensures seamless payment processing for challenging industries

- Enhanced Security and Compliance: Tools like fraud detection and encryption minimise risks while ensuring regulatory compliance

- Flexibility and Scalability: Transferty’s payment gateway platform supports growth and adapts to changing business needs

- Improved Customer Trust: Providing a secure and efficient checkout experience fosters loyalty

- Cost Efficiency: Tailored pricing models and competitive payment gateway fees make Transferty an economical choice for businesses

Conclusion

Nowadays, ecommerce payment gateways are indispensable for facilitating secure, efficient transactions. Choosing the right payment gateway provider is critical to overcoming challenges and driving growth. Transferty’s high-risk payment gateway combines cutting-edge technology, robust security features, and support, making it the perfect partner for businesses aiming to boost their payment efficiency