- Payment gateway

- Blog

- Streamlining Business Finances: The Benefits of Reconciliation in Payment Gateways

Streamlining Business Finances: The Benefits of Reconciliation in Payment Gateways

As businesses rely heavily on online transactions to facilitate their operations and generate revenue, the fintech industry is rising the features to correspond to the relevant needs of merchants. With the increasing complexity of financial processes, reconciliation in payment gateways has emerged as a vital business practice. Reconciliation ensures the accuracy, integrity, and transparency of financial data, providing numerous benefits to merchants. Today, we will explore how reconciliation works in payment solutions and delve into the advantages it offers for businesses

Understanding Reconciliation

Reconciliation is an accounting process of the meticulous comparison and matching of transactional data from the payment solution with providers. This process is performed to verify the consistency and accuracy of financial information, ensuring that all transactions are accounted for and properly recorded

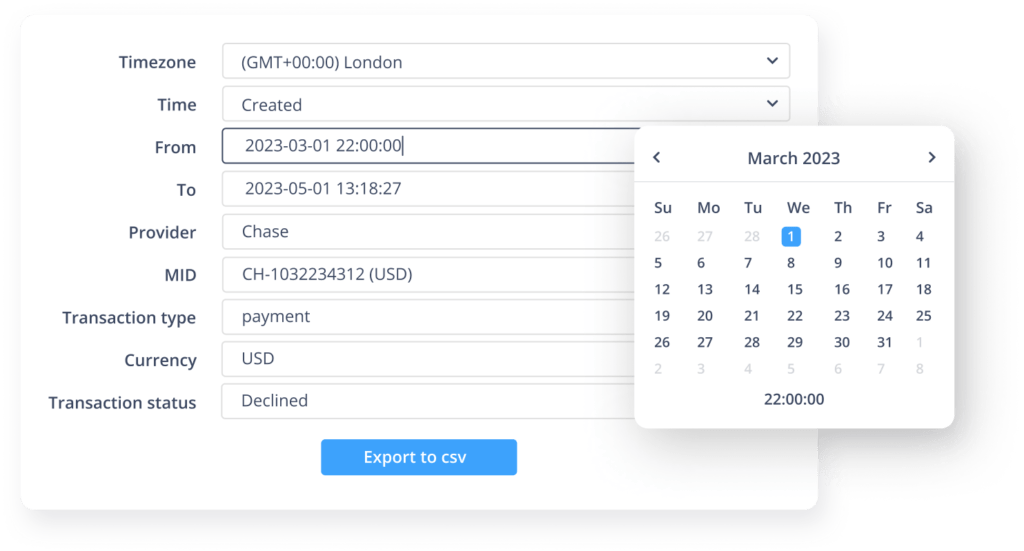

The business-oriented gateway providers, such as Transferty, are proposing technical solutions, to make the reconciliation process comfortable to merchants, including the additional toolkit, such as filters. Using filters is one of the features, which allows finding out the relevant information on your transactions and improving the payment flow. Transferty payment solution proposes the following filter parameters to ensure the continuity of your payments:

Customize the report according to the preferred timezone. If you are picking GMT+00:00, the date and time in the file will be in the chosen timezone

Use these parameters to find the relevant information on your transactions according to the specific timeframes

Use these filters to specify and analyse the transactions only of the chosen providers or MIDs you cooperate with to ensure the data accuracy

Choose what type of data you are looking for. With this filter, you can download the information on the transactions or transaction attempts

Pick the relevant data, according to the type of transaction. Use one of the possible values, such as Payment, Payout, Refund

Choose these parameters to easily diversify and find the required transactions, according to the status or currency they were performed in

The traditional reconciliation leads to the risks, related to the human factor, as it requires the involvement of many employees and becomes time and cost-consuming. On the other hand, the reconciliation feature, proposed by innovative gateway providers, such as Transferty, makes this process more effective and comfortable for merchants

How does it work

By reconciling gateway data with providers, businesses can identify discrepancies such as missing transactions, double entries, or errors in amounts. These discrepancies can then be investigated and resolved promptly, ensuring accurate financial reporting

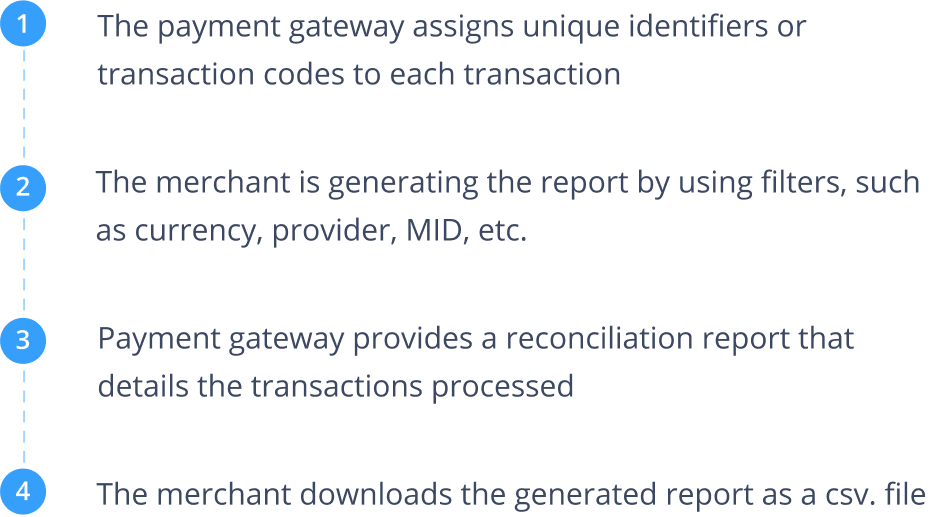

The process of reconciliation has a basic algorithm of work, which ensures its efficiency and high performance

The reconciliation works as follows:

Reconciliation in gateway solutions is a vital practice that enables businesses to maintain accurate financial records, detect discrepancies, prevent fraud, and make informed decisions. By aligning payment solutions data with providers’ records, businesses can streamline their financial processes, ensure compliance, and enhance the overall efficiency and transparency of their operations. Embracing reconciliation as an integral part of financial management is a wise move for any business aiming to thrive in the digital economy. Contact us to find out more about reconciliation and other payment features, provided by Transferty

The Benefits of Reconciliation for Businesses

Here are some benefits you can expect from using reconciliation:

Reconciliation significantly enhances the accuracy of financial data by aligning gateway records with providers. This ensures that financial reports and statements are reliable, reducing the risk of errors. Using filters allows checking the data from multiple providers and making a point sampling in case of discrepancies

In the case of chargebacks or customer disputes, reconciliation enables businesses to swiftly address and resolve issues. By having accurate and well-documented transactional data, businesses can provide evidence and respond effectively to disputes, minimizing financial losses and maintaining customer satisfaction

Accurate and up-to-date financial data resulting from reconciliation enables businesses to make informed decisions. By having a clear understanding of their financial position, businesses can assess profitability, track trends, and make strategic choices that drive growth

Reconciliation plays a crucial role in ensuring compliance with regulatory standards and audit requirements. By maintaining accurate financial records and reconciling them with payment data, businesses can demonstrate transparency and reduce the risk of penalties and fines as well

Conclusion

Reconciliation in payment solutions is a vital practice that enables businesses to maintain accurate financial records, detect discrepancies, prevent fraud, and make informed decisions. By aligning gateway data with providers’ records, businesses can streamline their financial processes, ensure compliance, and enhance the overall efficiency and transparency of their operations. Embracing reconciliation as an integral part of financial management is a wise move for any business aiming to thrive in the digital economy. Contact us to find out more about reconciliation and other payment features, provided by Transferty