- Payment gateway

- Blog

- The Evolution of Recurring Payments: Opportunities and Challenges

The Evolution of Recurring Payments: Opportunities and Challenges

In an era dominated by digital transformation, recurring payments have emerged as a corestone in the subscription-driven economy. The global recurring payment market is on an upward trajectory, expected to grow from $13.2 trillion in 2023 to $15.4 trillion by 2027. This growth signals the increasing adoption and potential of subscription models across the globe. Facilitating transactions at predetermined intervals, these payments ensure convenience, underpinning the steady revenue streams for businesses while offering simplicity for consumers. Today we will deeply analyse the nature of recurring payments, look through their specificities and challenges may appear

What are Recurring Payments?

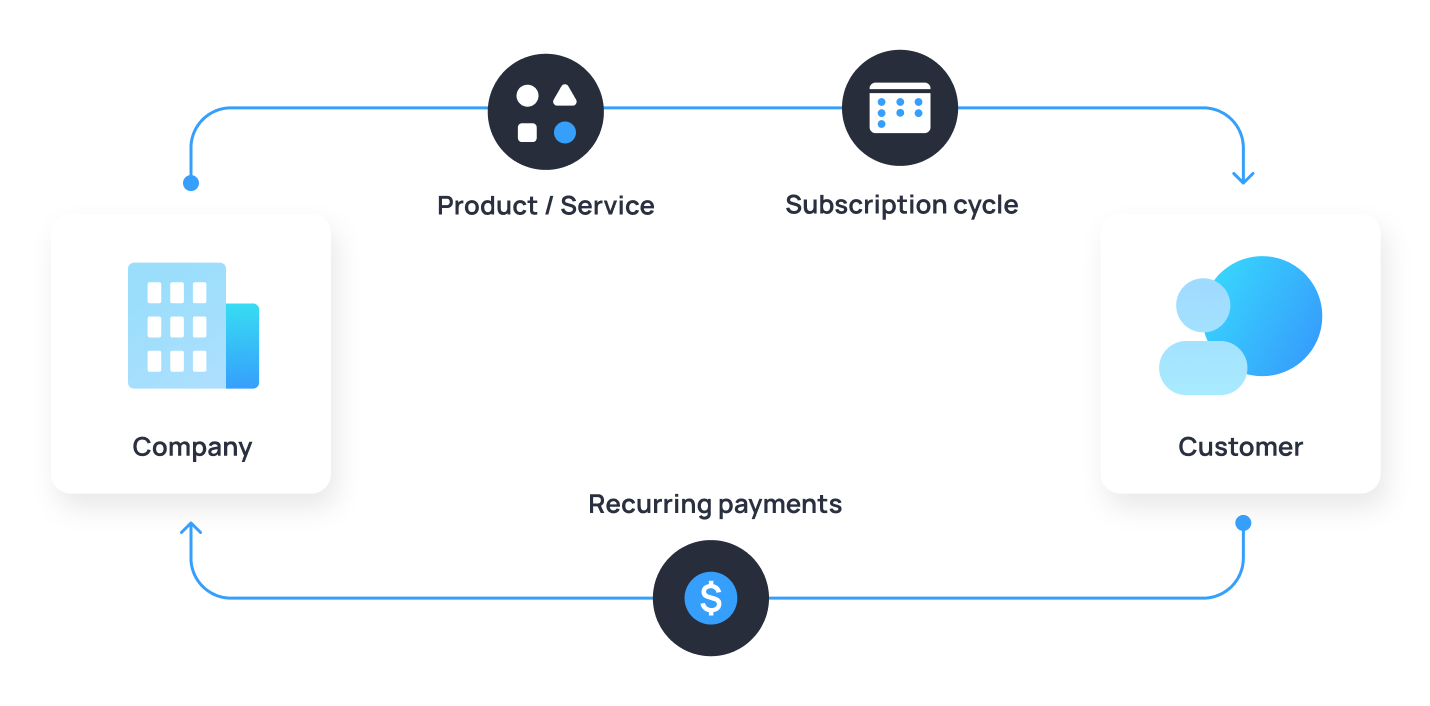

Recurring payment is an automated charge applied to a customer’s bank account or credit card, as per an agreed schedule between a business and its customer. This mechanism supports various frequencies, from weekly to annually, ensuring a seamless transactional experience for both parties. Subscription services have seen exponential growth across numerous industries. The global SaaS industry, for instance, has expanded by 500% over the last seven years

Types of Recurring Payments

Recurring payments can be classified into two categories: fixed recurring payments and variable recurring payments

Fixed Recurring Payments are scheduled to occur at regular, predetermined intervals and involve charging a set amount each time. This type of payment is typically automated, ensuring consistency and predictability for both the service provider and the customer. Examples of fixed recurring payments include monthly subscription fees for streaming services or rent payments. The main advantage of fixed recurring payments is their simplicity and reliability, as both parties know exactly what amount will be charged and when

Variable Recurring Payments, on the other hand, also occur at regular intervals but the amount charged can vary from one payment to the next. This variability is often due to factors such as usage, consumption, or other changing conditions. For instance, utility bills, mobile phone charges based on data usage, and credit card payments that depend on the outstanding balance are examples of variable recurring payments. Unlike fixed payments, variable recurring payments require more sophisticated billing systems to accurately calculate the amount due each period, reflecting the actual usage or consumption patterns of the customer

Both types of recurring payments offer distinct advantages. Fixed recurring payments provide stability and ease of budgeting, while variable recurring payments offer flexibility and are more aligned with actual usage, ensuring that customers only pay for what they use. Understanding these differences can help businesses choose the most appropriate billing method for their services and customers

How Recurring Payment Works

The recurring payment process begins with a customer’s consent, followed by the selection of a payment method. Details are stored securely, with intermediaries ensuring transaction approval. Recurring payments are categorised by their execution method, like card payments, direct debits, ACH, and SEPA, and by the nature of charges: fixed or variable. This classification underscores the flexibility of recurring payments to accommodate different business models and consumer preferences

Once the customer subscribes to your product or service, they begin by selecting their preferred payment method. After choosing the payment method, the customer enters their payment details for the initial transaction. These details, including information such as the card number, expiration date, and billing address, are securely stored in a payment gateway designed to handle and protect sensitive financial data. Following the entry of payment information, the transaction undergoes approval by various payment intermediaries. This process involves the acquiring bank, which works with the merchant, the credit card network that handles the transaction routing, and the issuing bank that manages the customer’s account. Once these intermediaries approve the transaction, the payment amount is transferred from the customer’s account to the merchant’s account. To ensure ongoing convenience and efficiency, payments are then set up to be automatically debited from the customer’s account according to a predetermined billing schedule, which might be monthly, quarterly, or annually, depending on the subscription terms. This automation ensures that as long as the subscription remains active, payments are processed without requiring the customer to manually re-enter their payment details for each billing cycle. The recurring payment process could be described in six following steps:

- Authorization

The customer grants permission to the service provider to charge their payment method on a recurring basis. This step typically involves agreeing to terms and conditions that outline the nature and frequency of the charges. Authorization is crucial as it establishes the legal and procedural framework for recurring payments

- Payment Setup

The customer and service provider agree on the specific terms of the recurring payment. These terms include the payment frequency, the amount to be charged, and any other relevant conditions. This step often involves the customer selecting a payment plan or subscription model that suits their needs

- Payment Information Storage

The service provider or payment processor securely stores the customer’s payment information. This information typically includes the payment method details and the billing address. Security is paramount in this step to ensure that sensitive information is protected against fraud and unauthorised access

- Payment Processing

At the scheduled intervals, the service provider or payment processor automatically initiates the transaction using the stored payment information. The process is automated to ensure consistency and reliability in payment collection. This automation helps in reducing administrative overhead and ensures timely payments

- Authorisation Check

Before processing each payment, the service provider or payment processor verifies that the stored payment method is still valid and that the customer has sufficient funds or credit available. This step helps in minimising payment failures and ensures that the service provider can predict and manage cash flow more effectively. The authorisation check may involve contacting the issuing bank or card network to confirm the payment method’s status

- Payment Execution

If the authorisation check is successful, the payment transaction is executed at the agreed-upon time. The specified amount is then charged to the customer’s payment method. Following the execution, the service provider typically sends a receipt or confirmation to the customer, detailing the transaction and updating their account status

Benefits for Businesses

The benefits of recurring payments extend well beyond the fundamental aspects of predictable cash flow and customer retention, underpinning the operational and strategic advantages for businesses in today’s digital-first economy. Here’s some of them:

Automates billing to improve customer satisfaction and retention, fostering long-term relationships

Reduces manual billing and administrative tasks, allowing focus on strategic growth areas

Facilitates the introduction of new offerings to customers, increasing revenue per customer

Improves the ability to manage financial resources with regular, predictable payments

Offers valuable insights into customer behaviours and preferences for informed decision-making

Simplifies international payments, expanding the customer base beyond local boundaries

Challenges in Implementing Recurring Payments

Despite their advantages, integrating diverse payment methods and managing them can pose significant challenges, like:

Technical teams often face complexities in integrating and managing new payment methods, affecting operational efficiency

Ensuring the security of recurring transactions, especially with multiple payment channels, remains a critical challenge

Staying compliant with global and local financial regulations demands continuous effort and updates to payment processing systems

Effectively managing subscriptions, including upgrades, downgrades, and cancellations, requires sophisticated systems

Handling failed payments and ensuring seamless retry mechanisms pose operational challenges

Providing robust support for issues related to recurring payments can strain resources

Addressing these challenges requires a strategic approach, leveraging advanced payment technologies, and possibly partnering with experienced payment service providers to streamline processes and enhance customer experience

Strategic partnership

Payment gateways play a pivotal role in addressing the challenges faced by businesses in recurring payments. By acting as the intermediary that facilitates the secure transfer of transaction data from the merchant to the acquiring bank, payment gateways offer several solutions to common hurdles. They simplify the integration of new payment methods by providing a single platform that supports various payment options, from credit cards to digital wallets, direct debits, and beyond. This eliminates the need for to develop and maintain multiple systems for different payment types, significantly reducing integration complexity and engineering resources

Moreover, payment gateways ensure compliance with international security standards like PCI DSS, alleviating concerns about fraud and cyber threats. They also offer advanced features such as tokenisation and encryption, further enhancing transaction security. With capabilities for handling recurring billing, payment gateways assist in managing subscription-based models more efficiently, offering automated billing cycles, and facilitating smooth customer experiences. Their analytics and reporting tools provide with valuable insights into payment trends, helping to inform strategic decisions and improve payment success rates

Conclusion

The evolving landscape of recurring payments signifies a strategic shift in the global economy, with businesses and consumers increasingly embracing the subscription model. This transition underlines the model’s resilience and expanding footprint across various industries. Recurring payments stand as a cornerstone, offering unmatched convenience, enhancing operational efficiencies, and ensuring a stable revenue flow for businesses while simplifying transactions for consumers