- Payment gateway

- Blog

- The Evolution of Payment Service Providers: Adapting to Modern Business Needs

The Evolution of Payment Service Providers: Adapting to Modern Business Needs

Payment Service Providers are one of the key actors in global online payments. These companies ensure the transaction flow and growth of the businesses, working online. This industry opens a lot of opportunities, attracting more and more companies to open their own PSPs. It leads to a highly competitive market, forcing Payment Service Provider companies to rapidly increase their capacities and develop new payment features to stay ahead of the market. Today we will talk about the modern issues, hindering Payment Service Providers to grow, and provide our tips to overcome them

What Market Says

The report “Embedding a Competitive Edge,” shows a significant paradigm shift among businesses and explains what is a Payment Service Provider should do to remove it. This trend highlights the essential need for adaptability and innovation in the financial technology sector

According to the report, 66% of businesses in a five-market survey spanning the UK, US, and European States are streamlining their supplier list, with PSPs being a focal point. The primary driver behind this strategic shift is the urgent need to reduce operational costs, cited by 31% of businesses surveyed. This leads to the high demand for Payment Service Providers, which can ensure the large capability to optimise payment operations for really attractive prices for businesses

Despite this emphasis on cost reduction, modern businesses are not merely seeking the cheapest solutions. A substantial 34% of businesses are willing to invest in advanced fraud prevention solutions, while 25% are ready to pay more for tools enhancing payment success rates. Furthermore, 31% are open to a wider array of payment methods, a figure climbing to 38% in the US. As a result, technology still keeps the first position for many businesses, instead of the cost reduction. Now let’s discover the main challenges and opportunities, according to the report and our own observations

Challenges and Opportunities for PSPs

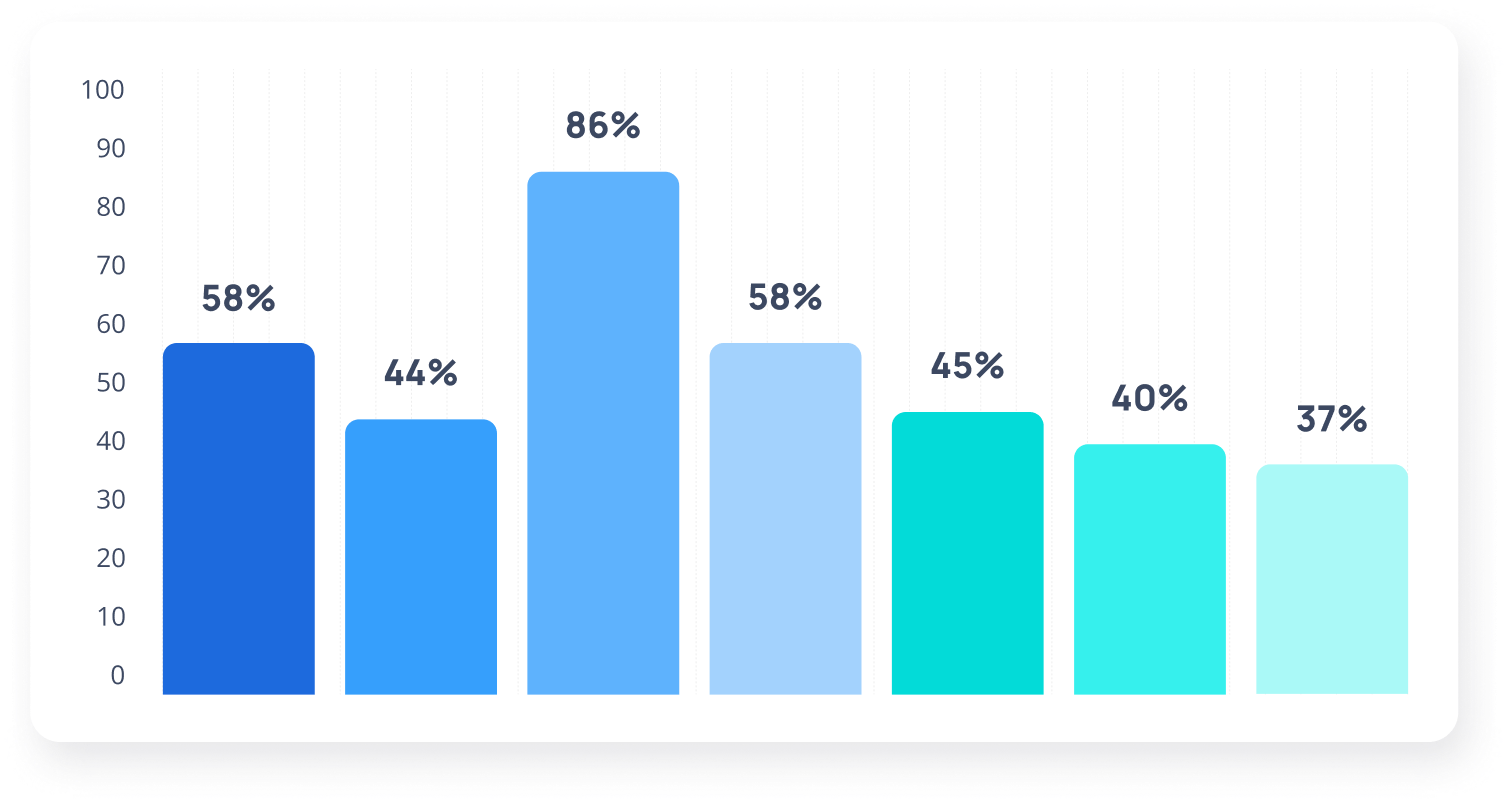

The report reflects the tendencies of over 200 PSPs across the surveyed markets. 58% of PSPs prioritise enhancing customer satisfaction and retention, underlining the vital role of customer-centricity in the industry. Additionally, 44% aim to boost competitiveness, indicating a keen awareness of market dynamics. Responding to merchant demands, 86% of PSPs plan to integrate new payment methods within the next year. Digital wallets emerge as the frontrunner, with 58% of PSPs opting for this solution. However, the hurdles may arise, obstructing the will to growth

A significant 45% of PSPs express concerns about the time-consuming nature of integrating new payment methods. 40% worry about the complexities faced by their engineering teams during integration, and 37% are apprehensive about managing these new methods in the long term. What is Payment Service Provider should do? Such a situation forces them to look for the new opportunities and strategic cooperations to ensure their superiority. For example, with the third-party payment technology providers, that are highly advanced in the payment flow optimisation and new features development. Let’s find out how such cooperation may enrich the value proposition of PSPs

Innovation Through Collaboration

In many industries, collaboration becomes the cornerstone of success. Online payments is not an exception. PSPs equipped with agility, innovation, and a customer-first approach are poised to grow. By embracing external expertise and understanding merchant needs, PSPs can not only overcome the industry turbulence but also emerge stronger, offering high-quality services to their clients. As online businesses and PSPs continue to evolve hand in hand, the future promises a payment ecosystem characterised by efficiency, security, and unparalleled customer convenience

At this point, Payment Service Providers should look for strategic collaboration with payment technical solutions, like online payment gateway service provider. According to EY Research, about 21% of interviewed PSPs are implementing SaaS solutions to scale and grow. So called Payments-as-a-Service Platforms (PaaS), is one of the smartest choices in this direction. A Payments-as-a-Service platform is a cloud-based software solution that provides comprehensive payment processing services to businesses. It operates similarly to Software as a Service (SaaS) but specifically focuses on managing various aspects of payment transactions. According to Mordor Intelligence, the Payment as a Service Market size is expected to grow from USD 8.30 billion in 2023 to USD 33.60 billion by 2028, showing the high-popularity of such services among businesses

PaaS platforms offer a wide range of functionalities, including processing online payments in multiple currencies, handling operations such as refunds, chargebacks, and settlements, managing invoicing and subscription services, and providing tools for efficient payment optimisation. By leveraging PaaS platforms, PSPs can avoid the complexities and costs associated with developing and maintaining their payment processing systems. Psp payment service provider offer ready-made, customisable solutions that can be quickly implemented, enabling businesses to launch, upgrade, and accelerate their payment services. Payment gateway service provider ensure scalability, guaranteed uptime, lower operating costs, and increased team productivity, making them an attractive choice for banks, FinTech, and PayTech companies looking to enhance their payment processing capabilities. Let’s take a look at some benefits, of cooperating with online payment service provider for PSP

Boosting Financial Operations

Unlike the life-long and costly process of developing payment software, payment service provider psp offer a shortcut. With the access to ready-made online payment platforms, PSP can be operational within a few days, eliminating the daunting development phase

Partnering with payment service provider companies shifts the burden of maintaining and updating the platform from businesses to the provider. This strategic alliance ensures access to the relevant features and updates without the associated risks and costs

Payments-as-a-Service Platforms offer unparalleled scalability. Expertise in managing high volume payment flows mitigates performance risks, saving time and costs. This scalability empowers Payment Service Providers to focus on revenue generation and long-term goals

Payments-as-a-Service Platforms are fortified with redundancies, safeguards, and proactive Service Level Agreements (SLAs), ensuring that all your transactions will be settled. This reliability, contrasted with outdated legacy systems, instils trust and confidence among customers

As all the technical issues will be handled by internet payment service provider platforms employees, there is no need to spend a lot on the operating costs. This reduction directly translates into increased profitability and financial stability, vital to stay competitive

By eliminating operational bottlenecks and legacy challenges, Payment Service Providers can redirect their focus towards delivering exceptional customer experiences. PaaS Platforms can customise the payment environment according to customer needs

Conclusion

As the Fintech industry moves forward, the landscape of online payments will continue to evolve. For PSPs, the key to sustained growth lies in their ability to adapt, innovate, and collaborate strategically. By nurturing partnerships that resonate with their strategic vision and investing in technologies that enhance their capabilities, PSPs are shaping the very currents of the industry’s future. Strategic partnerships, especially with innovative solutions like Payments-as-a-Service Platforms, are vital for the growth and sustainability of PSPs. Embracing collaboration and innovative technologies is not just a choice, it’s a strategic imperative for PSPs aiming to grow and gain more clients

Data was taken from the following Sources:

- The report “Embedding a Competitive Edge,” by GoCardless

- “Cards and payments service providers,” by EY HFS Horizons Report

- “Payment as a Service Market Size & Share Analysis – Growth Trends & Forecasts” by Mordor Intelligence