- Payment gateway

- Blog

- Transferty’s industry overview #1

Transferty’s industry overview #1

Digital payment industry is rapidly evolving. To keep on track of the latest payment insights we want to present new column, where Transferty experts overviewing the most interesting news from the previous month to find out how Fintech grows

Growth Trends & Forecasts of Fintech Industry 2024

The fintech industry is poised for significant growth, with market predictions estimating a leap from USD 312.92 billion in 2024 to USD 608.35 billion by 2029, marking a CAGR of over 14%. This surge is attributed to a blend of technological advancements and strategic adaptations in financial services, pushing businesses towards a more customer-centric model. The evolution of fintech, influenced by crises such as the 2008 financial downturn and the COVID-19 pandemic, has fostered a collaborative environment among startups, tech giants, and traditional banks, all aiming to harness new market opportunities and enhance service delivery

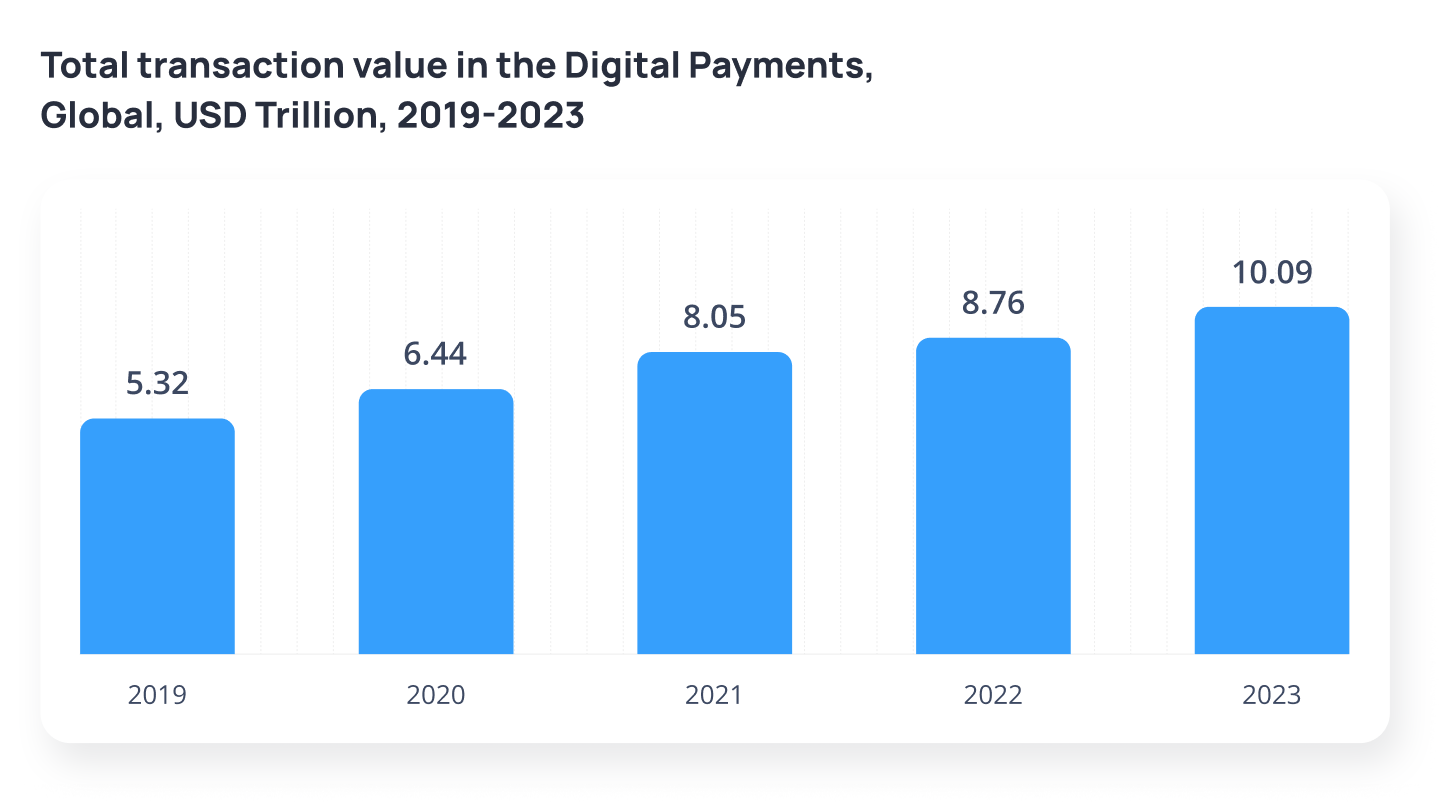

Key trends shaping this market expansion include the widespread adoption of digital payments, which form the backbone of fintech innovation, offering a gateway to financial inclusivity for underserved demographics. The advent of digital payments has changed money transfers, making them more accessible, efficient, and secure, thanks to technological integrations like blockchain, AI, and APIs. Furthermore, the Asia-Pacific region is emerging as a fintech powerhouse, with digitization efforts and supportive regulatory policies propelling the market forward

This fintech market analysis underscores the industry’s dynamic nature, emphasising the need for businesses to remain agile and innovative to navigate the rapidly evolving digital financial landscape successfully

European Council’s New Payments Regulations

The European Council’s new instant payments regulation marks a significant leap towards enhancing the EU’s financial autonomy and streamlining transactions for both consumers and businesses. This initiative allows for euro transactions to be completed in just ten seconds, anytime, fostering economic efficiency across EU and EEA countries. It aims to reduce dependency on non-EU financial entities, encouraging innovative financial solutions

Under these regulations, banks and payment service providers are mandated to support instant payments in euros, ensuring the costs align with those of standard credit transfers. The phased introduction promises swift adoption within the euro zone, with extended timelines for non-euro countries to accommodate the changes.

Addressing security, the regulations stipulate stringent verification of recipient details, enhancing fraud protection measures. This development is part of the broader capital markets union effort, intended to facilitate investment flow across the EU, benefiting citizens, investors, and businesses alike

However, industry experts highlight the challenges ahead, particularly in integrating and managing these new payment systems. The technological shift requires significant effort from banks to meet tight deadlines, ensuring seamless and secure transactions, especially in cross-border payments. The move is widely anticipated to optimise liquidity management, cut transaction costs, and simplify access to new markets for businesses, ultimately fostering greater operational efficiency and economic growth within the EU

Fraud Trends for 2024: Key insights

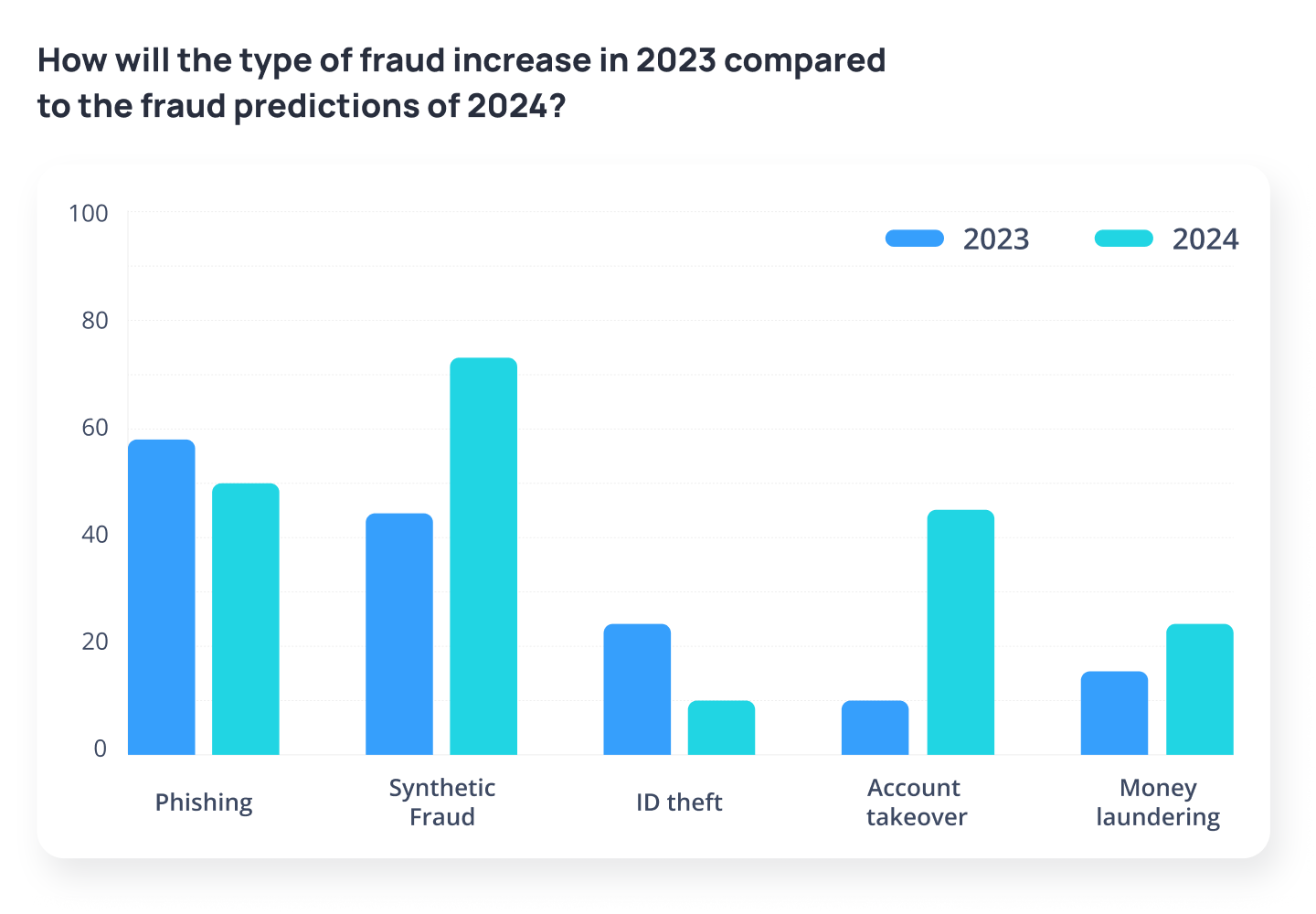

The landscape of fraud is expected to become increasingly complex in 2024, with experts predicting a significant rise in both the volume and sophistication of fraud attempts. “Fraud Trends 2024” report, based on insights from 316 cross-industry experts, highlights a concerning trend with 87% of respondents anticipating an increase in fraud. This surge is attributed to advanced technologies like Artificial Intelligence, the emergence of Fraud-as-a-Service, and the demand for swift, frictionless transactions amid growing economic pressures

Key findings from the report reveal that AI plays a dual role in the fraud ecosystem, both as a tool for fraudsters to craft more complex scams, such as deepfake technology and automated attacks, and as a crucial component in developing more effective anti-fraud solutions

Furthermore, the guide forecasts a rise in various fraud types, including phishing, synthetic fraud, identity theft, account takeovers, and money laundering. As a result, many businesses are expected to bolster their anti-fraud measures in response. The guide also stresses the importance of strategic investment in comprehensive fraud prevention and detection solutions to mitigate these emerging threats effectively

One of the most significant challenges highlighted is the balance between implementing advanced technological solutions and maintaining the human element in fraud prevention strategies. The integration of machine learning with human insight is deemed essential for maximising accuracy and maintaining necessary oversight in combating fraud. Businesses must navigate the challenges of integrating new technologies and adapting to the dynamic fraud landscape by investing in comprehensive solutions that offer both advanced detection capabilities and the flexibility to respond to new threats as they arise

Conclusion

The evolving fintech landscape, marked by rapid advancements in technology and regulatory shifts, presents both challenges and opportunities for businesses. Partnering with a reliable payment gateway emerges as a strategic benefit in this dynamic environment. Payment gateways offer streamlined integration with new payment systems, enhanced fraud protection measures, and support for instant transactions, which are crucial for adapting to the European Council’s new payments regulations and combating the increasing complexity of fraud

A trusted payment gateway enables businesses to navigate the digital financial landscape successfully by ensuring compliance with evolving regulations, providing robust security measures to mitigate fraud risks, and offering flexible solutions that cater to the diverse needs of global markets. As the fintech market continues to grow and the demand for secure, efficient payment solutions rises, the role of payment gateways in fostering business growth and innovation becomes increasingly significant. By leveraging the expertise and technology of a reliable payment gateway like Transferty, businesses can unlock new opportunities for efficiency, security, and customer satisfaction, positioning themselves for success in the competitive fintech ecosystem

Sources

- Fintech Market Size & Share Analysis – Growth Trends & Forecasts (2024 – 2029) by Mordor Intelligence

- “European Council Rolls Out Instant Payments Regulations, Eyeing EU Single Market for Capital” by Fintech Times

- SEON Fraud Trends 2024 by Seon