- Payment gateway

- Blog

- Payment Trends in 2025: Insights from Payment Experts

Payment Trends in 2025: Insights from Payment Experts

As we move closer to 2025, the payments industry is set for the changes, driven by technology, consumer expectations, and global economic trends. Payment gateway services, including solutions for e commerce payment gateways and international payment gateways, are evolving to meet these demands. Experts predict groundbreaking changes in how businesses and consumers interact with payments, from the rise of online payment gateway platforms to advancements in quantum-resistant cybersecurity. In this article we will take a comprehensive look at the top payment trends expected for 2025 and beyond. Transferty’s experts will provide the insights for companies aim to keep on track of the payment industry and keep their business competitive

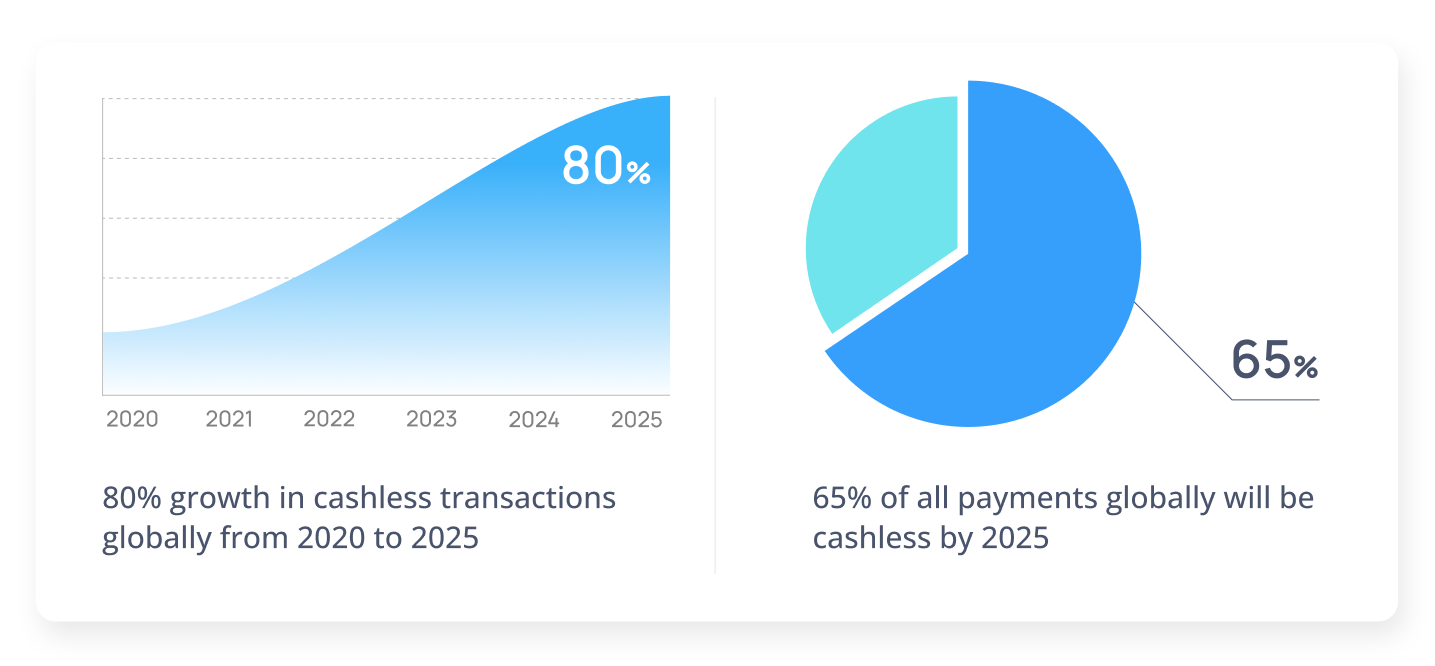

The Cashless Economy Expands

Cash is quickly becoming obsolete in many regions, with cashless transactions projected to grow over 80% between 2020 and 2025. By 2025, it’s expected that cashless transactions will account for over 65% of all payments globally, with digital payment volumes in Asia-Pacific projected to grow by 109% and Europe by 64% from 2020 levels. By 2030, transaction volumes in cashless payments are expected to triple. In regions like Asia-Pacific and Europe, digital transactions are becoming the standard, making it crucial for businesses to provide accessible gateway payment services. Businesses are increasingly looking into gateway for online payment to facilitate these cashless options, making cashless payments easy and convenient for consumers

Real-Time Payments Take Over B2B Transactions

Real-time payments, already popular in the consumer sector, are poised to transform B2B transactions in 2025. Studies indicate that 96% of manufacturers are moving from traditional checks to real-time payments. The shift is expected to reduce payment delays by up to 75%, enhancing cash flow and strengthening supplier relationships. For businesses aiming to adopt B2B gateway payment processing, real-time solutions are becoming a priority. Many companies now evaluate payment gateway comparisons to select providers that can offer immediate settlements and seamless transactions

Embedded Payments for Financial Inclusion

Embedded finance, integrating payment services directly within non-financial platforms, allows users to access transactions easily within their preferred applications. In 2025, embedded payments will expand to underserved markets, opening doors to financial inclusion through online payment gateway service providers. Embedded finance is anticipated to grow at a 40% CAGR, with 80% smartphone penetration globally expected by 2025. This trend could provide over 1 billion people in underserved regions access to basic financial services without needing traditional banking. It would be relevant for businesses using a web payment gateway solution that accommodates users without traditional banking services, promoting convenience for various demographics

Open Finance and Evolving Regulations

Open finance is progressing, especially in Europe with new PSD3 regulations, and in the U.S. with open banking initiatives. These policies support increased competition and innovation, benefiting companies that integrate payment gateway providers into their financial ecosystems. Open finance regulations will allow businesses to partner with online payment gateway providers seamlessly, improving transaction flexibility and compliance

CBDCs on the Horizon

Central Bank Digital Currencies are gaining traction globally as governments develop digital alternatives to traditional currency. CBDCs are being piloted in over 80 countries as of 2024. The global CBDC market could represent $2 trillion in transaction volume by 2030, particularly benefiting cross-border transactions in emerging economies. As businesses prepare to handle CBDC transactions, partnering with a gateway payment provider service that supports digital currency payments will be essential. These digital gateway for payment solutions help streamline cross-border transactions and adapt to the demands of a globalised economy, ensuring secure and regulated digital payment processes

Quantum-Resistant Cybersecurity

The payments industry faces a new wave of cybersecurity challenges with the advancement of quantum computing. Quantum-resistant encryption is expected to protect sensitive payment gateway websites from potential threats posed by supercomputing capabilities. For businesses using payment gateway systems, it is critical to explore advanced encryption standards to secure sensitive data and maintain customer trust in digital payment transactions

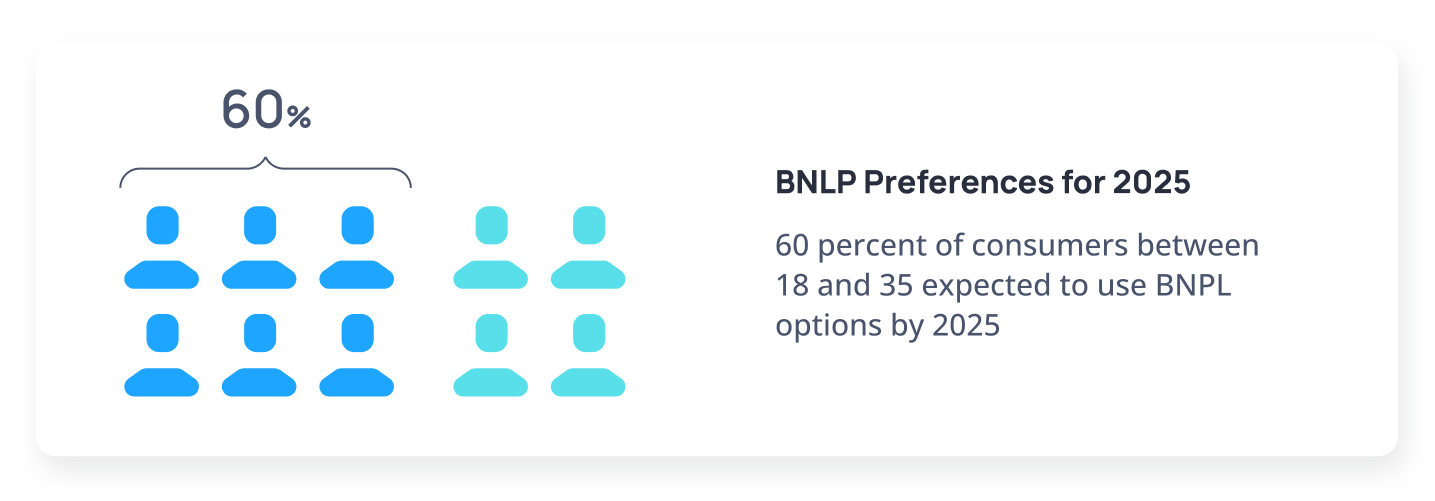

The Expansion of Buy Now, Pay Later

BNPL solutions allow consumers to defer or split payments, a feature that’s growing more prevalent across e-commerce platforms. BNPL market is set to expand at a rate of 28% annually, with 60% of consumers aged 18-35 expected to use BNPL options by 2025. This trend is forecasted to drive an additional $500 billion in retail sales globally. By offering BNPL through an all-in-one payment gateway, businesses meet consumer demand for flexible payment options, especially among younger audiences. Companies using website payment gateway for ecommerce can expand their customer base by accommodating BNPL at checkout, though they must remain compliant with regulatory guidelines on fair lending

Features for Fraud Prevention

As digital payments grow, so does the risk of fraud. Payment processing gateway providers are increasingly adopting features for fraud detection. With these technologies, a payment gateway service provider can offer real-time transaction monitoring, protecting customer data and minimising potential losses. For businesses relying on payment gateway solutions, integrating fraud prevention features is essential for safeguarding both brand reputation and consumer trust

Super-Apps and Unified QR Codes for Seamless Payments

Super-apps, which consolidate services onto a single platform, are transforming payment experiences, particularly in Asia. Super-apps are projected to reach 2.5 billion users by 2025, accounting for over 60% of all digital transactions in Southeast Asia. Integrating payment solutions within these apps increases customer retention by up to 25%. Unified QR codes and mobile integration allow businesses to partner with gateway payment solution providers and offer customers a simplified checkout experience across diverse services. By using a payment gateway platform that supports super-app functionality, businesses can improve the customer journey and gain deeper insights into consumer behaviour

Real-Time Cross-Border Payments

Cross-border transactions are rapidly evolving to support real-time capabilities, especially in emerging markets. Various initiatives enable seamless cross-border payments between countries. The global real-time cross-border payment market is expected to grow to $55 billion by 2025, with Asia leading the charge. The average cross-border transaction time has already reduced by 60%, and further advancements are expected as new rails link countries. For companies engaged in global trade, using an international payment gateway provider that supports cross-border transactions can help meet consumer demand for immediate transactions and reduce currency exchange delays

B2B Payments Evolution and Virtual Cards

Virtual cards are becoming a preferred choice in B2B transactions, offering secure, flexible payments with fraud prevention features. The use of virtual cards is expected to save companies up to $1 billion in fraud-related losses by 2025. The virtual card market is growing at a 20.9% CAGR, driven by increased adoption in the B2B sector for secure, trackable transactions. Payment gateway companies increasingly offer virtual card services, supporting single-use transactions to help mitigate fraud and streamline expenses. The rise of virtual cards is a strong reason for businesses to partner with gateway payment service providers, as these cards help improve cash flow while minimising risk

Preparing for 2025: Key Considerations for Businesses

With these trends changing the global payments industry, businesses must prioritise several actions to stay competitive and secure in the coming years:

As cashless and instant payments become standard, using a reliable online payment gateway for websites is essential for businesses to meet consumer demands and improve efficiency

Various new laws require businesses to adapt quickly. Compliance is essential for maintaining continuous operations and sustaining consumer trust, especially for payment providers

Businesses should compare payment gateways to select the best for their needs, whether it’s a cheap payment gateway for startups or an all-in-one gateway platform for big companies

As quantum computing advances, it’s vital to adopt quantum-resistant encryption through a gateway payment provider to safeguard transactions for the next generation of digital commerce

Conclusion

The payments industry in 2025 is entering a new stage defined by technological innovation, growing consumer expectations, and global regulatory changes. For businesses, staying informed of these trends and investing in the right payment gateway processing solutions is essential for thriving in a highly digitised and interconnected payment industry. By embracing new technological features, and integrated online gateway payment services, businesses can meet consumer demands while securing their position in the industry. The upcoming 2025 offers a variety of opportunities, and those who adapt early with effective gateway payment services will lead the next wave of payments innovation

Sources:

- WEX INC.: “Real-time payments adoption in B2B transactions, virtual card trends in B2B payments”

- Finance Magnates: “Growth in embedded finance and financial inclusion trends through payment gateway solutions”

- Finextra Research: “Open finance developments and evolving regulations in Europe and the U.S.”

- Fintech Review: “The expansion and impact of Buy Now, Pay Later (BNPL) solutions on e-commerce”