- Payment gateway

- Blog

- EMEA Regional Financial Trends and Predictions for 2024

EMEA Regional Financial Trends and Predictions for 2024

The financial technology landscape within the Europe, Middle East, and Africa region (EMEA) has been notably dynamic over the past few years. In this article we will compare the analytics of 2023 and 2024 to provide a comprehensive understanding of the regional fintech environment and discover the main financial trends and predictions in the EMEA region

General Overview

In 2023, the EMEA region experienced a significant drop in fintech funding, falling from $27 billion in the second half of 2022 to $11 billion in the first half of 2023. This decline was largely due to global macroeconomic uncertainties, rising interest rates, and intense pressure on valuations, which collectively led investors to focus more on profitability. Despite the downturn, the EMEA region maintained a resilient outlook, with expectations of recovery once market conditions stabilised. The financial environment in the EMEA region in 2024 has continued to face challenges, although there are signs of cautious optimism. Early 2024 saw a sustained focus on profitability and strategic investments in emerging technologies such as generative AI, real-time payments, and green fintech. These areas are expected to drive future growth and attract significant funding as the market stabilises. Now let’s get deeper for each sub-region specifically

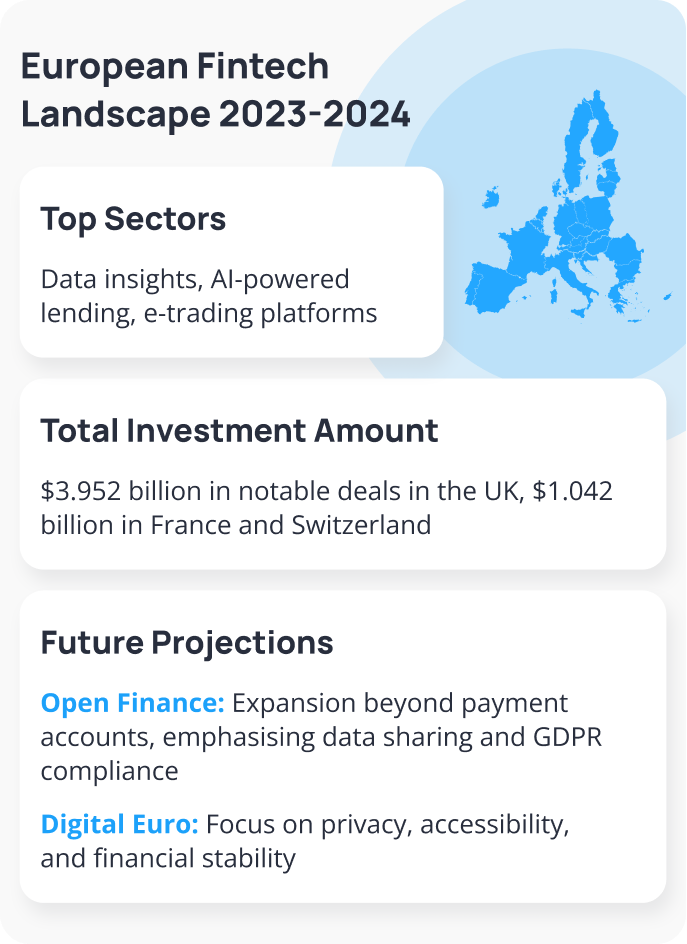

European Region

In 2023, the European fintech landscape saw substantial shifts, marked by a significant decline in funding yet laying a strong foundation for future growth. The United Kingdom emerged as the dominant player, securing a significant portion of the region’s investments. Major deals in the UK included substantial investments in sectors such as data insights, AI-powered lending, and e-trading platforms reached $3.952 billion investments in general. This demonstrated the UK’s resilience and its ability to attract substantial investments even in a challenging economic climate

France also made notable strides with significant funding in the cryptocurrency hardware sector, underscoring the country’s growing influence in the fintech industry. Switzerland followed with substantial investments in financial technology and digital asset companies, highlighting the strength of its fintech ecosystem. The general price of the described investments was $1.042 billion

Looking ahead to 2024, the European fintech sector is poised for further transformation. The UK continues to lead, bolstered by regulatory initiatives such as the Financial Services and Markets Act 2023. This legislation aims to enhance the UK’s attractiveness for IPOs and foster innovation in crypto assets and other financial technologies. Additionally, there is a growing focus on Environmental, Social, and Governance and regulatory technologies. European regulations, such as the Corporate Sustainability Reporting Directive, drive investments towards ESG compliance, while regtech solutions that utilise AI and automation are increasingly in demand to streamline compliance processes and enhance efficiency

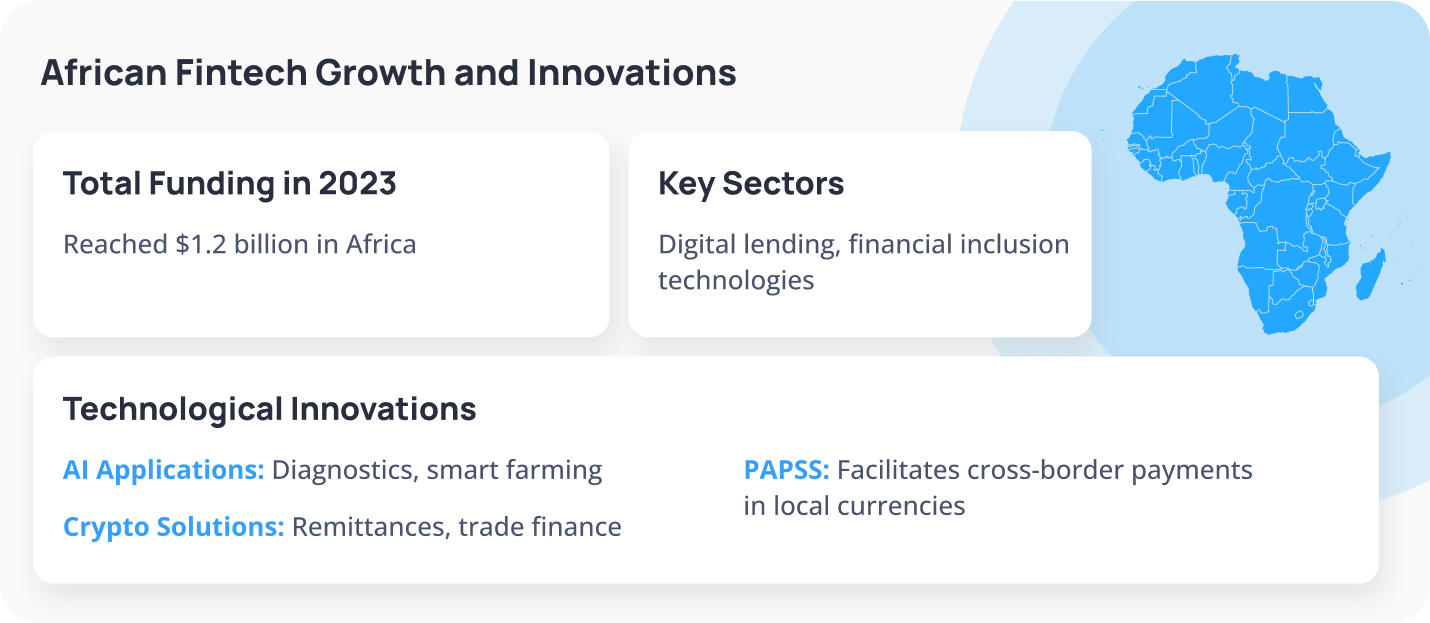

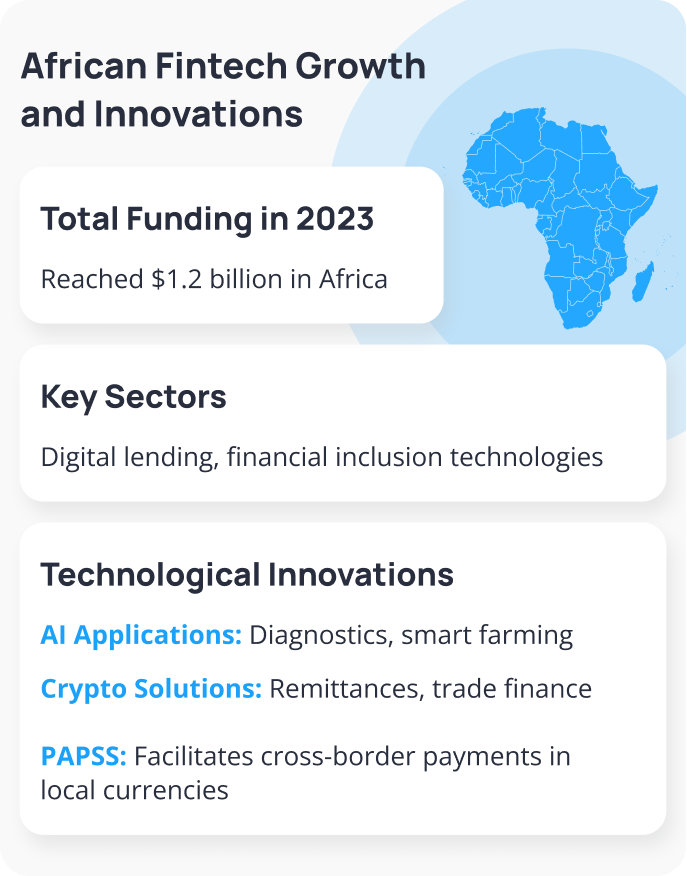

Africa

The African fintech ecosystem has shown remarkable resilience and growth, even amid global economic challenges. In 2023, total fintech funding in Africa reached $1.2 billion. Although this marked a decline from peak years, the number of funded ventures nearly doubled since 2021. This growth trajectory underscores the robust nature of Africa’s fintech sector and its potential for future expansion

Key sectors in the African market include digital lending and financial inclusion technologies, which have secured significant investments. Companies in these sectors are expanding their operations across multiple regions, showcasing the scalability and appeal of African fintech solutions. This expansion reflects a broader trend where African fintech startups are attracting diversified funding sources, including debt financing and government-backed initiatives. This diversification is crucial for sustaining growth and overcoming the funding challenges faced by many startups

Looking ahead to 2024, the African fintech landscape is expected to witness increased mergers and acquisitions. This consolidation will likely enhance the competitiveness and operational efficiency of fintech companies across the continent. Furthermore, AI and cryptocurrency innovations are set to lead the market. AI applications in areas such as diagnostics and smart farming, along with innovative crypto solutions for remittances and trade finance, are poised to address critical market needs. Initiatives like the Pan-African Payment and Settlement System (PAPSS) aim to facilitate instantaneous, cross-border payments in local currencies, promoting financial inclusion and economic integration across the continent

Middle East

The Middle East’s fintech sector is experiencing rapid growth, driven by a combination of technological advancements, supportive government policies, and increasing consumer demand for innovative financial services. In 2023, the region saw substantial investments and regulatory developments aimed at fostering a robust fintech ecosystem. Countries like the UAE and Saudi Arabia have taken significant steps to integrate fintech into their economic frameworks, with a strong commitment to environmentally and socially responsible financial practices

Technological advancements such as blockchain and AI are playing transformative roles in the Middle Eastern fintech landscape. These technologies are reshaping financial services by enabling secure, efficient, and transparent transactions. The introduction of regulatory frameworks like the Distributed Ledger Technology (DLT) Foundations Regulations by Abu Dhabi Global Market (ADGM) and the upcoming Digital Assets Law by Dubai International Financial Centre (DIFC) further support the integration of digital assets into the financial ecosystem

In 2024, the Middle East is expected to continue its growth with key trends such as the expansion of open banking, sustainable finance, and decentralised finance. Open banking is set to grow significantly, driven by regulatory support and consumer demand for seamless financial services. Sustainable finance initiatives, inspired by global commitments like those made during COP28, will push for more green fintech solutions. Additionally, the region’s focus on DeFi and cryptocurrencies will see advancements in the tokenization of assets and the adaptation of stablecoins as payment methods, further integrating digital currencies into everyday financial transactions

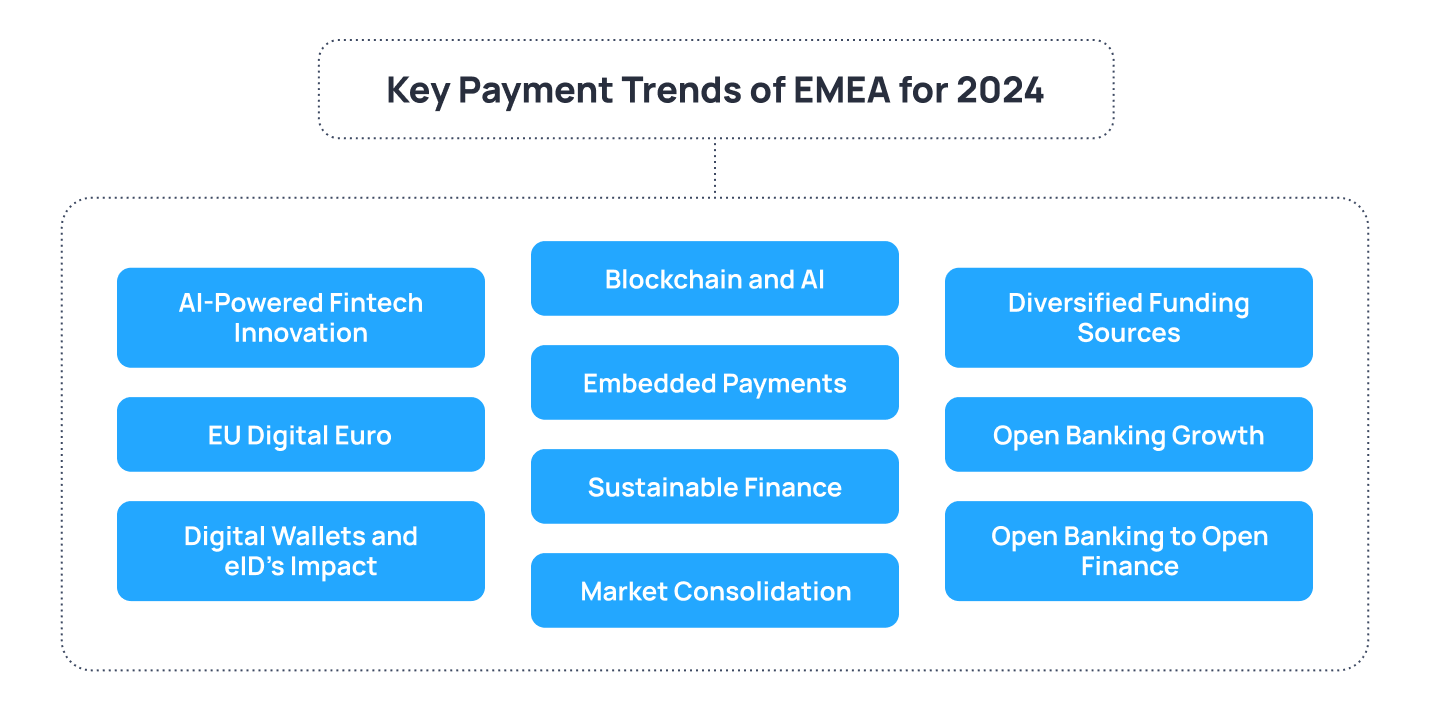

2024 EMEA Payment Trends

Open Banking to Open Finance

The EU is expanding the existing open banking model towards a broader framework called open finance. This shift is intended to enhance the sharing and reuse of financial services customer data across a wider range of financial products

- Legislative Framework: The proposed Financial Information Data Access (FIDA) framework emphasises customisation based on explicit consent and GDPR compliance. This will allow financial institutions and new actors like Financial Information Service Providers (FISPs) to improve their offerings

- Implementation Requirements: For open finance to succeed, the EU must establish clear data-sharing parameters, robust technical infrastructure, and ensure a level playing field between financial incumbents and technology firms

EU Digital Euro

The EU is making progress in discussions on the digital euro, with legislative proposals and technical work by the European Central Bank gaining traction

- Key Debates: Privacy, holding limits, and the compensation model for making the digital euro widely accessible are central to the debates. Policymakers are also considering the role of public and private entities in its distribution to ensure broad accessibility

- Future Outlook: While progress has been slow, the EU is expected to finalise draft legislation for the digital euro in 2024. This initiative aims to enhance financial stability, improve cross-border transactions, and promote financial inclusion, balancing technological advancement with safeguarding individual rights

Embedded Payments

Embedded payments are set to gain prominence in 2024, integrating payment functionalities seamlessly into various platforms and devices. This innovation enhances user experience by reducing transactional frictions, particularly in e-commerce and the Internet of Things (IoT). Embedded payments also promote financial inclusion and security, driving the adoption of biometric authentication and advanced encryption protocols

AI-Powered Fintech Innovation

As the EU prepares to implement the AI Act, the fintech sector anticipates significant regulatory impacts. AI technologies promise to enhance operational efficiencies, reduce costs, and offer more tailored financial products, marking a pivotal moment for the convergence of technology and finance

Digital Wallets and eID’s Impact

The EU-wide digital identity framework is expected to transform the payments sector by enabling citizens to authenticate their identities during transactions. This initiative will improve customer onboarding processes for banks and enhance payment security. Pilot projects are underway to integrate digital wallets into payment systems, focusing on interoperability between the EU and the US

Open Banking Growth

The open banking market in the Middle East is projected to grow significantly, with a predicted annual growth rate of 25% over the next five years. This growth is driven by regulatory support and consumer demand for seamless financial services

Sustainable Finance

The UAE has pledged over AED 1 trillion in sustainable financing by 2030, reflecting a strong commitment to environmentally and socially responsible financial practices. This trend is expected to influence fintech innovations, including green blockchains and eco-friendly banking apps

Blockchain and AI

In the Middle East, blockchain and AI technologies are reshaping the fintech ecosystem, with applications in digital assets, cross-border transactions, and financial inclusion. In Africa, AI applications in diagnostics, smart farming, and other high-impact areas, along with innovative crypto solutions for remittances and trade finance, are poised to lead the market

Diversified Funding Sources

African fintech startups are increasingly tapping into diversified funding sources, including debt financing, government-backed initiatives, and corporate venture capital. This diversification is crucial for sustaining growth amid funding challenges

Market Consolidation

Increased mergers and acquisitions are expected in 2024, driven by market consolidation and corrected valuations. This trend will enhance the competitiveness and operational efficiency of fintech companies

Conclusion

The fintech landscape in the EMEA region is poised for significant transformation in 2024. Enhanced regulatory measures, technological advancements, and innovative solutions will drive the evolution of the fintech sector, ensuring a more secure, efficient, and inclusive financial ecosystem. While 2023 witnessed a significant funding decline, the outlook for 2024 remains cautiously optimistic, with potential growth areas in AI, green fintech, and regulatory advancements. By understanding these trends and adapting to new market realities, fintech companies in the EMEA region can overcome the challenges and capitalise on emerging opportunities. While doing so, a reliable payment gateway partner with depth experience in the region’s specificities is a must-have. We, at Transferty, are ready to streamline your operations in EMEA by providing the advanced payment technology and expertise, tailored to your business model. Reach out to us to get more

Sources

- KPMG Global, «Fintech Funding Down in EMEA in 2023 Report.»

- FT Partners, «Fintech Research Reports.»

- Disrupt Africa, «African Fintech Ecosystem Reports.»

- McKinsey, «Fintech in Africa Analysis.»

- Fintech News Africa, «African Fintech Funding Data.»