- Payment gateway

- Blog

- Poland’s Digital Payment Landscape and the Role of Payment Gateway

Poland’s Digital Payment Landscape and the Role of Payment Gateway

Poland’s digital payment landscape is a rapidly developing market of online transactions, showcasing an impressive blend of innovation, technology, and consumer behaviour trends. With nearly 90% of the population now online and the e-commerce sector poised for significant growth. Understanding the dynamics of this market is crucial for businesses aiming to grow their revenue. Today we will discover the specificities of the Polish digital landscape and find out more on market of payment gateway in Poland

The Evolution of Digital Payments in Poland

As of the latest data, Poland’s e-commerce market is valued at US$36 billion, with projections indicating a rise to US$54 billion by 2027. Digital payment methods are overwhelmingly preferred, accounting for more than 80% of online transactions. The bank-transfer app BLIK, holding an almost 30% market share, stands out as a key player in this domain, exemplifying the market’s openness to innovative payment solutions

Technological Infrastructure and Consumer Adoption

The digital payment ecosystem in Poland is underpinned by robust technological infrastructure, with a significant portion of the population using online banking (68%) and mobile applications (more than 19.3 million users). This widespread adoption of digital banking tools has facilitated a seamless transition towards cashless transactions, further accelerated by the COVID-19 pandemic

Preferred Payment Methods

In Poland, the preference for bank transfers in e-commerce transactions stands out, with a staggering 67% of all online transactions conducted via this method. This is closely followed by the growing popularity of card payments, which are expected to capture nearly 15% of the market. The rapid ascent of card usage, with Visa and Mastercard leading the charge, reflects a significant shift in consumer behaviour, moving away from cash and towards more digital forms of payment

Technological Infrastructure

Key to Poland’s success in digital payment adoption is its robust technological infrastructure, characterised by widespread internet connectivity and a significant penetration of mobile devices. With over 22 million Poles engaging in online banking and 19.3 million utilising mobile banking apps as of 2022, the country boasts a solid foundation for the seamless integration of digital payment systems

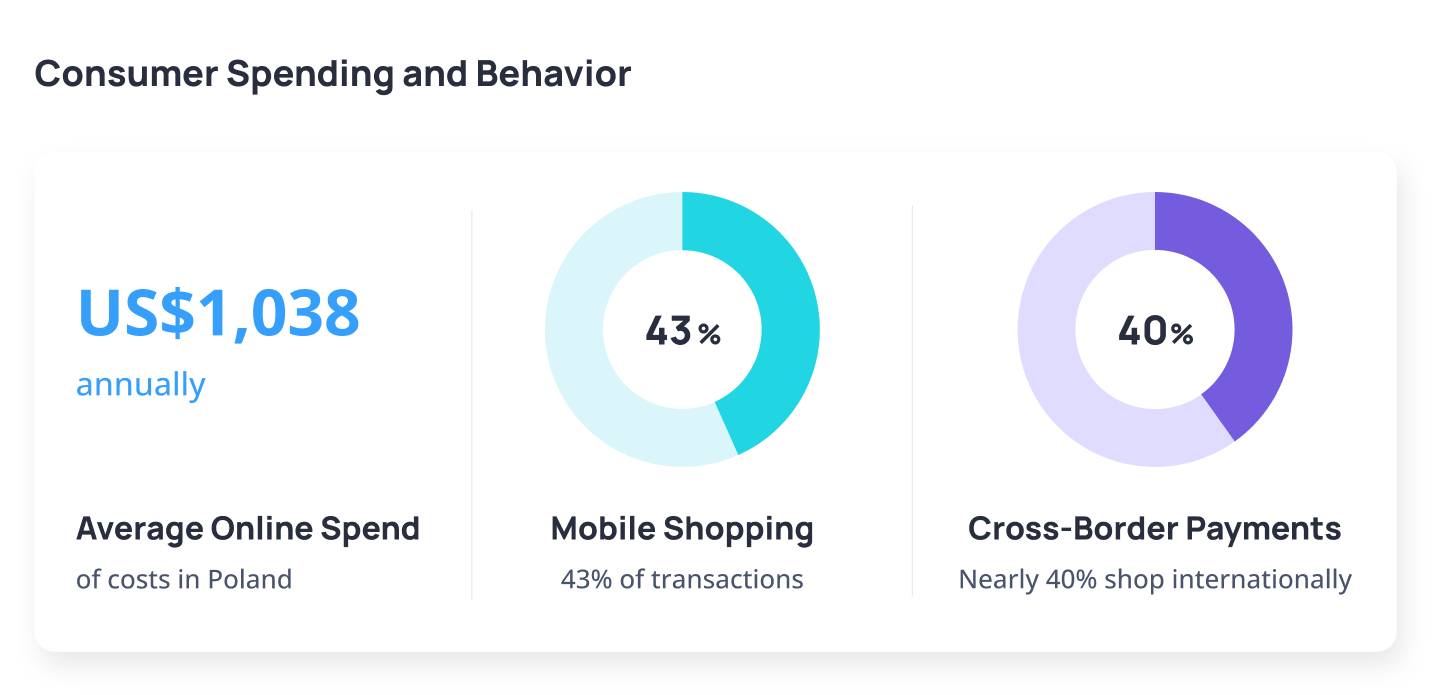

Consumer Preferences

The Polish consumer exhibits a strong inclination towards digital payments, with a notable preference for mobile commerce. The average Polish shopper not only prefers online transactions but is also increasingly making purchases through mobile devices. Despite this, there remains a cautious approach to social media advertisements, highlighting the importance of building consumer trust in digital platforms. With Polish online shoppers spending an average of US$1,038 annually and making 43% of their purchases via mobile devices, optimising digital payments is essential. Additionally, the significant volume of cross-border shopping, valued at almost US$2 billion in 2022, underscores the importance of integrating versatile payment options to accommodate both local and international consumers

E-Commerce Growth

Polish e-commerce sector, projected to reach US$54 billion by 2027, underscores the critical role of digital payments in facilitating online commerce. Bank transfers and mobile payments, particularly through platforms like BLIK, dominate the online transaction space, signifying the consumers’ preference for these methods

Navigating Cross-Border E-Commerce

The inclination towards shopping from international e-commerce sites presents both opportunities and challenges. Ensuring compatibility with popular local payment methods can serve as a competitive advantage for foreign businesses entering the Polish market. Payment gateways play a crucial role in facilitating this integration, enabling merchants to expand their reach and tap into Poland’s growing e-commerce sector

The Role of Payment Gateway Poland in Business Growth

In this landscape, payment gateways emerge as pivotal enablers of digital transaction success. These platforms, which facilitate secure and efficient online transactions, are instrumental in covering the gap between consumers’ payment preferences and merchants’ need for reliable transaction processing. Partnering with a reliable payment gateway in Poland can significantly boost a business’s growth, offering benefits such as:

- Enhanced Security

Payment gateway Poland implements robust security measures to protect against fraud, building consumer trust

- Improved Conversion Rates

By offering preferred payment methods, such as BLIK, Przelewy24, and card payments, businesses can cater to consumer preferences, reducing cart abandonment

- Streamlined Transactions

Efficient processing of payments, including bank transfers which account for 67% of e-commerce transactions, ensures a smooth checkout experience for customers

- Access to Analytics and Insights

Payment gateway in Poland provides valuable data that can help businesses understand purchasing behaviours and tailor their strategies accordingly

Conclusion

Poland’s digital payment industry, characterised by a high preference for electronic transactions and a thriving e-commerce market, offers fertile ground for businesses looking to capitalise on digital commerce. The strategic partnership with reliable payment gateways, aligned with consumer payment preferences, can significantly enhance business growth, customer satisfaction, and market penetration. As Poland continues to lead the way in digital payment adoption, the opportunities for innovative and forward-thinking businesses are boundless

Sources

- Statista: Digital payments in Poland – statistics & facts

- Statista: Preferred digital payment methods in Poland 2020-2023

- Statista: Use of digitally enabled payment services by end consumers in Poland 2022

- Statista: Number of non-cash transactions in Poland 2017-2023