- Payment gateway

- Blog

- Chargeback Issues and Friendly Fraud: Tips for UK Merchants to handle them

Chargeback Issues and Friendly Fraud: Tips for UK Merchants to handle them

Did you know that increased prevalence of chargebacks costs UK merchants more than £128 million annually. A significant portion of these chargebacks results from friendly fraud, where customers dispute legitimate purchases, sometimes mistakenly and other times with intent to defraud. In this article we will find out the extent of chargeback issues in the UK, explore the causes and consequences of friendly fraud, and suggest strategies for merchants to mitigate these challenges

The Impact of Chargebacks

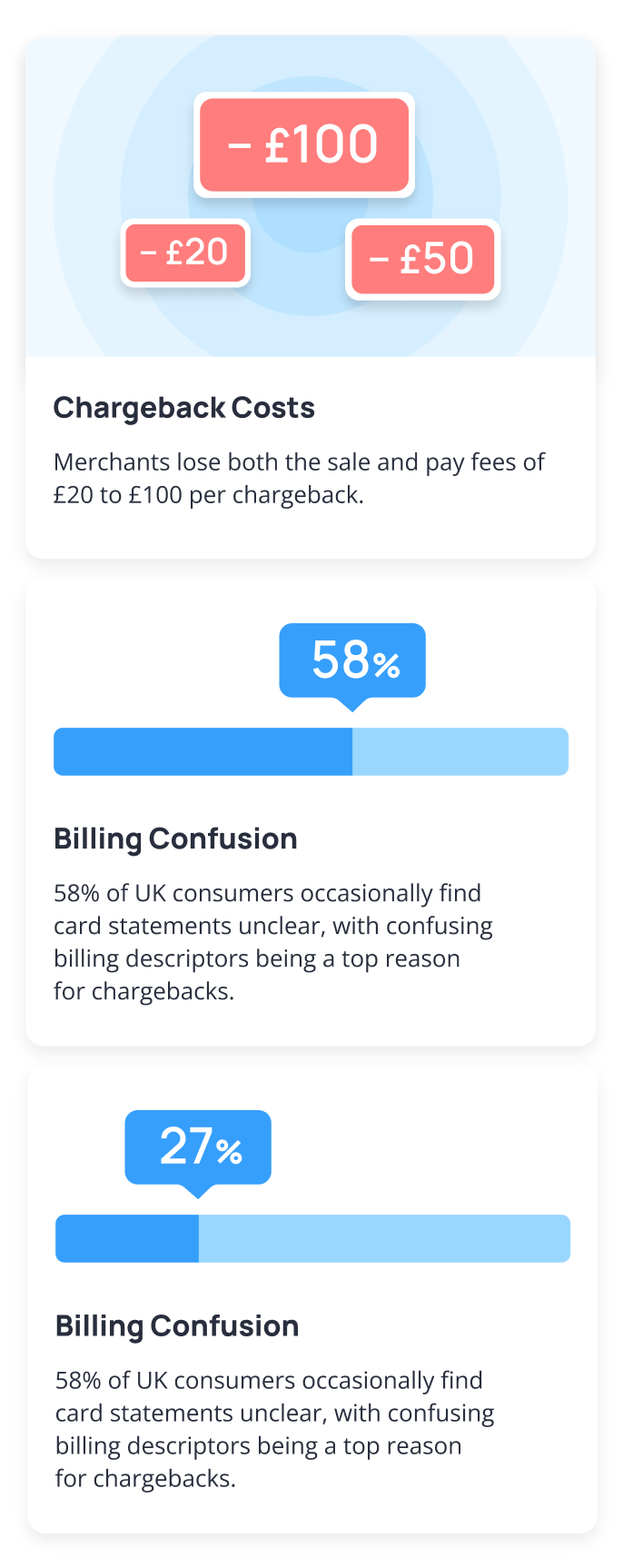

Chargebacks are financial and operational burdens. When a chargeback occurs, merchants lose the sale and are often hit with fees that can range from £20 to £100 per case. Additionally, excessive chargebacks can lead to reputational harm, strained relationships with payment processors, and higher processing fees or stricter transaction limits. A recent survey highlighted that confusing billing descriptors are a top cause of chargebacks, with 58% of UK consumers admitting they occasionally find their card statements unclear. Nearly one-third of these respondents said they found descriptors confusing ‘somewhat often’ or ‘very often,’ leading to disputes 27% of the time. Merchants who fail to address this issue may be harmed by chargebacks, which can ultimately impact their profit and customer loyalty

Friendly Fraud: The Revenue Killer

Friendly fraud, or first-party fraud, occurs when customers dispute a legitimate transaction. It often arises from simple misunderstandings, such as a customer not recognising a transaction on their statement or forgetting about a purchase. However, in many cases, customers knowingly dispute transactions to avoid payment. According to industry research, friendly fraud accounts for 60-80% of chargebacks in e-commerce, making it a costly issue for merchants. The rise of e-commerce and card-not-present transactions has stimulated the problem. E-commerce sales are expected to grow by 64.69% between 2023 and 2027, reaching $6.34 trillion globally. With this growth, the likelihood of chargebacks due to friendly fraud increases, especially as customers transact with unfamiliar brands across borders

Why Do Chargebacks Happen?

The leading causes of chargebacks include:

Confusing Billing Descriptors

A study found that one-third of merchants are unaware of how their billing descriptors appear on customer statements. This lack of clarity leads to disputes when customers cannot identify a transaction

Customer Convenience

Many customers prefer contacting their bank over the merchant because banks often provide quicker resolutions. The chargeback process allows customers to dispute transactions directly through their bank, which may be faster and simpler than reaching out to the merchant

Unauthorised Family Transactions

Family members, particularly children, may make purchases without the cardholder’s knowledge, leading to disputes over unfamiliar transactions

Strategies to Reduce Chargebacks

Merchants should work with payment processors to ensure descriptors match their brand names as closely as possible. Updating descriptors regularly can minimise misunderstandings and reduce unnecessary disputes

Establish transparent return and refund policies and ensure these are easily accessible on your website. Communicate proactively with customers by providing real-time updates on order status, delivery timelines, and any potential delays

Chargeback monitoring tools alert merchants as soon as a chargeback is filed, allowing them to respond promptly. In some cases, a direct conversation with the customer can resolve the issue without escalating it to the bank

Adding layers of security, like multi-factor authentication, helps verify customer identities and prevent unauthorised transactions. Coupled with IP tracking, MFA reduces the risk of disputes arising from suspected fraud

How a Reliable Payment Gateway Can Help

Payment gateways are essential in processing secure transactions, but they also offer vital tools to help merchants manage and reduce chargebacks. Key benefits include:

Fraud Prevention Tools

Fraud prevention features such as tokenisіation and encryption, allowing optimisation of your operations. These tools protect transactions and minimise disputes by flagging potentially fraudulent activity

Effective Dispute Management

Handling chargebacks involves collecting evidence, meeting strict deadlines, and adhering to bank protocols. Payment gateways can streamline this process by gathering necessary information and submitting it on behalf of the merchant

Compliance Support

Keeping up with evolving chargeback regulations and industry standards, such as Visa’s Compelling Evidence 3.0, can be challenging. A good payment gateway ensures compliance with these standards, helping merchants avoid penalties and maintain a good standing with payment processors

Сonclusion

As e-commerce continues to grow, so will the challenges associated with chargebacks. However, Chargebacks and friendly fraud can be mitigated through a proactive approach. Merchants who invest in robust fraud prevention and chargeback management strategies, as well as partnering with a reliable payment gateway partner will be better equipped to overcome all the issues related with the income decrease and maintain positive customer relationships

Sources:

- Business Wire: “2024 Chargeback Field Report: Merchant Survey Reveals Latest Trends, Impacts of Friendly Fraud”

- TWIC: “2024 Chargeback Field Report Sheds Light On Increase Of Friendly Fraud”

- ThePaypers: “Effective strategies for combating chargebacks and friendly fraud”

- Barclaycard Business: “Protect your business from friendly fraud”

- Chargeflow: “2024 Chargeback Management Guide for Merchants”

- Chargeback 911: “2024 Cardholder Dispute Index”