- Payment gateway

- Blog

- The UK New Regulations: Why BNPL’s Future is on Infrastructure, Not Intent

The UK New Regulations: Why BNPL’s Future is on Infrastructure, Not Intent

In 2025, Buy Now Pay Later in the UK has changed. New rules, from affordability checks to fast-tracked refunds and formal complaint processes, are going on, and with them, the UK government has presented a clear requirement: BNPL needs to be operated at the same level of discipline and regulation as other consumer finance products. Regulation offers a new foundation of trust and legitimacy, but with burdensome structural and operational demands on fintechs, retailers, and embedded finance providers. With higher stakes come higher expectations of quality and resilience of the infrastructure underpinning every BNPL transaction. In this article we will explore the key legislative changes businesses developing BNPL in the UK should focus on.

What the New Rules Mean

The UK government formally launched new BNPL regulations in May 2025 following two years of consultation between HM Treasury, the Financial Conduct Authority, and industry stakeholders. The new rules are aiming to bring BNPL products in line with other credit agreements regulated under the Consumer Credit Act.

BNPL has grown quickly, with over 10 million UK consumers by early 2025. A new survey of consumers last year found that 48% of adults state they are more likely to make use of BNPL since the regulation has been established. It is a great opportunity to increase consumer trust and loyalty, but only if businesses have capabilities to address the new standards all the time.

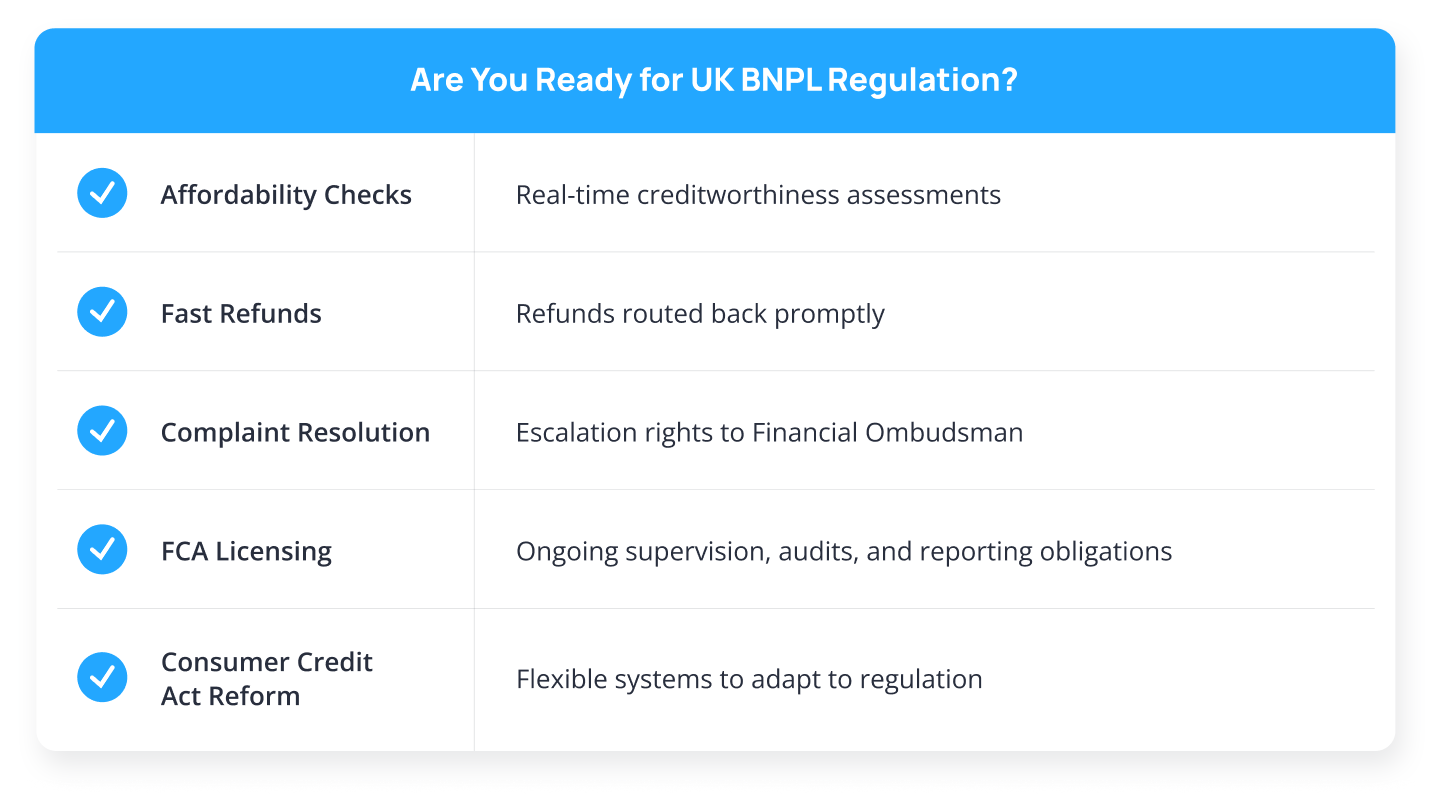

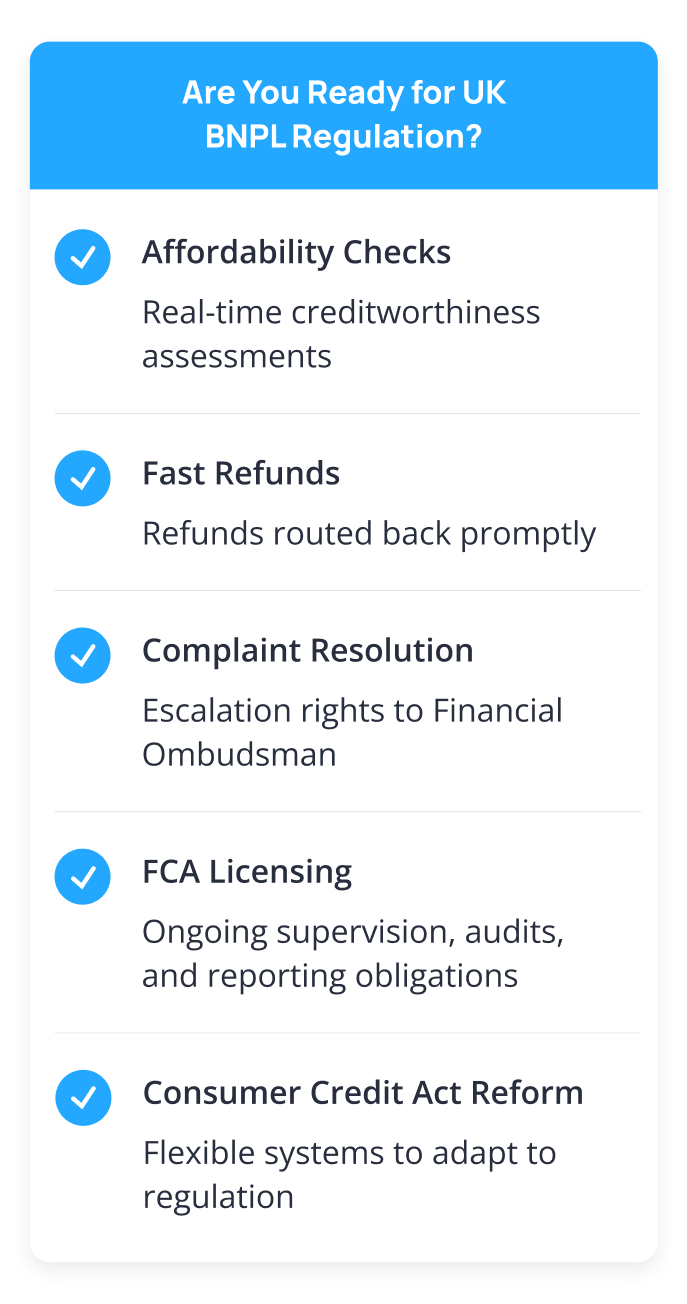

The act covers five main topics:

Consumers are more protected. They must be informed of their repayment plan. They have to undergo an affordability test. They must be able to get speedy and fair redress. These are not recommendations. They affect a lot of operational aspects, from how you onboard users, to how you collect payments, handle complaints, and manage data.

This is what each rule influence:

Affordability Checks

All BNPL customers are now subjected to a check to verify they can afford to borrow. It needs to happen in real-time, at sign-up or checkout. It is required to be fast and accurate, and not impact conversion negatively.

Complaint Rights

Customers are now able to complain to the Financial Ombudsman Service. That means every BNPL provider needs to have records, a support process, and a way to show how they settled a case.

Rapid Refunds

Refunds must be processed rapidly. They must be given back to the user’s initial payment method. They require payment systems that run in real-time, with full tracking.

FCA Licensing

BNPL is now regulated by the Financial Conduct Authority. That includes ongoing supervision, audits, and disclosure. Companies have to keep neat records, focusing on consent, and disclose risks.

Reform of the Consumer Credit Act

The 1974 Consumer Credit Act is being replaced by an updated legal system more adapted to borrowing needs of customers. The overhaul brings new products of the BNPL-type within regulatory scope and requires providers to maintain a higher level of transparency. There is also the potential for future regulation to offer additional protection regarding repeat buys, late fees, and multi-lender agreements.

For the governmental financial institutions, the goals are to simplify legal language, reduce providers’ administration, and satisfy customer expectations. Fintechs will thus have to ensure modular, auditable, and user-friendly systems to address the regulatory updates. New regulation will take effect on more credit types. That means systems must be flexible and easy to update when the rules change.

What a Good Compliance Stack Is

A compliance-focused technology stack is now essential for any BNPL provider who aims to operate business in the UK. This stack needs to do more than enable payments. It needs to be able to cover compliance, data security, reporting, and future-proofing against regulation.

Here’s what to look for:

Modular Architecture

Your infrastructure should never be a barrier to change. When the Consumer Credit Act is revised and new regulatory requirements come into force, your systems must be agile enough to evolve. Modular architecture enables you to introduce changes, like new affordability tests, consent models, or disclosure requirements, without replatforming. It reduces technical debt and makes regulatory compliance an ongoing process of improvement.

High Availability and Redundancy

In the BNPL industry, downtime is not just a technical issue, but a serious business risk. Your platform must function flawlessly, 24/7. This requires built-in redundancy, automatic failover mechanisms, and disaster recovery mechanisms. Whether it’s an affordability check, a payment confirmation, or a refund request, your system must process it continuously, even at full load.

Real-Time Execution

Every controlled action, from affordability checking to approval of a refund, must happen in real time. Delays frustrate customers and can breach regulatory requirements. Real-time data processing underpins more streamlined user experiences and minimises operational risks. It also allows issues to be identified and resolved prior to escalating disputes.

Comprehensive audit readiness

Control obligations under regulatory scrutiny require demonstrating not just that you acted within guidelines, but how and when. Your stack must record, timestamp, and retain all user actions, permissions, financial activity, and internal decisions so the logs are exportable in an easily reviewable format for internal teams and external regulators. Audit readiness is not merely a matter of passing an inspection. It is a matter of building an open and resilient business flow.

Absent these qualities could lead to the risk of delayed market launches, increased operating costs, or even regulatory penalties. A strong compliance stack is the basis of trust and the guarantee of long-term, sustainable growth.

Why Infrastructure Partners Matter

Regulated BNPL is about operating with control, speed, and trust. That’s why the proper and reliable technical partner matters.

Transferty is a high-performing payment gateway designed to meet the requirements of regulated and high-risk financial conditions. Transferty offers critical capabilities that directly complement the UK’s 2025 BNPL regulatory framework.

This is what Transferty offers:

Advanced refund orchestration

Transferty enables fast and traceable refund flows, guaranteeing merchants comply with regulatory requirements for timely refunds and maximizing customer satisfaction.

Routing and multi-rail functionality

The solution enables card payment, alternative payment methods, and multiple currencies. Smart routing and cascading logic maximise transaction success and availability.

Chargeback reduction and dispute management

Transferty has functionality for risk monitoring, early dispute involvement, and chargeback loss reduction, critical to protecting BNPL margins.

Featured monitoring and reporting

Transferty provides detailed analysis, transaction history, and document-supported dispute resolution. It creates strong audit trails and enforces ease of compliance reviews.

Transferty helps you remove compliance complexity, reduce risk, and maximise operating efficiency. It makes your product fast, secure, and trusted, even as regulation tightens. In the UK BNPL market, regulation is now the entry point. With Transferty, you’re not just compliant. You’re competitive, ready, and built for your business growth.