- Payment gateway

- Blog

- PCI DSS: Everything you should know about

PCI DSS: Everything you should know about

Nowadays, when financial transactions are increasingly executed online, the security of cardholder data has never been more crucial. Businesses of all sizes are seeking ways to ensure their customers’ payment information is protected against the rising tide of cyber threats. This is where the Payment Card Industry Data Security Standard becomes a vital element of payment security of your business. Today we will talk about the PCI DSS and how businesses could obtain it

What is PCI DSS?

PCI DSS or Payment Card Industry Data Security Standard is a set of security standards designed to ensure that all companies that accept, process, store, or transmit credit card information maintain a secure environment. Developed by the PCI Security Standards Council (PCI SSC), which includes major credit card brands like Visa, MasterCard, American Express, the standard aims to protect cardholder data from fraud and theft

For businesses, compliance with PCI DSS is not just about avoiding penalties associated with non-compliance. It’s a fundamental component of their security posture that protects customers’ sensitive payment information from breaches and cyberattacks. Adhering to PCI DSS standards helps in building trust with customers, ensuring customer data is handled securely, and maintaining a strong brand reputation. Furthermore, it lays the groundwork for a secure payment ecosystem, which is vital for the sustainability and growth of any business operating digital payments. Among the main benefits are:

How Does It Work?

Achieving compliance with PCI DSS involves understanding and implementing a set of security standards designed to secure credit and debit card transactions against data theft and fraud. It works by enforcing strict security measures that businesses must follow to protect cardholder data. Here’s a detailed look at how PCI DSS works, structured around its core processes:

Scope Determination

To kick off the PCI DSS compliance process, businesses first need to define the scope by identifying all systems, networks, and processes that handle cardholder data. Determining the scope is crucial as it directly influences the effort, resources, and measures required to achieve compliance. This phase also involves identifying the merchant level based on transaction volume, according to the validation requirements

Assessment

The assessment phase involves a thorough examination of the business’s current security posture against PCI DSS requirements. Businesses must inventory their IT assets and pinpoint where cardholder data resides, travels, and rests. This step is critical to understanding potential vulnerabilities and gaps in compliance. It covers reviewing business processes, security controls, and environments to ensure they align with the standard’s 12 core requirements:

Repair

Following the assessment, the next step is to address any identified vulnerabilities by patching and securing systems and processes. This may involve configuring software securely, updating systems, removing unnecessary storage of cardholder data, and enhancing security measures to close compliance gaps

Reporting

The final step involves documenting and reporting the compliance status to the acquiring bank and global payment brands you do business with. Depending on the business’s merchant level, this could involve completing a Self-Assessment Questionnaire (SAQ) or undergoing a Report on Compliance (RoC) by a Qualified Security Assessor (QSA). Additional documentation, such as records of ASV scans, penetration test results, and information on compensating controls, may also be required

Levels of PCI DSS Compliance

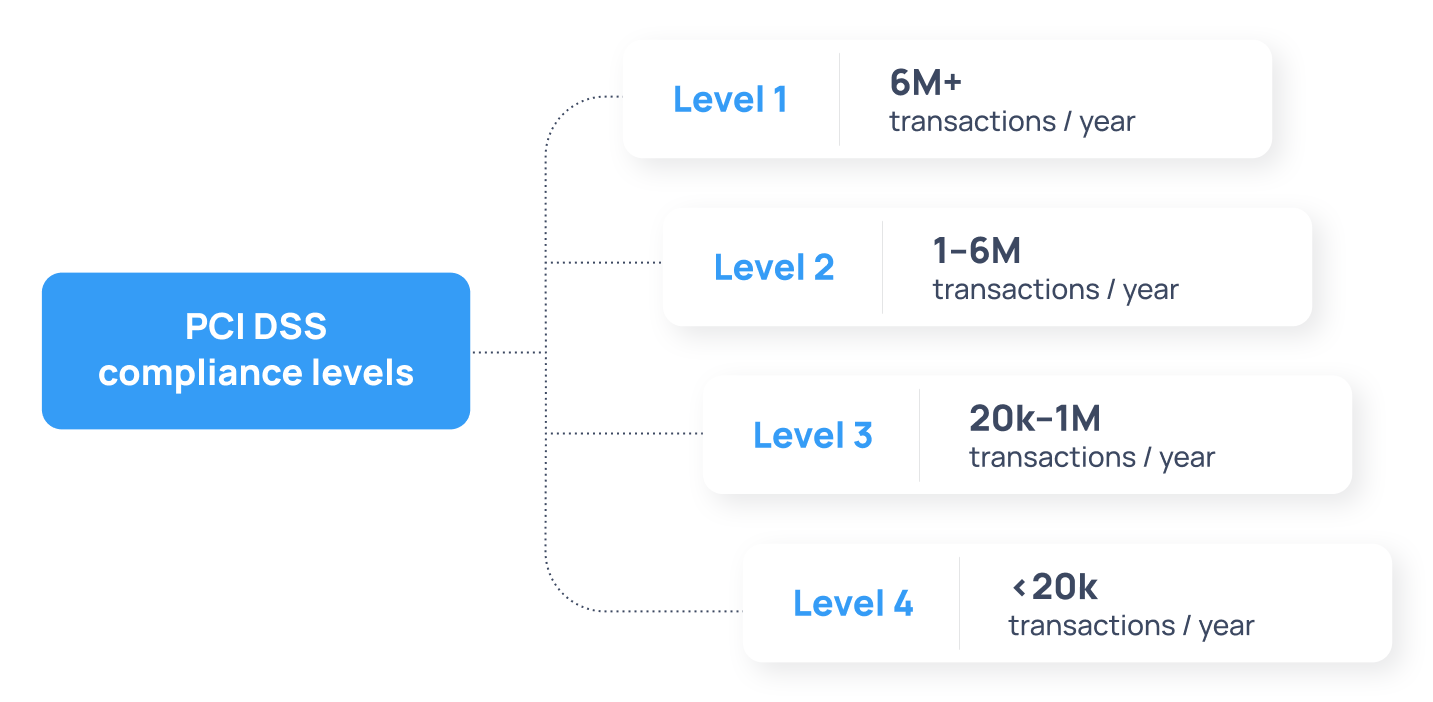

Based on transaction volumes, merchants are categorised into four levels, each with distinct validation requirements ranging from self-assessment to external audits. The level determines whether a Self-Assessment Questionnaire or a Report on Compliance needs to be submitted for validation. A customers’ sensitive information but also their reputation and financial well-being

Level 1: For businesses like Transferty, processing over 6 million transactions per year. Such companies are required to engage a PCI-qualified security assessor for an audit that validates adherence to PCI data security standards. Additionally, an annual Report on Compliance must be submitted as part of their operational protocols

Level 2: Applicable to businesses processing 1 to 6 million transactions annually. These entities should complete a Self-Assessment Questionnaire to verify the implementation of necessary security measures, as outlined by the PCI Data Security Standard

Level 3: Targets businesses with annual transaction volumes ranging from 20,000 to 1 million. Similar to Level 2, a Self-Assessment Questionnaire is required to affirm compliance

Level 4: For businesses processing fewer than 20,000 transactions annually. While completing a Self-Assessment Questionnaire is recommended to ensure compliance, it is not a stringent requirement at this level

Determining your compliance level is critical for adopting the appropriate measures to secure cardholder data effectively and maintain PCI DSS certification

How to Get PCI DSS Certification Step by Step

Identify Your Compliance Level

Determine which of the four PCI DSS compliance levels applies to your business based on the volume of transactions you process

Scope Your Environment

Identify all systems and processes that store, process, or transmit cardholder data

Assess

Evaluate compliance with PCI DSS requirements through self-assessment or a QSA audit, depending on your level

Remediate

Address any compliance gaps by implementing necessary security measures and controls

Report

Complete and submit the required compliance reports to the acquiring bank and card brands you do business with

How Much and How Long

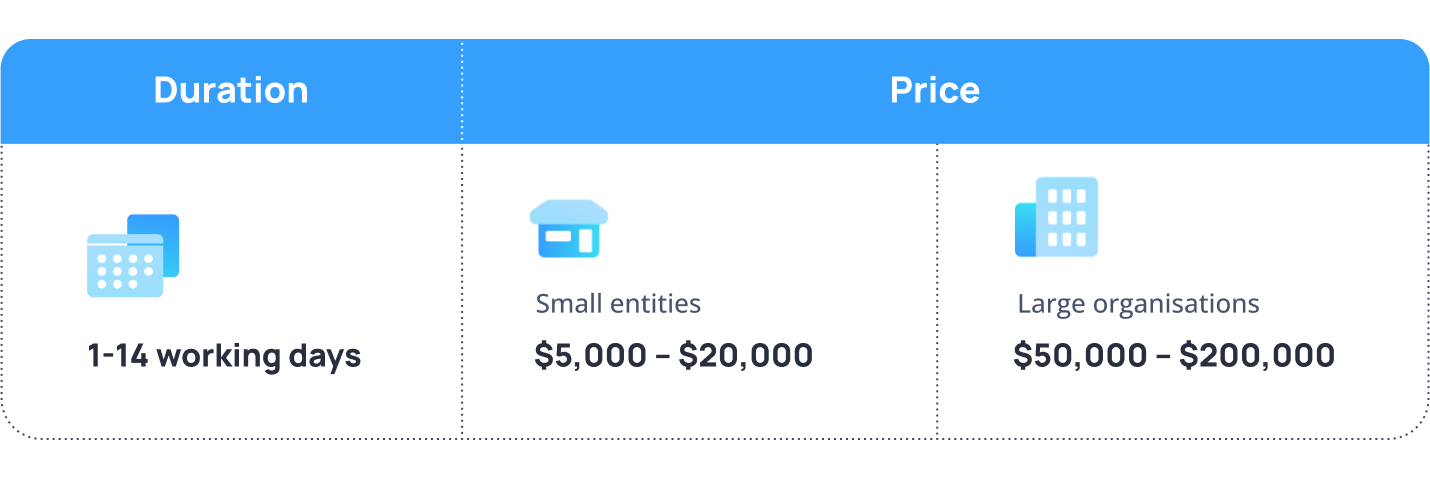

The duration to achieve PCI DSS certification can vary widely, typically ranging from as short as one day to up to two weeks. This timeframe is contingent upon how swiftly a business can complete the self-assessment questionnaire and successfully pass the PCI scan. After these steps are fulfilled, the certification results are communicated to the merchant’s bank and subsequently verified with the payment card industry to establish compliance

The cost associated with obtaining PCI DSS certification varies significantly based on factors such as the size of the organisation and the specific recertification requirements that must be met annually. For smaller entities, expenses can range from $5,000 to $20,000, while larger organisations might see costs between $50,000 and $200,000. However, the additional costs are required to develop and maintain a reliable security system which addresses the PCI DSS requirements and perform regular audits. The price varies depending on the business size, industry and personal characteristics

How to Obtain PCI DSS Faster and Cheaper

Partnering with a reliable payment gateway can ease the process of PCI DSS obtaining. Such gateways have already established secure, compliant platforms that handle sensitive cardholder data, reducing the burden on merchants to build and maintain such systems from scratch. By integrating with the payment solution, businesses can leverage the gateways’ robust security measures, including encryption and fraud prevention tools, ensuring compliance with PCI DSS standards. Additionally, payment gateways often provide guidance and support throughout the certification process, offering resources and expertise to help merchants navigate the complex requirements, thereby making the PCI DSS certification faster and more manageable. This partnership not only enhances data security but also instils trust among customers, knowing their payment information is processed through a secure, compliant channel

Conclusion

PCI DSS certification is essential for any business that handles credit card information. It not only helps in protecting sensitive cardholder data from breaches and theft but also boosts customer confidence in your business. While obtaining and maintaining PCI DSS certification may seem daunting, the benefits far outweigh the costs and effort. Partnering with a reliable payment gateway can simplify the compliance process, offering robust security features, seamless integration options, and expert guidance to navigate the complexities of PCI DSS compliance