- Payment gateway

- Blog

- Starting PSPs: Growth Strategy Tips for Early-Stage Business

Starting PSPs: Growth Strategy Tips for Early-Stage Business

Launching a Payment Service Provider is a complex activity requiring a solid strategy to ensure business success in the payment industry. The proliferation of payment solutions and the dominance of established players make it essential for new PSPs to adopt a strategic approach to gain market traction. In this article we will highlight the key strategies for early-stage PSPs and explore how partnering with a third-party technical solution could become a competitive advantage, ensuring rapid growth

Exploring the Market

A common pitfall for new PSPs is the assumption that success in the payments industry is simply a matter of replicating what established companies do. However, without thorough market research and validation, this approach can lead to failure. Instead, new PSPs should identify underserved markets or niches that established players overlook. For instance, while the e-commerce sector is booming, much of this growth comes from small merchants who often rely on well-known platforms. Finding a niche within this space, such as focusing on specific industries or regions, can provide a competitive edge. Identifying specific industries and regions allows PSPs to tailor their services to the unique needs of these markets

Proper Business Model

The business model a PSP adopts will depend on the size and type of merchants it targets:

- Small to Medium Size Merchants: Typically require simpler solutions and lower fees

- Large to Enterprise Merchants: Demand more robust solutions with higher fees but larger transaction volumes

Understanding the revenue potential from different merchant sizes helps in selecting a sustainable business model. For example, micro and small merchants might generate lower revenues per transaction but can offer higher overall volumes if aggregated

Obtaining Licences for Specific Regions

Obtaining the necessary licences to operate in specific regions is crucial for PSPs aiming to expand their market presence. Each region has its own regulatory requirements, and compliance is mandatory to legally process payments. Here are few steps making this process more effective:

- Understanding Local Regulations: Research and understand the specific financial regulations, licensing requirements, and compliance obligations in your target regions. This may include anti-money laundering (AML) regulations, payment services directives, and data protection laws

- Engaging Legal Expertise: Working with legal experts who specialise in financial services to navigate the complexities of obtaining the necessary licences. This ensures that all legal requirements are met and reduces the risk of non-compliance

- Building Relationships with Regulators: Establishing strong relationships with regional regulatory bodies can facilitate the licensing process and ensure smoother operations. Proactive communication with regulators can also help address any compliance issues before they become problematic

By securing the appropriate licences, PSPs can operate confidently within their target regions, ensuring legal compliance and building trust with both merchants and consumers. This not only mitigates risks but also opens up opportunities to expand into new markets, further enhancing market traction

Focus Solutions and Payment Methods

Once a PSP has identified its target industries and regions, it must decide on the solutions it will offer. Common solutions include:

- E-Commerce: Online payment gateways for merchants

- Point of Sale (POS): Systems for in-store transactions

- Pay By Link: Payment links for easy transactions

Selecting the right payment methods is also crucial for meeting the needs of the target market. Options include:

- Cards: Credit and debit card processing

- Digital Wallets: Integration with platforms like Apple Pay and Google Wallet

- Buy Now Pay Later (BNPL): Offering deferred payment options

- Alternative Payment Methods: Open banking, direct transfers, etc

Technology: Buy, Rent, or Build?

Selecting the right technology approach is a crucial decision for any new PSP, as it directly impacts the company’s agility, scalability, and overall operational efficiency. The three primary options are buying, renting, or building technology. Each has its own unique advantages and challenges. Below, we explore these options in detail

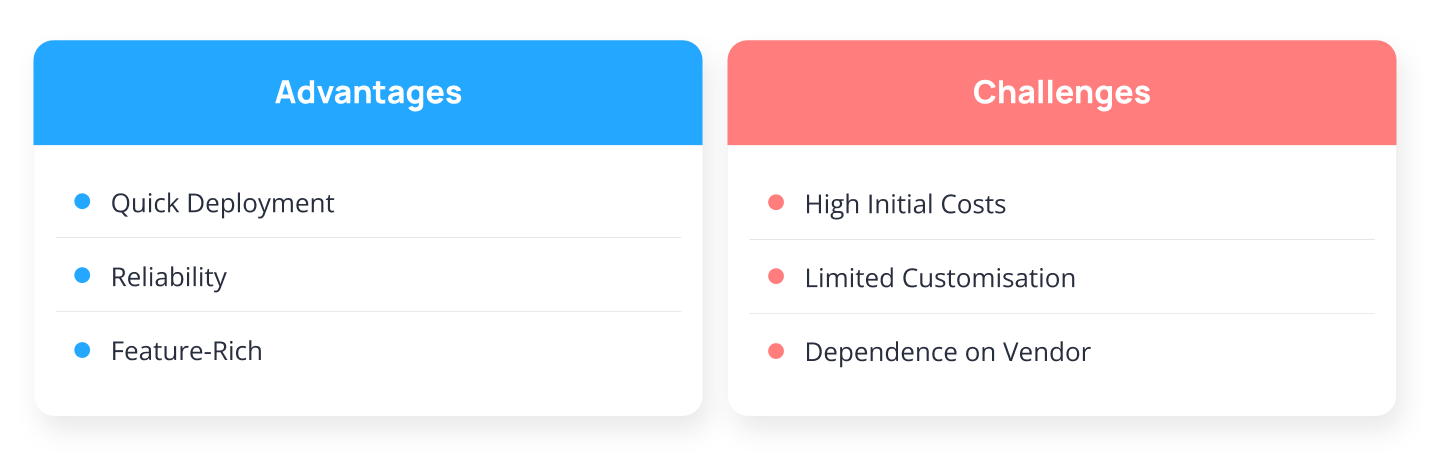

Buy: Purchasing Gateway Technologies

Advantages:

- Quick Deployment: Purchasing gateway technologies can significantly reduce the time to market. Established technologies come with pre-built integrations, compliance certifications, and tested reliability, allowing PSPs to start processing payments almost immediately

- Reliability: These solutions are typically robust and reliable, having been tested and refined through real-world usage. This reduces the risk of technical failures and ensures a smoother operation

- Feature-Rich: Bought technologies often come with a suite of features such as fraud detection, analytics, reporting tools, and multiple payment method integrations, providing a comprehensive solution out of the box

Challenges:

- High Initial Costs: Licensing fees for high-quality gateway technologies can be substantial. This requires significant upfront capital, which might be a barrier for early-stage PSPs with limited budgets.

- Limited Customisation: While these solutions are feature-rich, they may not perfectly align with a PSP’s unique needs. Customising them can be challenging and expensive, potentially limiting differentiation in the market

- Dependence on Vendor: PSPs may become dependent on the technology provider for updates, maintenance, and support

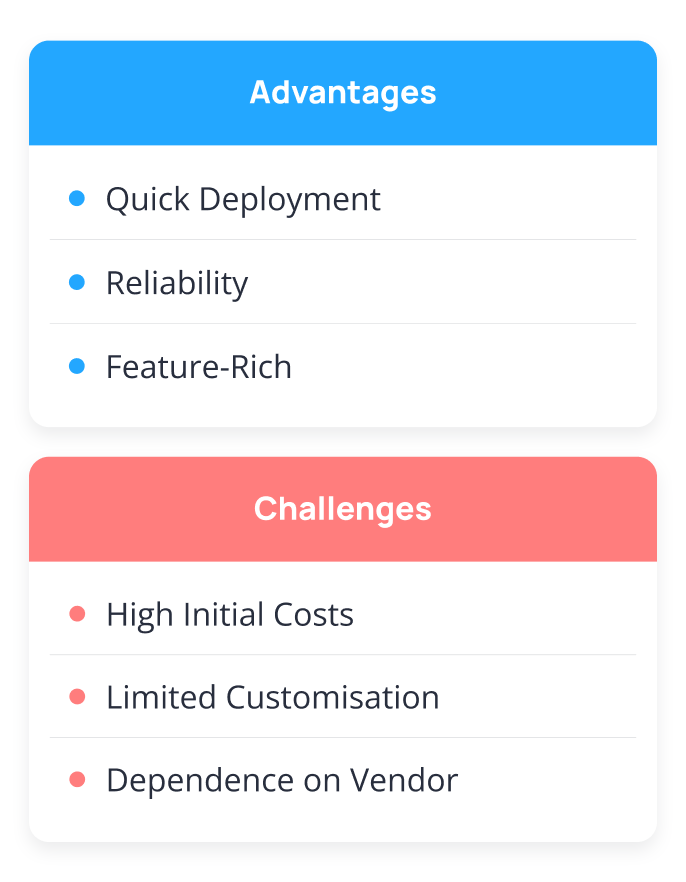

Rent: Leasing Technology Platforms

Advantages:

- Cost-Effective: Renting technology platforms can be more affordable initially, as it typically involves lower upfront costs compared to purchasing

- Focus on Core Business: By renting, PSPs can focus more on their core competencies, such as customer acquisition, marketing, and service delivery, while leaving the technical aspects to the technology provider

- Scalability: Leased platforms often offer scalable solutions that can grow with the business. This flexibility allows PSPs to adjust their capacity and services based on demand without significant additional investment

Challenges:

- Ongoing Costs: While renting reduces initial costs, it involves ongoing monthly or annual fees. This needs to be carefully managed to ensure it remains cost-effective

- Limited Control: PSPs may have limited control over the platform’s features and updates. Customizations might be restricted, and any changes or enhancements typically depend on the provider’s roadmap and priorities

- Vendor Reliability: The success of a PSP relying on rented technology is closely tied to the reliability and support of the technology provider. Any issues on the provider’s end can directly impact the PSP’s operations

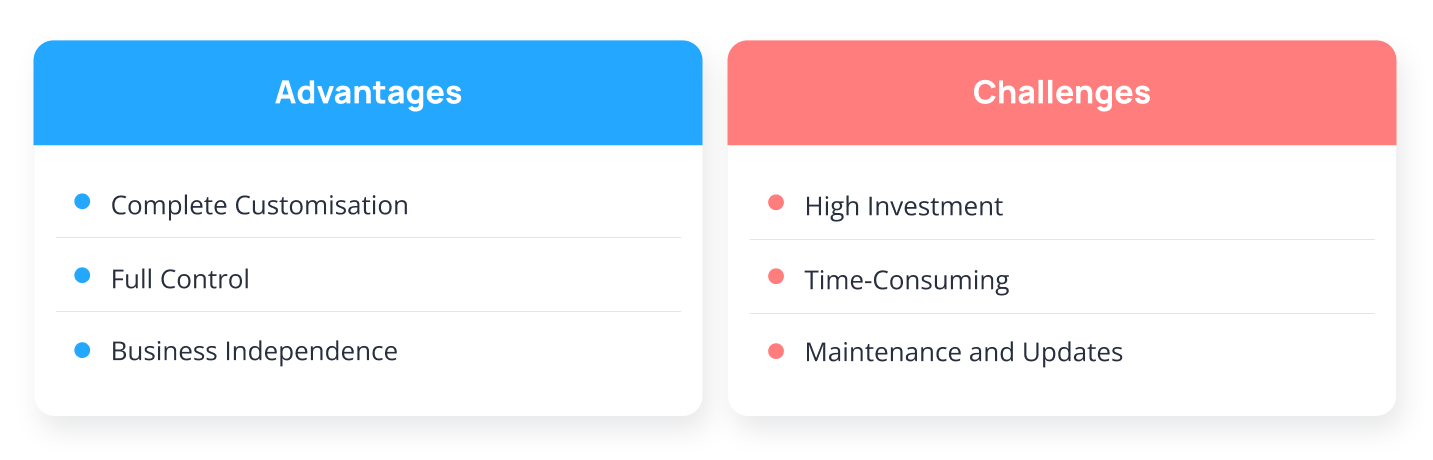

Build: Developing a Platform

Advantages:

- Complete Customisation: Building a proprietary platform allows PSPs to create a solution tailored precisely to their business needs and the needs of their target market

- Full Control: Owning the technology means complete control over its development, features, and updates. This autonomy allows PSPs to innovate and respond quickly to market changes or customer feedback

- Business Independence: Only you are responsible for your technical solution, no negotiations with third-party partners which allow to ease the decision-making process

Challenges:

- High Investment: Developing a proprietary platform requires substantial capital and resources, including hiring skilled developers, ensuring compliance, and building infrastructure. This can be a considerable barrier for new PSPs

- Time-Consuming: Building a platform from scratch is time-intensive. It can take months or even years to develop, test, and launch a fully functional payment gateway, delaying time to market

- Maintenance and Updates: Post-launch, the platform requires ongoing maintenance, updates, and security measures to stay competitive and compliant with industry standards. This demands continuous investment in technical expertise and resources

When deciding whether to buy, rent, or build technology, early-stage PSPs should consider the following factors:

- Budget: Evaluate the financial resources available and weigh the initial costs versus long-term expenses

- Time to Market: Consider how quickly the PSP needs to launch. Renting or buying can offer faster deployment compared to building a proprietary platform

- Customisation Needs: Assess the level of customisation required to meet the unique needs of the target market and how each option addresses these needs

- Long-Term Vision: Align the technology choice with the company’s long-term strategy

- Vendor Reliability: For those considering buying or renting, carefully evaluate the reliability, reputation, and support services of potential technology providers

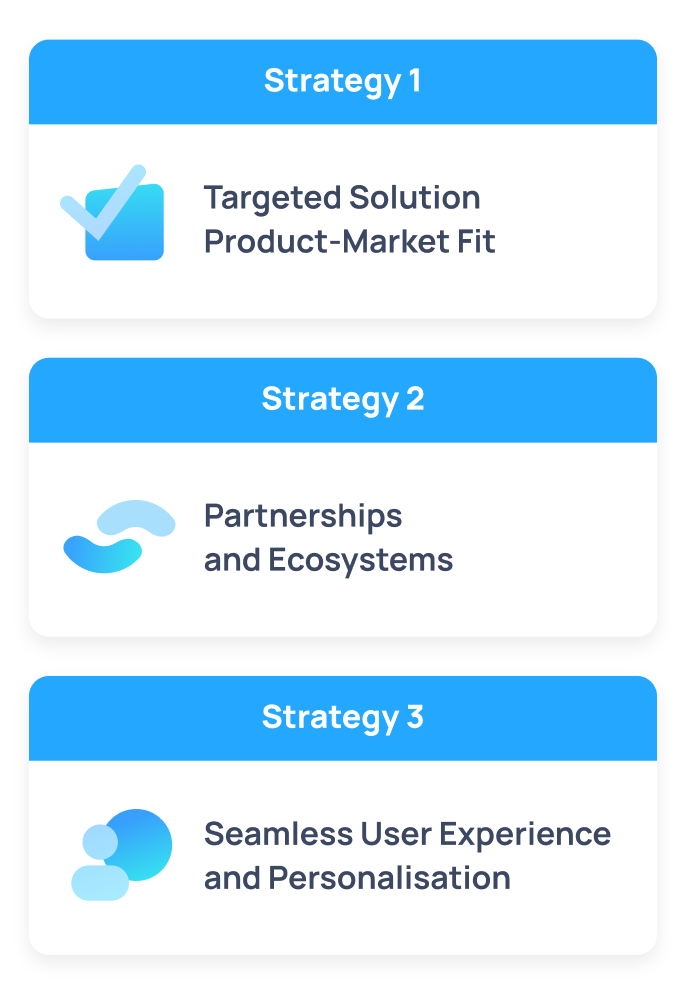

Strategies for Market Traction

Achieving market traction requires more than just having the right technology and business model. PSPs must implement effective strategies to capture and retain market share. Here are three key strategies for early-stage PSPs:

Strategy 1: Targeted Solution Product-Market Fit

Identify and Solve Specific Pain Points

PSPs that succeed in gaining market traction often do so by addressing specific pain points in their target market. This strategy involves a deep understanding of the target audience’s needs and tailoring solutions to meet those needs. For example:

- E-commerce Solutions: Developing a comprehensive platform designed for direct-to-consumer brands, solving their needs for a seamless online selling experience

- Restaurant Management: Providing a robust management and POS system that improves operational efficiency and enhances customer experience for restaurants

- Service Industry Platforms: Delivering an all-in-one solution tailored to specific service industries, streamlining their operations and enhancing customer management

By clearly defining and communicating the value proposition, PSPs can attract merchants who see their solutions as directly relevant and beneficial to their specific challenges

Strategy 2: Partnerships and Ecosystems

Leverage Strategic Partnerships

Forming partnerships within the payments ecosystem can significantly boost a PSP’s market traction. This strategy involves collaborating with other companies that offer complimentary services or solutions, such as:

- Tokenisation Platforms: Enhancing security and compliance

- Fraud Engines: Providing robust fraud detection and prevention

- Analytics Providers: Offering data insights to merchants

- KYC/KYB Tools: Simplifying compliance with identity verification requirements

By integrating with these partners, PSPs can offer a more comprehensive and attractive solution to merchants. Additionally, participating in industry ecosystems allows PSPs to tap into established networks, gaining credibility and expanding their reach

Strategy 3: Seamless User Experience and Personalisation

Prioritise User Experience

A seamless and personalised user experience can be a significant differentiator for PSPs. This strategy involves simplifying the onboarding, implementation, and usage of the payment solution, making it easy and intuitive for merchants to adopt and use. Key elements include:

- Intuitive Interfaces: User-friendly interfaces that reduce the learning curve for new users

- Personalised Onboarding: Tailored onboarding processes that address the specific needs of different types of merchants

- Responsive Support: Providing exceptional customer support to address issues quickly and efficiently

Focusing on user experience can result in strong word-of-mouth referrals and high customer retention rates, as merchants appreciate the ease of use and the level of support they receive

Benefits of White-Label Payment Gateways

To ensure that each of these strategies could be implemented, effective cooperation with technical solutions is vital. Partnering with a white-label payment gateway can provide several advantages:

Cost-Efficiency: White-label solutions provide a cost-effective way for PSPs to enter the market without incurring the high costs associated with building or purchasing proprietary technology. The upfront investment is significantly lower, and ongoing costs are predictable, allowing for better financial planning

Speed to Market: White-label payment gateways come pre-configured with essential features and integrations, enabling PSPs to launch their services quickly. This rapid deployment can be crucial in capturing market opportunities and gaining a competitive edge

Scalability: These solutions are designed to scale with the PSP’s growth. Whether expanding into new regions or adding more merchants, white-label platforms can easily accommodate increased transaction volumes and additional services without major overhauls

Focus on Core Competencies: By leveraging a white-label gateway, PSPs can concentrate on their core business activities, such as customer acquisition, marketing, and service differentiation. The technology provider handles the technical complexities, maintenance, and updates

Brand Customisation: White-label gateways can be branded with the PSP’s identity, ensuring a seamless customer experience. This branding flexibility helps PSPs build a strong market presence and brand recognition without developing the technology from scratch

Access to Advanced Features: White-label solutions often come with advanced features such as fraud detection, analytics, multi-currency support, and various payment methods

Сonclusion

Early-stage PSPs must adopt a strategic approach to gain market traction in a competitive payment market. By focusing on specific industries and regions, offering tailored solutions and payment methods, choosing the right business model and technology, and leveraging partnerships and user experience, new PSPs can effectively carve out a niche and achieve sustainable growth. Partnering with a white-label payment gateway can further accelerate this process, providing a solid foundation for long-term success