- Payment gateway

- Blog

- Payment gateway: Multilateral Guideline for Businesses

Payment gateway: Multilateral Guideline for Businesses

Payment gateways could be named as a core of online commerce, ensuring transactions are not only seamless but secure. Acting as a mediator between customers, merchants, and banks, these gateways encrypt sensitive information, such as credit card numbers, to safeguard against data breaches and fraud. Today we will comprehensively find out everything business owners should know about the payment gateways

What is a Payment Gateway?

A payment gateway is a technological solution that enables secure digital transactions. It facilitates the authorization of digital payments by encrypting confidential data, including credit card numbers and security codes, thereby preserving the integrity and safety of the data. More than just processing transactions, payment gateways implement sophisticated security strategies such as tokenization, SSL encryption, and fraud prevention to safeguard against unauthorised entry and online risks. Tailored for businesses needing online payment capabilities, payment gateways refine the online checkout experience, ensuring it is efficient, smooth, and secure for all involved

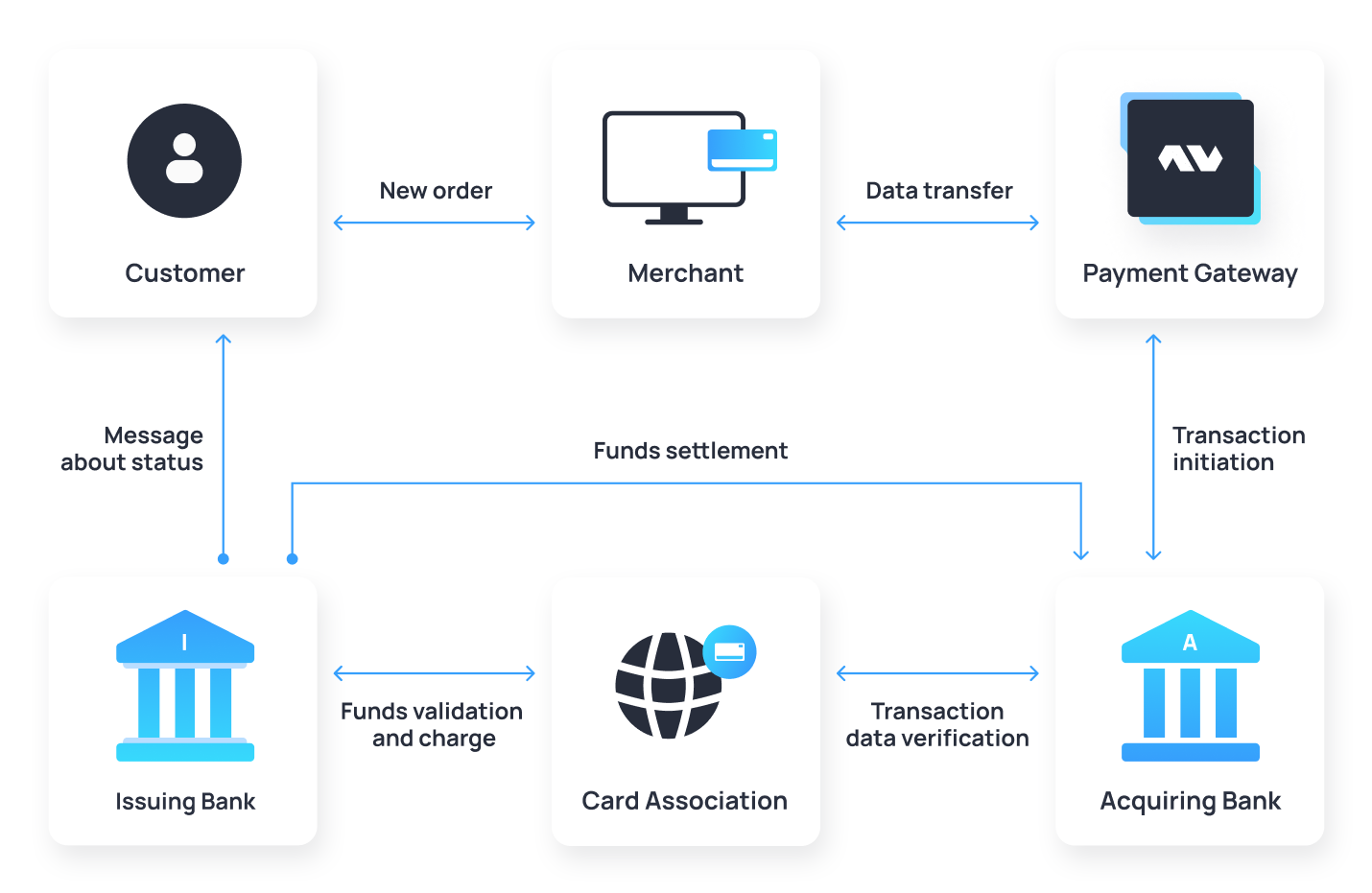

How Payment Gateways Work?

When a customer places an order, the gateway encrypts the payment information and sends it to the merchant’s bank. It then forwards this data to the card network and the issuing bank for authorization. Upon approval, the transaction is completed, and the funds are transferred to the merchant’s account, all within a matter of seconds

Let’s discover this process specifically:

- A customer places an order on a merchant’s online platform and inputs their credit card information at the checkout

- At this point, the payment gateway comes into action. It encrypts the submitted information and securely forwards an authorization request to the merchant’s acquiring bank

- Simultaneously, the gateway sends a request to the card network associated with the customer’s card to verify the card’s validity and ensure sufficient funds are available

- The card network then confirms to the acquiring bank through the payment gateway, detailing the amount that needs to be deducted from the customer’s bank account

- The issuing bank reviews the customer’s account balance and forwards a confirmation of the transaction back through the card network. This approval is communicated to both the acquiring bank and the payment gateway

- Once the transaction receives approval, the customer’s bank account is debited, and the corresponding funds are transferred to the merchant’s bank account

Revenue Models of Payment Gateways

Payment gateways sustain their operations and secure infrastructure through various fees. Primarily, these include:

Transaction fees

A percentage of each transaction amount

Fixed fees

For maintaining the gateway’s services

Additionally, gateways may impose charges for ancillary services like fraud prevention, chargeback management, and integration capabilities, ensuring a comprehensive suite of tools for merchants to manage their online transactions efficiently

Among the principal types of fees for credit card transactions are:

Interchange Fees

Known alternatively as issuing bank fees, interchange fees are composed of charges for financial risk and fixed operational costs incurred with each card transaction, representing a significant portion of all credit card processing expenses

Assessment Fees

Also referred to as dues, assessments, or card association/network fees, these are the charges payment processors pay to card networks. The amount of these fees is tied to the aggregate monthly volume of transactions, with additional fees applied to transactions processed outside the merchant’s home country

Processing Fees

These fees are billed to merchants by payment processors for the utilisation of their services and software. Known as the provider markup, these fees may be charged per transaction or on a monthly basis and are calculated as a fixed amount, a percentage of the transaction, or a combination of both

Safety of Payment Gateways

Payment gateways are dealing with sensitive information, incorporating several stringent security measures to protect against fraud, data theft, and losses. Understanding these measures can provide reliability of the payment infrastructure:

Data Encryption

Encryption transforms sensitive data into unreadable code, safeguarding cardholder information through a blend of cryptographic algorithms. This multi-key approach ensures that compromised data remains inaccessible without the unique decryption keys

TLS (SSL) Protocols

The Transport Layer Security (TLS) protocol, successor to Secure Sockets Layer (SSL), secures data transfer between servers and clients, utilising HTTPS to thwart data interception and prevent redirection to fraudulent sites

Tokenization

Tokenization substitutes sensitive data with non-sensitive tokens, which can represent the data in transactions without exposing it to risk. This method significantly reduces the potential for data breaches and misuse

3D Secure Authentication

3D Secure (3DS) enhances security by verifying the cardholder’s identity during online transactions, reducing the risk of fraud for the issuing bank and providing an additional layer of security for merchants and customers alike

PCI DSS Compliance

Compliance with the Payment Card Industry Data Security Standard is mandatory for payment gateways, covering extensive security protocols and procedures to ensure comprehensive protection of payment data

Data Masking

Masking replaces sensitive data with placeholders, limiting exposure while preserving the utility of the data for analysis or testing, with techniques like static and dynamic data masking catering to different access control scenarios

Key Payment Processing Terms

It is vital to differentiate the main terms used in online payment processing. Let’s take a look at the key of them:

Payment Service Providers – Offer a comprehensive suite, including payment gateways, processing services, and merchant accounts, facilitating a direct link between merchants and the financial ecosystem

Merchant Accounts (MID) – Represent the destination for funds post-transaction, before their transfer to a business’s primary bank account

Payment Processors – Ensure the smooth flow of funds by managing the connections between merchants, credit card networks, and banks

Payment Aggregators and Facilitators – Streamline the payment process for multiple merchants under a unified system, differing primarily in the method of merchant integration

Payment orchestration platforms or Payment Gateway – Serve as a software layer or platform that manages the entire payment process, from authorization to routing and settlement. These providers integrate various acquirers, banks, and payment service providers into a unified system. Technically, it’s another name for payment gateways. More details you could find here

How to Obtain a Payment Gateway

For businesses looking for a setting up a payment gateway, the roadmap presents several options, each with its unique set of considerations:

- Partnering with Third-party Providers emerges as a popular choice for its ease of integration and immediate access to a broad spectrum of payment functionalities

- Opting for In-house Development demands a significant investment in technical expertise and resources to develop and hold the payment platform, but offers in-house development

- Adopting White-Label Solutions strikes a balance between customization and convenience, offering a payment gateway that seamlessly aligns with your brand identity without the hefty investment required for in-house development

Choosing Payment Gateway for Your Business

The decision to select a payment gateway should be informed by a thorough analysis of your business’s specific needs, market dynamics, and customer preferences. Key considerations include:

A gateway that supports a wide array of payment methods can significantly enhance customer satisfaction and conversion rates

Compliance with PCI DSS and other regulatory standards is vital for safeguarding customer data and maintaining trust

The ability to tailor the payment experience to align with your brand enhances customer recognition and loyalty

Understanding the full spectrum of fees associated with the payment gateway is crucial to ensuring it aligns with your financial planning

The more payments you want to process, the biggest operational capabilities and PCI DSS compliance your payment gateway should have

Features like routing and cascading allow to optimise the payment flow to reduce the number of failed transactions and conversion increase

Selecting a payment gateway also requires delving into industry-specific requirements that address to the unique challenges and opportunities within each sector:

Streamlined payment pages and a wide range of payment options are key to optimising the checkout experience

Advanced chargeback management tools are essential for mitigating risks associated with frequent chargebacks

The gateway should support recurring billing and effectively process the transactions under subscription terms

Demand for merchant account management, monitoring and evaluation capabilities and billing optimisation

How to Integrate a Payment Gateway?

Integrating a payment gateway into a website or application can be achieved through several methods, each offering different levels of customization and complexity

Via API

Integrating through an Application Programming Interface is the most popular one. It allows the integration of more customised solutions. The integrating steps include:

API Exploration

Select a gateway offering comprehensive API documentation, obtain API keys, and use tools to familiarise yourself with the API’s capabilities

Development

Write code to handle API requests for payment processing, including error management and user feedback mechanisms

Testing

Thoroughly test the integration to validate functionality across all intended use cases

Via Plugins

Plugins provide a straightforward way to add payment capabilities to websites

Via SDK

Software Development Kits allow integration by providing pre-built libraries

Conclusion

Payment gateways are an undeniable element of the online payment process, providing the infrastructure necessary for secure, efficient, and versatile payment processing. By understanding how these gateways work, their necessity, and their revenue models, businesses can better navigate the online marketplace, offering secure and convenient payment options to their customers