- Payment gateway

- Blog

- Global Acquiring: A Guide to Cross-Border Payments

Global Acquiring: A Guide to Cross-Border Payments

Nowadays businesses are no longer confined by geographical boundaries. The rapid growth of digital transactions has created new opportunities for companies to reach customers across the globe. However, with these opportunities come challenges, particularly in managing cross-border payments. Global acquiring is a powerful solution for businesses looking to expand internationally, offering a streamlined way to accept payments from customers worldwide and manage currency conversions. As we move into 2024 and beyond, understanding the specificities of global acquiring becomes increasingly important for businesses aiming to stay competitive in a global market. In this article we will explore the nature of global acquiring, the pros and cons of adopting this payment processing practice, and how businesses can simplify the process, making it faster and more efficient

What is Global Acquiring?

Global acquiring is a payment processing method that allows businesses to accept transactions from customers worldwide, regardless of the customer’s location or the currency they use. Unlike local acquiring, where the acquirer and the customer’s bank are located in the same country, global acquiring facilitates transactions across borders. This capability is essential for businesses aiming to reach a global audience, as it allows them to interact with various international issuing banks and accommodate diverse payment methods

Types and Specificities of Global Acquiring

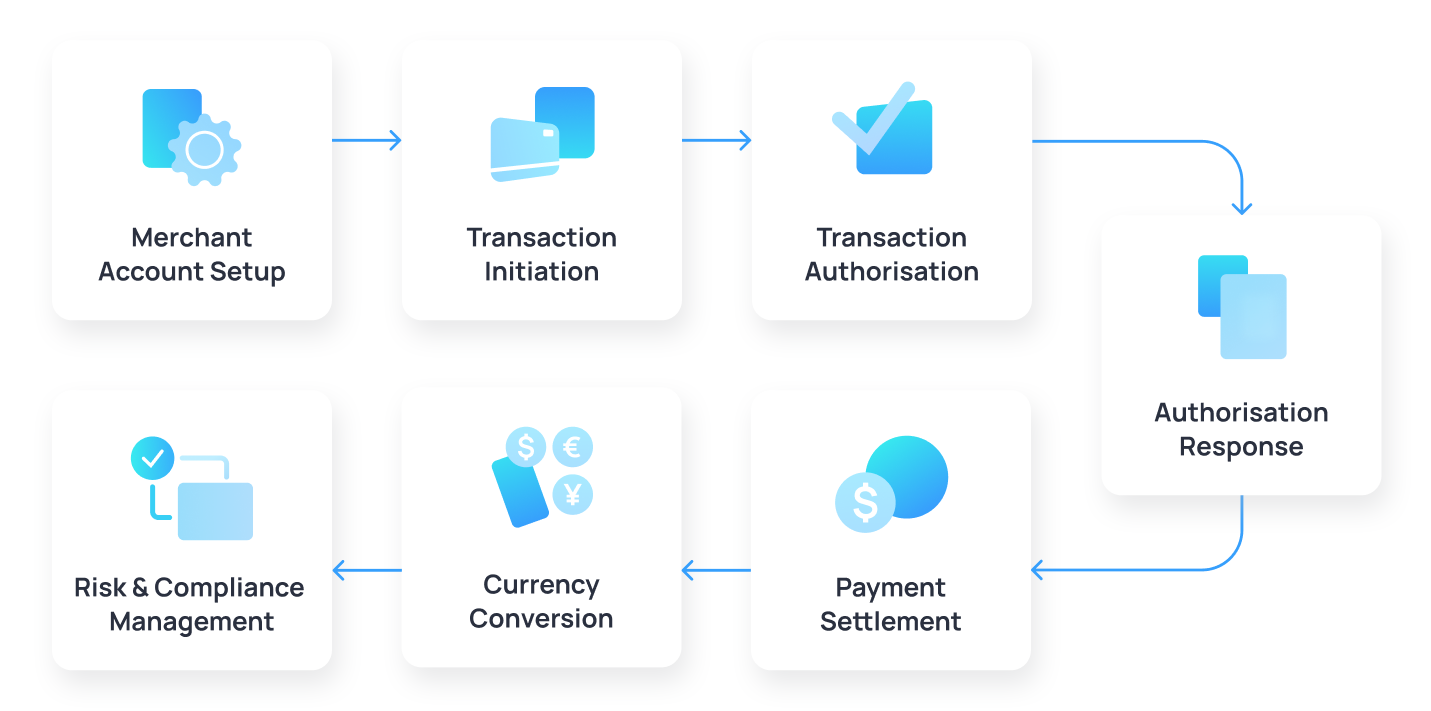

Global acquiring involves multiple steps and requires collaboration among various financial entities. Here is how the process typically works:

1. Merchant Account Setup

Businesses first need to establish a relationship with a global acquiring bank or a payment service provider that offers global acquiring services. This involves setting up a merchant account specifically for handling international transactions

2. Transaction Initiation

When a customer makes a purchase, the payment data is transferred from the business to the acquirer

3. Transaction Authorisation

The global acquirer sends the payment data to the card network such as Visa or Mastercard, which then forwards it to the issuing bank for approval

4. Authorisation Response

The issuing bank reviews the transaction details and either approves or declines the payment based on various factors, such as the customer’s balance and fraud potential. This response is relayed back to the business through the acquirer

5. Settlement

If approved, the issuing bank transfers the funds to the acquirer, who then deposits them into the business’s main account

6. Currency Conversion

If the transaction involves different currencies, the acquirer or card network handles the conversion

7. Risk and Compliance Management

Global acquirers assist businesses in managing fraud risks, ensuring compliance with international regulations, and handling disputes and chargebacks

Global acquiring simplifies the process of accepting international payments, but it also involves handling a complex web of financial regulations, currency conversions, and risk management

Pros and Cons of Global Acquiring

Pros

International Reach

Global acquiring enables businesses to accept payments from customers around the world, expanding their potential customer base and increasing sales opportunities. This capability is increasingly important, with cross-border e-commerce projected to reach $4.8 trillion by 2026, growing at a CAGR of 27% from 2021 to 2026. The expansion of internet access, mobile commerce, and improved logistics and payment infrastructures are key drivers of this growth

Currency Conversion

Acquirers handle currency conversions, making it easier for businesses to receive payments in their preferred currency and reducing the hassle for customers. However, managing multiple currencies can present challenges due to fluctuating exchange rates and conversion fees, which can impact a business’s bottom line

Diverse Payment Methods

Global acquirers can support a wide range of payment methods, accommodating local preferences in different markets and improving customer satisfaction. As the use of alternative payment methods continues to rise, these methods are expected to account for 55% of global transaction volume by 2024

Compliance and Risk Management

With expertise in different regulatory environments, global acquirers help businesses comply with local laws and manage fraud and security risks effectively. This is particularly crucial given the projected increase in global payment fraud, which is expected to reach $40.62 billion by 2027

Improved Authorisation Rates

By maintaining relationships with banks worldwide, global acquirers often achieve higher authorisation rates for transactions, reducing the number of declined payments

Unified Reporting and Reconciliation

Businesses benefit from streamlined financial management through a single platform for reporting and reconciling transactions across all markets

Cost Efficiency

Global acquiring can reduce cross-border fees and associated costs by processing payments locally in multiple countries

Cons

Complex Regulatory Environments

Handling the diverse regulations of different countries can be challenging and resource-intensive. Compliance is becoming more stringent with data protection laws like the GDPR in Europe and similar laws in other regions, requiring global acquirers to stay up-to-date and compliant across multiple jurisdictions

Currency Management Challenges

While acquirers handle currency conversions, businesses still need to manage the financial impact of exchange rate fluctuations and conversion fees

Fraud and Security Risks

International transactions can expose businesses to higher fraud risks, requiring robust security measures and ongoing monitoring. The increase in sophisticated fraud tactics necessitates advanced fraud detection and prevention tools

Consumer Behaviour Differences

Understanding and adapting to local payment preferences and consumer behaviours in various markets is crucial but can be complex

Managing Multiple Interconnections

Depending on their strategy, businesses might need to manage multiple relationships with various acquirers, adding to operational complexity

Dispute Handling and Chargebacks

Resolving disputes and managing chargebacks can be more complicated in a cross-border context, requiring knowledge of different rules and timelines

How to Improve the Cross Border Payments?

Partnering with a reliable PSP that offers global acquiring services can simplify the complexities associated with cross-border payments. Here’s how a good PSP can help:

A reputable PSP has experience working in various markets and can handle the regulatory landscape, ensuring compliance and reducing potential reputational risks

PSPs invest in advanced technology to secure transactions and prevent fraud, providing businesses with robust protection against potential security breaches

From setting up merchant accounts to managing currency conversions and handling disputes, PSPs provide end-to-end support, making the global acquiring process seamless

As businesses grow, PSPs can offer scalable solutions that adapt to increasing transaction volumes and expanding markets, providing flexibility for future growth

Future Trends in Global Acquiring

As we look ahead to 2024 and beyond, several trends are shaping the future of global acquiring:

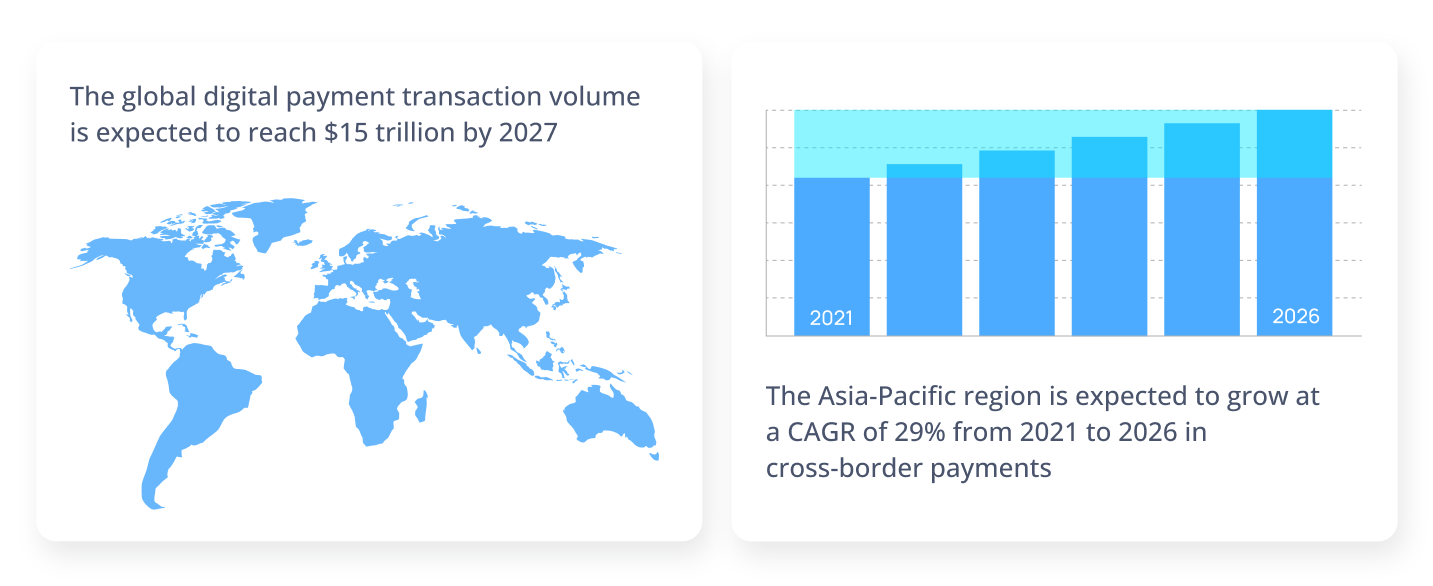

Rise in Digital Payments

The global digital payment transaction volume is expected to reach $15 trillion by 2027, driven by the adoption of mobile wallets, BNPL, and other digital payment methods. Businesses need to adapt to these trends to remain competitive in the global market

Growth in Emerging Markets

Rapid growth in digital payments in emerging markets, particularly in Asia-Pacific, Latin America, and Africa, presents significant opportunities for businesses to expand. For example, the Asia-Pacific region is expected to grow at a CAGR of 29% from 2021 to 2026 in cross-border payments

Demand for Faster Settlement and Lower Costs

The demand for faster settlements and reduced transaction costs is rising. Real-time payments and blockchain technology are being explored as solutions to enhance speed and cost efficiency

Сonclusion

Businesses that effectively leverage global acquiring will be better positioned to tap into new markets, provide a seamless payment experience to their international customers, and overcome the complexities of cross-border transactions. By understanding the market dynamics and partnering with experienced PSPs, businesses can ensure they are well-equipped to apply the full potential of global acquiring to drive growth and customer satisfaction