- Payment gateway

- Blog

- Top-5 Payment Gateways for 2024 Worldwide

Top-5 Payment Gateways for 2024 Worldwide

The digital payment landscape is continually growing. The payment gateways perform as a facilitator of seamless transactions for businesses and consumers alike stimulating the growth of online payments. In 2024, selecting the right payment gateway is more critical than ever, as businesses strive to enhance customer experience, expand globally, and ensure transaction security. In this article we will explore the five best payment gateway options for various business needs

Understanding Payment Gateways

A payment gateway is a tech-based solution that serves as an intermediary for electronic financial transactions. It plays a crucial role in authorising digital payments by encrypting sensitive information like credit card details and security codes, ensuring the data’s integrity and security. Beyond mere transaction processing, best international payment gateways employ advanced security measures, including tokenization and SSL encryption to protect against unauthorised access and cyberthreats. Designed for businesses requiring online payment functions, best payment gateways for international transactions optimise the online checkout process, making it efficient, seamless, and safe for all parties involved

How to Choose the Payment Gateway

Selecting the best payment gateway for your business is a critical decision that can significantly impact your operational efficiency, customer satisfaction, and bottom line. This choice should be made after careful consideration of various factors that align with your business model, industry requirements, and customer expectations. Here are key points to guide you through this decision-making process:

Variety of Payment Options

Customers appreciate flexibility and convenience at checkout. A gateway offering a wide range of payment methods, including credit cards, digital wallets, and alternative payment methods, caters to diverse preferences, enhancing customer satisfaction and potentially increasing conversion rates

Security Standards

The gateway must adhere to the highest security standards, such as PCI DSS compliance, to protect sensitive customer information. This not only safeguards against data breaches but also builds customer trust in your payment processes

Customization Potential

A customizable payment experience allows you to maintain brand consistency across all customer touchpoints. Tailoring the checkout process to match your brand can improve customer recognition and loyalty

Cost-Effectiveness

Analyse all associated costs, including setup, monthly, and transaction fees, to ensure the gateway fits within your budget while meeting your needs. Be aware of hidden costs that could inflate your expenses over time

Payment Volumes

Your chosen gateway should be scalable to handle your expected payment volumes. Higher transaction volumes require robust processing capabilities and stringent security measures to ensure smooth, secure payment experiences

Optimization Tools

Features that optimise payment processing, such as routing and cascading, can reduce failed transactions and improve conversion rates. These tools are particularly useful for businesses looking to expand globally

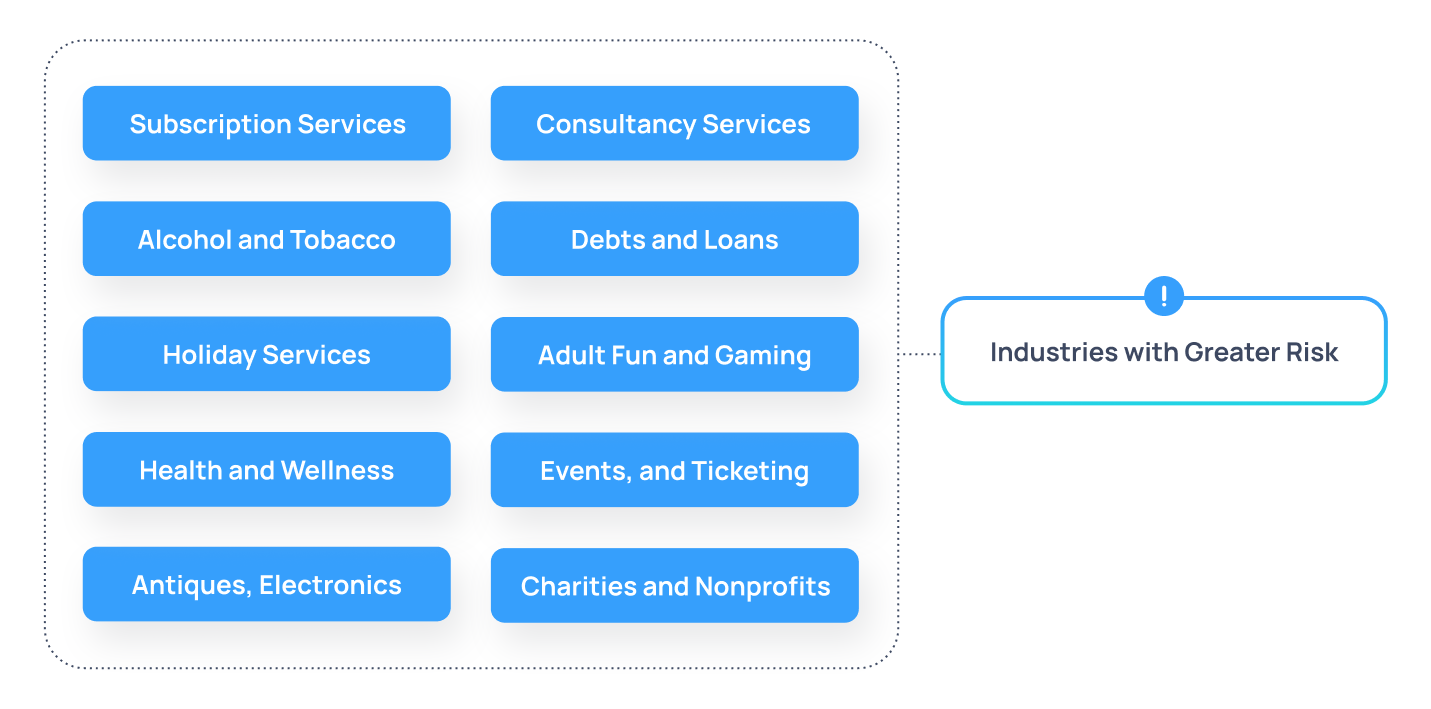

You have also consider the industry-specific considerations, as different payment gateway solutions are tailored for different type of business, here are some industry-oriented recommendations on what you should keep an eye:

Look for streamlined integrations with popular marketplaces, plugins, as well as extensive payment options

Advanced security tools and pool of PSPs working with high-risk businesses are crucial for high-risk payment gateways

Recurring billing capabilities are essential for managing subscriptions efficiently and ensuring a steady revenue stream

Comprehensive merchant account management, transaction monitoring, and billing optimization features are vital

By taking these factors into account, you can choose a payment gateway that not only meets your current needs but also supports your business growth. Remember, the right payment gateway is a key partner, ensuring that every transaction is a step towards success

Best Payment Gateways in 2024

Now let’s discover the best online payment gateways for various businesses in 2024:

Stripe

Stripe stands out for businesses with their own apps or existing websites that require payment processing integration focusing on online, mobile and ecommerce payments. Renowned for its developer-oriented solutions, Stripe enables businesses to plug into various marketplaces and online platforms effortlessly. Stripe is a key player in digital payments, working with big names like Uber, Amazon, McDonald’s, and Spotify. However, Stipe has its policy on cooperation with specific types of businesses. For example, they may doubt to cooperate with the high-risk sector, as it has its specificities

Best for: Сompanies requiring a lot of customization or want to accept payments in person

Platforms Supported: SaaS/Web and mobile devices

Support: Webinars and 24/7 live support online

API: Available

Company Information: Established in 2010, based in the United States

Benefits: Billing and Invoicing, Subscription Management, Customizable solution, Global reach

Cons: Complex for non-technical users, High price for micro-transactions, May refuse to cooperate with some industries, considering as a high-risk by their policies

Adyen

Adyen offers an omnichannel all-in-one solution for businesses seeking a global payment processor capable of supporting multiple payment channels. It is suitable for a wide range of transactions, including online, mobile, in-store in-app purchases and QR code payments. Adyen also proposes their POS terminals, making their solution good for businesses operating online and offline as well. Among their clients major retail brands like Levis, Tiffanys and Co, and Gap

Best for: Large enterprises operating online and offline payments

Platforms Supported: SaaS/Web

Support: Documentation and live support online

API: Available

Company Information: Founded in 2006, based in the Netherlands

Benefits: B2B Payments, Multi-currency transactions, Cross-channel consistency

Cons: Complex pricing, Steep learning curve

Braintree

Owned by PayPal, Braintree caters to businesses looking for an integrated payment solution that supports credit cards, PayPal, and Venmo. It’s particularly well-suited for mobile app and website payments, as well as greatly tailored to integrate with digital wallets

Best for: Businesses operating with digital wallets

Platforms Supported: SaaS/Web

Support: 24/7 live support online and documentation

API: Available

Company Information: Founded in 2007, based in the United States

Benefits: Includes SaaS Billing, Feature variety, Fast Integration with eCommerce platforms and shopping carts

Cons: Accumulating fees, Customization issues, High-price for SMEs

Clover

Clover provides a best payment gateway for small business, especially retailers and restaurants with physical locations. It offers various terminals and systems with an initial investment, complemented by a range of monthly plans. Clover’s payment solutions fit businesses prioritising face-to-face transactions

Best for: Small to mid-sized businesses, particularly in the food and retail sectors

Platforms Supported: SaaS/Web and mobile devices

Support: Offers documentation and phone support

API: Yes

Company Information: Founded in 2012, based in the United States

Benefits: POS systems, Billing and Invoicing, Transparent pricing plans, Features like order management, tracking and loyalty programs, variety of payment methods

Cons: Complicated for technically-limited users, Optional add-ons increasing costs, No free trial

Transferty

Transferty specialises in high-risk payment processing, offering tailored solutions that address the unique challenges faced by high-risk businesses and fintech companies. Their products are tailored to cover the needs of enterprises and SMEs as well. With a focus on minimising chargebacks, increasing conversion rates, and reducing business risks, Transferty is a perfect partner for businesses in industries often considered high-risk. White-label solution is developed for fintech companies, addressing their requirements, like high uptime, customisation, additional feature development, high security standards and compliance

Best for: Businesses operating in high-risk sectors and fintech companies

Platforms Supported: SaaS/Web

Support: Offers comprehensive support options including 24/7 live technical support, personal account manager for onboarding, and online resources to assist with the complexities and urgent needs of high-risk businesses

API: Yes

Company Information: Founded in 2022, based in the United Kingdom

Benefits: High-Risk Payment Gateway, White-label solution, Features for fraud prevention, chargeback management, and global payment acceptance, user-friendly interface, checkout customisation, conversion rate optimisation features

Cons: Does not tailored for small businesses with small transaction capacity and lack of processing history

The Niche of High-Risk Payments

High-risk payment gateways cater to businesses that operate in industries considered risky by traditional banks and payment processors. These businesses might face higher rates of chargebacks, operate in regulated sectors, or have irregular high-ticket sales. High-risk payment gateways like Transferty provide specialised services to manage these challenges effectively

Transferty stands out in the high-risk payment gateway market by offering comprehensive solutions designed to mitigate the common pitfalls of high-risk businesses. With features aimed to ensure higher success rates, and supporting a diverse array of payment methods, Transferty helps high-risk businesses to reach the best operational performance of their transactions

Conclusion

Choosing the right payment gateway in 2024 is essential for businesses aiming to succeed in the digital economy. Whether you’re looking for a solution that supports global transactions, provides specialised services for high-risk industries, or offers seamless integration for online sales, the options highlighted in this article cater to a broad range of business needs. By understanding the specifics of each gateway and considering your business’s unique requirements, you can select a payment processing partner that not only meets your current needs but also supports your future growth