- Payment gateway

- Blog

- Payment Processing Fees: How much and how long?

Payment Processing Fees: How much and how long?

Looking for a payment provider can be a slow and challenging process. At the first glimpse all of them look similar. However, getting deeper into their specificities you may find the great differences. As you found the best one for your needs, the long-lasting process of integration starts, from payment processing fees negotiation to the technical issues. Today we will discover why this process is so demanding, analyse how to make it more effective and explore the real business cases to help you find out which issues you may face and how to overcome them

What are Payment Processing Fees?

Payment processing fees are the charges that merchants pay each time a customer completes a purchase using a credit card or an online payment system. Online payment processing fees are essential for maintaining the efficiency and reliability of the payment processing network, ensuring that transactions are conducted quickly, safely, and effectively

Payment processing fee is a complex charge made up of various smaller fees levied by different parties involved in the transaction. These parties include the customer’s issuing bank, the merchant’s acquiring bank, the payment processor, and card networks such as Visa and Mastercard. The fees cover the costs associated with the technology, security, and services that facilitate the authorisation, funding, and settlement stages of a payment transaction

The Main Payment Processing Fees

Let’s go through payment processing fees comparison. Payment processing fees include such primary categories:

A percent taken for each transaction

A fixed amount that is taken from each transaction

A fee you pay for each processed chargeback

A fee for each refund made

A fee for expenses related to registration and calculations in the transaction

A fee you pay to the payment gateway through which transactions will be processed

All these commissions already include the commission taken by the card brand like Visa or Mastercard and the acquiring bank

Rolling reserve – An amount holded by merchant account providers for some period of time as a guarantee safeguarding against chargebacks

Among additional fees that may arise depending on the choice of provider are:

- Set up fee – some providers charge a fee for issuing and setting up the MID

- Monthly fee – some providers may charge a monthly fee for the maintenance of the MID

Case Studies

Now we will analyse three different cases, exploring which difficulties may appear with various types of businesses and calculate which commission offers they may receive, according to their specifications

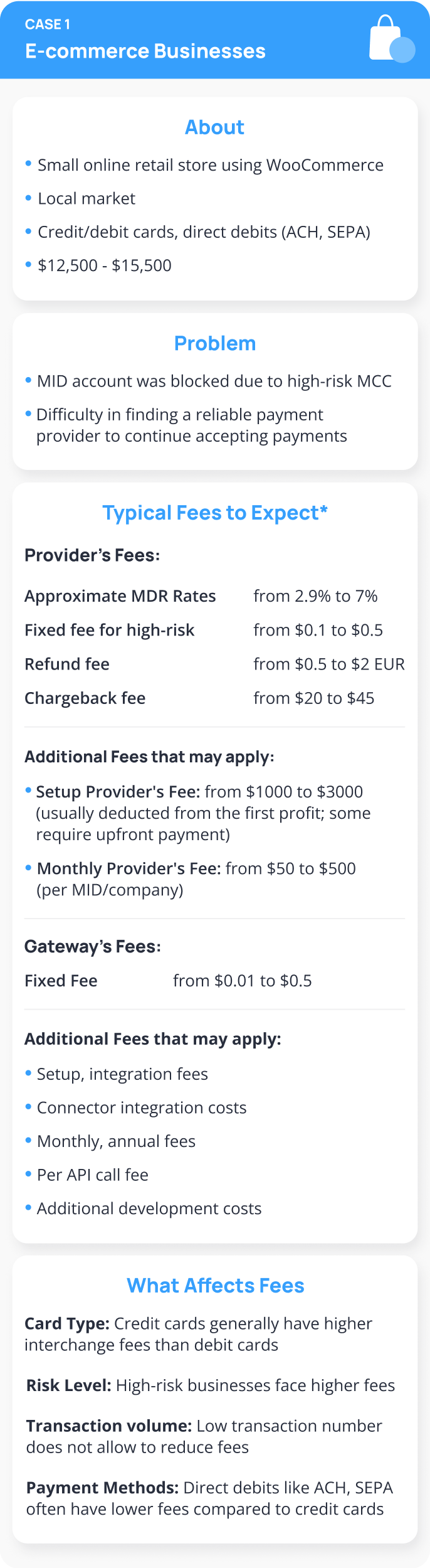

Small Online Retail Store

Business description

Small online store operating at WooCommerce platform. Business is focused on the local market retail. Among main payment methods are credit/debit cards and direct payments via ACH or SEPA. The average transaction volume per month is between $12,500 and $15,500 and the average purchase is from €50 to €100

Issue faced

The business owner tried to open a Merchant ID with one well-known payment provider, but the account was blocked because the business was recognised as high-risk. It caused the challenges for further operations. The owner had to look for another reliable provider agreeing to cooperate with his E-commerce business

Calculating Fees

Let’s take an example. Imagine, that the merchant profit for the previous month was $15,000 with 200 transactions proceeded. He had 8 refunds and 4 chargebacks. To calculate the approximate processing fees and the revenue gained we should take into account the lowest payment processing fees and the maximal prices

With minimal prices

- MDR – 2.9% from $15,000 = $435

- Fixed fee for high-risk: $0,1*200 trxs = $20

- Refund fee: from $0.5: 0.5*8 = $4

- Chargeback fee $20: 20*4 = $80

- PG fee if $0.01 per transaction: 200*0.01 = $2

The approximate processing fee will be $541 and the revenue will be $14459

With maximal prices

- MDR – 7% from $15,000 = $1050

- Fixed fee for high-risk: $0,5*200 trxs = $100

- Refund fee from $2: 2*8 = $16

- Chargeback fee $45: 45*4 = $180

- PG fee if $0.5 per transaction: 200*0.5 = $100

The approximate processing fee will be $1446 , and the revenue will be $13554

What Affected these Fees?

Card Type: Credit cards have higher fees than debit cards

Risk Level: Businesses considered as high-risk may have higher commissions

Transaction Volume: Low transaction number does not allow to reduce fees

Payment Methods: Direct payments have lower fees compared to credit cards

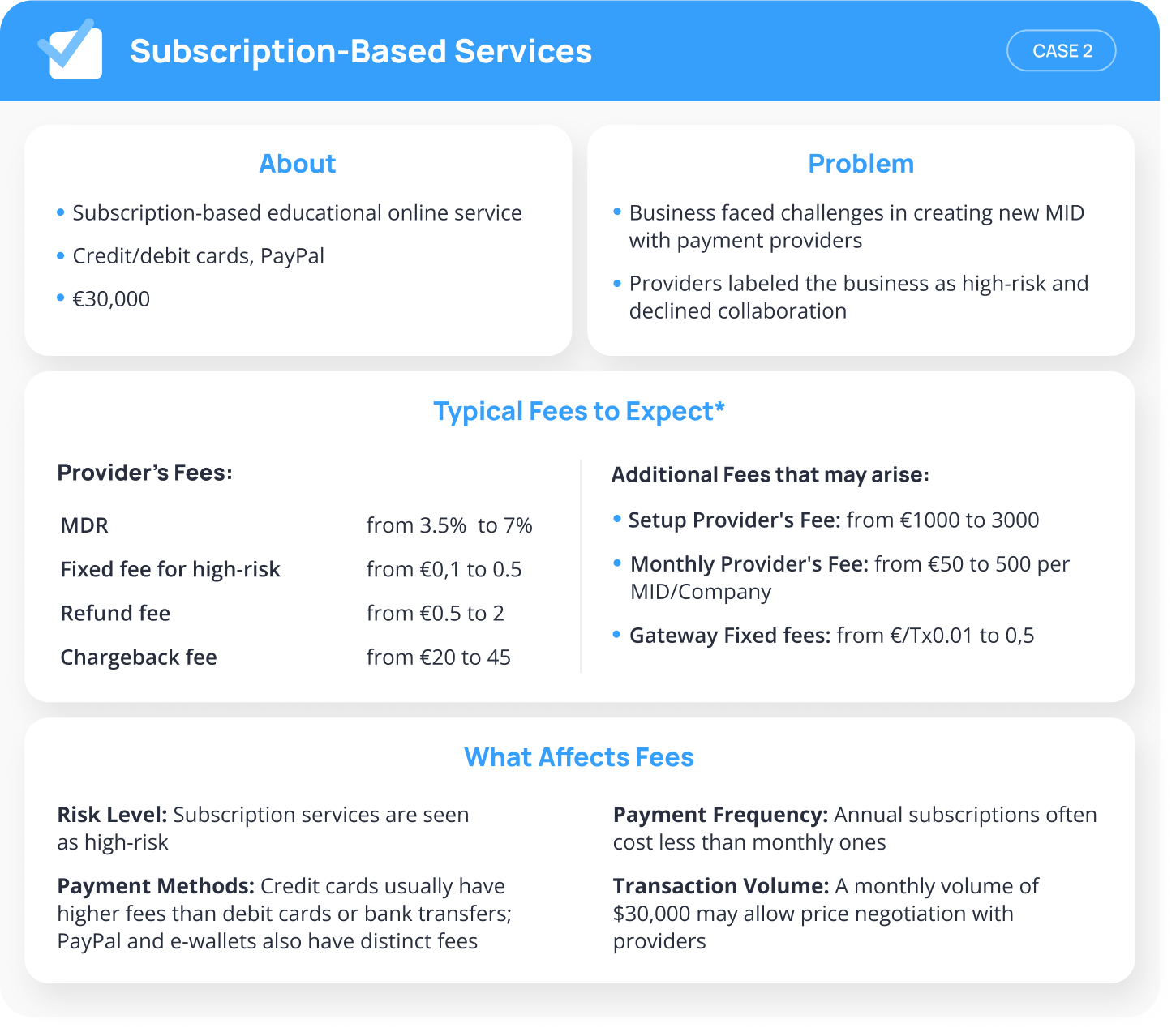

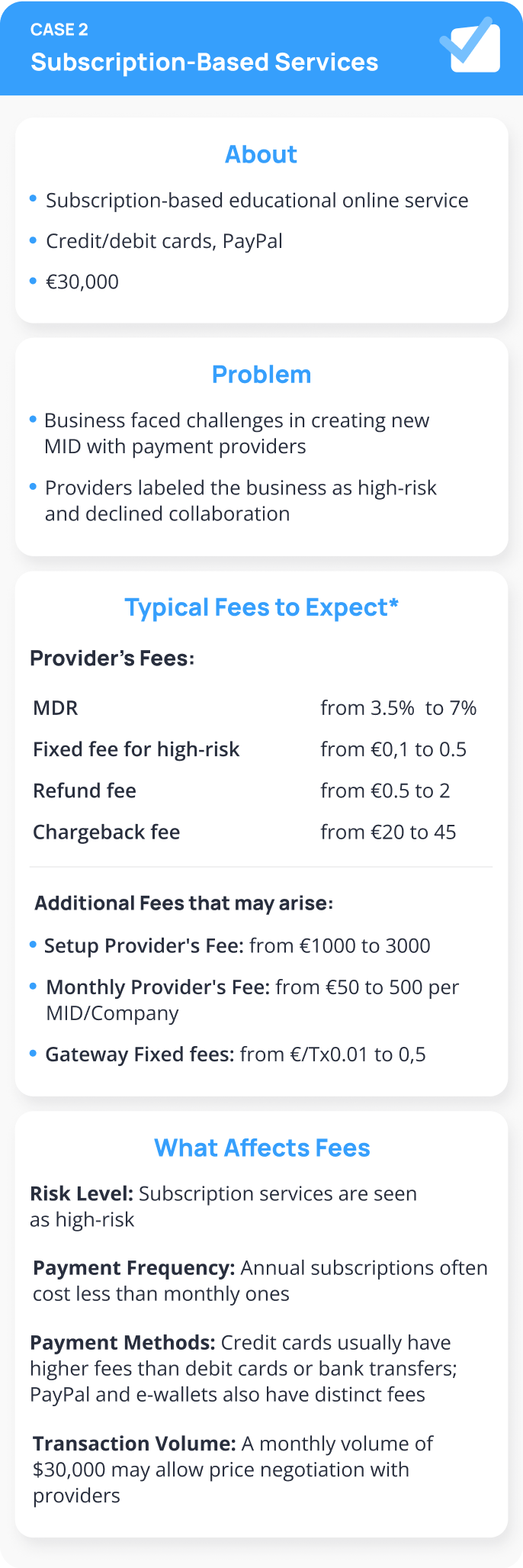

Educational Online Service

Business description

Subscription-based educational online service with monthly or annually charges. The main payment methods are credit/debit cards and via PayPal. The average transaction volume per month is €30,000

Issue faced

The business tried to integrate new payment methods and faced the issues with creating a new MID with several payment providers. Some providers have considered business high-risk and refused to cooperate

Calculating Fees

Let’s discover the typical commissions in this case. Imagine, that the profit for the previous month was €30,000 with 1450 transactions proceeded. Business had 40 refunds and 28 chargebacks. Calculating the fees with the minimal and the maximal prices

With minimal prices

- MDR – 3.5% from €30,000 = €1050

- Fixed fee for high-risk: €0,1 * 1450 trxs = €145

- Refund fee: from €0.5: 05*40 = €20

- Chargeback fee €20: 20*28 = €560

- PG fee: if €0.01 per transaction: 1450*0.01 = €145

The approximate processing fee will be €1920, and the revenue will be €28080

With maximal prices

- MDR – 7% from €30,000 = €2100

- Fixed fee for high-risk: €0,5 € * 1450 trxs = €725

- Refund fee from €2: 2*40 = €80

- Chargeback fee €45 EUR: 45*28 = €1260

- PG fee if 0.5 EUR per transaction – 1450*0.5 = €725

The approximate processing fee will be €4890, and the revenue will be €25110. If merchant additionally pays the monthly fee 500 EUR, then the revenue will be €24610

What Affected these Fees?

Level of Risk: Subscription services are generally considered as a high-risk

Payment Frequency: Annual subscriptions usually have lower fees than monthly ones due to fewer transactions

Payment Methods: Credit cards often incur higher fees compared to debit cards or direct bank transfers, while PayPal and e-wallets have unique fees that can impact overall costs

Transaction Volume: A monthly transaction volume of €30,000 allows some level of negotiation with providers

Large online traveling platform

Business description

Large online traveling platform, that offers booking services for flights, hotels, car rent and other. The company operates globally, supporting different payment methods, including credit/debit cards, e-wallets and cryptocurrencies. The average transaction volume per month is over $1,000,000

Issue faced

As the business operates globally, it faces several issues, like higher payment fees due to currency conversion, higher risk of fraud and additional operational expenditures. The main challenge is that the commissions vary, making it difficult to forecast and plan the potential expenditures

Calculating Fees

Imagine, that the profit for the previous month was €1,000,000 with 4200 transactions proceeded. 3500 transactions via credit/debit cards with € 803,300 revenue, 400 transactions via Apple Pay with €124,700 revenue, and 300 transactions via Google Pay with € 72,000 revenue. Business had 90 refunds and 69 chargebacks. Calculating the fees with the minimal and the maximal prices

With minimal prices

- MDR: 2.9% from €803,300 = €23,295.7

- Apple Pay: Visa/MC scheme fee (MDR) + 0.1% = 2.9%+0.1% = 3% from €124,700 = €3,741

- Google pay: Visa/MC scheme fee (MDR) + 0.1% = 2.9%+0.1% = 3% from €72,000 = €2,160

- Fixed fee for high-risk merchants: €0,1 * 3500 trxs (Only CC) = €350

- Refund fee from €0.5 EUR: 05*40 = €45

- Chargeback fee €20: 20*28 = €1380

- PG fee: If €0.01 EUR per transaction 4200*0.01 = €42

As a result, merchant will pay €31,013.7 of commissions, and his profit will be €968,986.3

With maximal prices

- MDR: 8% from €803,300 = €64,264

- Apple Pay: Visa/MC scheme fee (MDR) + 0.1% = 8+0.1 = 8.1% from €124,700 = €10,100.7

- Google pay: Visa/MC scheme fee (MDR) + 0.1% = 8+0.1 = 8.1% from €72,000 = €5,832

- Fixed fee for high-risk merchants: €0,5 * 3500 trxs (Only CC) = €1750

- Refund fee: from €2: 2*90 = €180

- Chargeback fee: €45: 45*69 = €3105

- PG fee: if €0.5 per transaction: 4200*0.5 = €2100

As a result, merchant will pay €87,331.7 of commissions, and his profit will be €912,668.3

What Affected these Fees?

Cross Border Transactions: Bookings made from abroad or in a currency other than the base currency may incur higher fees

Payment Types: Credit cards often have higher fees due to additional risks. E-wallets may have additional transaction and withdrawal fees

Transaction Volume: High transaction volume providing advantages in negotiations with payment processors, but international transactions can limit this flexibility

Product Type: Airline bookings may incur higher fees due to the risk of cancellation and the difficulty of refunds

What about timeframes?

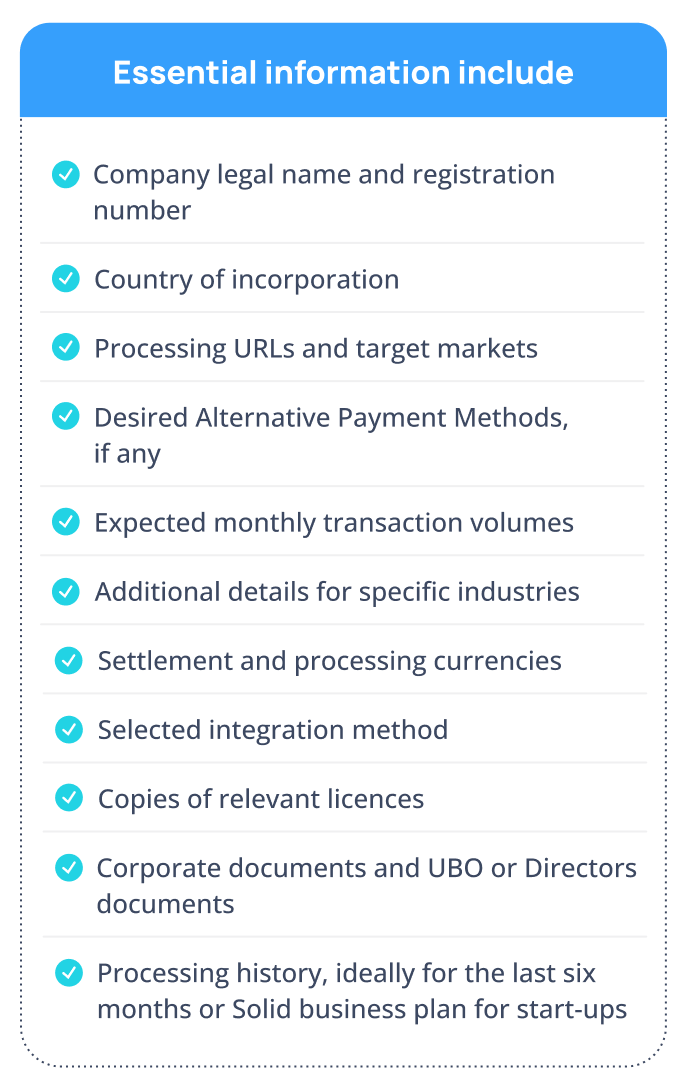

The technical integration with your website may take 3 to 5 days. However, the process of integration with payment providers can take much longer due to business verification and legal issues. Let’s take a look at how the process takes place on the example of Transferty

The first 3 steps can generally be completed within 2 days. You may contact us in any convenient way via the website. The information we request from you is required to negotiate provider prices

Step 4 is the most time-consuming. Verification by the provider could last from 3 weeks to 9 months. This check may include different criteria, it also depends on the specific provider and individual characteristics of your business. Here are some of the verification stages may appear

At the 5th step you are receiving the proposal from the payment provider. If everything is alright, the process of approval may take up to 2 days. If its conditions don’t fit your requirements, we will look for another provider for you. In that case the whole process is starting again, as each provider has to verify your business and provide their proposal

Signing legal documents at Step 6 usually happens quickly. However, for a large business, this process could last a little bit longer due to corporate bureaucracy

Step 7 is about technical integration. Usually website integration takes 3-5 days. All the additional integrations and features are taking more time and calculating individually

The last, 8th Step is onboarding. The speed of this stage is mostly depending on you. Our account manager will help you to tune and optimise our solution to address your requirements

Selecting a Payment Gateway

As every business has unique needs, the fees you’ll encounter can vary widely. Some payment gateways might add extra costs, such as monthly subscriptions, setup fees, or charges for connecting additional providers. If you are looking for an advanced features, like additional antifraud tools or integration with complex products, or need custom functionality, you might incur additional costs

Consider these factors while looking for a payment gateway:

Scalability: Your growth is depending on how the gateway is able to handle increased traffic and support new markets

Advanced Functionality: Large companies might require specific features like margin management or consolidated analytics. Make sure that a gateway supports these functionalities

Payment Provider: Consider if your Payment Service Provider has its own licensing and pricing, or a technical provider that collaborates with financial institutions. At Transferty, we are a technical provider connected with an extensive network of partners, enabling us to provide flexible pricing tailored to your business requirements

Customer Service: Should your payment service experience interruptions, waiting three days for support is not viable. It is essential to choose a provider known for outstanding customer service and prompt response times

Transferty's Approach

At Transferty, we aim to make payment processing straightforward. We don’t charge additional fees for yearly or monthly subscriptions, our fees are transaction-based. You pay only for tools you use, giving you the flexibility to focus on growing your business. The exact fees you face from other providers and card networks will depend on your specific business, your needs, and your growth plans

If you need more information or personalised advice, we’re here to help. Reach out to us for guidance on optimising your payment processing strategy