- Payment gateway

- Blog

- Winning Strategies: How PSP could gain new partnerships

Winning Strategies: How PSP could gain new partnerships

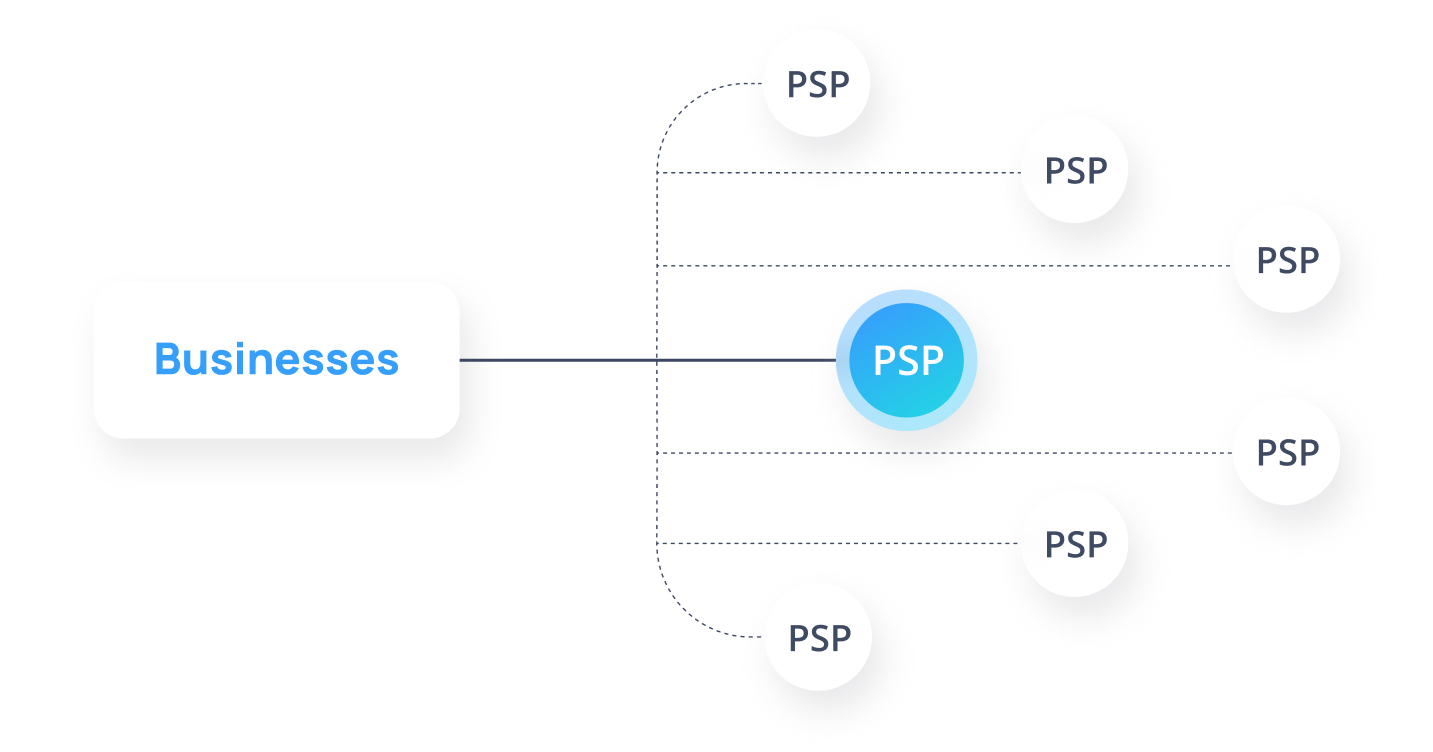

A Payment Service Provider is one of the main actors of the online payment process. Such a position opens great opportunities for the companies working in this industry. Figuring out what is a payment service provider and which opportunities this business opens, more and more companies aim to start their own PSP, creating a high-competitive environment. To gain new clients and save the customer loyalty, it is not enough to be a simple online Payment Service Provider. All of them have to change their business strategies, add new features and cover as many needs of their clients as possible. Today we will talk about the key demands businesses expect from the Payment Service Providers, provide our tips on how to ensure them and discover extra features, allowing PSPs to stay ahead of the competition

Understanding Customer's Needs

What is payment service provider according to the customer’s opinion? Payment Service Providers (PSPs) are authorised financial entities entrusted with managing funds and establishing payment accounts, known as Merchant IDs (MID), for their clients. Unlike basic intermediaries, PSPs possess a dual capability, not only dealing directly with financial assets but also integrating seamlessly with external payment solutions such as gateways or orchestration platforms, ensuring the technical aspects of payment processing are flawlessly executed. As licensed financial entities, PSPs play a pivotal role in directly handling funds, establishing payment accounts, and integrating with diverse payment solutions, offering a comprehensive payment facilitation service to businesses

You should get clear what your customers are expecting while choosing payment service provider. We have prepared several questions that every PSP should ask themselves to gain new customers

Addressing these queries not only refines your services but also lays the foundation for enduring partnerships. Some PSPs can handle all the technical issues by themselves. However, it may be expensive and time consuming. That is why, many PSPs are looking for the ready-made solutions, like white-label payment gateways, that totally cover all the technical aspects of payment processing, leaving PSP only business operations and financial part of their activity. Now let’s move further and find out the main expectations businesses have, while looking for Payment Service Provider companies for partnership

Main requirements

Selecting the right Internet Payment Service Provider is a pivotal decision for any business. The process demands careful consideration of various factors to ensure seamless transactions and exceptional customer experiences. Here is a few main characteristics businesses pay attention to while looking for a reliable PSP

Fees and Commercial Terms

Scalable fee structure is fundamental. PSPs typically involve fixed and variable fees. Fixed costs encompass setup fees and monthly charges, while variable costs are transaction-based, generally some percent of business sales. For companies dealing with diverse transaction volumes, it’s crucial to assess these costs thoroughly. Some PSPs offer flat fees, ideal for high-value transactions, while others provide a mix of services including chargebacks, dispute management, and currency conversion. To stay competitive, Payment Service Providers should consider to provide customisable prices and fees, according to the business type, transaction capacity and individual specificities of companies they want to cooperate with

Brand awareness and Market Specialisation

Proper brand promotion matters. Popular PSPs with clear industry orientation often bring valuable insights into market, specific payment methods and customer preferences. Use statistics related to approval ratios and other valuable numbers in your brand promotion to engage the related businesses. Use success stories and promote your brand via reliable channels of the industries you work with. This will definitely help your PSP to rise the brand awareness, ensure customer loyalty and gain newcomers to cooperation with you

Onboarding Process and Security Standards

A seamless onboarding process is essential. Ensure clear understanding of the timelines, documentation requirements for your clients, as well as the level of support offered during onboarding. Individual approach as well as fast and easy onboarding process will guarantee the extra points for your PSP. Prioritise adhering to global security standards like Payment Card Industry Data Security Standard (PCI DSS). This certification not only guarantees the safety of customer credit card data, but also saves you time and effort in obtaining compliance. Do not forget to follow the local security requirements of the regions you are oriented to. Leave no space for merchant’s doubts on your reliability, and you will see the positive results in your relationship with them

Conversion-Optimised Checkout and Integration

Customising the checkout process is key to enhancing user experience. Successful PSPs often offer flexibility in integrating customers’ branding elements, optimising for various devices, and ensuring a smooth payment flow. Payment service providers that allow seamless integration with merchants existing invoicing and accounting software are more likely to be chosen for cooperation. This integration minimises manual efforts, ensuring accurate and efficient payment processing. It may be challenging for PSPs to develop and maintain such features. That is why, many of them are looking for reliable white-label online payment gateway service provider, which will cover all the technical aspects of payment process

Support and Holding Time

Robust support services are non-negotiable. Evaluate the support mechanisms provided by your PSPs, such as 24/7 support, live chat, and dedicated account managers. Quick response times and clear Service Level Agreements (SLAs) are indicative of reliable support. Additionally, pay attention to the optimal holding times for funds. Swift payment settlements are vital for maintaining your clients cash flow. Reasonable holding periods not only avoid disruptions in the financial operations of businesses you work with, but also increase their loyalty to your brand

In summary, a holistic approach is what businesses use while selecting the best PSP for their needs. Companies assess fees, security measures, integration capabilities, and support services thoroughly. Prioritise the industries aligned with your strategy, ensuring they understand your specificities

What about added values?

While the main characteristics are vital to follow for each Payment Service Provider to stay competitive, the extra features are creating the industry leaders. Here are some tips on the features, that could highly boost your PSP

Global Reach and Currency Acceptance

Globalisation allows businesses to operate without borders. That is why your customers shouldn’t face barriers when making transactions. You should ensure that your psp payment service provider operates globally, supporting multiple currencies and payment methods. Your potential customers shouldn’t face hurdles when making transactions due to currency limitations.

A white-label payment gateway can easily help with this. All the technical and compliance parts of the online payment could be covered by your white-label partner. It ensures that your customers, regardless of their location or currency preference, can sell without any hassle. The ability to accept international payments effortlessly is a key feature that attracts a global customer base

Seamless Mobile Experience

Mobile transactions are on the rise. Your PSP should offer a seamless mobile experience, ensuring your customers can make payments effortlessly using various devices. Customers prefer convenient and secure mobile payment options. Features like mobile-optimised checkouts, QR codes, and SMS payment options that enhance user convenience. A white-label payment gateway partner can make the process of these features implementation much easier and faster. These tailored mobile solutions not only boost customer satisfaction but also increase brand recognition and conversion rates

Proactive Risk Management

Fraud prevention is paramount. A proactive PSP conducts thorough checks, addressing risks associated with missing payments, chargebacks, and fraud. Providers should offer additional modules for fraud prevention that can be integrated into clients’ websites, safeguarding their revenue. White-label payment gateway service provider comes equipped with advanced fraud prevention modules that can be seamlessly integrated into your website. These modules conduct comprehensive checks, mitigating risks associated with missing payments, chargebacks, and fraud. Proactive risk management safeguards your revenue and ensures a secure transaction environment for your customers.

Routing and Cascading

To become the best payment service provider, companies may use advanced routing and cascading technologies to hold a distinct advantage in the industry. These technologies streamline transaction management, ensuring efficient and reliable payment processing for businesses. By optimising transaction paths and offering seamless fallback options, PSPs enhance global reach and significantly improve transaction success rates. The integration of routing and cascading technologies also bolsters security measures, minimising the risk of data breaches and fraud. In this context, white-label gateways play a crucial role, enabling seamless incorporation of these features. PSPs offering these capabilities through white-label solutions not only enhance their partners’ confidence but also expand their market appeal, making them the preferred choice for businesses seeking secure, efficient, and globally accessible payment solutions

Monitoring Tools

Payment Service Providers armed with robust monitoring tools showcase a commitment to transparency, reliability, and exceptional service, making them highly attractive to potential business partners. These tools empower businesses with real-time insights into transaction performance, helping them optimise their operations and enhance customer experiences. By offering comprehensive monitoring solutions, PSPs instil confidence in their partners, assuring them of seamless transaction management and proactive issue resolution. White-label gateways play a pivotal role in ensuring these features, providing customisable, user-friendly interfaces for businesses. Through white-label solutions, PSPs can offer their partners tailored monitoring tools, fostering trust and enabling businesses to make data-driven decisions, ultimately positioning the PSP as a trusted ally in the competitive payment landscape

Conclusion

Selecting the right PSP is a strategic advantage for every business. By carefully considering these factors, you empower your PSP to address the requirements of the businesses and gain new customers. Remember, that you always can close any technical gaps in your PSP by partnering with a robust payment partner. A white-label payment gateway emerges as the ideal solution tailored to your PSP and customer needs. Empower your business today by choosing a white-label payment gateway that not only meets but exceeds your customer’s expectations. It’s a strategic investment in your Payment Service Provider psp business’s future success