- Payment gateway

- Blog

- Payment Gateway Integration: Main Challenges and Tips for Optimisation

Payment Gateway Integration: Main Challenges and Tips for Optimisation

Nowadays, offering seamless payment solutions is crucial for any business that aims to remain competitive. The ability to handle transactions quickly and securely is not only a key factor in customer satisfaction but also essential for business success. However, integrating a payment gateway into your website or app can be a daunting process filled with technical challenges and compliance requirements. Below, we’ll discuss the key obstacles businesses face when incorporating a payment gateway and provide tips on how to optimise this critical step in your business strategy

How Integration Works

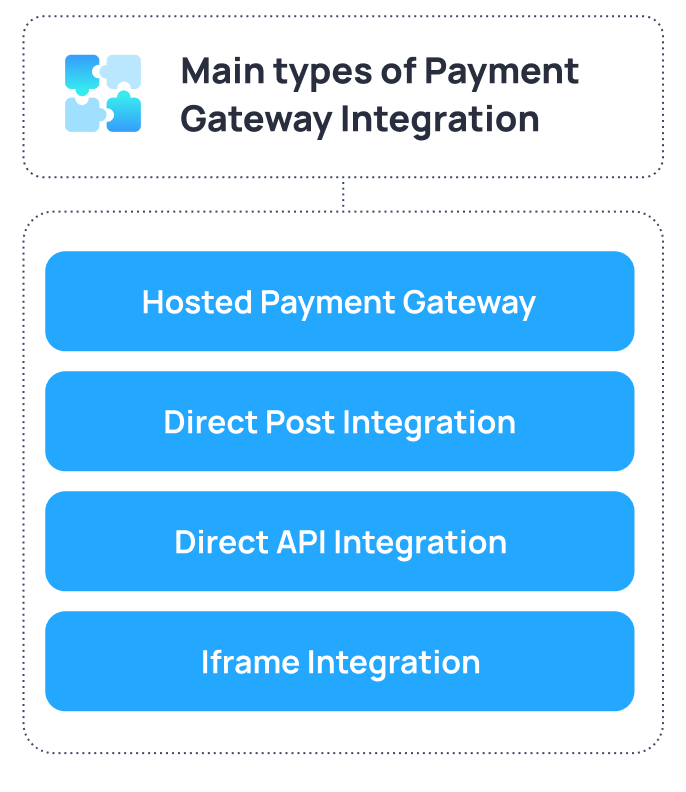

When businesses decide to integrate a payment gateway, they can choose from several types of integration methods based on their specific needs and technical requirements. Each type of payment gateway integration offers different levels of customisation, security, and user experience. Here are the main types and how they work:

1. Hosted Payment Gateway

In a hosted payment gateway setup, the customer is redirected to the payment provider’s secure platform during checkout. After completing the payment, they are redirected back to your website. This method is popular for its simplicity and security, as the payment gateway provider manages all sensitive payment data

2. Direct Post Integration

This method allows the business to collect payment information directly on their website but processes it by posting the payment details directly to the payment gateway’s servers. The payment details never hit the merchant’s server, which reduces security risks

3. Direct API Integration

In Direct API Integration, the merchant’s server handles all communication with the payment gateway API. This method gives full control over the payment process, allowing for more customisation and a smoother user experience. It is ideal for businesses that require high-level customisation and complete control over the checkout experience

4. Iframe Integration

In iframe integration, the payment form is embedded into your website using a small, secure window (iframe) that is hosted by the payment gateway provider. This way, the payment gateway handles sensitive data without redirecting the customer away from the site

Each type of payment gateway integration has its advantages and disadvantages, and the choice depends on your business requirements, technical capabilities, and customer experience goals. For example, Magento payment gateway integration might rely more on direct server-to-server integrations, while a small business might opt for a simpler hosted gateway. Understanding these types will help businesses make informed decisions and choose the most suitable method for their needs

Common Challenges in Payment Gateway Integration

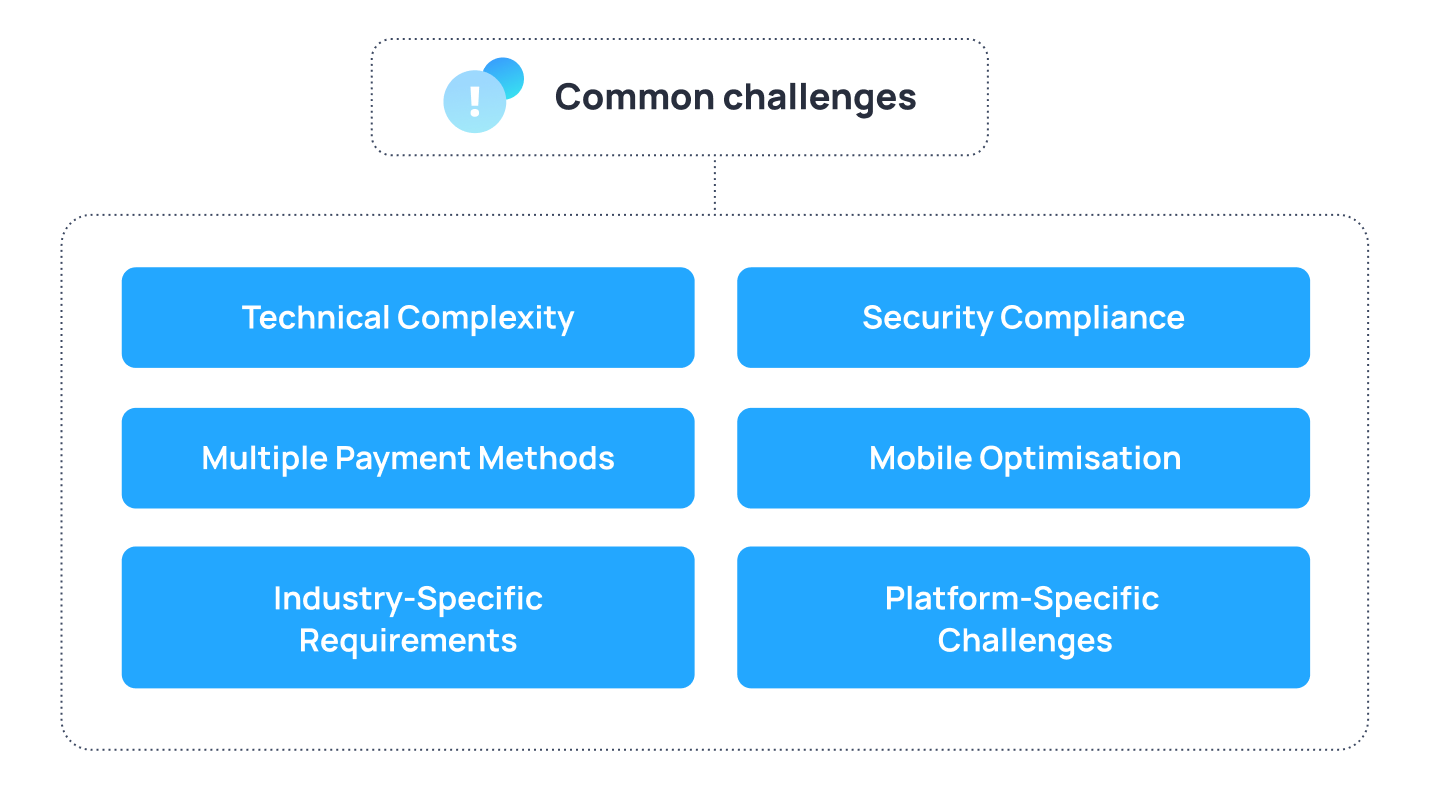

Technical Complexity

One of the primary challenges in payment gateway integration is the complexity of setting up the API and making sure it works seamlessly with your existing infrastructure. Whether you’re integrating a basic or complex gateway, the payment gateway API integration requires coding expertise and a deep understanding of your backend systems

Tip: Choose a payment gateway that offers detailed and clear documentation, and consider using SDKs provided by the payment gateway to simplify the coding process. For non-technical teams, seeking payment gateway integration services might be the most efficient way to ensure everything runs smoothly

Ensuring Security Compliance

Another critical challenge in the payment gateway integration process is ensuring that your system adheres to strict security standards such as PCI DSS compliance. You need to ensure that sensitive payment data, including card information, is processed securely and that your business is protected from potential data breaches

Tip: Utilise tokenisation and encryption techniques to secure sensitive data. Most online payment gateway integration solutions offer these features out of the box. Additionally, stay up-to-date with the latest security requirements to ensure your system remains compliant

Handling Multiple Payment Methods

Today’s consumers expect to be able to pay using a wide range of methods – from credit and debit cards to digital wallets and even cryptocurrencies. Integrating a payment gateway that supports multiple methods is essential but can add layers of complexity to the setup

Tip: Research the payment preferences of your target audience and choose a gateway that supports the relevant methods. Opt for multiple payment gateway integration to avoid relying on a single provider, which could mitigate risks if one provider experiences technical difficulties

Mobile Optimisation

With a growing number of transactions happening on mobile devices, it’s crucial to ensure that your payment gateway integration works seamlessly on smartphones and tablets. Mobile payment gateway integration adds complexity, especially if your existing infrastructure is not optimised for mobile experiences

Tip: Use responsive design techniques and mobile-optimised APIs to enhance the mobile payment experience. Choose payment gateways that are already optimised for mobile, especially if your business relies heavily on mobile traffic.

Industry-Specific Requirements

Certain industries, such as gambling, face stricter regulations and require specialised payment solutions. Businesses offering high-risk services often encounter additional challenges when integrating gambling payment gateway integration services, including adherence to local and international laws and the need for enhanced fraud detection.

Tip: When dealing with niche industries, make sure the payment gateway you choose supports industry-specific requirements and compliance standards. Additionally, test the system thoroughly to ensure it adheres to regional regulations and fraud prevention protocols

Platform-Specific Challenges

Different e-commerce platforms or content management systems require different approaches when integrating payment gateways. For instance, Magento payment gateway integration might have different challenges compared to iOS payment gateway integration for mobile apps

Tip: Select payment gateways that provide tailored plugins or APIs for your platform. For example, if you’re using Magento, opt for a gateway that provides a dedicated Magento payment gateway integration module to minimise setup difficulties. Similarly, if you have a mobile app, prioritise providers that offer iOS payment gateway integration support

Global acquiring simplifies the process of accepting international payments, but it also involves handling a complex web of financial regulations, currency conversions, and risk management

Optimising the Payment Gateway Integration Process

Despite the challenges mentioned above, businesses can take several measures to optimise the payment gateway integration process and ensure smooth, secure, and reliable payment handling

Plan the Payment Gateway Integration Steps

The first step to optimisation is proper planning. Before you begin the integration, list the payment gateway integration steps, including obtaining API credentials, reviewing the provider’s API documentation, coding the integration, and testing in a sandbox environment. Create a detailed roadmap for the entire process to avoid common pitfalls. Ensure that all stakeholders – from your developers to compliance officers – are aligned on the timeline and deliverables

Utilise Sandbox Testing

Before going live, it’s crucial to use a sandbox environment to test the payment gateway. This allows your team to identify any issues, such as failed transactions or API errors, in a controlled setting. Test all possible transaction types (e.g., payments, refunds, voids) in the sandbox. Many providers offer a robust testing environment that mimics real-world scenarios, which is key for reducing the risk of errors once you go live

Monitor and Optimise After Launch

Once the integration is live, it’s important to continuously monitor transaction success rates, customer feedback, and performance. Even after a successful integration, regular updates and optimisations are necessary to ensure long-term efficiency. Set up transaction monitoring tools that will notify you of any failed transactions or unusual activity. Additionally, keep track of customer complaints related to the checkout process and fix any bugs or usability issues promptly

Leverage Professional Payment Gateway Integration Services

If your business lacks in-house technical expertise, outsourcing the integration to professional payment gateway integration services can save time, reduce errors, and ensure best practices are followed from the start. When choosing a service provider, check their experience with the specific gateway you plan to integrate and ensure they can handle any customisations required by your business model

Сonclusion

Successfully integrating a payment gateway is a crucial step for any business looking to offer secure, reliable, and diverse payment options to its customers. While the process can be complex, especially when considering industry-specific needs like gambling payment gateway integration services, it can be optimised through careful planning, leveraging available resources like api integration payment gateway capabilities, and using professional services when necessary. By following the steps and tips outlined above, you can simplify the payment gateway integration process and ensure that your business is well-prepared to handle digital transactions efficiently