- Payment gateway

- Blog

- Starting an ISO/MSP: Challenges and Opportunities

Starting an ISO/MSP: Challenges and Opportunities

As the payment industry continues to evolve and expand, many businesses are exploring the benefits of becoming an ISO (Independent Sales Organization) or MSP (Member Service Provider). These companies play a critical role in the payment ecosystem, acting as legal intermediaries between acquiring banks or payment service providers and merchants and facilitating the launch of ISO card processing, as well as accepting payments from customers

However, starting an ISO/MSP can be challenging, and businesses need to be aware of the potential issues they may face in this competitive market. According to a report by McKinsey, the global payment industry is expected to grow by 6% annually and reach a value of $3.3 trillion by 2023. With the right strategies and investments, businesses can tap into this growth and establish themselves as leaders in the payment industry

Today, we will discuss the key challenges ISO/MSP may face before launching and the solutions that may help them eliminate such issues

Understanding the Regulatory Landscape

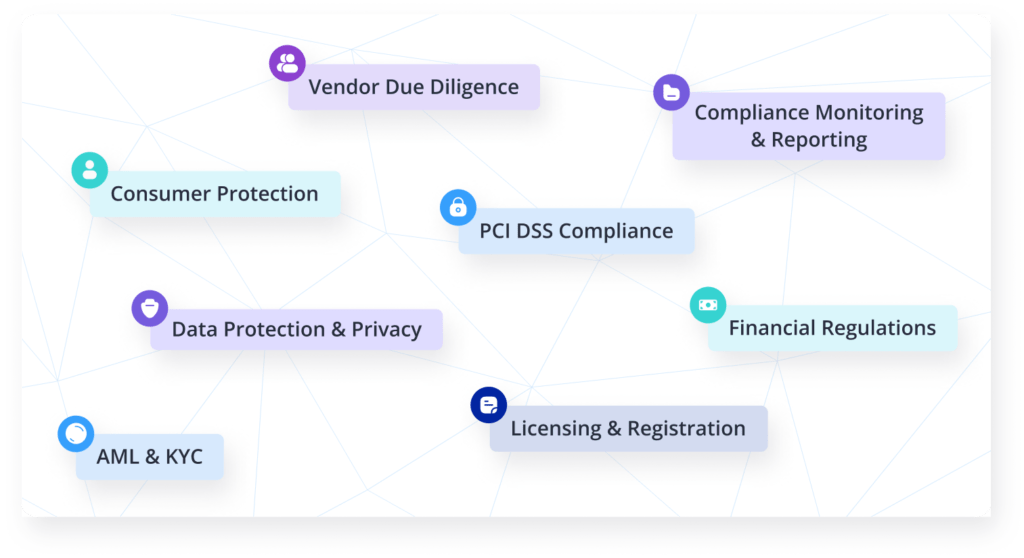

One of the key challenges for businesses looking to start an ISO/MSP is understanding the regulatory landscape. The payment industry is highly regulated, with a complex web of laws that can vary from state to state and country to country. Failure to comply with these regulations can result in fines, legal action, and damage to a company’s reputation. For example, to become ISO/MSP and handle payment processing duties, businesses have to cooperate with credit card associations such as Visa or Mastercard. It takes at least 6 months and significant resources to prepare all legal documents for examination

- Conduct thorough research on the regulatory requirements in the target markets and consult with legal and compliance experts to ensure compliance with all applicable regulations

- Stay informed and adapt to changes in industry regulations and standards to ensure compliance and avoid penalties. Regularly review and update business practices to align with the latest rules and requirements

- If you want to process the payments, find a reliable technical solution, which meets the industry and PCI DSS security standards to make the regulatory process more efficient

Such a white-label solution will not only save you funds and time for the certification process, but also will ensure that your payment gateway will comply with the following security standard changes. In this situation, cooperation with white-label partners is a benefit, as all technical issues are resolved on their side

Effective revenue gaining

As the main revenue source for ISO/MSP is mediation, it may be challenging to develop channels for additional income generation. It leads to issues with growing your business and improving the business processes by raising additional funds

In the payment processing industry, merchants typically prefer customized pricing packages that meet their unique business needs. Consider offering tiered pricing plans that align with the volume and value of transactions

Partnering with other businesses can be a powerful way to expand your customer base and drive revenue. Consider partnering with value-added resellers and independent software vendors that offer complementary services

Providing exceptional customer support is essential to building strong relationships with merchants and driving revenue. Consider offering multiple channels of communication, and personalized service to ensure a positive experience for merchants

Implementing a referral program can be an effective strategy to enhance revenue generation for ISO/MSPs. A referral program encourages existing merchants or partners to refer new customers to your business in exchange for incentives or rewards

Reliable technical solutions, such as a White-label payment gateway, allow ISO/MSP to gain additional revenue from payment processing. Having a tailored payment gateway solution, you can set your commission for transactions, as a result, develop an effective channel to gain additional revenue and grow your business

Attracting and Retaining Customers

Attracting and retaining customers is another key challenge for businesses starting an ISO/MSP. In a crowded and competitive market, businesses must differentiate themselves from their competitors and offer compelling value propositions to attract and retain customers. According to a report by Statista, the global e-commerce market is expected to reach $6.4 trillion by 2024, up from $3.5 trillion in 2019

- Focus on providing excellent customer service, to attract and retain customers, offering competitive pricing and value-added services, and leveraging marketing and branding strategies to build awareness and reputation

- Conduct market research and tailor your solutions to meet the specific needs of your target customers. By understanding the market deeply, you can differentiate your offerings, attract more customers, and gain a competitive edge

- Partner with a reliable technology provider to enhance the value proposition of your business. A dependable technical partner can help you provide better solutions, improve customer satisfaction, and stand out from your competitors

White-label solutions propose a variety of customization tools, as well as the ability to develop specific features to make your business exclusive. It ensures tailoring your payment gateway according to your audience preferences and gaining more customers without the time and cost-consuming procedures

Investing in Technology and Infrastructure

Investing in technology and infrastructure is also crucial for businesses starting an ISO/MSP. The payment industry is constantly evolving, and businesses need to stay up-to-date with the latest technologies and tools to remain competitive

To stay competitive in a rapidly evolving payments landscape. New payment technologies, such as contactless payments, mobile wallets, and digital currencies, are becoming increasingly popular, and ISO/MSP that can offer these payment options can differentiate themselves from competitors

ISO/MSP must take steps to protect their merchants and customers. Investing in robust security measures, such as encryption, tokenization, and multifactor authentication, can help prevent data breaches and fraud

It can help ISO/MSP streamline operations and gain insights into customer behaviour. For example, analytics tools can help ISOs identify trends in transaction data and make data-driven decisions about pricing and marketing

Fostering innovation through collaboration can greatly benefit ISO/MSPs in their technology and infrastructure investments. Properly pick a reliable and innovative technical partner, as collaboration with industry drivers can lead to new features and accelerate your growth

Even if you will develop your own payment solution, it is still vital to hire high-quality experts to upgrade your product according to the fast-changing industry and security requirements, as well as customize your payment gateway according to your needs. Such processes can be long-term and expensive

Another option is a ready-made white-label solution, that can be tailored for your needs. It is comfortable because the experienced developers of White-label products can not only cover the requirements you have, but also help you to improve your payment processes and fit the specific needs of the markets you work with. As a result, your ISO/MSP will be more competitive and attractive to the customers, leading to revenue growth. In such cases, you have to focus only on the business processes, the team of White-label developers will handle all the technical issues and upgrades

Conclusion

Starting an ISO/MSP can be a challenging but rewarding venture for businesses in the payment industry. By understanding the regulatory landscape, effective revenue gaining, attracting and retaining customers, and investing in technology and infrastructure, businesses can overcome the challenges they may face and position themselves for success in this dynamic and rapidly evolving market