- Payment gateway

- Blog

- Global money movement: Payment gateway role

Global money movement: Payment gateway role

The Role of Payment Gateways in Global Money Movement

The movement of money across borders is a critical aspect of the global economy, and payment solutions play an essential role in facilitating this process. Gateway solutions are online platforms that enable businesses to accept electronic payments from customers, providing a secure channel for transferring funds between different parties, including buyers, sellers, and banks

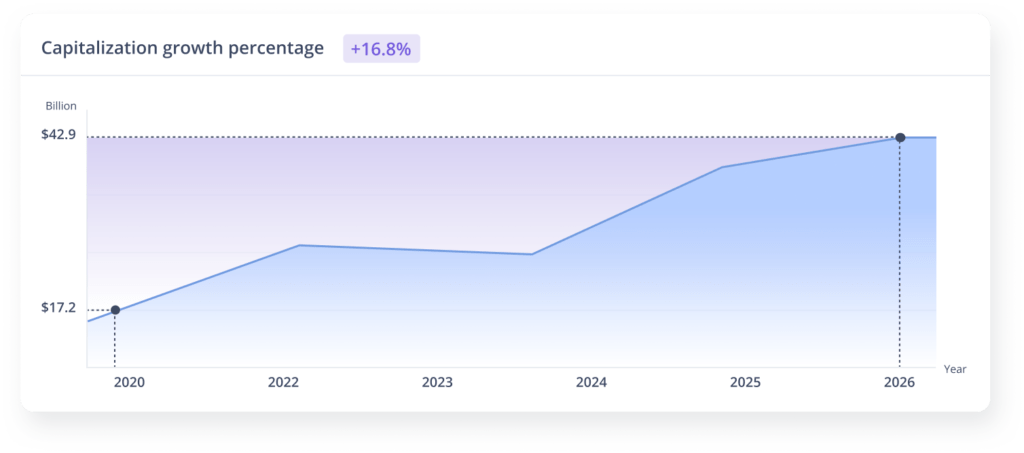

The global gateway market is expected to grow from $17.2 billion in 2020 to $42.9 billion by 2026, representing a compound annual growth rate (CAGR) of 16.8%. – According to a report by MarketsandMarkets

This growth is driven by the increasing adoption of mobile payments, the rise of e-commerce, and the need for faster and more secure payment processing

Key Drivers of Growth

Several factors drive this growth, including:

Increasing Adoption of Mobile Payments

The widespread use of smartphones has changed the way people make transactions. Mobile payments have become increasingly popular due to their convenience, speed, and security. Several trends contribute to this adoption:

- Contactless Payments: The COVID-19 pandemic accelerated the shift towards contactless payments as consumers sought safer ways to transact without physical contact

- Mobile Wallets: Services like Apple Pay, Google Wallet, and Samsung Pay allow users to store their payment information securely on their smartphones and make payments with a simple tap

- Global Reach: Mobile payment solutions have penetrated emerging markets where traditional banking infrastructure is lacking, enabling financial inclusion for millions of people

Rise of E-Commerce

E-commerce has seen exponential growth over the past decade, transforming how businesses operate and how consumers shop. Key factors include:

- Consumer Preferences: Shoppers increasingly prefer the convenience of online shopping, with access to a wider range of products and competitive pricing

- Global Marketplace: E-commerce platforms enable businesses to reach customers worldwide, necessitating efficient and reliable payment gateways to handle international transactions

- Technological Advancements: Innovations such as augmented reality (AR) for product visualisation and AI-driven personalised shopping experiences enhance the online shopping experience, driving more traffic to e-commerce sites

Need for Faster and More Secure Payment Processing

In today’s world, speed and security are paramount for both consumers and businesses. The demand for faster and more secure payment processing is fueled by:

- Instant Gratification: Consumers expect quick transaction processing times to complete their purchases without delay, enhancing their overall shopping experience

- Fraud Prevention: Advanced security measures, including encryption, tokenization, and two-factor authentication, protect against fraudulent activities, giving consumers and businesses peace of mind

- Regulatory Compliance: Businesses must comply with stringent regulations such as the General Data Protection Regulation (GDPR) and Payment Card Industry Data Security Standard (PCI DSS), ensuring the protection of customer data and transaction security

Global Expansion of Businesses

As businesses expand their operations globally, the need for robust payment gateways that can handle international transactions efficiently becomes critical. Key considerations include:

- Multi-Currency Processing: Businesses must be able to accept payments in various currencies to cater to their diverse customer base

- Local Payment Methods: Different regions have preferred payment methods (e.g., bank transfers in Europe, e-wallets in Asia), and payment gateways must support these methods to ensure smooth transactions

- Cross-Border Transactions: Efficient processing of cross-border payments reduces costs and transaction times, making it easier for businesses to operate on a global scale

A Look at the Rapidly Expanding Gateway Solutions Market

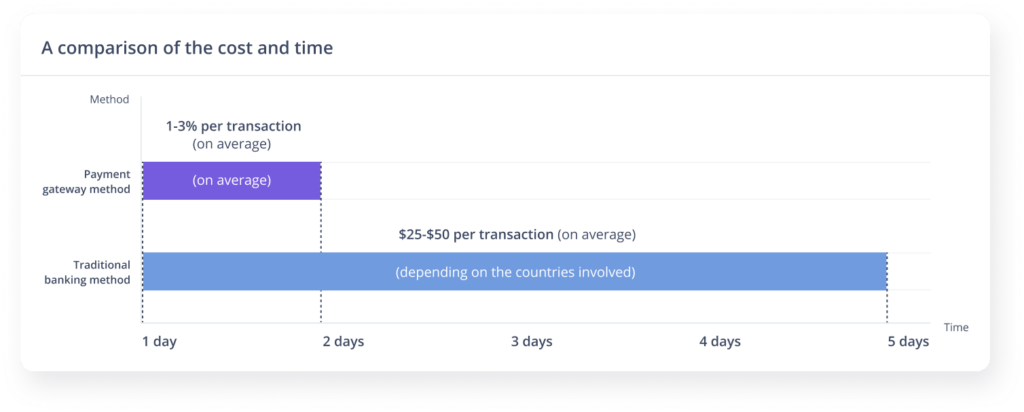

Gateway solutions are particularly useful for processing cross-border payments. Traditional banking methods for international money transfers can be slow, expensive, and often have restrictive limits. Payment solutions, on the other hand, can process international payments in real-time, at a lower cost, and with higher limits. This is critical for businesses operating in the global marketplace, where speed, efficiency, and cost-effectiveness are essential to success

Traditional banking methods for cross-border payments can take up to 5 days to complete and cost between $25-$50 per transaction. In contrast, gateway solutions can process the same transaction in 24–48 hours with a 1-3% transaction fee. These differences make gateway solutions a more efficient and cost-effective option for businesses operating in the global marketplace

Advanced Features and Business Insights

Real-Time Analytics and Reporting

Payment gateways provide businesses with valuable insights into their financial operations. They offer real-time analytics and reporting on transactions, allowing businesses to track their revenue and cash flow in real time. This information can help businesses make data-driven decisions, optimise operations, and plan for future growth

Multi-Currency Support

Payment gateways enable businesses to process payments in multiple currencies. This is particularly important for businesses that operate in different countries and need to accept payments in different currencies. Payment gateways can convert payments into local currency at competitive exchange rates, making it easier for businesses to accept payments from customers worldwide

Security and Fraud Prevention

Enhanced Security Measures

Payment gateways use advanced security protocols to ensure the safety of transactions. This includes encryption, tokenization, and secure socket layer (SSL) technologies to protect sensitive information from fraud and breaches

Fraud Detection and Prevention

Many payment gateways come equipped with robust fraud detection and prevention tools. These tools use machine learning and artificial intelligence to monitor transactions for suspicious activity, helping businesses reduce the risk of fraud

The Future of Gateways in a Global Economy

Blockchain and Cryptocurrencies

Blockchain technology and cryptocurrencies are poised to streamline the payment gateway industry. Blockchain provides a decentralised ledger that enhances transparency and security, reducing the risk of fraud and errors. Cryptocurrencies offer an alternative payment method that is gaining traction for several reasons:

- Lower Transaction Fees: Cryptocurrency transactions often incur lower fees compared to traditional banking methods

- Speed: Transactions are processed quickly, sometimes within minutes, irrespective of geographical boundaries

- Security: Blockchain’s decentralised nature makes it highly secure, reducing the risk of hacking and fraud

Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are increasingly being integrated into payment gateways to improve their efficiency and security. These technologies enable payment gateways to:

- Enhance Fraud Detection: AI algorithms can analyse transaction patterns to detect and prevent fraudulent activities in real-time

- Personalise Customer Experiences: ML can help tailor payment solutions to individual customer preferences, enhancing the user experience

- Optimise Operations: AI can streamline operations by automating routine tasks and providing predictive analytics for better decision-making

Internet of Things (IoT)

The IoT is set to impact payment gateways significantly by enabling connected devices to facilitate transactions autonomously. For instance:

- Smart Appliances: Devices like refrigerators and washing machines could automatically order and pay for supplies when running low

- Wearable Technology: Smartwatches and other wearable devices could allow users to make payments with a simple gesture or voice command

Emerging Markets

Emerging markets present a significant growth opportunity for payment gateways. As these economies develop, the demand for efficient and secure payment solutions will increase. Key factors driving this expansion include:

- Rising Internet Penetration: More people gaining access to the internet means a larger user base for digital payment solutions

- Increasing Smartphone Usage: Smartphones are becoming the primary mode of accessing digital services, including payments, in emerging markets

- Government Initiatives: Many governments are promoting digital payments to enhance financial inclusion and reduce the shadow economy

Data Privacy Regulations

As payment gateways handle sensitive financial data, compliance with data privacy regulations is paramount. Laws such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the U.S. set stringent requirements for data protection. Future regulations may further tighten these requirements, emphasising the need for robust data security measures

Anti-Money Laundering (AML) and Know Your Customer (KYC)

AML and KYC regulations are critical in preventing financial crimes. Payment gateways will need to:

- Implement Comprehensive KYC Processes: Ensure that all customers are thoroughly vetted to prevent fraudulent activities

- Adopt Advanced AML Solutions: Utilise AI and ML to monitor transactions for suspicious activity and comply with global AML standards

Cross-Border Regulations

Global expansion of payment gateways requires navigating various regulatory environments. Harmonising these regulations can facilitate smoother international transactions. Key considerations include:

- Compliance with Local Laws: Adhering to the regulatory requirements of each country where the payment gateway operates

- Currency Exchange Regulations: Ensuring compliance with laws governing currency exchange to prevent illegal activities

Seamless Integration

Future payment gateways will prioritise seamless integration with various platforms and services to provide a unified experience. This includes:

- E-Commerce Platforms: Direct integration with major e-commerce platforms to streamline the checkout process

- Point-of-Sale Systems: Integration with in-store POS systems to offer a consistent experience across online and offline channels

Enhanced User Interfaces

Improving the user interface (UI) and user experience (UX) will be crucial for future payment gateways. This involves:

- Simplified Payment Processes: Reducing the number of steps required to complete a transaction

- Customizable Interfaces: Allowing businesses to tailor the payment gateway interface to match their branding

Conclusion

Payment gateways are crucial for facilitating the movement of money worldwide. They provide businesses with a faster, more secure, and cost-effective way to process electronic payments, particularly for cross-border transactions. With the global payment gateway market projected to grow rapidly, businesses adopting these technologies will be better positioned to compete and succeed in the worldwide economy