- Payment gateway

- Blog

- Top Cybersecurity Threats of Financial Ogranisations 2023-2024

Top Cybersecurity Threats of Financial Ogranisations 2023-2024

Nowadays, the importance of robust security measures cannot be overstated. As businesses increasingly move their operations online, the protection of sensitive data and the trust of customers have emerged as pivotal elements of success. Transferty is presenting the key cybersecurity analytics for 2023-2024 to keep your business aware of the modern cyberthreats and fortify your payment processing security

Key Cyberthreat Data for 2023-2024

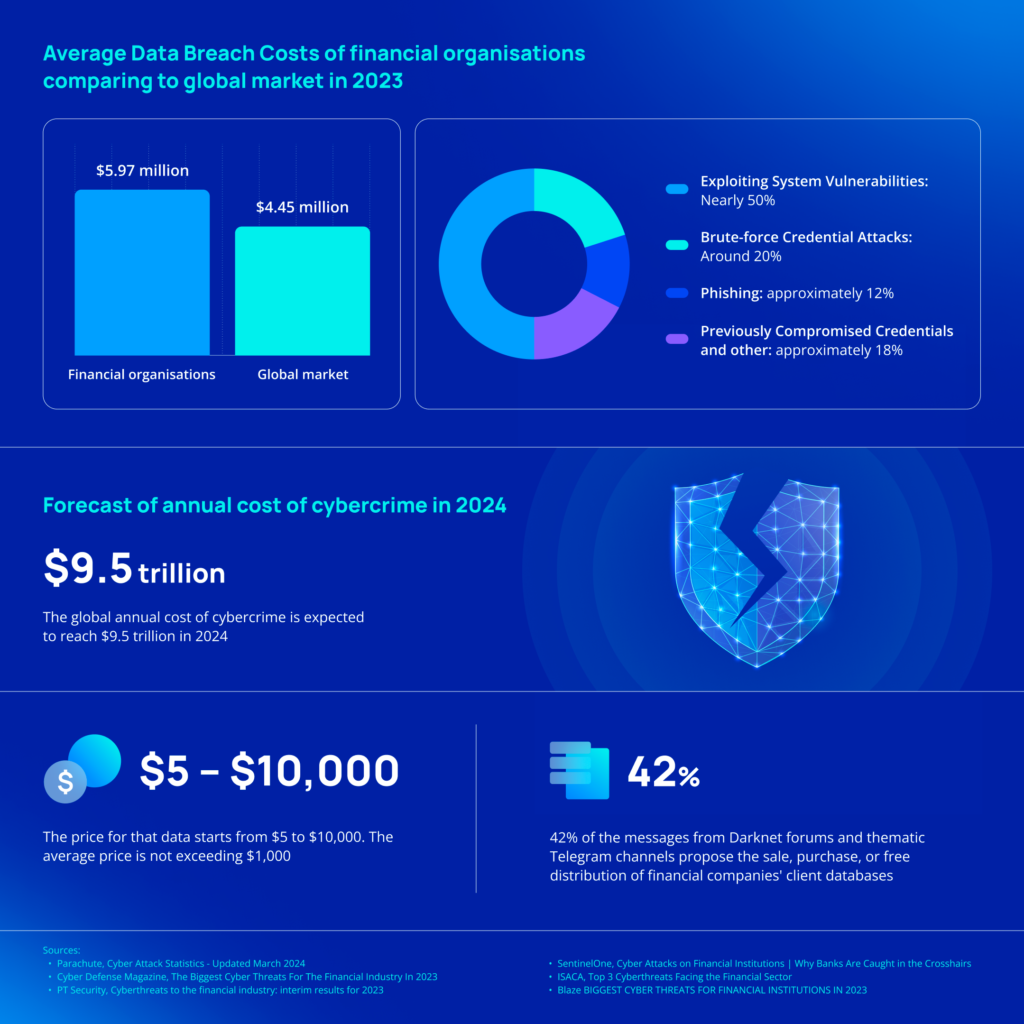

It is evident that organisations are contending with significant cyberthreats. The average cost of a data breach for financial institutions, standing at $5.97 million, surpasses the global market average by over $1.5 million, underscoring the high stakes involved. The predominant threat involves exploiting system vulnerabilities, accounting for nearly half of all cybersecurity challenges. This, along with brute-force attacks, phishing, and the use of compromised credentials, forms a daunting array of risks

Looking ahead to 2024, the anticipated global cost of cybercrime is a staggering $9.5 trillion, reflecting both the growing sophistication of cybercriminals and the expanding attack surface as digital financial services proliferate. Additionally, the dark web continues to be a bustling marketplace for financial data, with 42% of messages related to trading client information from financial firms. These troubling trends underline the urgent need for robust security measures and proactive defences in the fight against cyber threats to the financial industry

How to overcome

Here are some tips from Transferty’s experts, that are definitely help your business to keep the payments safe, ensure the high uptime of your processing and reduce the risks, associated with cybercriminal activities:

Utilise end-to-end encryption and tokenization for data protection

Adhere to PCI DSS and other standards to mitigate risks and avoid fines

Employ anti-fraud rules for early detection and blocking of fraud

Stay ahead of cyberthreats by providing constant security updates

Build confidence by using secure and reliable payment processing

Benefit from the guidance and assistance of Transferty experts

Conclusion

Enhancing your business’s payment processing security is a multi-faceted endeavour that requires a strategic approach, attention to detail, and a commitment to continuous improvement. By ensuring reliable security, businesses can not only protect themselves and their customers but also build a solid foundation for long-term success in the digital marketplace. The emphasis on security, compliance, and trust within the payment processing practices has never been more critical. By prioritising these elements, we can collectively ensure a safer and more dependable business environment